The Stimulus Package and CARES Act Bank Playbook

Go to any Trader Joe’s market and then go to a competing market, and you will be likely to find a significant difference. Trader Joe’s has produced a COVID-19 response that is thoughtful, practical, relatively inexpensive, and caring. From their increased staffing to their small gestures like a preferred senior’s line, the handing out of hand sanitizer, restricting the number of customers in the store, restricting hoarding, the sanitizing of carts and baskets and their general knowledgeable happy disposition and they are attracting new customers by the droves. For all the downside of the COVID-19 pandemic, one of the minor upsides is that it creates a tremendous amount of opportunity for banks to become more relevant to their customers.

At more than 1,800 pages of reading, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), the Small Business Administration changes, various state programs and tax relief (we are going to collectively lump all this together to define the “CARES Act”) is a daunting read. Over the past four days, we have slogged through it to analyze the salient points, risks, and opportunities for your bank’s consideration.

Below, we have ranked various considerations in order of impact and required resource allocation.

Education and marketing: For any bank CEO that has not invested in their marketing team, they are about to regret their decision. If there was ever a time to message your customers, it has been now. Daily website updates; press releases; CEO letters; production of graphics/videos/calculators; digital advertising; email update, text alerts, and so forth are now expected.

Your bank’s marketing and communication team should be in every executive meeting and should be leading the charge in getting out a cohesive and insightful message that has the right tone. Banks that do this will not only stay relevant to their customers but will find they will come out the back end with a line of customers waiting to do business with them.

The first step here is to get into a communication cadence if you have not done so already, and then find ways to more efficiently communicate all the changes that are going on including setting up to help customers navigate their way through the myriads of programs. Just the fundamental decision of how you provide guidance to your small business customers whether to take an SBA loan under the Payroll Protection Program or utilize the Employee Retention credit can be off-putting.

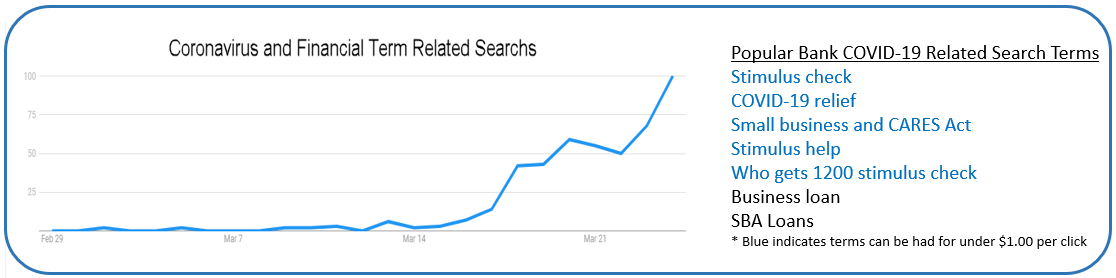

Right now, there are millions of searches going on for specific terms that can lead new customers directly to your bank. Because these search terms are so new, there are no banks bidding on them as of yet (this will start to change by the time you read this), so gathering eyeballs has never been better. More to this point, since there is so much anxiety around these topics, interaction, time on page, open rates, clicks, conversions, and a host of other metrics have never been more in a bank’s favor.

Training: Next to gearing up marketing and communication, the next order of business is to train your staff to answer tough questions that are about to be forthcoming. Already your bank is likely getting calls at 10x the usual rate, and this frequency is not likely to slow down for some time. Every banker should have a working knowledge of the CARES Act and be able to direct customers where to go to find more information. It is hard to argue that you are a “trusted advisor” if you cannot provide a modicum of leadership in a customer’s most pressing time of need and national importance.

