How Your Bank Business Model Impacts Performance

You are likely in the process of finalizing your strategic plan. The good news is that strategy matters and your team’s time and effort in refining your strategy should pay off. The question is, how much will it pay off? That answer depends on the strategy your bank is pursuing and the underlying business model your bank chooses to leverage. In this article, we look at two very similar institutions, but ones with different bank business models, and show how their model impacts performance.

Comparing the Two Banks

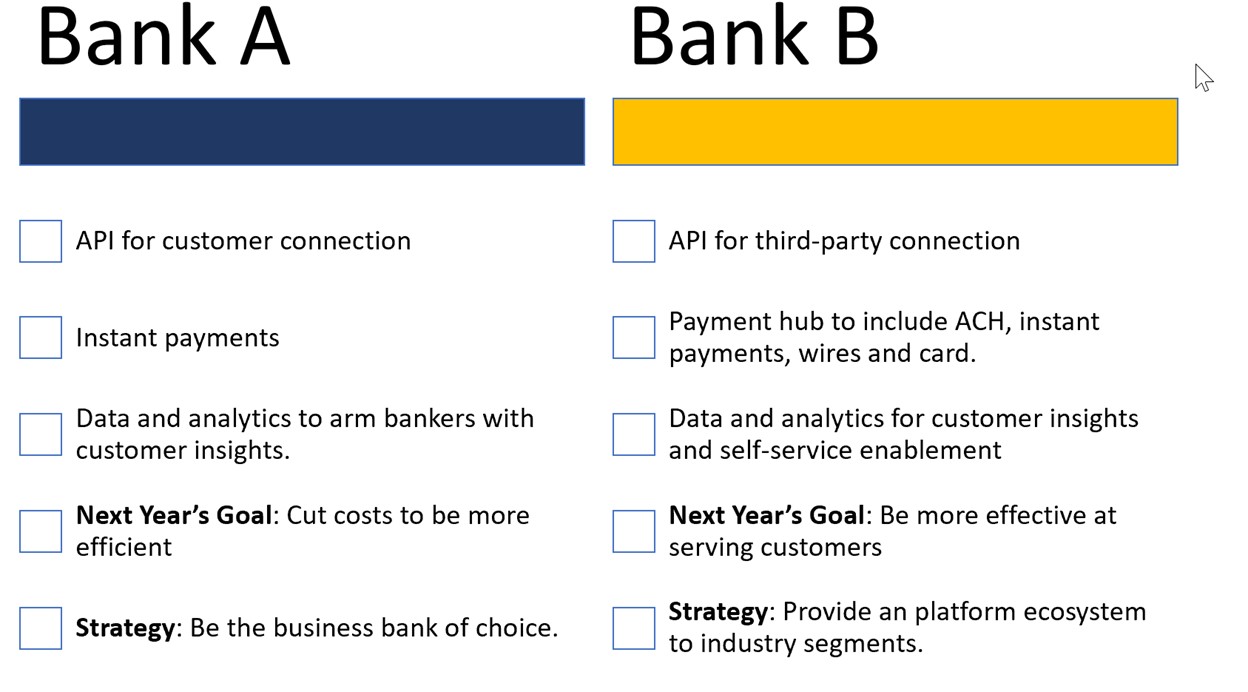

Let’s say we have two banks competing in the same market. Both banks have a primary goal next year to grow their commercial customer portfolio. Both banks are the same size and have the same sized technology, compliance, sales, risk, and marketing budgets. Both banks invest in the same technology and have about the same compliance, risk, sales, and marketing tactics. Look at the comparison below:

