Use This Guaranteed 5-Step Process for Faster Bank Product Growth

Get your process right, and all else will follow. Most banks do not have an evolved process when it comes to bank product growth through product development, marketing, and sales. Growing a product is a quantitative effort that takes capital, planning, math, and a laser focus. In this article, we provide banks with a proven step-by-step formula that has not only never failed but is responsible for getting some financial institutions over one million customers. Follow it and take your bank product growth from 3% to 300%.

The Concepts of Faster Bank Product Growth

The three keys to this strategy that can apply to almost any endeavor at the bank are to:

- Create a repeatable process that can be improved upon with each iteration,

- Start with the end in mind, then breakdown the steps into manageable goals, shorter-term goals that will get you to the primary target, and

- Use data to inform and modify the process.

In this manner, a bank’s marketing group can improve upon the process constantly and get more and more efficient with resources.

Step 1: Set SMART Bank Product Growth Targets

This step is easy, and most bankers are familiar with setting SMART goals or objectives that are (S)pecific, (M)easurable, (A)chievable, (R)elevant, and (T)ime-bound. Here, bankers take a specific product, derive a SINGLE key performance indicator that can be reasonably achieved in a given, and stated time frame.

Goals shouldn’t be market share that is hard to measure, but revenue, new customers, total customers, or something similar that is easily measurable on at least a monthly basis. A common mistake is to set a goal for a product sector but not for individual bank products. A “10% loan growth goal” is not specific enough and is so vague that it is not actionable.

Set a SMART target for any product that has a different process. A commercial loan directly with a customer is a different process than gathering commercial loans through syndications or brokers and is entirely different from generating consumer loans.

As they say – “Set goals for products you care about using the amount of effort equal to how much you care about achieving those goals.”

Once annual goals are established, you can break down the goals into monthly (our preference for new products) or quarterly (our preference for mature products) targets. Attaching each target to a time frame conveys a sense of urgency to all involved in the effort, from management to marketing to the line.

Step 2: Resource Correctly – Cost of Conversion and Channel Costs

Here is where things typically go wrong. While every banker wants to grow their products, most don’t tie the effort to specific resources. As a result, resources are not allocated correctly, and the required growth doesn’t ensue. Every bank can grow without many resources in accordance with their community’s natural growth rate. If you want to grow more than that, it takes resources to essentially “buy” growth.

Banks that say they want to “grow 10%” but hold their marketing budget constant are either assuming their marketing departments can become more efficient quickly or are undermining their growth effort at the outset. Not matching sales and marketing efforts correctly with the endeavor is usually enough misalignment to cause a failure in the process.