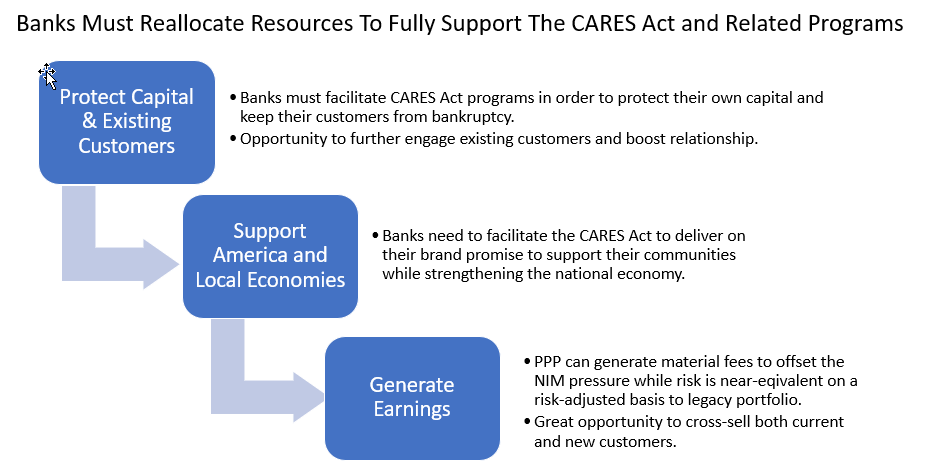

Credit and Capital Allocation: It is all hands-on deck with handling forbearance request, but now the bank must look ahead and start to figure out how the CARES Act will impact credit and what happens next. Credit now has one of the toughest jobs in the bank attempting to forecast and price risk that the banking industry has never seen before. It’s clear that banks have to start increasing their reserve immediately (See our Credit Shock article), but the question is by how much and how fast. In the coming months, banks will have to make tough decisions, and the more analysis and thought each bank puts in now, the more robust your decision-making framework will be later.

Since it is unlikely that the average community bank will be able to handle the forthcoming CARES Act loan restructuring volume, banks will have to decide soon which customers to save themselves and which customers that need to be turned away to the competition. A number of customers will eventually be forced into bankruptcy, so bankers will need to make the decision now, with imperfect information, which of these customers it wants to keep on its books and try to work out later, and which credits it wants to move to another bank.

Here, bankers will have to make some assumptions on how long the pandemic will impact the business and how fast demand will snap back at the company. Further, each bank will have to forecast the probability of similar future government stimulus packages. For customers it wants or must turn away because the bank cannot handle the volume, bankers will also need to ascertain the reputational risk involved.

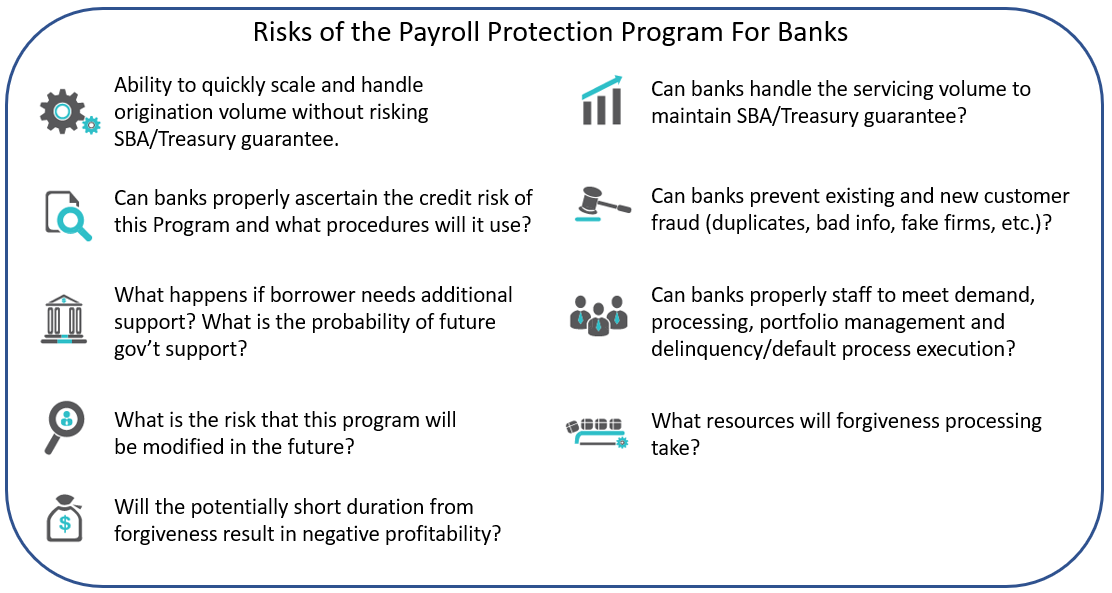

Banks must also decide if they want to take on new customers under this program. With little credit underwriting required and a 100% guarantee, it will be tempting to cut corners in order to book volume and fees. However, even if the guarantee is valid, there is still the cost of management, reporting, collections, non-accruing interest, and litigation for defaulted credits that will drive up the cost.

