What Will Be The Fed’s Terminal Fed Funds Rate?

Last week the Federal Reserve raised the Fed Funds rate by another 75 basis points – that was no surprise to the market. However, in Powell’s unscripted remarks at the press conference, he stated that interest rates have reached a “neutral level.” The market reacted to those words with equities and bonds both rallying. We believe that some market participants misinterpreted Powells’ comments, and banks should be ready for an environment where short-term rates are higher for longer – as in years, not quarters. This article breaks down our expectations for a terminal Fed Funds Rate.

The Neutral Rate Fed Funds Rate

The Fed has stated that a neutral rate is the theoretical federal funds rate at which monetary policy is neither accommodative nor restrictive and is consistent with the economy maintaining full employment with associated price stability. The question is this: “Is the current Fed Funds rate consistent with monetary policy being neither contractionary nor expansionary?” For seven reasons stated below, we believe that the Federal Reserve has some ways to go in restricting monetary policy further (regardless of recessionary consequences), and community banks need to be ready for short-term interest rates to go higher and inflation to remain above the Fed’s preferred 2% level for longer.

Why We Predict a Higher Terminal Fed Funds Rate Than The Market

There are a number of compelling reasons to conclude that we are now in a world where inflation consistently runs hotter than in the previous four decades. In fact, this is the underlying message of a number of global central bankers, and there are various reasons why inflation rates may be above the 2% target for the near term and why future shorter-term rates may be high by historical norms.

- Forward Guidance is Over – In some previous rate hike cycles the Fed did not give forward guidance, and it did not provide a summary of economic projections with forecasts. When interest rates are at zero, forward guidance is a powerful tool for the Fed, since it is difficult to cut below zero (though not impossible), and forward guidance provides a timeline for the duration of zero. However, at this stage of the rate hiking cycle forward guidance is not needed and undermines the Fed’s credibility. The Fed does not know where policy should be in the future because they cannot predict the future – and have made some blunders in most recent attempts. Therefore, the Fed will be data-dependent. The conclusion is that Powell is not guiding the market with his statement that we have reached “neutral rates.” We may be a ways off from neutral if CPI is 9.1% and Fed Funds is only 2.32%.

- Real Rates Still Negative – Real rates are nominal rates minus inflation. By any measure of inflation (CPI, CPE, or PPI), real interest rates are presently highly negative. In order to not stoke inflation, real interest rates must be equal to or higher than zero. Therefore, the Fed Funds rate has room to rise.

- Dual Mandate Turns to Single Mandate – The Fed’s number one job, backed by the administration and every politician that wants to be re-elected is to tame inflation. Inflation is a pernicious phenomenon (although long forgotten) that claims the most vulnerable citizens as victims. The Fed has stated that “inflation remains much too high and is inflicting considerable hardship on Americans.” The Fed is willing to err on the side of unemployment to control inflation and will continue its work to tighten monetary policy. The Fed would prefer to overshoot interest rates to ensure that inflation is contained.

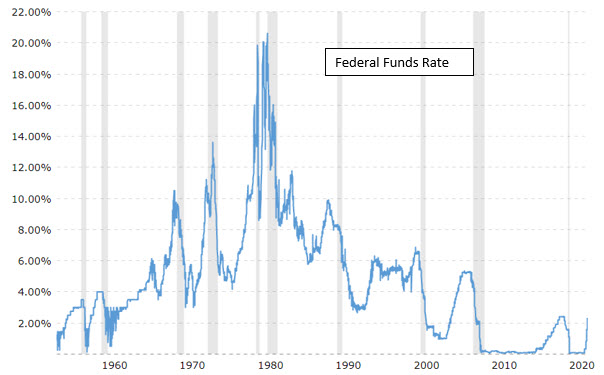

- Avoid the Volcker Policy Mistake – The graph below shows the federal funds rate from 1950 to the present. Most readers are familiar with the then-Fed Chair Paul Volcker’s work to tame inflation in the late seventies and early eighties. What some do not remember is that the Fed made several mistakes by vacillating on monetary policy.

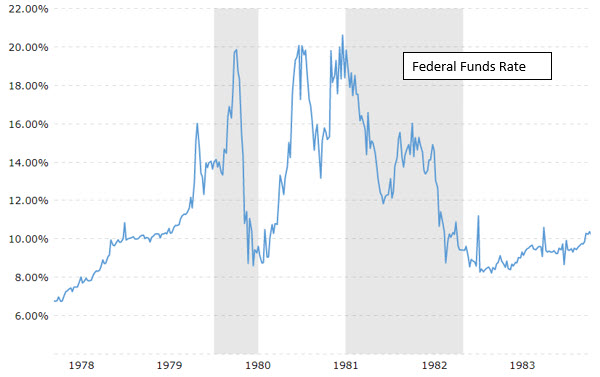

The graph below shows the federal funds rate during the Volcker inflationary period. The Fed raised rates to 20% to tame inflation but then lowered rates to 9% during the recession that followed, only to recognize that inflation was not quashed by the recession and higher unemployment. The Fed had to zig-zag twice more between 20% and 13% federal funds rate. Each zig-zag prolonged the inflationary environment. The current Fed understands this policy mistake well and has stated that it will not be repeated. The current Fed is motivated to keep rates higher until it sees inflation subside to its desired level.

