15 Ways We Are Using ChatGPT in Banking

No doubt you have heard other bankers talking about ChatGPT. This AI-powered digital assistant, technically called “generative AI,” has taken banking, and society, by storm. In three months, it has become the primary tool of many bankers, helping make banks more efficient across the organization. Our innovation working group, called Spark, has been playing with the tool for the past several months, and this article details how we use it to jump our productivity by 20%.

What Is ChatGPT?

OpenAI is a non-profit startup known for having the popular image generator Dall-E 2 that can create any image you can imagine. Last year they introduced a chatbot that acts like a digital assistant, currently available for free. With the capital raised by Elon Musk, Microsoft, and others, this year, banks look to license the technology utilizing a paid professional version and leverage the tool through the Microsoft Office Suite to accomplish a variety of tasks more efficiently.

ChatGPT is a powerful language model that can understand a variety of languages, including emojis, that can assist banks with increasing the productivity of bankers, improving their customer experience, automating repetitive tasks, and providing personalized financial advice to customers. With the ability to understand and respond to natural language, ChatGPT is an easy way to leverage artificial intelligence to harness data or resources on the internet.

Herein lies the poetry of ChatGPT. Banks tend to store data in a flat, static manner that only a few can access. This application now allows “didactic AI,” where a banker can natively ask questions and get the information they need. ChatGPT does an amazing job at maintaining the state of a conversation so that you can drill down and interrogate information. Each question can build on itself. Instead of producing a set of reports for a board meeting, a computer with ChatGPT can be present to answer any question.

The same goes for a bank’s intranet. Most data on a bank’s intranet either is not used and/or is outdated. ChatGPT eliminates this problem by crawling all available information in an organization and providing the latest knowledge to employees in a concise and useful manner. Bankers no longer have to worry about the taxonomy or ontology of the knowledge. AI intelligence categorizes and links the information for either general or expert use.

How Good Is It?

The answer to the above question is that it is likely better than your average employee for a relatively wide range of tasks. ChatGPT recently took the SAT (HERE) and scored 1020 on the test, ranking in the 52nd percentile. When ChatGPT answered questions for a job interview, it was deemed better than 80% of the responses. ChatGPT also answered Wharton MBA interview questions and received a “B” for its answers.

Like a Google search, the answers outputted by ChatGPT aren’t foolproof. The tool is only as accurate as the dataset provided to it. Like any other data-based tool, inaccurate or limited data likely means inaccurate results.

How Bankers Will Use This Amazing Tool

Bankers can use ChatGPT in various ways to improve their productivity, operations, and customer experience. Below are 15 of our favorite ways that gave us the greatest boost in productivity:

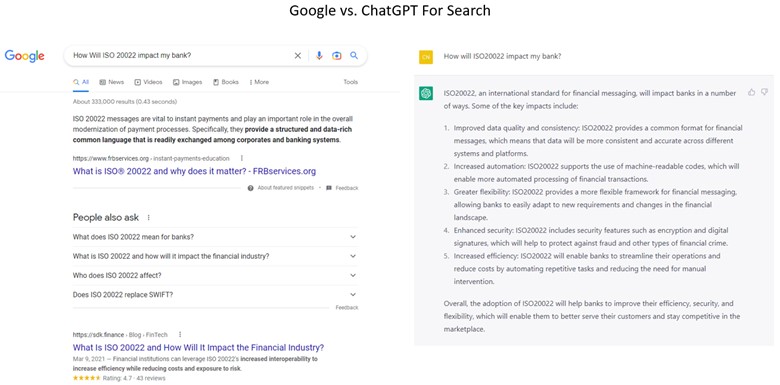

1) In place of search: The considerable advantage of ChatGPT is the aggregation and synthesis of knowledge. This is critical whether you need some quick information or a more in-depth research project. For example, if a banker wanted to learn about how ISO20022 was going to impact their bank, they might do a Google search to return a bunch of webpages that now have to be sifted through and determine each page’s efficacy. ChatGPT, on the other hand, scours the web to return a precise answer.

Pause for a minute to think about this. You can now synthesize the World’s knowledge in a fraction of a second. While ChatGPT may not make you an expert, it can give you quick working knowledge for most situations. Our bankers are using this aspect of the tool some 10+ times per day. Here are some recent examples:

- Create bullet point notes on employee retention credits.

- What are the best practices around the gamification of deposits?

- How can our mobile banking app be more inclusive to older adults?

2) Copy and graphical work product: Where it starts to get mind-blowing is when ChatGPT and Dall-E 2 are integrated. Thus, you can prompt ChatGPT to incorporate both. Here are some recent prompts that saved us a material amount of time:

- Design a lightning bolt icon for a loan sweep product.

- Make a mobile banking wireframe so a customer can report a problem at a specific branch.

