Net interest margin (NIM) is the most widely used performance measure for commercial lending for community banks. Community banks are working hard to maintain NIM and thus profitability – or, so the thinking goes. In this article, we look at the latest 2021 correlation between NIM and profitability in the form of return on equity (ROE) and present how NIM is not only a predictor of UNDER-performance but is a contributing factor to bank failure.

The Data for Net Interest Margin

We looked at the average NIM and ROE for all operating banks in the country (4,973 of them) for the past ten years. We started with the thesis that the wider a bank’s NIM is, the more profitable the bank would be. We also looked at the NIM and ROE for almost 11,000 defunct banks (banks that were acquired or were in receivership through the FDIC) to see what that data told us.

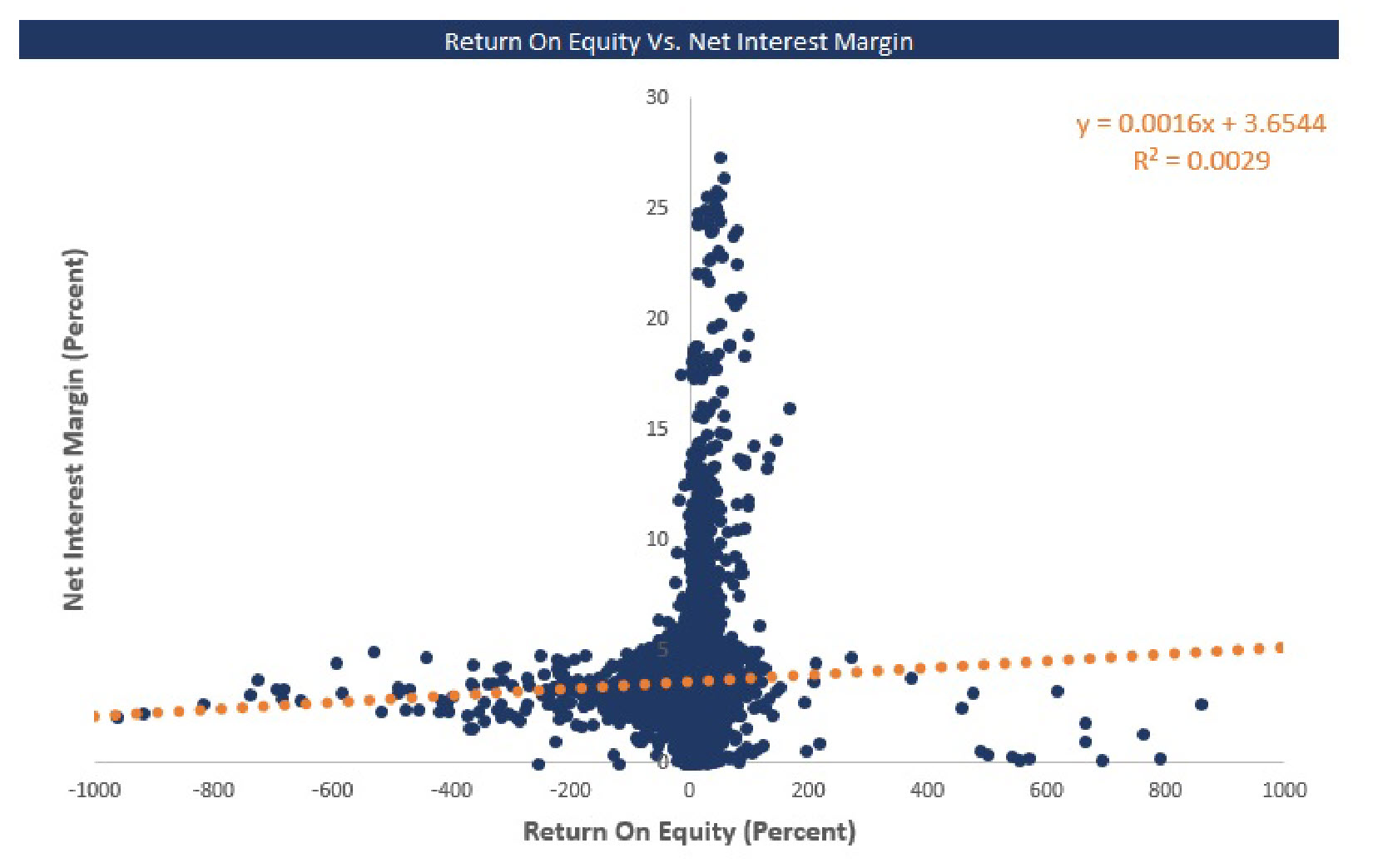

Below is a graph of all the remaining banks in the country showing the last ten-year average NIM and ROA extracted from FDIC call report data. In the last ten years, the industry’s ROE has averaged 7.22%, and NIM has averaged 3.67%. Most pertinent is the correlation between NIM and ROE.