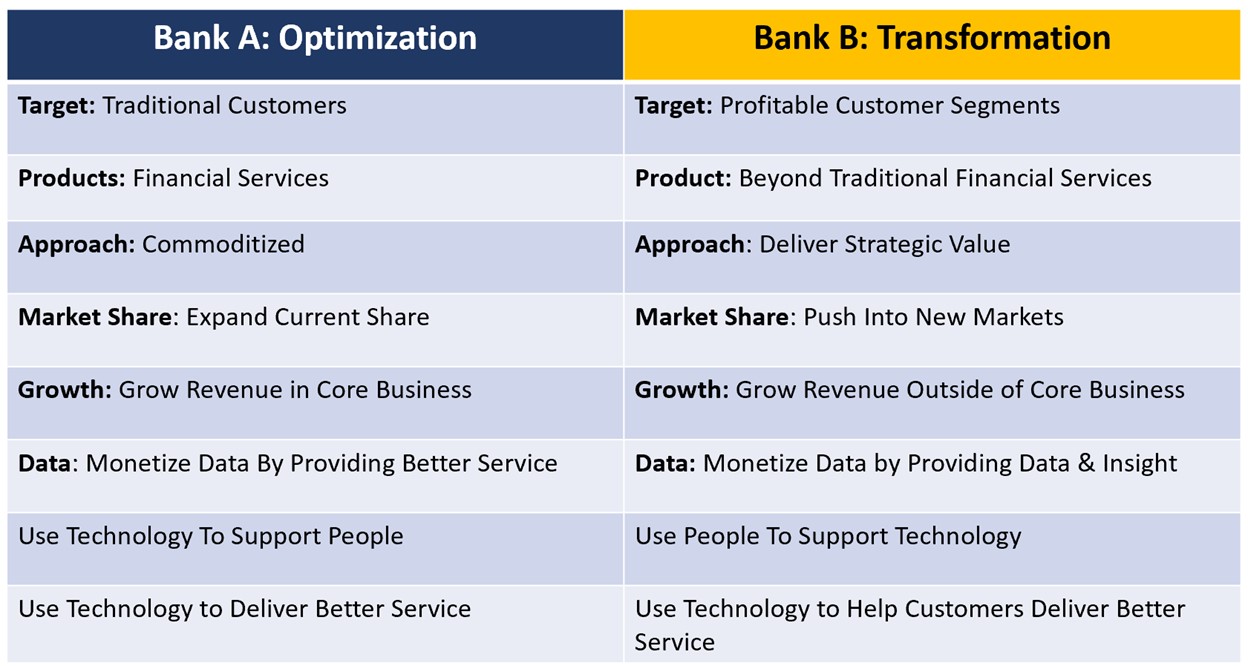

On the surface, both banks are similar. However, the difference between these two banks comes down to HOW these banks deploy their platforms. Bank A has a generic approach, while Bank B is using almost the same technology to provide more profitable products to more profitable customers. They are building a platform where partnerships can be added, and new products and services can be delivered at a faster pace.

Bank A focuses on optimizing, while Bank B focuses on transforming. Bank A is trying to deliver traditional products in the most efficient way possible. Bank B is sacrificing efficiency for effectiveness and innovating new products to capture new markets.

It is essential to point out that both models can achieve above-average results and create happy employees and shareholders. The question is, which model is better? Statistically, which bank business model gives managers the best chance to achieve their goals?

The Data on Bank Business Model Strategy

To answer the question, we turn to Gartner data that looked at this very issue and grouped a set of sample banks into two categories – those banks that kept their current model and optimized product delivery and those banks that used their technology budget to create a platform that can be used to go after specific, profitable customer niches.