Conversely, while the new SBA/Treasury programs seem attractive, they are not without material operational risk – risk that increases with volume. The cost of forgiveness management is a new one for banks and one that originating banks must build in. Fraud risk will undoubtedly be prevalent as it is for every crisis, a problem that will be exacerbated given the window for processing.

Bankers need to be crystal clear on staffing levels to help balance labor cost, throughput, and operational risk mitigation. To this end, banks will likely need to hire to handle the volume or reallocate credit personnel to process.

Conventional and SBA Loan Production: By far, one of the most significant changes is in the demand and supply curves for loans. Banking has never faced a time where credit risk and credit spreads have increased so fast and so dramatically, while at the same time, supply has constricted with equal speed. While the directional movement is similar to 2008 and 2009, the rate of change is some 10x+ faster, giving banks (and borrowers) less time to adjust. Further to this point, what has radically changed is the dramatic increase in loan demand and payment forbearance.

Hopefully, banks have triaged all their credit risk by now (see our framework for credit triage) and started work on restructuring some of the larger conventional loans. Now it is time to restructure your SBA process as banks will have an exceedingly short window to process loans under the CARES Act.

Here, banks also need to scale up their process and technology to process a forthcoming massive amount of volume. While the Payroll Protection Program is under the 7(a) SBA structure, it has little in common, and banks need to restructure their process to ensure eligibility and processing without collateral or guarantees. Banks that are not preferred lenders will need to quickly partner with other banks or fintech firms to be able to process the volume or risk losing customers.

Since the triage work is done, banks now need to immediately go to work to document the reason for triage and the borrower’s eligibility. Similar to the credit process, banks need to figure out staffing levels to handle the sheer volume. Since the SBA process can only be so automated, banks will need to hire or reassign, lenders, closers, funders, packagers, and pipeline managers to the tune of at least three to four full-time equivalent employees for every $5mm per month of notional of loans. Since conventional lending will dry up, banks will need to retrain and reallocate bank personnel quickly.

There is also a question of budgeting and economics. The banking industry will attempt to process some $350B of loans before June 30th, 2020. That is a staggering number to process in less than three months, but with a 4.25% weighted average fee, that is almost $15B in fees to be earned mainly within the second quarter. However, there is a question of margin; most banks will see a dramatic reduction in their net interest margin, with the average margin being below 3.35%. The good news is that on a risk and cost-adjusted basis, this is likely better than the adjusted net interest margin in the prior state except for the shorter duration tied to loan forgiveness.

It is likely that most borrowers will ask for forgiveness at the first opportune time, thereby shortening the duration of the loan by years robbing the bank of a decent asset.

Sales: It is estimated that more than 30 million small businesses, self-employed, contractors, sole proprietors, and non-profits are eligible to apply, and more than 60% will. This is a considerable number of customers that your bank’s relationship managers are going to have to manage on the front end of the funnel. Many, of course, will be your most valued customers. Still, many others will be potentially more profitable that banks will have to decide on whether to take on their already strained portfolio of customers needing their attention.

Lenders will have to be hyper-organized with clear direction on how to proceed, plus they will have to have an action plan in the next two weeks. Some banks will be using their relationship managers to start surveying the market in order to understand which customers will employ which CARES Act tactic. Lenders or relationship managers will have to offer their opinion on if the Payroll Protection Program, Employee Retention Credit, or the Payroll Tax Holiday offers the best relief.

Savings: Each married household with income below $198,000 and each individual with income below $99,000 will get a payment plus $500 per child. On average, each household will receive approximately $3,400 that will hit their transaction or savings account. Banks can play a crucial role in helping customers manage those funds.

