The Crypto Wallet for Web 3.0 – Why It Needs To Be In Your Strategic Plan

Set aside the noise of cryptocurrency for a second and focus on the potential of a new digital asset, or crypto, wallet. The crypto wallet can be the centerpiece of customer engagement for Web 3.0 and can be used for a myriad of new applications. The bigger picture here that banks should consider is that the blockchain has the ability to bring together an array of bank products and make them more secure, more interoperable and more efficient than they ever could be under Web 2.0. This article looks at how this wallet of the future will enable customers to new levels of engagement and why this product should be on every bank’s strategic roadmap.

What Is a Crypto Wallet?

By this time in the evolutionary cycle, you are likely familiar with the various types of closed wallets (like Starbucks). Semi-open digital wallets that work for a select group of retailers (more popular in other countries) or open wallets such as Apple, Samsung, Paypal, Google, and maybe even your bank.

These are digital wallets, with a foundation in Web 2.0, that are driven by a specific payment channel such as a debit card, credit card, or ACH transfer. It is a representation of plastic. Save for accessing your transaction history; a digital wallet is a refined analog wallet. It holds your charge cards; you can tap to pay and see your transaction history. This is boring stuff.

If we add the ability to store a cryptocurrency, such as Bitcoin, or Ethereum, it becomes a little more interesting. A dual currency digital wallet – one that holds Euros and Pounds, for example – is rare, but they do exist. HSBC, for example, launched one in the U.S. in early 2021.

In the future, customers will need a crypto wallet to handle their U.S. Central Bank digital currency or E-Dollar.

Being able to pay in U.S. Dollars, Euros, or a cryptocurrency starts to get fun. If you combine this digital/crypto wallet with a payments hub where you can send a variety of payment types in any currency you would like in real-time, you will be on to something. Cross-border friction starts to fall away, and payment efficiency will win the day.

JP Morgan, Onyx product is doing just that and is having unmitigated success.

However, that is still just the start of the revolution.

Digital Assets in Crypto Wallets

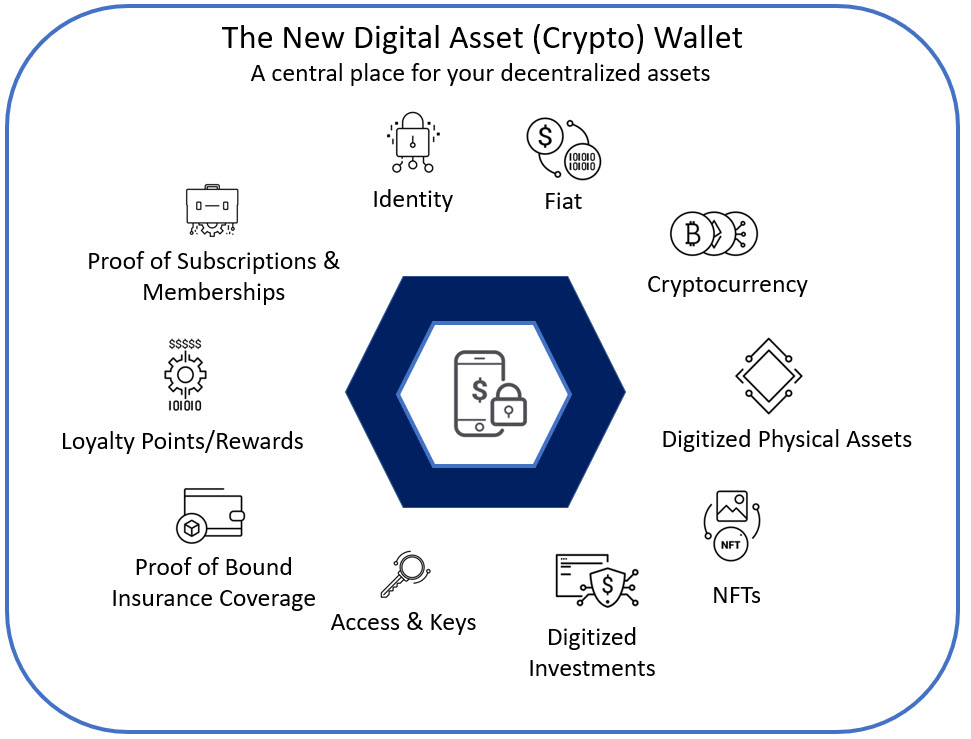

The transformational aspect of the crypto wallet rests on the notion that all assets will be digital, and households and businesses will need someplace to store these assets.

Onyx, for example, started with the intraday repo. Repo traditionally requires a day to settle. You borrow cash against securities, and it settles that night, allowing you to roll it or terminate the transaction the next day. Now, with Onyx repo, you can move money and title in seconds, allowing the innovation of a two-hour repo, for example, to satisfy a daylight overdraft.

