Use This Loan Proposal Tactic To Boost Conversions

We review hundreds of term sheets and proposals for commercial borrowers each month. One successful loan proposal tactic for community banks to improve their acceptance rate is to embrace the old marketing rule of the “power of three.” We often see banks proposing one or two options for a commercial borrower, and often, the options presented to the borrower are ones that are most prevalent and acceptable at the bank but not necessarily the option that may fit the borrower’s needs best. The “power of three” marketing rule states that human brains make better decisions when given a small selection of appropriate options, but not too many to become confusing. One or two options are usually insufficient, and five or more options are too many, but successful banks present three (sometimes four options) that reflect what the lender understands as the borrower’s goals in financing.

Why “Power Of Three” Works as a Loan Proposal Tactic

The “power of three” as a loan proposal tactic is used universally in marketing products and services. The reason this rule works well is as follows:

- Too many options may confuse some customers, but most clients can compare and contrast three options easily.

- Our brains prefer patterns; three lines, selections, or columns fit nicely into a human thinking framework.

- While lenders pay particular attention to borrowers’ communicated needs and try to address their wants and concerns, human communication is not perfect. Lenders may not fully appreciate all of the borrower’s needs, and showing three options increases the chances of matching the borrower’s goals.

- Borrowers may know their needs but may not know all possible solutions to those needs. Borrowers may ask for one solution, but other alternative bank solutions may offer a better match. Providing options that the borrower has not considered, along with the borrower’s direct request, may increase the chances of a successful sale.

- Providing options for the borrower’s consideration shows that the bank is interested in solving the borrower’s problem and has considered multiple options for a solution – this message is the hallmark of a trusted advisor.

- Positioning through comparison is a potent tool. The middle option is the one that the lender believes is the best fit, and the options above and below are presented so that the borrower may compare each option on price, flexibility, scalability, cash flow coverage, or some other criteria. This allows lenders to gently nudge borrowers into what the lender thinks might be the best solution for the borrower’s needs.

Examples of This Loan Proposal Tactic

For any commercial financing negotiation and proposal, lenders may identify many criteria that borrowers will consider important, such as amortization term, credit spread, advance rate, credit support structure, prepayment options, credit portability options, etc. We want to demonstrate “the power of three” for a few essential commercial loan criteria that borrowers may consider valuable in today’s market.

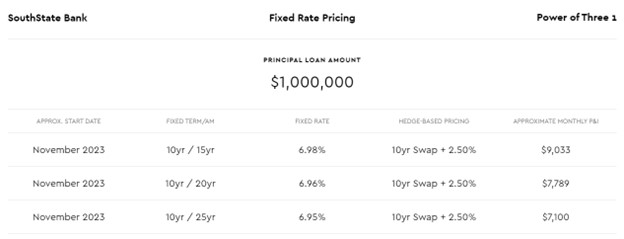

Amortization periods will strongly impact the borrower’s cash flow coverage and, therefore, the bankability of the credit. The three options below demonstrate how changing the amortization period affects the monthly P&I payment, and the resulting debt-service-coverage ratio can then be updated accordingly(0.95X for 15yr am, 1.10, for 20yr am, and 1.21X for 25yr am).

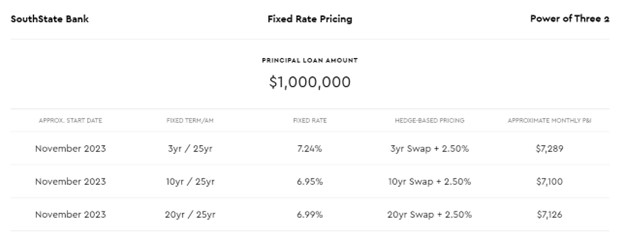

The term structure of interest rates can strongly influence a borrower’s financing decision. The current inverted yield curve may influence a borrower’s financing decision. The three options below demonstrate how changing the commitment term affects the loan rate and the monthly P&I payment. In today’s market, borrowers pay approximately 100bps more for a floating-rate loan than a long-term fixed-rate loan.

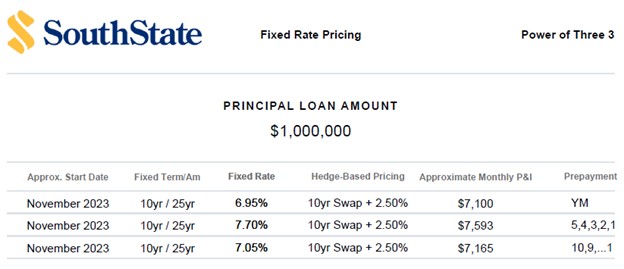

The prepayment and portability provisions on a commercial loan are paramount to many borrowers. The ability to structure optionality into future loan proceeds, prepay the loan, or transfer the loan to another piece of collateral is a major criterion that few borrowers consider or understand. The three options below were provided to a recent borrower and demonstrate how changing the prepayment provision influences the loan rate, portability, and collateral substitution. The particulars were described in more detail in the proposal letter, but the options below highlight how the power of three can get borrowers to review criteria they may not have considered before.

Conclusion

The “power of three” can be a valuable tool for lenders to educate borrowers, provide insightful service and advice, and close more loans. In a future article, we will review our online pricing generator to show how any community banker can use our online app to generate such pricing options and generate graphic-rich and uniform marketing material with the bank’s logo in a PDF format (all without charge or commitment).