Top 2021 Lessons From JP Morgan

We review and analyze two shareholder letters every year: Berkshire Hathaway’s and JP Morgan Chase’s (JPM). We feel that as community bankers, we can learn much from Jamie Dimon (Chairman and CEO of JPM) and from Warren Buffet. Recently JPM released its 66-page 2020 shareholder letter, and as usual, it was full of insight that every community banker should consider. We do not opine or care so much about JPM-specific performance and leave that to the equity analysts. Our focus is on information that pertains to the community banking industry.

Community Focused

Despite JPM’s enormous size ($3.4T in assets and almost $300B in equity), Dimon emphasizes in multiple ways that the Bank’s focus is on the communities in which it operates. The Bank aims to be a responsible citizen at the local level in every community where it lends and takes deposits. Furthermore, more than 100 million people in the US own stock in the bank. In 2020, the Bank extended $2.3T of debt and equity for its clients, and many of these clients are of small and medium-sized businesses. The beneficiaries of the bank are the individuals in the local communities where the Bank’s employees work.

Employee Focused

The basis of JPM’s success is its people. They are the ones serving customers and communities, build the technology, make strategic decisions, manage the risks, determine investments and drive innovation. The bank increased wages for branch and customer service employees to between $16 and $20 per hour while providing annual benefits packages worth on average $13,000. The Bank also offers 300 accredited skills and education programs to its employees.

Leadership

Dimon states that leadership is an honor, a privilege, and a deep obligation. When leaders make mistakes, a lot of people can get hurt. Good leaders demonstrate social and emotional intelligence. Good people want to work for good leaders, and bad leaders are corrosive to an organization and drive out almost everyone who is good. The best companies create and promote good leaders internally.

Getting a good decision-making process: Get the right people in the room with the right facts and then let a high degree of curiosity ask questions. All too often Dimon has seen where the right people are not present, and all the information isn’t transparent. When it comes to “facts,” it is often helpful to review the raw data underneath the metrics. Calculated numbers can often hide bias and looking at high-level metrics, such as “net new accounts” or market share by customer segment, can hide important trends.

Analysis can only capture so much: While Dimon is “fanatical” about data and multi-year analysis, sometimes a discounted cash flow model doesn’t tell the whole story. Chases customer lifetime value model fails to capture the compounding effect of a 20-year relationship with the Bank or capture customer happiness. Sometimes a new product or investment, such as AI is “table stakes” and a return on investment cannot be currently calculated. “Bureaucrats can torture people with analysis, stifling innovation, new products, testing, and intuition,” Jamie writes.

Bureaucracy: “If everything in a large organization must go up and down the hierarchical ladder, bureaucratic arteriosclerosis along with CYA sets in, and that company’s life expectancy is substantially shortened. It should be routine that data, memos, and ideas are shared – skipping hierarchies – and aren’t vetted by all in the chain of command…In addition, it’s good to have a few mavericks who are not afraid to shake things up. The ones who challenge authority or convention often get far more done than the ones who go along to get along. Collaboration is wonderful, but it can be overdone.”

Taking a stand: In the Letter, Dimon called on companies to play a bigger role in the world’s problems. “Companies (like ours), have an extraordinary capability to help…not just with funding but with developing strong public policy, which can have a greater impact on society,” he writes.

Banking Will Always Be Needed, But Banks May Not

Over the last 20 years, banks have become a much smaller size of the US financial market as measured by asset size, loans, market capitalization, or equity. The banking industry is shifting to shadow banks and other evolving competitors like Google, Amazon, Facebook, and private and public fintech companies. Fintech and big tech have extraordinary strengths, ubiquitous platforms, and endless data.

