Tiering Deposit Accounts Could be Hurting Banks (Part I)

Because of tradition, we tier our deposit accounts according to size. For a typical bank, their money market accounts often have six tiers ranging from $2,000 up to $100,000. The question that always comes up is – do you have the right tiers and the right number of tiers? Are you using your tiers to drive profit giving low rates or are your tiers just serving to confuse your customer and drive up operational cost? Further, are you paying the right rate on the tiers to motivate the deposit behavior you want? Let’s explore each question as the answers may change how you feel about deposit gathering.

Active Deposit Portfolio Managers

For starters, let’s challenge the assumption that you want to use your tiers to better control deposit behavior. While this is what many banks say, many banks don’t do too much selling of the tiers during account opening. It is also true that most banks are not active deposit portfolio managers. Few banks employ deposit cost management strategies such as balance building promotions, or retention cross-selling.

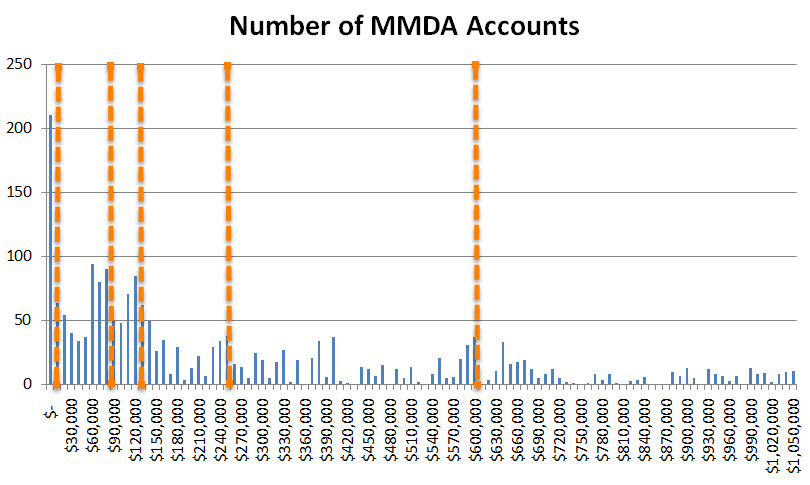

There are banks that actively market their tiers in order to build balances, and in those cases utilizing a tiering structure makes sense. From a behavioral economics standpoint, a bank wants to set its tier levels right above the clusters or groupings of accounts. In this manner, it has a value proposition to market around in order to try to increase balances. The orange lines in the example below illustrate one strategy of account tiering if the goal was to optimize account balance creation. Of course, if your marketing turned out to be ineffective at building balances up, or you simply don’t do account balance marketing, then there is reason to question the whole use of tiering in the first place.

Account Balance Behavior – The Positive Convexity of Large Balanced Accounts

There are other reasons to tier deposit accounts, and behavior is one of those reasons. If accounts that had balances between $10k and $25k reacted differently to rates, this might be a reason to tier accounts. There is some evidence of this that larger balance accounts tend to be more rate sensitive, but the evidence is pretty weak which also puts the entire tiering methodology in question. In looking at the relationship between account size and rate sensitivity, our analysis indicates that for accounts over $5,000, rate explains 21% of the account balance changes. This compares to about 15% for accounts between $500 and $5,000. This might be as expected, except when you look at accounts over $50,000 the relationship turns to a negative 12%, which throws the whole theory out the window. This is to say that these accounts over $50,000 exhibit some positive convexity and tend to increase when rates go down and decrease when rates go up.

This raises the question of should banks even be tiering? For some accounts, such as maybe a business savings, banks shouldn’t tier. These accounts exhibit even greater positive convexity, which tends to be more uniform across account balances. It is difficult to draw any conclusions here, as it could be that it is the presence of tiers that make account holders more rate sensitive (and thus less valuable), or it could be that less rate-sensitive accounts are attracted to those deposit types where there are no tiers.

Of course, things are not that simple. Deposit management is one of the more complicated sciences in finance. Next week we will add another layer to the onion, as it may be that banks are using tiering incorrectly. Maybe there are other elements we should be thinking about to better drive the behavior we want?

Stay tuned.