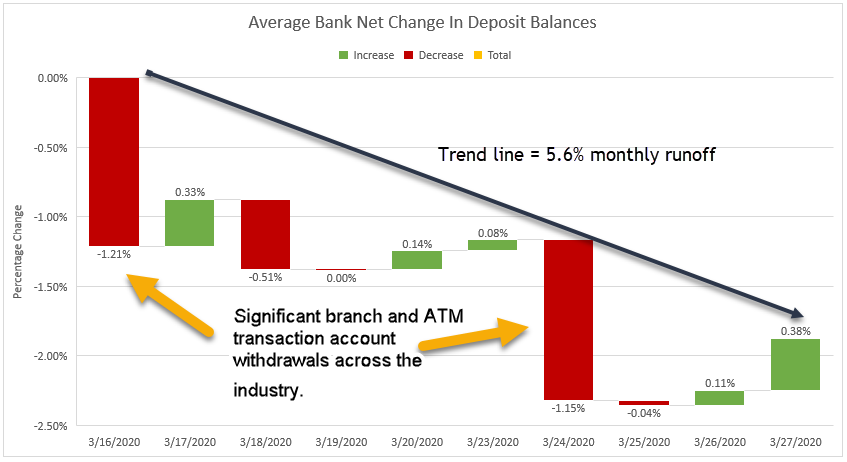

Deposits & Liquidity Monitoring: Along with the hoarding of toilet paper, cash has also been in demand. While banks should see an influx of deposits coming up, chances are the average bank has seen more runoff over the last couple weeks than inflows (below). Sometimes swings could be down more than 2.00% as reported by some banks. Here, banks need to be especially vigilant in monitoring liquidity flows, particularly when some of these deposit outflows also exacerbate line of credit draws. In times like these, liquidity presents an equal or greater risk as credit. Because of the potential funding demand from Payroll Protection Program loans, banks will have to monitor their liquidity closely.

Forbearance processing and having an orchestration layer: There is little doubt that by now, your bank has announced a consumer and commercial forbearance program directly related to the pandemic. However, it is likely that you are still dealing with a forbearance document that isn’t readily available on your website, and if it is, it is probably in the form of a PDF or Word document. This not only creates additional risk and costs but slows the process where time is critical.

This and many aspects of the COVID-19 economic response screams for banks to have an “orchestration layer,” which is an application to handle and automate workflow for multiple bank products. Popular bank programs such as Salesforce, ServiceNow, or many others can allow you to automate a process like forbearance loan processing in hours rather than weeks. If nothing else, banks can use secure form applications for their website and then route to a file system or worst case, via secure email. We calculate the manual processing of forbearance agreement (just the form movement and not the credit review) at about $24 per agreement and the electronic processing closer to $1.75.

Electronic B2B and B2C Payments: There was an in-depth discussion about the government’s ability to send stimulus payments out directly 100% through electronic means. At the end of the day, it was decided to utilize the direct deposit information that the taxpayer has on file with the IRS and then send checks out to the rest. What this means is that community banks should try harder and do some marketing around trying to get their bank utilized for the next tax filing period currently extended until June. As it stands now, the bulk of these payments and the resulting deposits will end up in the top three banks.

In addition to the digital disbursement push by the Federal government, there is also the question of how businesses will make payments. With more employees working from home, traditional controls (like two signatures on checks), and paper processing is harder to pull off. As such, we have seen an uptick in electronic digital disbursements (B2C) and business-to-business (B2B) electronic transfers. This channel change is making many banks rethink their treasury management platform to expand capabilities.

P2P Payments: Of course, despite all this social distancing, money still has to move, and like businesses, households are using more bill pay and relying more on P2P payments with the likes of Zelle and Venmo. While the frequency of use is down correlated to fewer social gatherings (splitting checks was one of the most significant P2P use cases), dollar amounts and new customers have increased.

The Under-banked & Prepaid Cards: The quality of the conversation on the Hill around electronic payments indicates to us that direct deposits will be a standard feature going forward for the government. In order to further capture, these payments and remain more relevant to our communities, banks need to think through how to have a prepaid card program to handle the underbanked or those that do not maintain active transaction accounts with any bank. While the ability to fund a prepaid card directly is still a possibility for the CARES Act, it is our opinion that the use of prepaid cards in the future will be more relevant as it pertains to government payments to the underbanked.