The Profitability and Banking of Youth Sports Accounts

One of the unspoken cults in America is youth sports. Youth sports is a perfect place to project your adult shortcomings, fears, dreams, hopes, and aspirations onto your child, all under the guise of teaching teamwork. If uncontrolled, it can become an obsession, and the next thing you know, you are flying to some distant city, spending thousands of dollars to play a tournament that doesn’t matter. If this rings true, then we ask – WHAT ARE YOU THINKING? How can you not be making money on this?

The reality is we love our kids and will do anything for them. Right or wrong, it is primarily a hallmark of the current parent generation, and today we point out that it also is the perfect environment for banking. An estimated 40 million kids play youth sports, and their parents spend more than $5B annually on the effort. Soccer, baseball, hockey, cheer, swimming, volleyball, lacrosse, and a hundred other sports often have teams or leagues in the average communities we bank. The demographics of the parents skew young, upwardly mobile, 40% suburban, 38% urban, and 34% affluent. In short, it is a perfect banking client with a set of potential customers that are all banded together to see little Jimmy win a trophy. The best part is – few banks focus on this segment.

The Profitability of Youth Sports Accounts

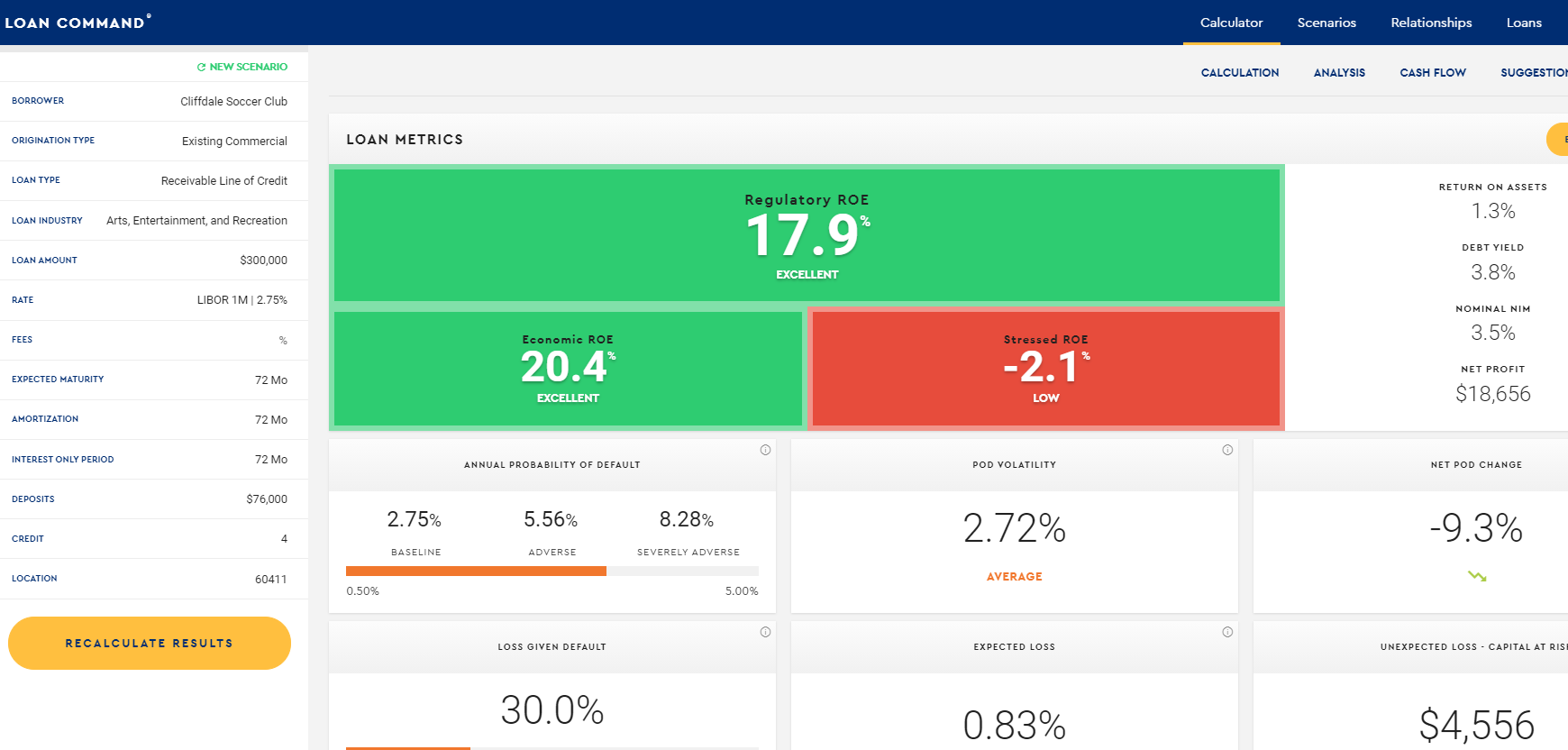

In terms of profitability, an account’s return is correlated to both age and competitiveness of the team. The older and the more competitive the team, the more profitable they are on an annual basis. Older teams do more traveling, have more tournaments, and have larger transactions.