- Create a photo of a banker talking about agriculture next to a car in a field of corn

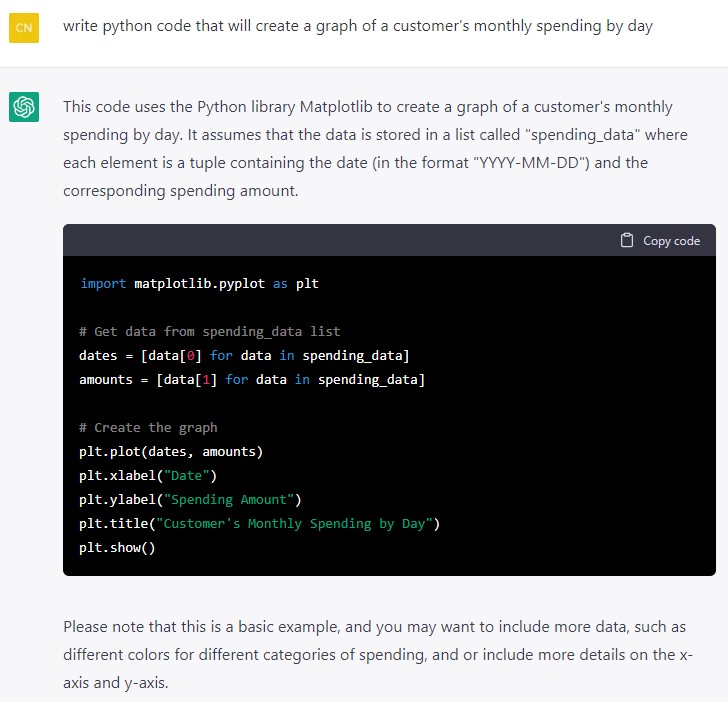

3) Create code: One of the most amazing things that ChatGPT does is analyze all open-source code and synthesize code libraries to help create code capsules. For example:

- Write python code that you can use to create a graph of their current month’s spending.

- Write C+ code that will match an email address to the one on file.

- Write Java code to create a poll for our website.

4) To aggregate emails: You return from a vacation and find several long email threads in your inbox. Instead of reading through each one, you provide the email thread to ChatGPT and ask it to summarize it. Instantly, you have a three-sentence summary complete with prioritized action items.

5) Write bank marketing copy: ChatGPT excels at producing high-quality prose with moderate accuracy. We use it to help write email subject lines, advertising copy, website copy, and more. It is perfect for overcoming the “blank page syndrome,” or the ability to have a starting place.

One huge advantage here is the ability to hyper-personalize the copy at scale. Thus, banks can combine ChatGPT’s API interface and feed the platform a variety of prompts. Here are our recent examples:

- Re-write this IT job opening to appeal to new college graduates, introverts, Aries, and employees who just got laid off at Google.

- Write a button copy that will get undecided customers to purchase a certificate of deposit.

- Redesign this webpage to better appeal to people with vision impairments.

- Create copy for this hero image that appeals to small business owners that have strong cash flow.

- Write a short message to explain to a user that their financial statements cannot be uploaded because the system only accepts CSV, Xls, doc, or pdf files.

6) Write copy based on data: ChatGPT can also analyze data and produce output based on that data.

- Generate a headline for a landing page based on the following survey results [insert survey results].

- Analyze this ACH data and give me trends [insert daily data for the past year]

- Write a title for this blog article [note – it did for this]

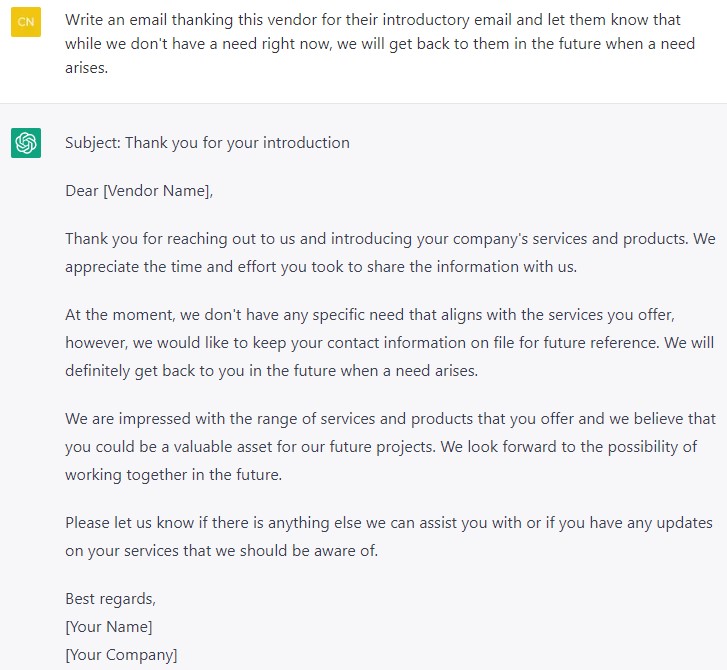

7) Email Automation: We can pair the above two items and use an automation tool such as Microsoft’s Power Automate or UI Path to customize email templates. For example, we have one that thanks potential vendors for their introductory sales pitch and tells them we will keep their information on file (below). Chat GPT ingests the email, responds to the prompt, and Power Automate creates the email and immediately sends it.

