Term SOFR and Our Last Update on Libor Cessation

US prudential regulators are clear that after 2021 banks may no longer use USD LIBOR as an index. The remaining USD LIBOR cash and derivative instruments will continue until June 30, 2023, at which point all USD LIBOR settings are expected to be discontinued, and most legacy LIBOR contracts will be converted to a Fallback Rate (effectively, SOFR plus a spread adjustment). In this article, we will discuss the challenges, successes, pitfalls, and recommendations related to the use of alternative indexes to LIBOR for community banks starting in 2022 and look at term SOFR as an alternative index. We will discuss the conversion of legacy LIBOR trades in an article next year.

Timelines for Libor

Most community banks are now ready for discontinuation of LIBOR for new lending, deposit gathering, and hedging. Most banks that we speak to have identified their preferred indexes and have finalized systems, processes, documentation, and third-party vendors. SouthState Bank, like many banks, will use various adjustable-rate indexes, including Prime, US T-Bills, Fed Funds, and SOFR. However, for hedged loans, SouthState Bank will use SOFR (except for certain government programs that mandate other indexes).

In recent months the CFTC’s advisory committee drove a SOFR First program to switch the dealer market from LIBOR to SOFR, and SOFR is emerging as the dominant index in the banking market as various regulators (FCA and CFTC) have issued statements about reinforcing the move to SOFR. In October of this year, SOFR comprised 25% of the hedging market while LIBOR represented approximately 70% of the market (however, this LIBOR market will come to a complete stop at the end of 2021, expected to be primarily replaced by SOFR).

Community banks should be careful not to increase principal or extend term commitments for LIBOR-based contracts after 2021. This can be tricky for loan modifications, extensions or renewals that are being contemplated or negotiated late this month and that may roll into 2022.

