The Bank AI Talent Roadmap

A central part of any bank AI strategic plan is the path banks will take to acquire and train human capital to manage this challenge. Artificial intelligence (AI) and its component parts, machine learning, generative AI and agentic AI, is unlike any technology we have ever seen. While undoubtedly some of the complexity will fade into the background like how the innovations of steam, electricity, computers, and the internet did, AI is fundamentally different in that humans will need a certain level of training and understanding akin to our adaptation of computers. In this article, we set forth an AI talent plan for banks to consider as they build their own individual AI vision.

Understanding the New AI Reality in Banking

To remain competitive and future-proof their organizations, banks must proactively invest in hiring new talent and upskilling their existing workforce for the AI-driven world. Gen AI, and soon agentic AI, will rapidly unlock a new level of machine learning, automation and coding while democratizing the effort for every banker.

Capitalizing on AI tools demand both specialized talent capable of harnessing AI effectively while providing every banker with a base understanding of the power. Banks must now consider specific new roles and critical skills that will position them advantageously in the emerging AI landscape.

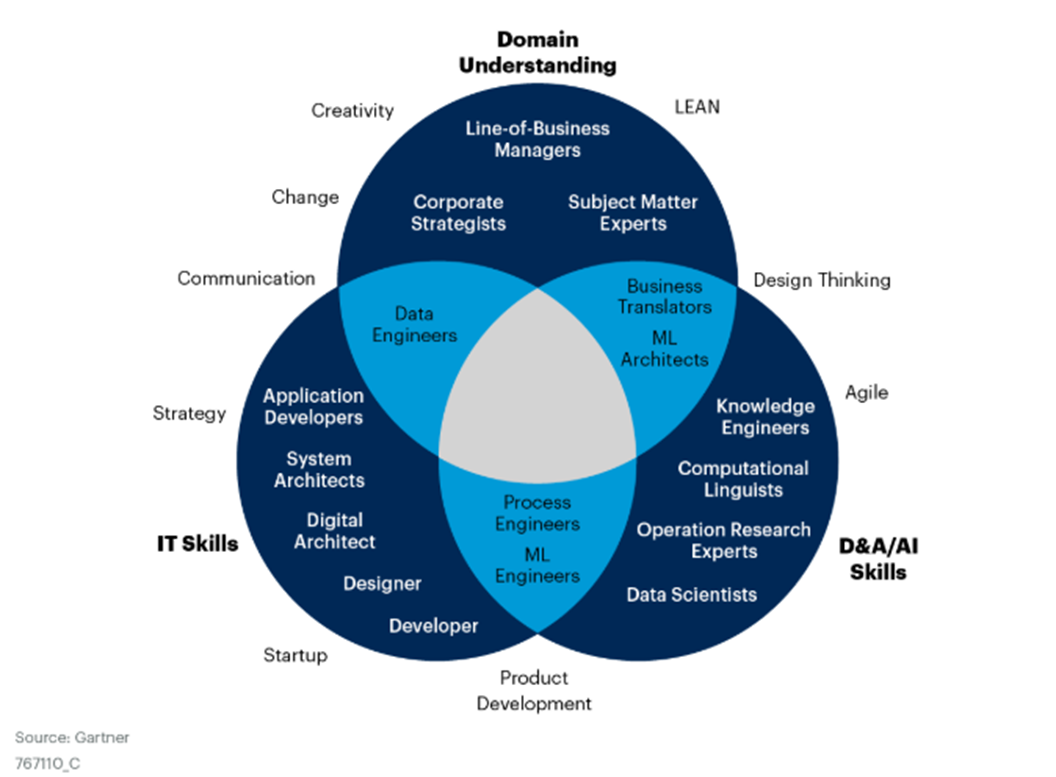

For a bank to be successful long-term, it must manage the building of its AI team to meet its objectives, budget and risk tolerance. A bank must balance interim talent leveraging existing employees with permanent talent that can focus on the positions full-time. Banks must also marry domain understanding, technical expertise and AI-specific skills together (below).