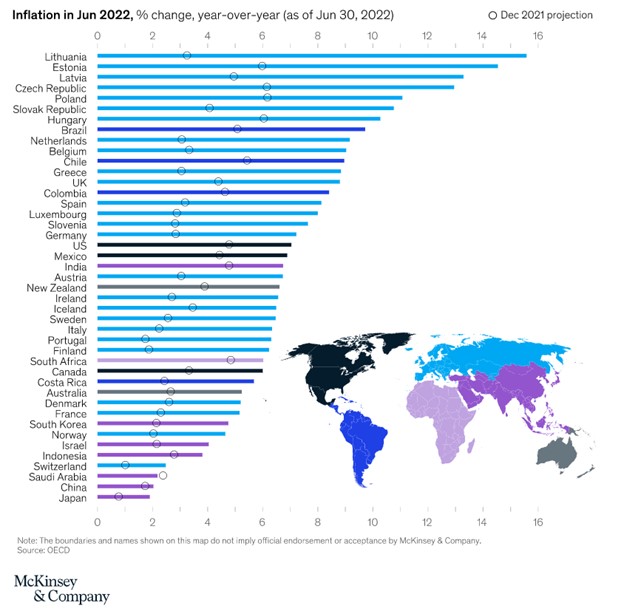

5) Inflation as World Phenomenon – Inflationary pressures are global and are caused by various short-term and long-term factors. The pandemic, wars, de-globalization, worker shortages, too much monetary and fiscal stimulus, and zero tolerance covid policy in China may all be fueling inflation. But the Fed will have a harder time taming inflation if the cause is systemic and global, versus a policy mistake that needs a domestic response. The graph below shows inflation in countries around the globe. The Fed’s policy fight is echoed by governments around the world, and they are all responding in a similar fashion – raising interest rates.

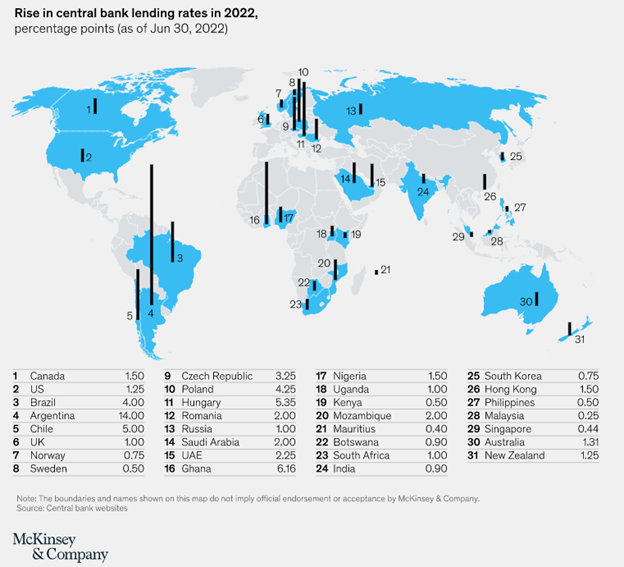

The graph below shows how central banks are taking up the fight against inflation. The Fed will be forced to fight not just a domestic inflation problem but a global rise in inflation and inflation expectations.

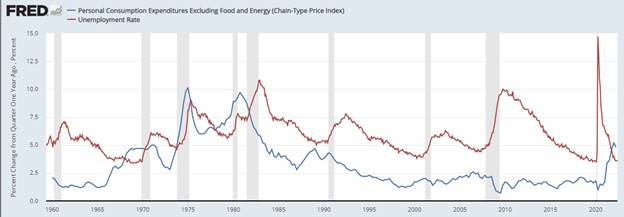

6) The Fed Killed the Phillips Curve – The Phillips curve represents the relationship between unemployment and wage inflation. That relationship has more generally been extended to price inflation. The more unemployment, the lower the inflation, and vice versa. The Phillips curve held up well until the early 1990s, when inflation and employment became unhinged. As evidenced in the graph below, between 1950 and 1990, high unemployment was associated with lower inflation, but since the early 1990s, changes in employment did not affect inflation. If the Phillips curve was flat in the last 30 years, we do not expect it to suddenly become a strong transmission mechanism again. By increasing unemployment, the federal reserve may not be able to achieve the inflation it hopes for. The last 30 years were marked by varying unemployment levels and low inflation, and the next few years may be likewise unaffected by employment levels but with high inflation.

7) The Market Forecast – The breakeven rates indicate the market’s expectations of forward inflation (Treasury yields minus TIPS rates). The market does not expect inflation to reach the Fed’s goal of 2% for the next 10 years. The breakeven rate for one year is just under 4%, and the breakeven for 10 years is 2.66%. To achieve its goal, the Fed may need to keep short-term rates anchored higher than expected for a longer period than anticipated.

Conclusion

Our seven points above lead us to the conclusion that the Terminal Fed Funds Rate for this cycle will be above 4.00%. This will have an impact on short-term indexed lending rates and deposit rates at banks.

As the federal reserve conducts a long-term battle against inflation, community banks should be ready with asset-liability management (ALM), deposit strategies, and loan structures for an environment where short-term interest rates are higher, and the yield curve is flatter, even during future recessions.