This PPP Forgiveness Staffing Model Could Help You Out

It is around this time that many banks are trying to determine the amount of staff and effort that will be required to process all their PPP Forgiveness Applications that are now ready to be filed. Late last Friday, the SBA issued new Final Rules that further outlines what is expected from borrowers and banks that also helps in building this model. To help banks, we put together the below data and model to help answer the question – How many bankers will I need for this effort and for how long. While we are all just guessing here, we pulled many banks and borrowers and tried to conduct preliminary reviews on about a dozen applications to help inform our model.

Base Workload Projection

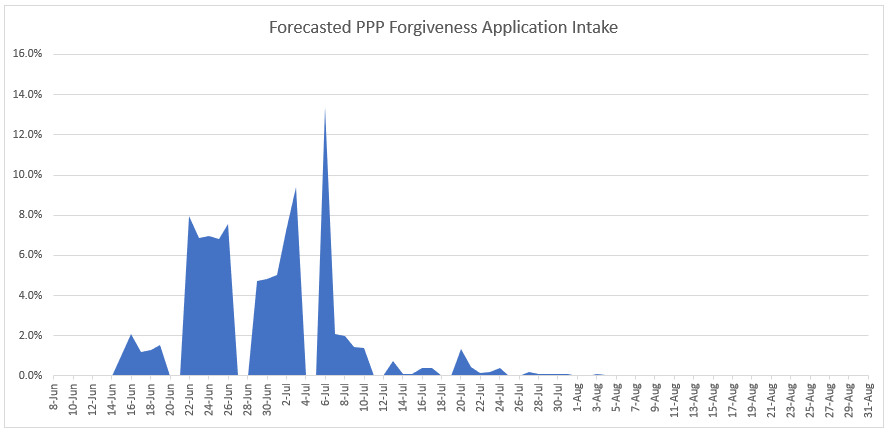

Any bank PPP Forgiveness staffing model should start with a couple of variables. The first, and most impactful, is the production of applications and the funding date of each application since that starts the eight-week clock. Below is a typical bank’s base projection for when they will likely receive the completed PPP Forgiveness Application that will start the 60-day clock for when banks need to respond.

The graph below is on a percentage basis; thus, on Monday, June 22, banks can expect to receive approximately 8% of their total applications. It adjusted not only for the percentage of customers that shift to an Alternative Period (70% of all Forgiveness filers) but also for weekends and holidays, assuming the bank would not be accepting Forgiveness application at those times.

Of interesting note in the above forecast is July 6 and the dates immediately proceeding the 5th. This is a quadruple whammy of impact because it is: A) Eight-weeks after the bulk of when many banks completed their first significant batch of funding at the end of April; B) The end of many borrowers Alternative Payroll Covered Period (for example, if you got funded on April 28 and you had an established payroll cycle you would shift your eight-week test period until the start of May which would end on June 30); C) the end of the Covered Period; and, D) Right after the July 4 holiday when banks are closed, and many borrowers will take the time to complete their applications.

Determining the Bank’s Level of Due Diligence

While creating the intake forecasting model was difficult, it pales in comparison with the decision many banks face over their level of targeted due diligence. Late last week, we saw the statement from the SBA, indicating the work that is required by each bank. Using that guidance as a base, we further adjusted it to our “standard of credit care” and came up with the following list of items:

- Confirm that the borrower has a signed Loan Forgiveness Application Form with the correct certification boxes checked.

- Verify if the borrower will be subject to a reduction in forgiveness based on a decrease in salaries or wages. Bankers should ensure that borrower records reflecting the salary and hourly wages paid and the number of hours worked per week for each employee during this time and for the period from January 1, 2020, through March 31, 2020.

- Verify payments made for vacation, parental, family, medical, or sick leave, allowances for separation or dismissal, payments for group health care coverage, including insurance premiums, and retirement, as well as payment of state and local taxes assessed on the compensation of employees

- Confirm that the documentation supporting payroll and non-payroll cost is submitted.