Term SOFR

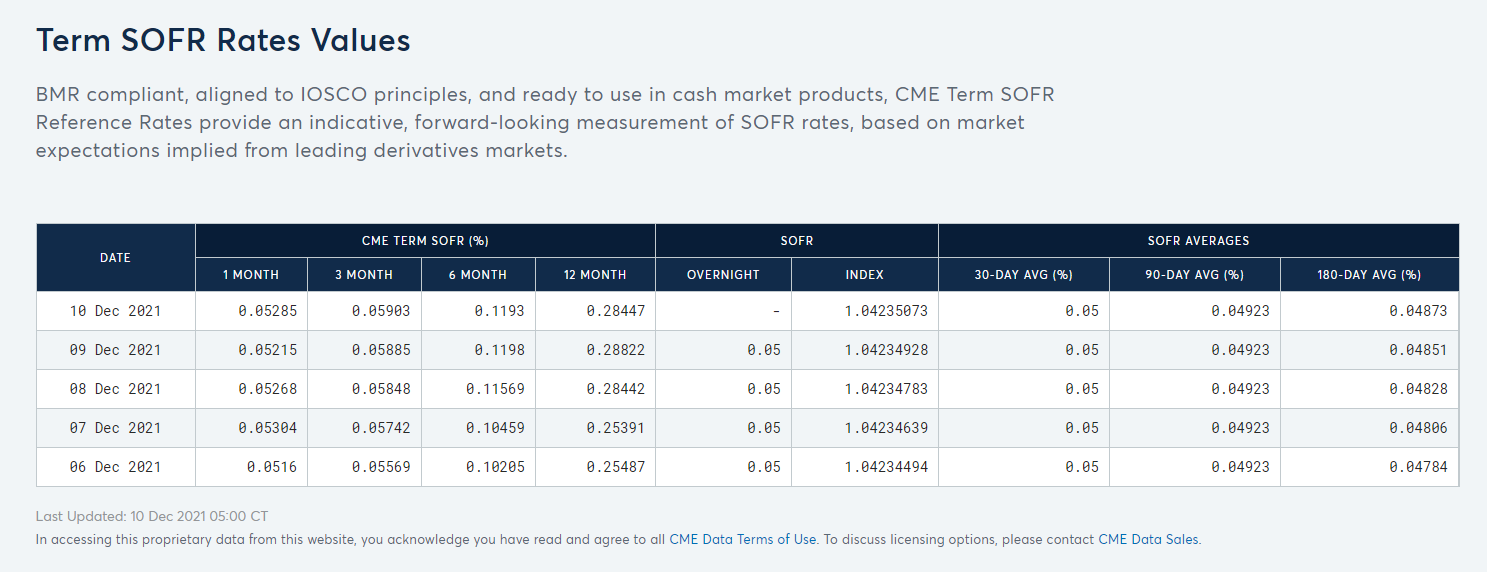

One recent key development has increased the use of SOFR by community banks – the availability of forward-looking term SOFR. The market has always expressed a preference for forward-looking, term indexes, but until recently, SOFR has only been priced as an overnight rate (or as a historical observed term rate). While the CME has been publishing term SOFR, the Alternative Reference Rate Committee (ARRC) only recommended term SOFR in July of this year and released best practices related to its use. In November of this year, the hedging market for term SOFR became available to community banks. SOFR rates for the term structure is published by the CME Group and can be found here: https://www.cmegroup.com/market-data/cme-group-benchmark-administration/term-sofr.html

Term SOFR is available for 1, 3, 6, and 12-month terms, and currently, most community banks may quote the index without a licensing fee. A snapshot of the CME term SOFR rates page is shown below:

There are a number of substantial benefits for community banks to use term SOFR over daily SOFR, as follows:

- The index is required to be updated less frequently (monthly, quarterly, semi-annually, or annually) instead of daily;

- Term SOFR eliminates the need for compounding interest – which is a function currently not supported by most bank core systems;

- Term SOFR allows lenders to calculate end-of-period accrual at the start of the period instead of at the end; and

- Term SOFR behaves and carries conventions very similar to LIBOR, so the transition may be simplified for documentation and core system booking.

For all of the above reasons, SouthState Bank is a proponent of term SOFR, especially for hedging term loans. We currently offer a 1-month term SOFR as a hedgeable index for our ARC loan hedging program. We also offer daily SOFR for those banks that prefer that index for hedging.

Detractors of SOFR

There is one major criticism of SOFR expressed by market participants. Because SOFR has no credit component (it is a risk-free rate), the index will not behave like most banks’ COF. During times of financial dislocation or stress, banks’ COF generally rises, but SOFR will decrease because the index is tied to Treasury secured repo contracts. The concern, as expressed by some bankers, is that banks will be unable to correctly hedge their risk during market dislocations.

The real concern for lenders is allowing a borrower to arbitrage the bank – to borrow cheaply from the bank when the bank’s cost of funding is rising. This is precisely what happens on lines of credit when banks price these facilities off indexes without a credit component.

However, SOFR is not the only risk-free index in the market. Prime and Fed Funds are also risk-free rates and do not contain a credit component; therefore, the shortfall of SOFR is not specific to that index alone. In times of financial stress, a bank’s cost of funding rises, but Prime, Fed Funds, and SOFR would all be expected to fall, lowering the cost of borrowing. This is particularly unfortunate since most banks do not charge a standby fee on lines of credit – lenders do not earn any return, potentially until the lender’s COF goes up, and that is when borrowers are more likely to draw.

This shortfall of SOFR is not specific to that index alone, and banks have historically accepted risk-free indexes and charged a premium to compensate for the market risk that may occur during a financial dislocation. Prime, Fed Funds, LIBOR, and SOFR are all highly correlated, and periods of financial stress, while severe, are infrequent. Therefore, most lenders can easily price a credit premium over Prime, Fed Funds, and SOFR to get an equivalent credit component inherent in LIBOR.

While there is a sound argument for lenders not to use SOFR (or Prime or Fed Funds) for lines of credit, lenders can build a credit component to SOFR and avoid that arbitrage. That credit component has already been determined by ARRC to be 11.448bps for SOFR versus 1-month LIBOR and 26.161bps for SOFR versus 3-month LIBOR. Since the beginning of this year, the national banks have been largely SOFR-ready and are offering customers SOFR-based products.

Conclusion

Community banks should choose a safe road when considering what to use after LIBOR. Alternatives to SOFR do exist, such as Ameribor and BSBY (Bloomberg Short-term Index). However, SOFR is by far the bigger market, and regulators have long emphasized the importance of using an index that is robust enough to be represented by trillions of dollars in contracts and one that will be available and representative during financial turbulence. ARRC has long recommended SOFR as a robust and durable index. Currently, ARRC-recommended fallback language is making its way through congress to make it a Federal statutory replacement index for LIBOR. SOFR may not be the right index for every instrument, but it is expected to gain the majority share in the banking market.