As can be seen below, the correlation is 0.29%, or basically not correlated at all. To put this in perspective, this means that NIM has about the same impact on ROE as your logo color (blue is best) or which way your branch doors face (south is best). Your management is far better off focusing on things like efficiency, fee income, and lifetime customer value.

Net Interest Margin is Worse Than You Thought

The above, however, is not the full analysis. By analyzing existing banks, we are analyzing some of the strongest and most successful banks in history. What about all the banks that no longer exist?

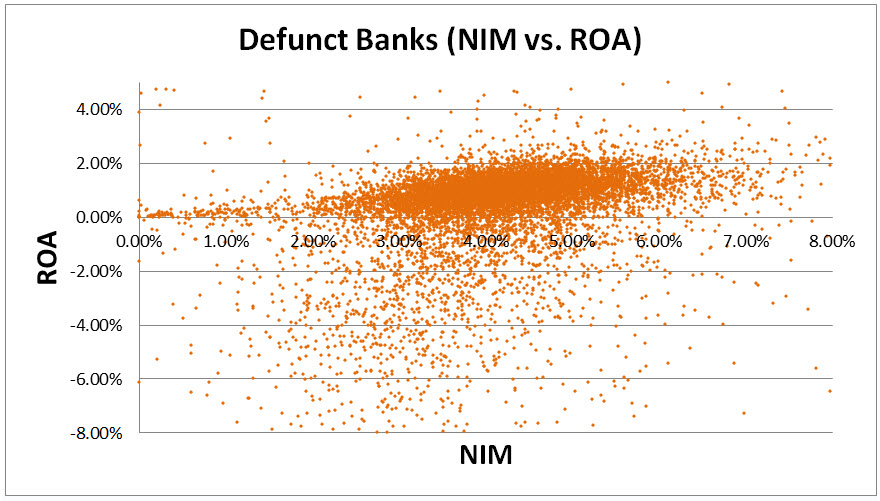

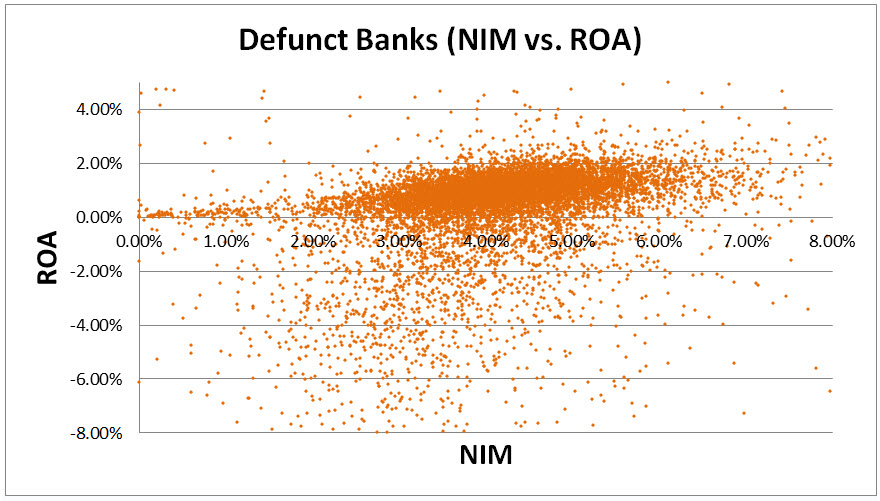

Below, is the data available for all defunct banks, almost 11,000 institutions that were acquired or failed. For this group of banks, the average NIM was 4.18%. When we look at the correlation between NIM and ROE we get a negative 11%. That is, for these defunct banks, higher NIM resulted in lower ROE.