- Confirm that the expenses that are being submitted are a result of the ongoing operation of the borrower (correct name), are valid expenses (make a good-faith determination), and from a liability created before February 15, 2020.

- Confirm the borrower’s calculations including the dollar amount of the (A) Cash Compensation, Non-Cash Compensation, and Compensation to Owners claimed on Lines 1, 4, 6, 7, 8, and 9 on PPP Schedule A and (B) Business Mortgage Interest Payments, Business Rent or Lease Payments, and Business Utility Payments claimed on Lines 2, 3, and 4 on the PPP Loan Forgiveness Calculation Form, by reviewing the supporting documentation submitted with the Loan Forgiveness Application.

- Ascertain if the borrower is claiming a Safe Harbor exclusion for all or some of their employees.

- Confirm that the borrower made the calculation on Line 10 of the Loan Forgiveness Calculation Form correctly, by dividing the borrower’s Eligible Payroll Costs claimed on Line 1 by 0.75.

Now within this guidance, there is still plenty of room for interpretation. The “good-faith” and “reasonableness” standard put forth by the SBA means different things to different banks. Some will rely on the borrower 100%, some banks to check the major items, and then sample, while still others will verify every document and check every calculation. For the sake of modeling, we term these three areas: “Low Level Diligence,” “Moderate Level Diligence,” and “High Level Diligence.”

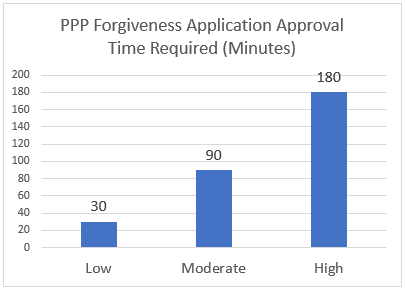

A Low Level of review including just verifying the calculations, reviewing the payroll documentation, and spot-checking other documents while a Moderate Level largely included all the steps above confirming both the obligation and the payments for the material expenses. A High Level due diligence effort included all the above, plus tying out ALL the obligations and payments PLUS having another banker review the work.

After detailing the work effort in each of the three categories and testing the effort on a series of mock forgiveness applications, we arrived at the below time and motion analysis per application.

The Wild Cards – Bank Decisions and Customer Interactions

Of course, the wild cards in all of this is how many times bankers need to talk with the customer and how fast bankers can make critical decisions. Despite the two recent Interim Rule updates, there are still many questions to be answered. Below are just some of the ones that potentially confuse borrowers and bankers and slow down the process.

Cash Tip: Per the SBA guidance, an employer can estimate the level of tips to be included in payroll. What will the bank accept for support? “Cash equivalents” can be included in tips, but it is still unclear what this means and what the bank will see (gift cards?).

Headcount Reduction: It is still unclear if an owner-employee or partner is considered for headcount reduction or what happens if an employee cannot return due to death.

Retirement Cost: It is still unclear what will be accepted here. Its clear bankers will need to analyze payments for tax-qualified 401k, pension, and profit-sharing plans. Still, it is murky if contributions of stock to an employee stock ownership plan or a non-tax qualified retirement plan (e.g., payments into a “top hat plan”) can count.

Mortgage Interest/Lease Expense: It is clear that all debt had to be in place before February 15 and that it has to secured by a mortgage or security interest in real or personal property. However, guidance is unclear if you secure a debt position after February 15 in order to count. This situation is germane as it has become popular with some professionals, and even some banks, to advocate for this position in order to make the interest on C&I loans count (plus improve the bank’s collateral position). The same goes for borrowers that have an increase in the interest rate or rent after the 15th.

Utilities: The quagmire of all the questions is what types of services that borrowers will include in utilities and how will the bank decision those. Definitions are still unknown for transportation and if “internet access” is just the data plan or does that mean internet access for the business to include cloud services such as Zendesk, QuickBooks, and similar. As just clarified, like rent, utility costs that were incurred before the Covered Period can be counted if paid during the eight-week period, but now bankers need to review yet another invoice or bill from the month before the covered period.

