The Content Acquisition Strategy

If you want to get ahead of a trend, consider investing in content for your bank. Content is the new growth accelerator in banking and banks would be wise to start small now, experiment, and learn the ways of the future. Content is the missing piece of growth acceleration and helps not only acquire new customers but slows turn while helping build a brand. In this article, we look at the formula for using content, some examples, and a game plan for blowing past your competition.

The Concept

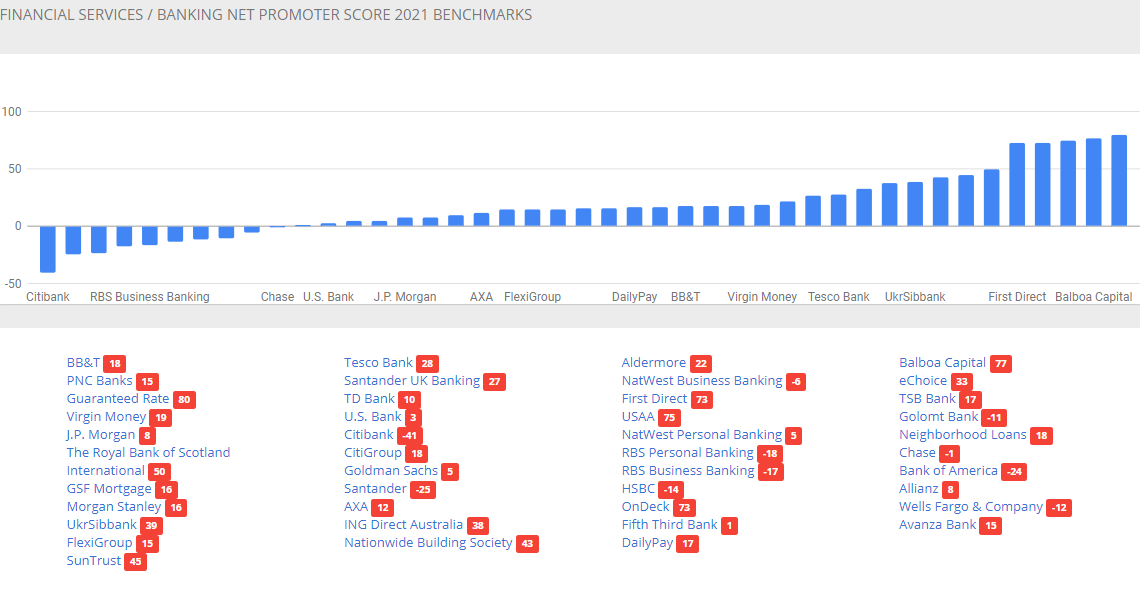

If you have an industry sub-sector, like community banking, that has low relative earnings multiples and low to average Net Promoter Scores (NPS), then it makes sense banks should look to acquire exclusive financial content that has high growth and high NPS in order to differentiate themselves in a way that efficiently helps attract customers while reducing customer churn. As can be seen by the list below, many banks suffer low NPS scores and would greatly benefit from this strategy.

If you buy off on that supposition, then two of the most undervalued content streams are YouTube video and podcast content. At scale, Netflix pioneered this approach when it produced the hit show House of Cards in 2013, and a huge number of new subscribers flocked to the platform, churn got reduced, and their stock price shot up due to an earnings multiple increase.

Spotify resisted acquiring their own content for years until it changed its strategy when it paid Joe Rogan $100mm for the exclusive rights for his podcast content, and in large part, due to that purchase (and a couple of others like it), the stock rose by 126% by the end of the year. That is more than $22 billion in market capitalization – a smart investment. Amazon, Apple, Hulu, and many others will continue with this strategy to acquire content and then monetize it to sell more product. Bank of America, Amex, and many other banks have also started to dabble in the strategy with some success.

Source: The Customer Guru

But What About Banking?

Banking, with its monthly charges for account services, is not that inherently different than Amazon or Spotify. Almost every bank is looking to increase its fee lines of business and at its heart, deposit charges, treasury management services, or similar lines of business are all basically subscription services like Spotify and Netflix. Instead of selling products like Amazon, banks sell credit and benefit both by adding more subscription fees (similar to the Prime Membership) while selling more credit. Add more meaningful content to a banking platform and banks will find selling subscription deposit services and loans easier.

Quality content abounds. TED talks, Snacks Minute, Planet Money, BFFs (Richards & Portnoy), The Dave Ramsey Show, How I Built This, Life Kit, Jocko Podcast, The Tim Ferriss Show, and thousands of others come with a huge customer base and growth that is five to 100 times greater than most every bank in America today.

Of course, banks can think on a smaller, cheaper, and more local scale. There are hundreds of thousands of content creators that would be open to partner with a bank either on an exclusive or semi-exclusive basis. Further, some of these content creators would love to work with a bank full time and bring with them 20,000 to millions of active listeners. JJ The CPA, Clara CFO Group, Graham Stephan, Whiteboard Finance, The Financial Diet, Debt Free Millennials, Mapped Out Money and the list goes on of inexpensive talent waiting for an acquisition or partnership.

A typical commercial and retail community bank has a customer segment cluster similar to the one below. Banks can either target specific content producers to go after specific segments or run this same analysis on influencer followers to see the general fit. A content producer like Planet Money has extremely similar customer segment clusters making an acquisition for a regional bank extremely efficient.

The Arbitrage of Relevance

By pursuing this strategy, banks are essentially arbitraging relevance. They are trading their capital in exchange to be more relevant in an effort to attract more customers, increase engagement and sell more products. Pick any given content creator with strong engagement and growth and if they make $600,000 and the bank could pay them $2 million, increase their net promotor score by 10 points and monetize it with more deposits and loans. The result could be a 10% increase in customers and a 500% increase in prospects. That is enough to add $10mm in market capitalization for a 5x return and a breakeven of less than a year. The bank would end up with a differentiated marketing strategy and an amplified voice across social media.

Putting This into Action

While banks should absolutely be producing their own content, they likely can’t match the creativity of most of the established content producers in the market. The diversity of content production is such that any size bank with any target customer focus can find a content producer to acquire or partner. Instead of paying a premium for a whole bank acquisition, consider the steep discount these content creators with their high NPS, large fan base, and stratospheric engagement can add to a bank’s value. Content acquisition is one of the cheapest ways for banks to differentiate themselves in the market.