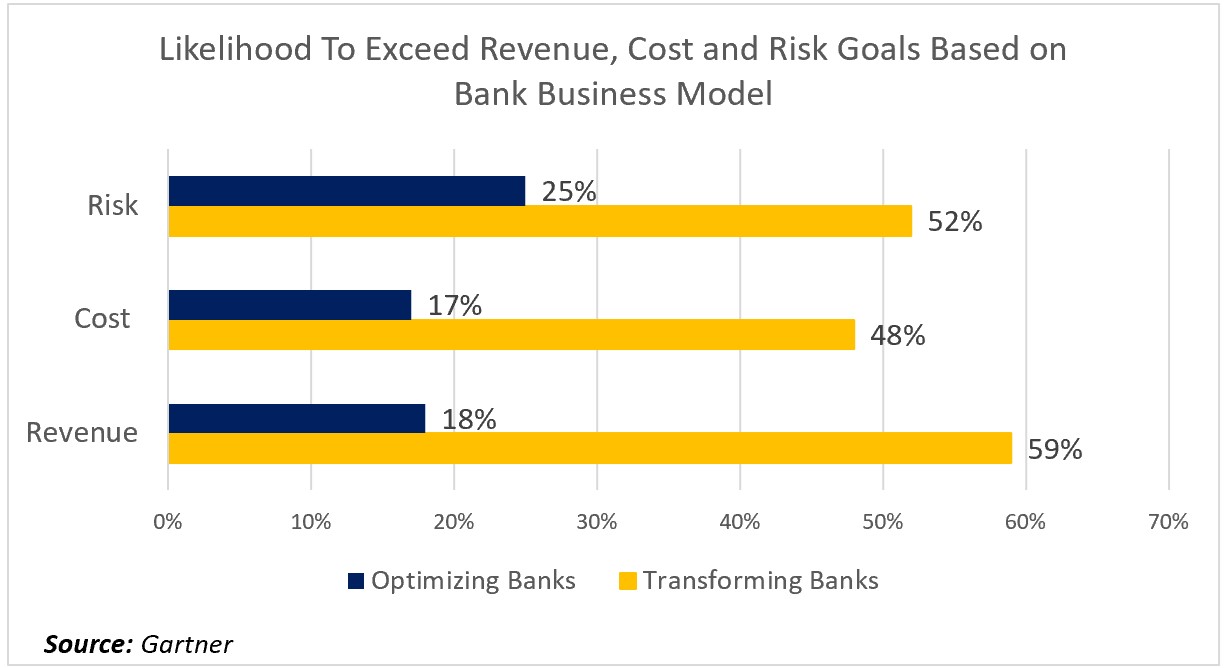

The data is startling. The path of executing a bank business model that creates unique products for specific customer segments is the clear winner. Banks that invest their capital to create new products and services to deliver a unique value proposition are far more likely to achieve their revenue, cost management, and risk goals by more than a 2:1 margin. That is – your chance of achieving your goals more than doubles when moving away from commoditized products (below).

The reason for this outperformance comes down to the ability to gather cheaper deposits, better margins on loans, and more fee income. It also means cheaper customer acquisition cost and a longer cumulative lifetime value as transformative banks often have more products per customer that not only increase profitability but also aid in retention. Hence, those customers stick around more than 30% longer.

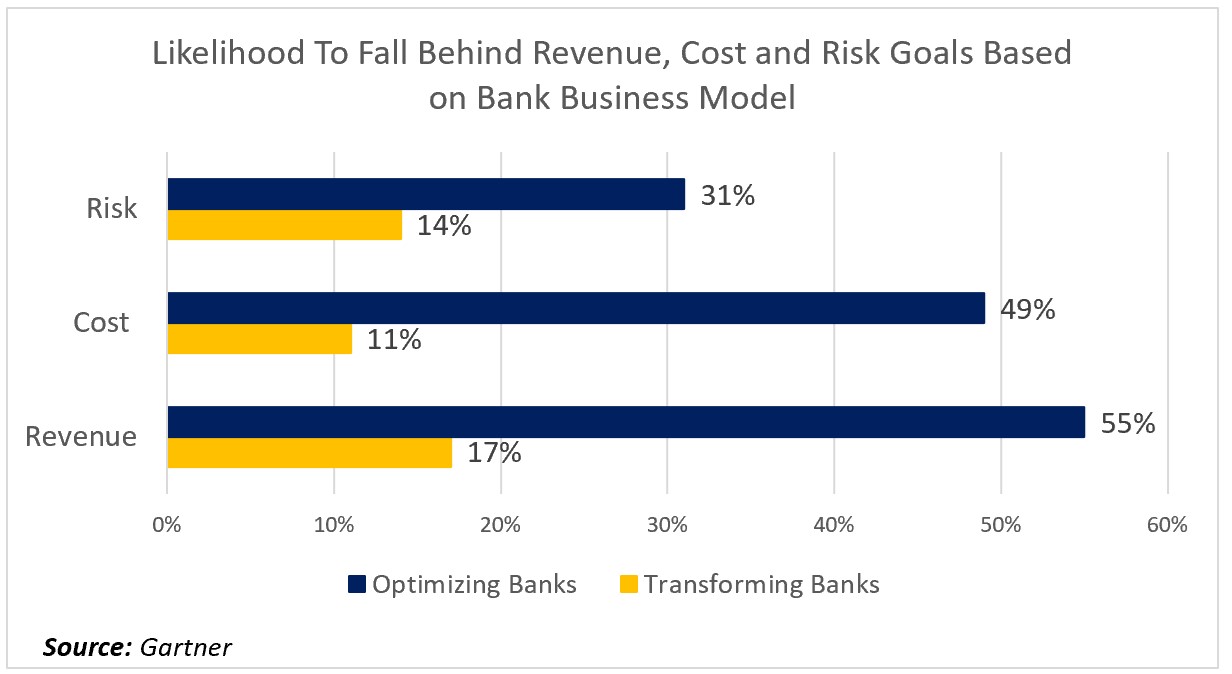

Reducing the Risk of Failure

There is a derivative of getting your bank business model right, and that is downside protection. Not only does a transformational and targeted banking platform increase your odds of success, but it also decreases your odds of failure. While creating new products for new market segments is risky, the return more than offsets that risk if done correctly. Risk is reduced because profit margins are greater, and the bank can generate more fee income from more customers. In other words, you are at least two times less likely to fall below your revenue, cost, and risk goals by pursuing a strategy where you have little or no competition.

