5 Steps to Better Treasury Management

If one product is the future of banking, it is treasury management. With a competitive offering, it will be easier to attract the small business and mid-sized companies that a bank needs to fuel its core growth. In this article, we detail the five steps to building a treasury management strategy, provide some tools to execute those steps, and then provide a complimentary survey to assess your strengths and weaknesses.

The Importance of The Treasury Management Customer

The treasury management (TM) customer drives deposit growth, superior deposit performance, and, as a result, relationship profitability performance. Having a relatively low cost-of-funds profile compared to other commercial customers, less interest rate sensitivity, more fees, and higher retention means a higher-than-average customer lifetime value.

The average deposit balance of a treasury management customer is about $900,000, or 31% higher than a non-treasury management commercial customer. That level of deposits, and associated TM fees, equates to an approximate 63% risk-adjusted ROE, or significantly above the current 17% target and the 16% commercial average. Part of this ROE value is driven by an average beta of 9 for a TM customer compared to an average beta of 50-60 for a money market or other interest-bearing deposit account.

The opportunity for the product is that for an average community bank, 83% of their commercial, non-profit, and municipal customers are NOT using treasury management services. This likely creates the most significant single profitability lift for any bank.

The question is, how do you get more treasury management customers?

Step 1 – Target the Right Customers

The 5 step formula is straightforward. It starts by targeting the right customers. While this seems obvious, it is an often overlooked first step as banks usually offer treasury management products on a reactive basis and think little about using marketing resources to target specific customer segments. If they do market, it is to every commercial customer in the footprint, which often results in suboptimal marketing results.

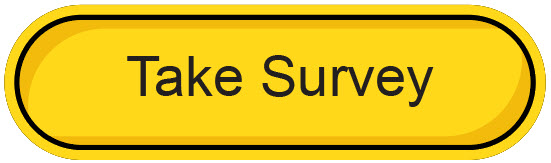

Having a clear list of customers you want, their priorities, and a definition of the customers you do NOT want will help define your sales and marketing efforts. Part of this equation is being clear on your bank’s goals. Is the priority pure customer profitability? Is the goal to generate deposit balances? Or does the bank want more fee income? Alternatively, a bank may want a diversified cross-section of customers and will be willing to sacrifice profitability to achieve more stability.

To help you target the specific customers you want, we provided an updated list of the Top 20 customer types HERE. Look for a list of the industry’s topmost profitable treasury management customers in the future.

Once a list is complete, it is helpful to sketch out the personas of each customer type to understand better how and when to market to each prospect type.

Step 2 – Have the Right Treasury Management Products

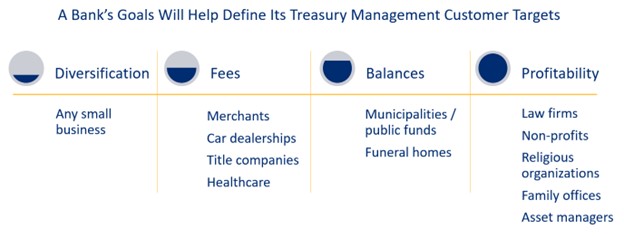

Having the right treasury products for the future is critical to stay competitive and attract the target customers you need. Below is our product map of the most popular treasury management functions. While your bank doesn’t need all of these, some additional capabilities should likely be on your roadmap over the next two years to grow your treasury management platform.

One critical need from treasurers that every bank can try to solve is the accuracy of cash flow forecasting. Most current platforms or methods (such as Excel-based models) are accurate out to three months. Beyond that, most models fall off. The current Holy Grail of the industry is to provide clients with six to 12 months of an accurate forecast driven by improved data quality and effective machine-learned tools.

Other needs of companies include management of foreign exchange and commodity price risk, investment and debt management, fraud management, continuity planning, and bank administration/relationship management.

To increase sales, banks can take these products and combine them into treasury management “bundles” so that there is a basic, intermediate, and high transaction package. In addition, there will be analyzed and specialty packages targeted at particular industries such as non-profits, e-commerce, or businesses with extensive international operations.