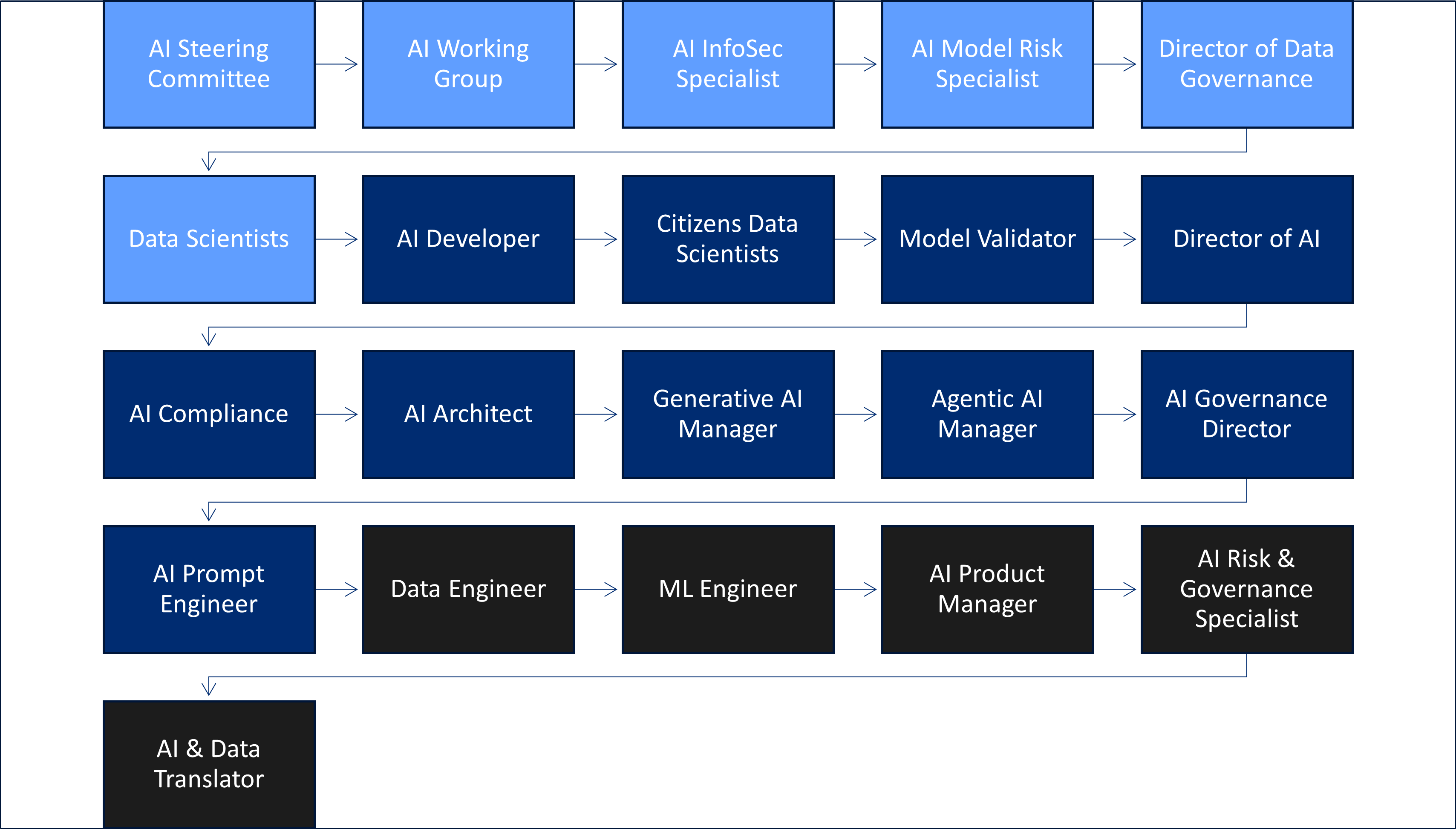

New AI Talent Roles and a Timeframe

As banks scale AI-driven initiatives will require distinct new roles that bridge traditional banking expertise with cutting-edge AI capabilities. However, this will not happen all at once and some of these positions may be part-time or outsourced. Let’s break it down in growth order.

Years 1-2: Discovery

During this period, banks are just forming their foundation and learning what they don’t know. Usually, this period is characterized with technology taking the lead with strong support from risk. A bank may choose to institute a single model such as ChatGPT 4o or a specific vendor-driven application such as Microsoft Copilot or a call center chatbot.

To manage this phase, a bank should consider having the following at a minimum:

- AI Steering Committee: Cross-functional team tasked with overall initiative management and governance.

- AI Working Group: Cross-functional team comprised of IT, Risk, Information Security, and a business line advocate.

- AI Info Security: Early on a bank will realize that many challenges with AI, particularly those managed by third parties, are largely the domain of the information security group. Since many vendors are utilizing third party large language models, data security, management, retention, training, and deletion are top concerns. Early on a bank will need to allocate an InfoSec banker that has a specialty in AI.

- Model Risk Management: Similar to InfoSec, particularly for banks approaching $10B in asset size, many AI challenges are challenges within model validation. This is largely true for machine learned models that help banks make decisions or face the customer. As such, early on, a bank will need to dedicate a model risk compliance person to the working group that will specialize in understanding ML and Gen AI models.

The problem with just having a steering committee and working group is the bank will be inundated by both vendors wanting to leverage AI and various use cases from the business line that will have to manage. Because both the Steering Committee and Working Group members will have “day jobs,” banks are encouraged to transition quickly through this phase and to obtain permanent staff leading the AI effort.

In addition to this core group, larger banks should also consider the following position during the discovery phase.

- Director of Data Governance: Once a bank approaches $1B in asset size, they should start thinking at least part of an FTE over data governance because of its importance. Banks in the past could get away without someone over data governance until $5B in size. Nowadays, it’s critical to have this person early as they can save you millions by having to restructure and clean data in the future. Since AI runs on data, this position oversees the integrity, security, and proper usage of data within the bank. They ensure that data policies are aligned with regulatory requirements and facilitate the seamless integration of data across various departments.