Think of the myriad situations where you have a general idea of the email structure, but it needs some customization. Emails to ask for more due diligence information, reschedule appointments, or respond to human resource recruiters that you are not interested in the position now but in the future.

8) Product Design: One of ChatGPT’s strengths is to take on a customer persona. Thus, you can have ChatGPT act like a doctor, retiree, CEO, or engineer. Bankers can now use the tool to inform work products. For example:

- Act like a Controller at a municipality. How should I pitch treasury management services?

- How would a lawyer like to be notified that we have placed a hold on their checking account?

- How would a motivational coach help a customer to save more?

- What are common UX issues for bank web pages?

9) Keywords and Sentiment Analysis: Another great use case for ChatGPT is to analyze a block of language and return a required verbiage analysis. Some of our recent examples:

- What are the keywords for this competitor bank’s webpage [insert webpage link]?

- What are keywords in popular job postings for bank digital marketing vice presidents [insert]?

- Conduct sentiment analysis on this performance review [insert performance review]

10) Proofreading: Insert a block of text and ask ChatGPT to proof the message, and it is instantly done for free. Many bankers pay for Grammarly or Wordtune, but the advantage of ChatGPT is that it fixes all the text in one action instead of going through word by word.

11) Automating customer service: Bankers can use ChatGPT to automate responses to Yelp or Google reviews. Banks can build chatbots that answer common customer questions and perform simple tasks, such as checking account balances or scheduling appointments. This can free up time for human bankers to focus on more complex tasks.

In a similar fashion, ChatGPT can be used to automate the process of onboarding new customers by guiding them through the required paperwork and answering any questions they may have.

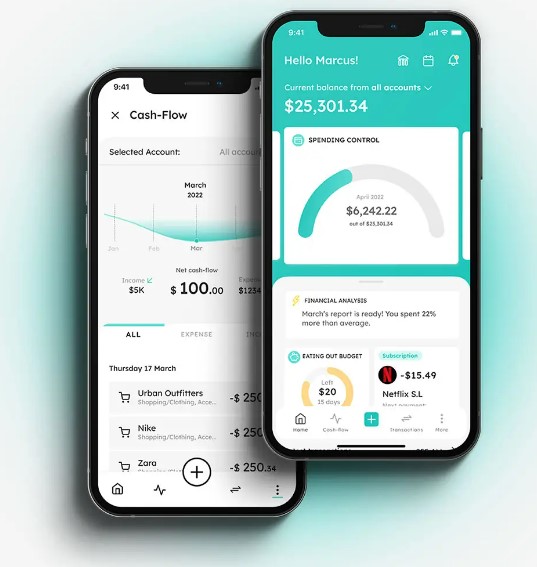

12) Providing personalized financial advice: Bankers can use ChatGPT to analyze customer data and provide personalized financial advice. ChatGPT can be embedded in a bank’s online and mobile application via API. For example, the model can analyze a customer’s spending habits and recommend ways to save money at a level much more granular and helpful than most personal financial management (PFM) systems banks use today. Customers can better get data on subscriptions, brands, cash flow, and changes. This can be done at a fraction of the cost and with greater flexibility than most existing PFM banking applications.

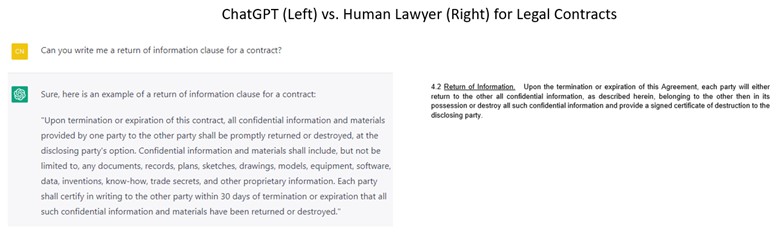

13) Legal Contracts: While not at a point where ChatGPT can write and analyze legal contracts, it is almost there. Already, ChatGPT can generate legal prose that is arguably better than many lawyers (see our test below and judge for yourself). We use it already to insert missing clauses about the return of information, venue, non-auto renewal, regulatory requests, and many other items into draft contracts to be reviewed by our legal team, thereby saving them time.