Step 3 – The Right Process

Once you have the right customers targeted with the right products, the next area to improve upon is process. A best-in-class TM strategy is to define treasury management as a separate product line with its own dedicated sales specialists. Too many banks, some 50% of our industry, have treasury management embedded within deposit operations where the sales channel gets understaffed, and most of the effort is on onboarding, not customer acquisition or building profitability.

Once a bank has a dedicated sales channel, making sure your support layer is right-sized, having a competitive incentive plan, having clear calling, conversion, and satisfaction goals, and being proactive in sales management are all best practices.

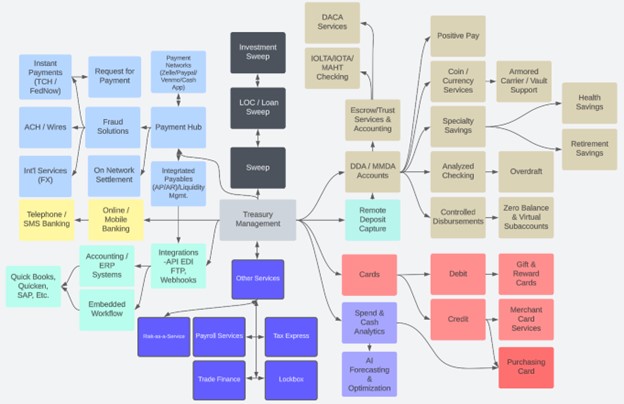

We have found that over 66% of our respondent bank client base has no TM sales or incentive plan. Almost 80% have no product-focused marketing plan that generates a material amount of TM leads. These banks do not buy keyword search terms for their market or have optimized their website so that customers can organically find their bank when searching.

Consider all the ways people search for treasury management and its derivatives (below). The number one search term by businesses is “treasury management,” and 2,900 businesses searched for that term last month looking for a new relationship. Despite these statistics, only a handful of banks currently purchase that term. For $6, a community bank can garner a lead that has an average of 9% probability of converting with over $33k per year in value.

Given the profitability of the TM product, it makes little sense to have a sales, marketing, and incentive plan for mortgage or commercial loan production but no plan for treasury management.

Step 4 – The Right People

Most banks do a great job of finding, recruiting, and keeping the right people. There is little we can add here, with the exception that some of the best treasury management salespeople we know were not bankers to start. They came from other industries and had ties to those industries. They were hired for their people skills, understanding of treasury management products from the customer point of view, and customer segment industry contacts.

Step 5 – The Right Pricing

Finally, a bank needs the right pricing of its treasury management platform to optimize sales and profitability. Unfortunately, most banks have not adjusted their pricing in years. Not only have costs changed, but demand considerations have changed.

Consider that many banks are still offering remote deposit capture (RDC) like it was 2007, and competition for the product was fierce. Now, a bank needs to price RDC higher in order to incent the customer to move away from checks and onto a faster payment platform. In this manner, costs will be reduced for everyone, satisfaction will increase, and balances will go up because of higher transaction volume.

How to Get More Help with Treasury Management

After partnering with Paramount Financial Technologies and interviewing hundreds of banks about their treasury management platform, we have compiled data to help banks benchmark their positioning in order to derive a roadmap for improvement. By completing a short survey, we will provide complimentary and automatic feedback on sales optimization, pricing, process alignment, and product selection. Should you want even more information, you can provide more survey data and order a $1,000 customized report from Paramount (a sample can be provided) to help you improve your offerings and further uncover opportunities in revenue and growth.

National and regional banks control 70% of the treasury management market, yet most treasury management customers choose their bank because of service. Community banks have an inherent advantage in delivering more personalized service and faster decision-making than national banks. Yet, many community banks have not organized their TM effort to exploit this service advantage.

If there was ever a time to improve your treasury management capabilities, the time is now with deposits so valuable.

It takes about 20 minutes to take the survey, and it will be time well spent, even for the complimentary automated evaluation. To take it, go HERE.

Or, click below.