Why Chasing NIM is Fool’s Gold

NIM is not a strong predictor of ROE for three material reasons.

- Does not consider risk

- The metric does not consider customer lifetime profitability

- NIM does not take into account expenses such as acquisition or processing cost

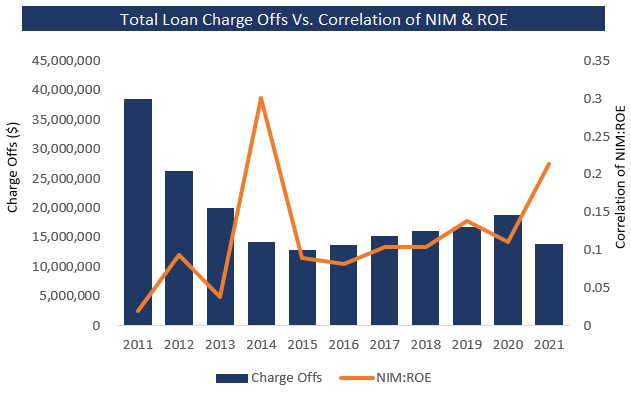

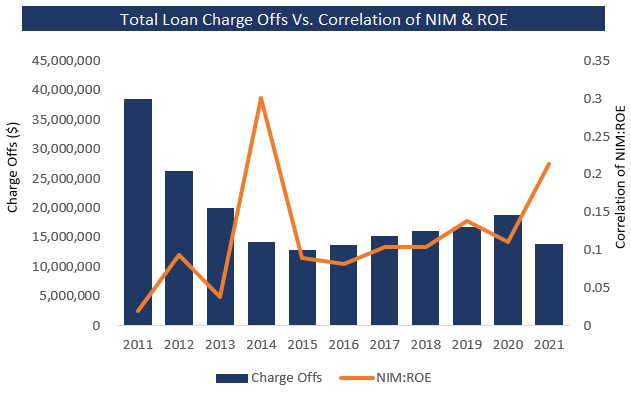

Let’s just focus on credit risk for a moment. The graph below shows that when credit risk is low, as it was in 2014 for example, net interest margin can explain approximately 30% of ROE. However, as credit quality decreases, as it did in 2011 on the graph, NIM explains very little and if failed banks are included in the analysis, has an inverse impact on profitability.

Construction loans, loans to inexperienced sponsors, and warehouse lines, for example, help NIM and perform fine when the economy is improving, but when a credit shock occurs, can be disastrous. Likewise, loans under three years in term, small loans under $400,000, and complex loans with high handling costs are all likely to garner higher than average net interest margin but often underperform due to high operating costs relative to revenue.

Finally, the largest predictor of ROE is customer profitability. What banks want is the highest and longest set of cash flows at the lowest cost and risk. If banks can get a wide risk-adjusted margin, great, it should. However, it is these borrowers that are the most competitive. A bank would rather deploy capital and have the option of improving the profitability over the life of the customer than having that capital sit idle earning the Fed Funds rate.

Conversely, banks that draw a minimum net interest margin have a higher probability of getting adversely selected. Quality borrowers often have other options and will tend to gravitate to a bank that can be competitive.

The current reality in banking is that very few banks have a robust and strictly applied RAROC (risk-adjusted return on capital) modeling system. This is why you often see large pricing differences between banks.

When banks focus on nominal NIM, other aspects of the loan are overlooked. For example, higher NIM may be obtained, but other aspects of the loan detract from ROE. The loan may be smaller, the credit quality lower, the relationship and cross-sell opportunities diminished, the customer lifetime value is lower, or there may be substantial interest rate risk (or other non-compensable risks).

Conclusion

To produce above-average profitability, banks want to build a portfolio of long and profitable relationships. Banks that focus on NIM often end up with a higher number of small, short, and riskier relationships.

We continue to see where the current misplaced emphasis on NIM is setting up some banks for challenging circumstances in the future. If the credit environment deteriorates or interest rates increase (both scenarios are predicated), the higher NIM will not offset lesser credit quality or declining revenue from rising deposit costs. To increase performance, banks should embrace a more nuanced view of loan pricing and consider factors beyond NIM.