Several banks have been playing around with digital mortgages and have settled transactions to a crypto wallet of sorts. While the mortgage process is still hampered by analog requirements, it is only a matter of time before you will be able to clear title, put in place insurance, satisfy conditions precedent and settle a transaction in real-time during the same day (business day or otherwise) you started the transaction. Many other asset classes will follow suit with the ultimate impact that the original product will be digital. Bonds, equities, real estate, funds, partnerships, derivatives, and other investments will all become digital assets at the point of inception and need to be stored in a crypto wallet.

The crypto wallet will become the centerpiece of everyone’s financial life.

The Tokenization of Commerce

The next evolutionary leap that is already underway is the digitization of physical assets. It is one thing to digitize an intangible asset such as an NFT, mortgage, or repo, but the tokenization of commerce starts to get widespread usage once it starts recording physical objects. As we wrote about in our piece on digital assets, this is being done with cars now. Few households keep proper track of purchase or maintenance data, so Alfa Romeo solved that issue by moving their newest SUV to the blockchain.

“Digital Twining” has already taken hold. Nike, Adidas, Burberry, Balenciaga, Dolce & Gabbana, Louis Vuitton, and others already have NFTs and will soon tie the digital assets to physical ones. Thus, when you purchase the latest special edition basketball shoes from Nike, you will not only be conferred ownership, but you will also get a digital representation of the article for your use in various games and metaverse space. These digital assets and proof of your physical assets will need to be stored in a crypto wallet.

Your Personal Ledger Brought to You By Your Bank

The paradigm-shifting aspect here is that households and businesses do not have an accurate inventory of their assets. They should, and a bank offering a crypto wallet is the perfect place to do that. Banks have the vast advantage of trust, credit and potentially being in the credit stream. A bank is at the ideal crossroads to enable and manage a comprehensive solution in the form of a crypto wallet. While banks are behind leading crypto wallets like Coinbase, Metamask, Trezor, Ambire, and others, they could quickly catch up.

Banks can now create their own payment stream or integrate with a third-party payment application to tokenize every transaction. Banks could take in payment messages which would act as a receipt on steroids. Not only would banks see all the transaction data, but it would help manage title and usage. By a new stovetop for the home, and your purchase gets added to a variety of folders within your wallet so that you can track appliances, your home’s value, and your warranty coverage all through your crypto wallet. Customers would go out of their way to use a bank’s wallet.

Up to this point in banking’s evolution, banks have played a role in pre-purchase and the point of purchase. Now, banks can play a role in a transaction’s post-purchase.

Personal and business financial management dashboards would get a considerable boost of transaction information to become more useful. The cross-sell opportunities for banks would skyrocket as a deeper picture would emerge about customers to sell wealth products, insurance, credit, or asset management.

In short, banks would be the recipient of a cavalcade of some of the most valuable data on the planet. A crypto wallet would be able to handle multiple fiat currencies, various cryptocurrencies, credit (negative balances), and digital assets. The crypto wallet would become a centralized repository of bank value and blockchain value.

Customer retention would increase, and customer lifetime value would skyrocket.

The Dynamic Identity of Crypto Wallets

Identity is already heading towards the blockchain. The blockchain is the perfect centralized ledger to encrypt identity data while letting the customer control who has access. Customers can populate their identity with government-issued identification, add third-party data to the extent needed, but then build their identity with millions of data points through transaction information.

Country club membership, certifications, academic credentials, payroll information, asset purchases, Netflix subscriptions, and thousands of other pieces of data now create an identity “crystal” more complex than a snowflake. What emerges is a dynamic identity that will be difficult for the bad guys to thwart. This dynamic identity will be brought to you by your bank, all enabled by your crypto wallet.

Putting Crypto Wallets into Action

Banks providing crypto wallets will go mainstream in the next five years. Proactive banks will start planning now and work backward to figure out what it needs to do today. The first step is researching and educating your executive management team so that they can have a vision of what they want the future to look like.

After that, banks should start to figure out their next step to get hands-on experience with crypto, blockchain, and digital assets. Few bankers who have taken the time to understand Web 3.0, defi, payment trends, digital assets, and blockchain have walked away without being changed.

The tokenization of sensitive payment and asset data is crucial for banks and all sellers of goods and services. Right now, asset purchase data and asset ownership are disorganized and largely unsecured. Banks can change that.

The massive advantage of a crypto wallet is not only that the purchase and ownership data become organized and accessible for insight, but it becomes secure. While nothing is 100%, the tokenized data in a crypto wallet is meaningless to steal, thus eliminating the huge risk we have now with data breaches of merchants, card companies, payment networks, and even banks. Each digital asset on the blockchain exists independently of the bank thereby putting the customer in complete control. The bank-provided crypto wallet merely brings it all together.