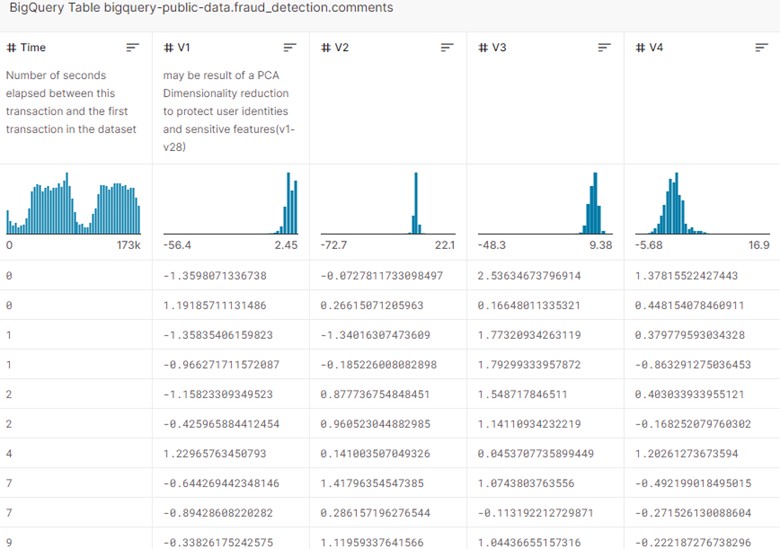

14) Fraud detection and Data AI: Bankers can use ChatGPT to detect fraudulent transactions by analyzing patterns in customer behavior. For that matter, it can turn any data set into a desired model.

Load a fraud data set like the one below into the chatbot, and it will detect what type of data you are working with. It can put the information into a table form and give you distribution counts and shapes. It can create pivot tables and group data according to any simple rules you want to set. We then asked it to encode the dataset in python, and after providing options, it generated the results. We asked it to build a model, and it walked us through how to preprocess the data, split the data into training and test sets, helped us choose an applicable algorithm, helped us train the model, and then evaluate the model.

ChatGPT provided us with two python libraries (Eli5 and Lime) to interpret the model, and when we asked it to use Eli5, it ran and interpreted the model. It did in an hour what it would have taken us a day to pull off. In the end, the tool helped us create a model that looked at an unbalanced data set composed of over two days of transactions totaling 285k transactions to detect fraud in 470 of the cases. While the accuracy wasn’t as good as a more robust model, its work was impressive, allowing a business line leader with little knowledge to pull off a complex analysis.

On top of that, do you know what else ChatGPT does really well? Suspicious Activity Reports (SARs). If you don’t have a tool like Hummingbird or Verafin, then this is an easy use case to execute. Most banks are still creating their own filing in Excel, Word, or a pdf and spending 2+ hours per report plus making more errors.

15) Improving customer engagement: Bankers can use ChatGPT to create engaging and informative content for their website or mobile app, which can help increase customer engagement and attract new customers.

How ChatGPT is Priced For a Bank

To get started, bankers should start with the free version for personal use and then upgrade to one of the paid versions, currently at $42 monthly. The professional version is always available and much faster. For bank use, there are a variety of professional models that are faster and more powerful than the freemium version and designed to be leveraged via an API and embedded within a product.

Pricing is pay-as-you-go, so banking applications based on ChatGPT are incredibly affordable for any size bank. Pricing is based on one thousand “token” increments where a token represents an amount of data. For example, when it comes to text, 1,000 tokens are equal to 750 words. Bankers can subscribe to a “Playground,” a sandbox for application development. Here, bankers can access a calculator that will display the cost of the application.

For context, creating an application that automatically politely responds to every comment left on both Google AND Yelp would run the average bank around $900 per year.

Putting This into Action

Many of the above paragraphs were written by ChatGPT. The above bank use cases are just a small group of examples of how bankers can use ChatGPT. The model’s ability to understand and respond to natural language makes it a versatile tool that can be adapted to a wide range of banking applications. The tool’s ability to link and understand knowledge will provide tremendous potential to banks. Over the next 12 months, look for a cascade of experimentation by banks bringing new use cases by the thousands.

ChatGPT is a perfect example of how bankers will leverage artificial intelligence daily. In short, ChatGPT can 10x your current skills. While not at the expert level yet, it can take a business line banker and give them the skills to handle coding, complex Excel formulas, marketing, data analysis, customer experience management, design, product management, and a host of other yet-to-be-discovered skills to the level of someone with five years of experience. Every banker should become familiar with this tool as it is about to alter the knowledge landscape the same way Google did back in 1998.

In addition to boosting personal productivity, banks can build applications off ChatGPT to help customers make sense of their financial data, automate customer responses or build various chat tools to handle repetitive tasks.

Look for this technology to open up a whole new class of bankers and bank products as this application and generative AI become omnipresent.