- Data Scientist: Since machine learning has been around for years, this is a position to add early, at least on an outsourced basis as analytic problems abound and it is important to build quality models from the start. A data scientist in a bank utilizes advanced analytics and machine learning techniques to interpret complex datasets, ensuring the integrity and security of data for strategic decision-making. They collaborate with IT, Risk, and business line advocates to seamlessly leverage data across various departments while adhering to regulatory requirements.

Years 2-4: Foundational

Once a bank is ready to transition from point solutions to platform solutions, there are some clear positions that need to be filled. It is one thing to provide your bankers with a single model to help them answer questions from their knowledge base or help assist customers on a website, but it is another effort to be able to leverage multiple internal models across risk, the customer experience, the employee experience and in operations. This effort boils down to inserting a whole horizontal layer of AI across various functions in an organized manner.

Banks in this phase should now consider the following positions (in order):

- AI Developer: A bank AI Developer designs, creates, and integrates artificial intelligence models and solutions to automate processes, enhance customer experiences, and optimize bank operations. They collaborate with various departments to ensure the seamless implementation and maintenance of AI technologies, adhering to regulatory requirements and best practices.

- Citizen Data Scientists: Given the democratization of AI, more business line bankers need to be trained on data analytical tools that are also subject matter experts.

- Model Validator: This position is responsible for assessing the accuracy and reliability of AI models, ensuring they meet regulatory and operational standards. They conduct rigorous testing and validation processes to detect any toxicity or errors in the models before deployment.

- Director of AI: The lead position will be accountable for the implementation and risk management of AI. Overtime, this position will fade into the background as AI becomes embedded and ubiquitous. However, over the next ten years, banks will need to proactively redesign most existing use cases to make the workflow and process AI-enabled.

- AI Compliance: Early in its growth, a bank will have to have risk functions solely focused on AI. This position ensures responsible and ethical use of AI technologies, protecting the bank’s reputation and regulatory compliance.

- AI Architect: A bank AI Architect is responsible for designing and overseeing the implementation of AI technical frameworks that align with the institution’s strategic goals. They ensure that AI solutions integrate seamlessly with existing systems and meet regulatory and operational standards.

- Generative AI Manager: Expert in creating and deploying generative AI solutions across the banking platform handling model management, governance, testing, prompt engineering and deployment.

- Agentic AI Manager: Oversees the deployment of agentic AI solutions, ensuring model testing, deployment, architecture, testing and governance.

- AI Governance Director: Manages policies and best practices around AI, including transparency, bias mitigation, and regulatory adherence around machine learning, Gen AI, and agentic AI.

- AI Prompt Engineer: Designs and refine prompts for generative AI models to deliver precise, context-aware outputs.

Years 4-7: Operational AI Platform

While only the national banks are here now, soon many more regional and large community banks will transition from building an AI operating layer to expanding this functionality into specialty AI lines such as sales, credit, fraud and payments. As a bank does, the following positions will be needed:

- Data Engineer: This position is responsible for designing, constructing, and maintaining scalable data pipelines and architectures that ensure efficient data flow and availability. They work closely with data governance, data scientists and analysts to support data-driven decision-making processes and improve banking operations.

- ML Engineer: An ML Engineer develops and optimizes algorithms to analyze financial data, enhance predictive accuracy, and improve decision-making processes. They collaborate with data scientists and IT teams to implement scalable machine learning models that drive efficiency and innovation in banking operations particularly in the deposit, credit and fraud fields.

- AI Product Manager: This position is responsible for overseeing the development and implementation of AI-driven products that enhance internal banking services and customer-facing products. They collaborate with cross-functional teams to ensure these products align with strategic goals, regulatory requirements, and market needs. Examples of Ai-first products include agentic digital wallets, wealth investment portfolio building, cash flow forecasting, expense management recommendation engine and small business operational optimization advisory.

- AI Risk & Governance Specialist: This position is responsible for identifying, assessing, and mitigating risks associated with the deployment of AI technologies. They ensure adherence to regulatory standards, establish best practices, and oversee ethical considerations to maintain the integrity and reliability of AI systems.

- AI & Data Translator: A bank AI & Data Translator acts as an intermediary between technical teams and business stakeholders, ensuring that AI and data solutions align with business objectives. They interpret complex data insights and communicate them in a clear and actionable manner to drive strategic decision-making within the bank.

Putting This AI Talent Roadmap Into Action

An AI talent plan is critical to support a bank’s overall strategic effort in AI. Customizing the above and producing a bank AI talent roadmap for your institution will help you identify open positions that you can start to recruit for or develop internal talent. Each role plays a crucial part in designing scalable data pipelines, optimizing algorithms, developing AI-driven products, assessing risks, and translating complex data insights to support strategic decision-making in banking operations that are both internally and externally facing.

Since Gen AI and agentic AI are such a new field for many banks, having the right AI talent is the difference between a successful and a failed program.