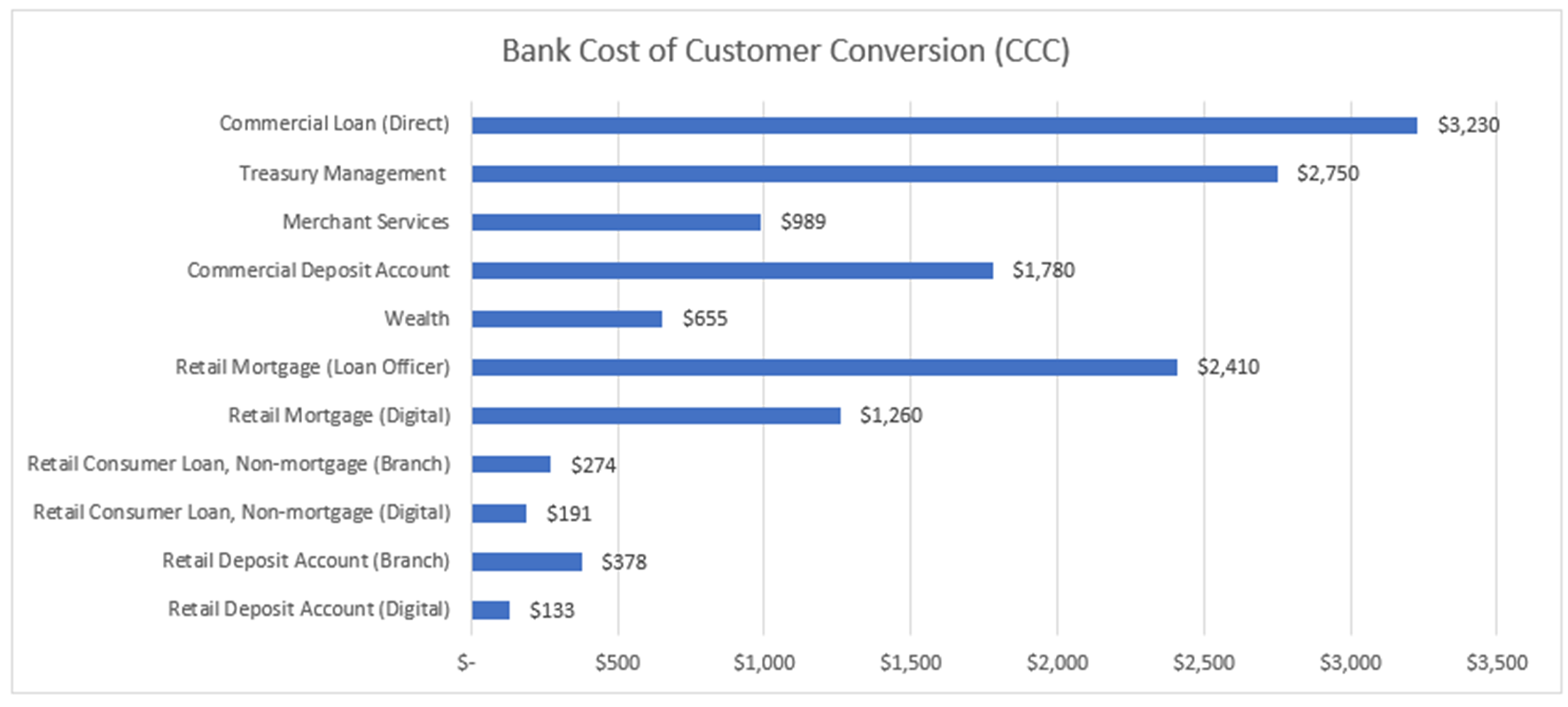

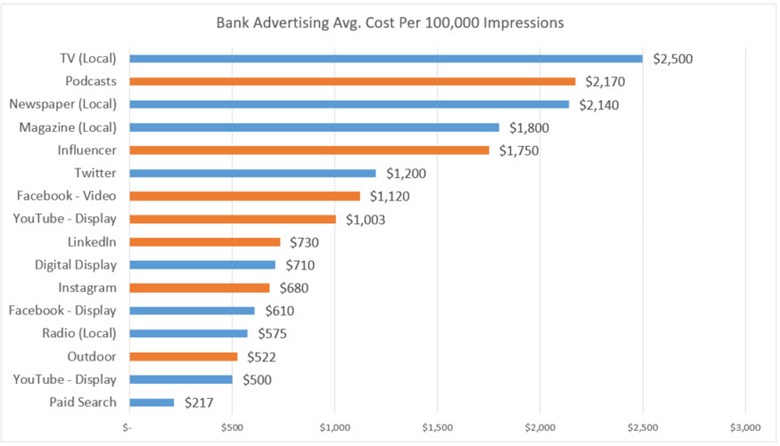

Banks can quantify resources in any number of ways, either by product or by channel (relationship manager, social media, digital advertising, etc.). It is vital to figure out the ballpark estimate of these costs as this drives capital allocation. If you don’t know your expenses, you can use our figures below, and while it is different for every bank and market, these will generally get you in the right budgeted area. For the Cost of Customer Conversion, you can deduct your personnel cost (sales, marketing, and management), and for the advertising channel, you can apply your conversion rate.

Note that these are not customer acquisition costs but a subset of that. The cost of conversion by product is what it takes to get the customer in the door with an application and does not include underwriting or loan processing.