These are just some of the many open questions that borrowers and bankers are set to run into, and each one has the potential for generating a time-consuming interaction. Few bankers we spoke with are willing to stake public positions upfront for fear of being wrong and creating additional liability. As such, bankers will pay with their time going back and forth with the borrower.

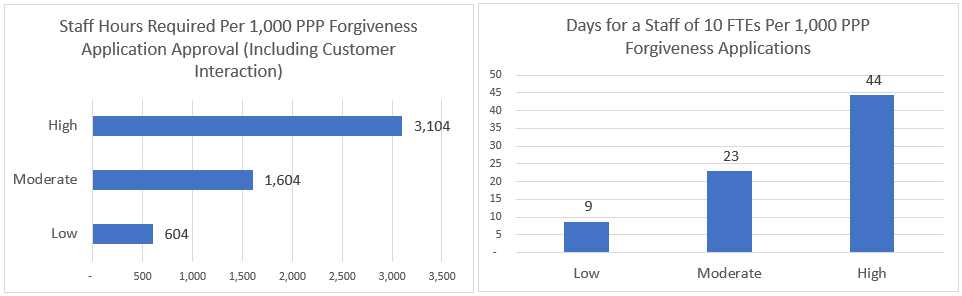

For the sake of modeling, we have assumed a little over 50% of the applications sail through without an issue, and 25% are simple questions that get resolved in five minutes or less. Unfortunately, that leaves 25% of the applications that take an extra 20 minutes to resolve either internally or with the customer.

If you add this additional time to the portfolio of Forgiveness loans, you get the below calculation of time needed per 1,000 applications. If you apply this time and assume you have ten bankers of outsourced full-time equivalent employees (FTEs) per 1,000 applications, then you get the outcome of the chart on the right. For example, it would take 23 business days for ten qualified FTEs to approve 1,000 Forgiveness applications.

The above model meets an assumption and constraint we set forth that we should be able to render a response within no more than 30 calendar days for the sake of the customer experience and to allow a buffer should anything go wrong with the technology or process.

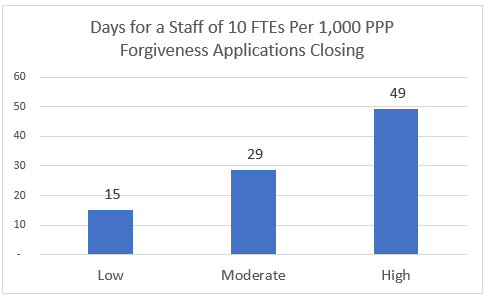

Finally, bankers will have to wait up to 90 days for an SBA decision and then will have to communicate the decision back to the borrower. Approvals will then need to be documented both with the borrower and on each bank’s system of record, while rejections will need to be further solved. For the sake of our staffing model, we assume that 25% get rejected from the Low Level Diligence category, while 10% get rejected from the Moderate group, and 2% for the High Level Diligence segment.

This final adjustment produces the following time in days to approve and close PPP Forgiveness applications using 10 FTEs working on 1,000 applications.

Further Staffing Model Refinements

Of course, banks will want to customize their methodology and refine our model but can use the same framework. For example, some banks we spoke with will adopt a Moderate Diligence Level but will form a “High Level Diligence Team” to handle all PPP Loans above $2mm since those will be reviewed by the SBA.

Another refinement some banks are making is the formation of a “Dispute Team” that will specialize in customer interaction when there is not a clear solution to the issue. This removes those applications from the mainstream workflow to not only keep things moving but also to put more experienced FTEs handling the most complicated issues.

This staffing model will most assuredly change as we learn more about the program but serves as a decent basis for allocating human capital resources. It is important to note that this model assumes some level of process and technology for the front end. Bankers, that plan on handling this manually will find themselves spending an extra 15 to 45 minutes per application managing that process increases the cost and staffing levels.

We look to further refine this model as we get more information out of the SBA, and we work on streamlining the workflow even more. Until then, stay tuned and be sure to share how you might save us time and effort on any of the above aspects.