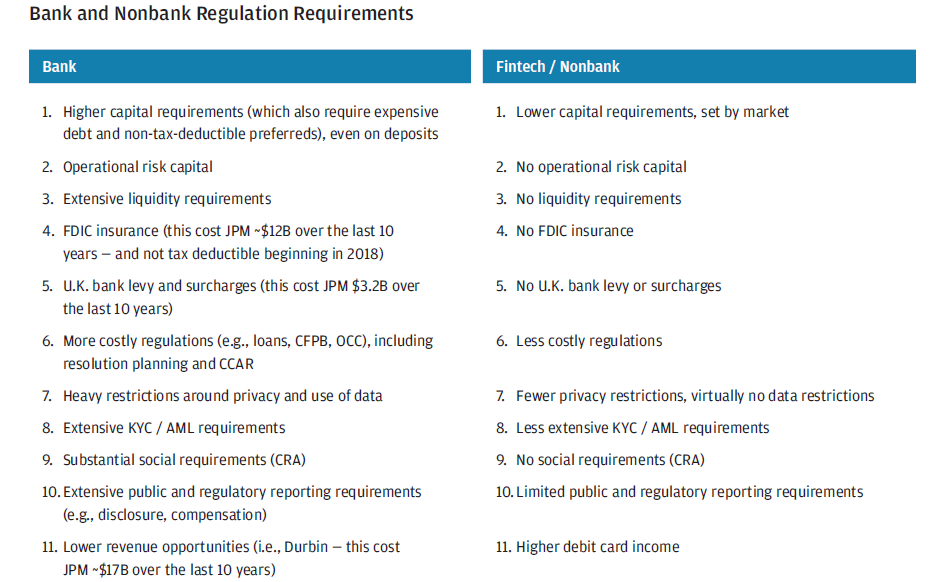

Risk in the financial market has moved from well-controlled, supervised, and well-capitalized banks to a shadow system of higher-risk competitors. Dimon compares the risks and controls of the banking system to the nonbanks world in the table below.

Artificial Intelligence, The Cloud and Digital Transforming Banking

All data, including the banking core system, will need to become cloud-enabled. Cloud data brings extraordinary advantages to organizations in the ability to access information and apply machine learning to that data. One of the most valuable assets at a bank is data – the ability to access that data, and learn from it, is currently essential for every bank.

Cyber Risk A Significant Threat

Cybersecurity is a risk to banks, customers, industries, countries, and economies. JPM spends more than $600mm a year on cybersecurity. But all agencies, banks, and governments need to acknowledge that they may be prime targets for cybercriminals. Organizations that cannot invest in cybersecurity and adopt safe and sound practices for data protection and handling may not survive.

Banks Must Earn Trust and Act Ethically

Reputation is everything to a good bank, and that reputation is earned every day in good times and especially in bad times. JPM aims to provide the following fundamentals: good products, fair and transparent pricing, thoughtful and responsive service, and continuous innovation. Dimon cites how Home Depot does not raise prices on its products in the immediate aftermath of a hurricane, even if it can gain those higher prices. He then draws the parallel of how JPM did not raise the cost of credit during Covid-19. Pricing should be what is fair, not what a company can get away with.

The Pandemic and Remote Work

While Covid-19 changed the way the bank works and accelerated ongoing trends, Dimon believes that many employees will work on location full time. The virtual working world has some serious weaknesses, as follows: Remote work is not effective when people do not know each other (as the case with sales). Most bankers learn their job through an apprenticeship model, which does not work well over Zoom. Remote meetings slow decision-making because there is little immediate follow-up. Remote work also decreases spontaneous learning and creativity because you don’t have opportunities for unplanned meetings and interaction with colleagues and clients.

America In A Strong Position

Dimon believes that the current deficit-spending response to Covid-19 will create a rapid and lasting recovery. With excess consumer savings, new stimulus savings, fiscal spending, more QE, a new potential infrastructure bill, a successful vaccine, and euphoria around the end of the pandemic, the US economy will revive. Dimon believes that this next growth cycle could easily run into 2023 because all the spending could extend that far. However, Dimon is concerned about stimulus spending when the economy is doing well, leading to inflationary pressures. In which case, interest rates rise rapidly when the US already has very high national debt.

The letter goes on to discuss public policy, American exceptionalism, competitiveness, and the challenges facing us on the world stage from China, Russia, and other geopolitical problems. We recommend that all community bankers at least skim Dimon’s letter HERE.