For example, if you want to grow Treasury Management customers by 13% and your market’s natural rate of growth is 3%, and you have 100,000 customers, then you need to add net 10%, or 10,000 by sales and marketing (3% should come by referrals and just answering your phone). If you want to do that with a combination of social media, print, and events, that is about $49 of indirect marketing cost (not counting direct sales presentations, lunch, etc.). This would mean that your bank’s marketing budget for this product for a 13% growth rate should be around $493,00 per year to achieve your goals.

At this point, you stop and adjust your budget or your goals to fit the available resources.

Step 3: Set Your Sales and Marketing Strategy

Once you have targets and a budget, the next move is to break down the strategy. Here, it would be best to think through what channels you want to use. Email is one of our favorites, so that is always a start, but then you can add to that to include direct calling, events, digital advertising, LinkedIn, Facebook, Google paid, branch leads, organic/content conversions, etc.).

On average, banks have about ten to 15 tactics/channels that are used within a product marketing strategy. Within those tactics, about 30% to 40% of the traffic is usually paid marketing, with the rest coming from organic marketing and sales.

Be sure to include public relations as you pitch the press, bloggers, community groups, and partners to promote your product. Creating content such as blogs, calculators, ebooks, infographics, and other lead-generating ideas will help target potential customers.

When setting your strategy, make sure you have a laser focus on exactly who your customer is, who is NOT your customer and where your prospects like to hang out (either physically or virtually).

Now you need to know the rough idea of conversions from each channel. Of those potential customers that are interested or click on the website/ad, how many will you get? On average, it is about 0.5% and 5%, with a median of around 2% for most of these product channels.

We keep these conversion rates in mind and then rank each channel for potential impact on a scale of 1 to 10, with 10 having the greatest impact. Creating a viral video on a social channel or having a feature article written in a major publication may be a “10,” while branch signage might be a “1.”

Finally, you want to rate your channels (we like a scale of 1-10, 1 being hard) for ease of execution. Placing paid search in Google is easy and might be considered a “10.” Conversely, creating a viral video might be closer to a “1.”

Once you know these above numbers, you can now prioritize your channels by multiplying the two factors together to get a ranking of 0 to 100. You can now adjust your marketing plan and interim targets to reflect your marketing plan’s priorities.

Step 4: Execute Your Bank Product Growth Plan

Next, execute your bank product growth strategy through each marketing channel. As you think through this, each channel, such as relationship manager training or digital ads, takes effort and resources. As such, you may have to space these out throughout the year so you can manage the action against the available resources. It is essential that your marketing plan reflect this staggering effort.

Step 5: Monitor, Analyze and Retarget (Plus Use AI in Marketing to Help Optimize)

The critical metric is to track the actual results for each channel and reassess them. If you don’t have a marketing program, a simple spreadsheet will do as you track channel, the status of the channel (active, paused, etc.), how much traffic you are getting (impression, sales calls, email clicks, etc.), conversions, your spend, and are you meeting your interim goals.

In addition, to your spreadsheet, you can leverage Google Analytics, your customer relationship management system (CRM), and various marketing tech stack tools like the ones we use such as Salesforce Marketing Cloud, Unbounce for landing pages, Wordstream for Google Ads, SEMRush for search engine optimization (SEO) and others.

With each month, you reassess your performance and adjust the effort and marketing spend accordingly to optimize the balance between each channel. Some banks employ a machine learning layer using platforms like D&B Lattice (our favorite), Adobe, Adext, 6Sense, Demandbase, or others.

Putting this into Action

You can apply this bank product growth framework to almost any sales and marketing effort within the bank, no matter if it’s promoting a new product, expanding market share for an existing product, driving people to an event, or building followers for a podcast. Building a repeatable framework for your bank not only helps you achieve your current revenue goals but improves the probability of obtaining future goals. Any new marketing channel or tactic can then be added and quantitatively evaluated for performance. The best part about this approach is that it can help train others at the bank both now and in the future to make your marketing team more valuable.