It is Not All or Nothing

There is nothing wrong with optimization. Making your bank more efficient is always a worthy endeavor. Our point in this article is that there is more than one way to achieve efficiency, and your bank might be better off being less efficient but more effective. Inventing new products and going after new markets takes time. Despite this added time, any step in the right direction is likely to pay off. Similarly, a bank may choose a hybrid business model between these two choices and have a strategy that invests in making traditional banking products more efficient and creating a limited number of new products to go after a limited number of new customer segments.

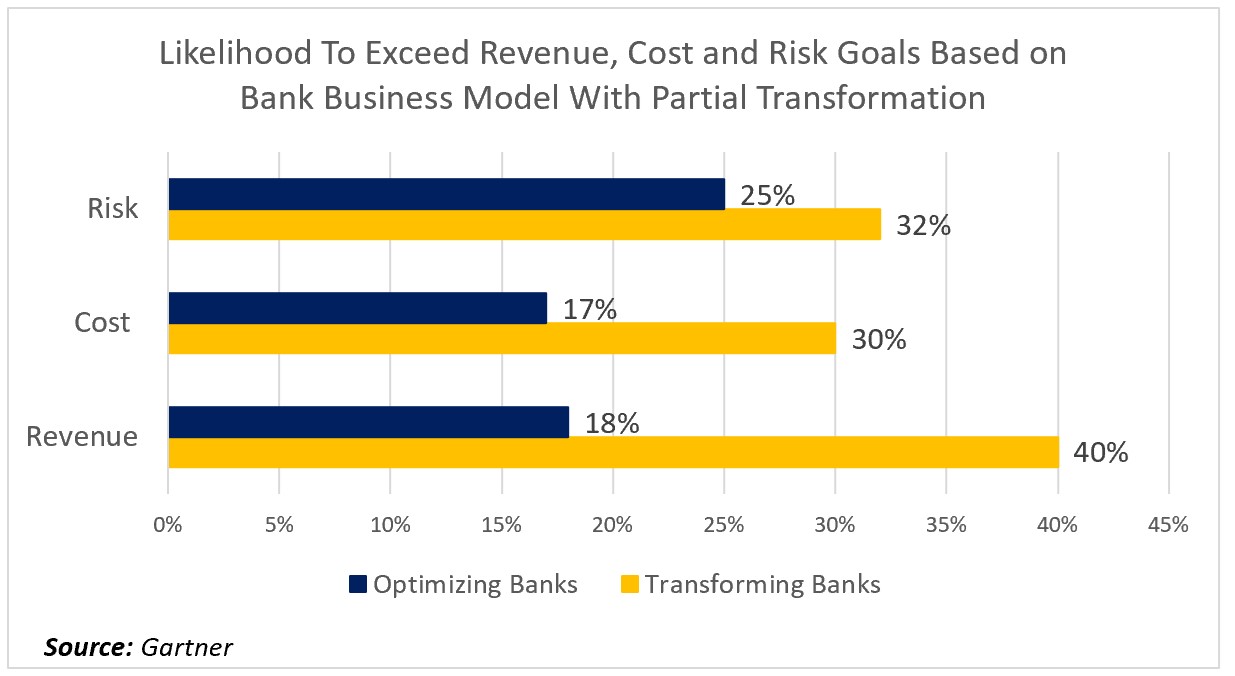

A hybrid structure produces superior results as well (below). Partial transformation pays off materially.

Real World Examples of Top Performing Bank Business Models

We recently wrote about some of the technological trends that are transforming banks (HERE). These are the ability to handle modern payments, connect and deliver banking products and services via API to customers and partners, and customize a banking platform to go after specific industries such as healthcare, insurance companies, municipalities, shipping, and asset managers. For the future, it means leveraging data and generative AI to provide more insight into customer finance and operations.

This can be done with a product such as trust (Thrivent), credit cards (Credit One), or captive financing (Eaglemark Bank). It can also be done by going after niche markets leveraging banking-as-service such as the likes of Finwise, The Bancorp, MVB Bank, etc.). Each of these banks, and about 80 more in the banking industry, produces consistent outsize returns being effective, transformative banks.