The greater your bank’s ability to market to the parents and collect referrals, the younger and more recreational you can go. A youth team for recreational basketball for 5 to 6-year-olds, for instance, loses about $65 per year for a large negative return. However, by getting other business, this could be turned profitable and can be used as a loss leader. Once you start getting into non-recreational teams in the 14 to 17-year-old category, profitability jumps to 17% return on equity (“ROE”) or greater (below).

Banking The League & Tournaments

Of course, the ultimate goal is to be able to bank a league. Here, an average size league has a core profitability of 45% plus, as the average annual balance size is in excess of $150k and lifetime value is multiple times longer than just a sports team itself. While tournament or showcase organizers may be separate and are also bankable, some leagues specialize in these large-scale events making both the league and banking relationship more profitable. If you can combine the league with the ability to capture separate accounts for each team, profitability is greater than 51% ROE.

How To Capture The Youth Sports Accounts

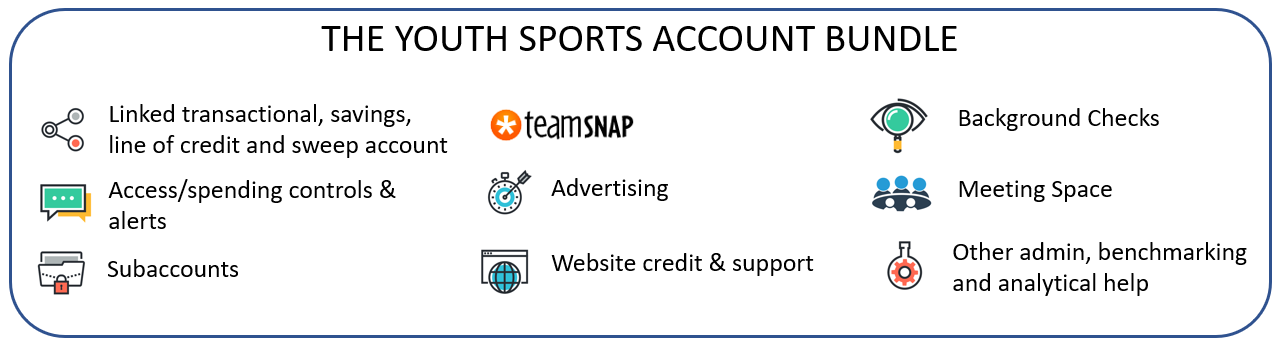

To capture the youth sports business, you need separate marketing materials as a start. You also need educational materials about how to handle a non-profit and how to manage the account to prevent fraud and misuse. Here, the ability to set alerts, manage co-signers with different limits, and electronic reporting (IRS, year-end, etc.) can all separate your bank from the rest of the industry.

In addition, you will need the ability to create companion accounts (or sub-accounts) so a team can have operational checking plus a savings/checking account to handle various aspects of team management such as social events, gifts, etc. Accounts should be all electronic to lower-cost plus have the ability to capture checks remotely via smartphone.

Adding Engagement Tools

On top of the marketing and basic account packages, banks that have succeeded in this effort have found it useful to package several attributes into their youth sports bundle. These include providing for the Ultra version of TeamSnap, a popular online management tool for teams and leagues. Providing certain annual advertising spend that brings in money to the league or team while promoting the bank. The list goes on but help with websites, background checks, meeting space, benchmarks against other teams/leagues, and other admin tools all help attract youth sports managers to the bank.

Putting This Into Action

Banking youth sports is an underserved segment of the community that can be leveraged not just for core deposit performance, but as a central lever to increase the brand within a community and to gather referrals of target customers. To become a more profitable bank, it helps to shift resources to the more profitable sectors instead of trying to bank everyone in the community equally.

For banks looking to increase deposit balances and profitability, youth sports is one strong tactic. If you do go down this path, make sure you clear room for all the team photos, not to mention some extra time to hear about little Cindy’s latest tournament.