Using Commuter Zones in Banking

Most banks serve a geographical area defined mainly by a political outline, such as a set of counties. Other banks choose less-defined regions, such as the “Tri-city Area” or “Northern Virginia.” While these defined service areas may be fine for marketing purposes, when it comes to operating efficiency, banks may want to think along other dimensions of geography. In this article, we explore how banks can gain more efficiencies by allocating resources to areas different than political boundaries.

Defining Geographical Areas

For the sake of focusing credit, operational, and marketing resources, a bank needs to standardize its geographical areas. Next to counties and cities, metropolitan statistical areas (MSA) are the most popular for banks. Here, banks track items such as profitability, credit performance, and market share according to MSA. MSA has the huge advantage that behind the state, county, and then city data, MSA has a large quantity of economic, demographic, and statistical data (traffic, crime, etc.). The disadvantage is that an MSA may be too big or too small to adequately achieve the bank’s stated goals. The Los Angeles MSA, for instance, may be too big for a small bank yet too diverse for a larger community bank. That is, the Los Angeles MSA is so large that homogeneous credit and profitability information cannot be obtained.

Another popular delineation is a “metro market.” A metro market may encompass more than just a political area and may cover multiple MSAs. Metro markets usually have the advantage of being reasonably homogenous with regard to credit and profitability. In a similar vein, “regions” also have the same benefit and may serve some banks well.

However, the latest trend in the geographical definition is to define certain service areas by “commuter zones.” To underscore why your bank may want to adopt a different geographical definition, let’s look further into how banks can leverage a commuter zone.

The Commuter Zone

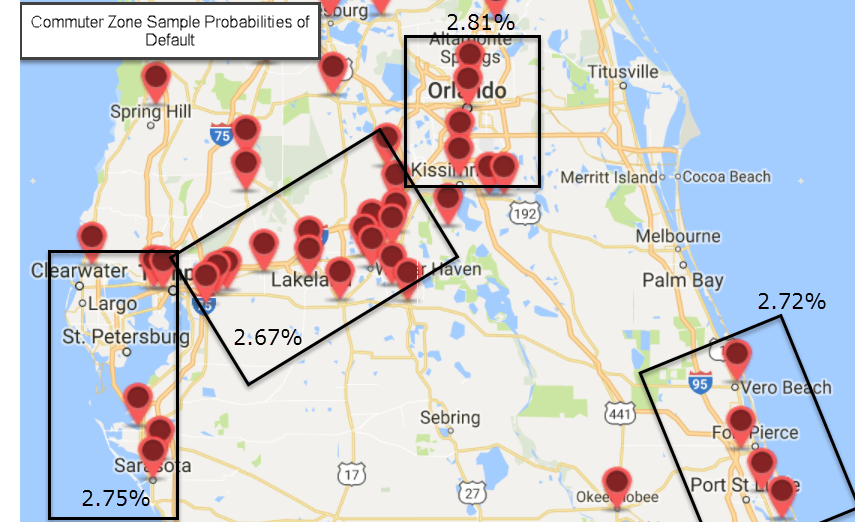

Just as the name suggests, commuter zones (CZ) are usually linear areas along significant transit routes where the population travels between major cities. As a result of this traffic, communities emerge, as do businesses that support those households. Here in Florida, for example, we branch heavily around commuter zones. Highway Four, the main traffic artery that runs between Orlando and Tampa, is one of the most prominent banking areas within the state and geography that some banks concentrate many of their branches (below, in red).

The Highway Four commuter zone cuts across multiple cities, several counties, and several MSAs. It is not defined by any region, and while demographical and economic information is hard to get, a commuter zone has the advantage of being homogeneous as to credit and profitability.

There are several third-party vendors such as Paynet that render credit data, and, as can be seen above, the annual probability of default (PD) information can vary between areas. The Orlando Metro Area has an average geographical probability of default for the area of 2.81%. This PD compares to our Hwy. Four commuter zone which has a PD of 2.67%. To put this in perspective, we have also highlighted two other commuter zones on the map, with the Clearwater-Sarasota CZ currently producing a 2.75% while the CZ around Port St. Lucie is a similar 2.72%.

This data is handy when managing a loan portfolio and in pricing a loan. From a tactical point of view, we may want to allocate more capital and marketing resources to the Hwy. Four CZ because of its lower probability of default. Since pricing is approximately three to seven basis points wider than it is in the Orlando metro or Tampa metro area, loan profitability can be higher.

Commuter Zones vs. County

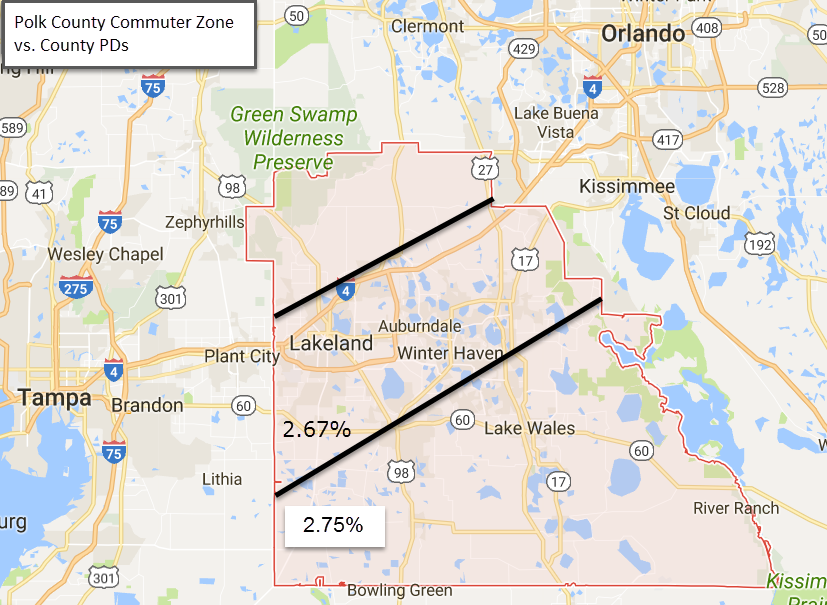

While credit and tactical capital allocation are important, there may be no more important reason to adopt a commuter zone view than when it comes to operations and marketing. Let’s focus on Polk County, which is highlighted on the Google map below. As can be seen, the Highway Four CZ cuts through the middle to the northern part of the county. Of the 13,000 businesses in Polk County, approximately 9,200, or 71%, fall within the commuter zone. Household density follows a similar pattern, but perhaps the most significant reason to focus on this particular commuter zone is that it is growing at about a 30% faster pace than the rest of the county.

From a credit perspective, the probability of default for the Hwy. Four CZ is 2.67%, or slightly less than the probability of default for the whole county, excluding the CZ at approximately 2.75%.

Economics of the Commuter Zone

While the Hwy. Four CZ is a better credit risk compared to the rest of Polk County; we want to quickly point out that commuter zones are not always better risks. Just as a CZ may be vibrant and growing, it may also be blighted and shrinking. While not always, CZs usually have greater densities compared to counties. This density often comes with more business competition, smaller households, less per capita income, and has a completely riskier credit and profitability profile.

The Advantage of Commuter Zones

The advantage of using commuter zones is not that they contain better credits, but they are more homogenous credits and usually areas of greater business / household density. Because the standard deviation of performance is more minor, it is often more efficient to make capital decisions based on a commuter zone instead of a county – returns increase for marketing investment, and credit decisions become more predictable.

We might, for example, want to allocate more marketing dollars to the Hwy. Four commuter zone than we do for the rest of the county. Not only might we make better use of our marketing dollars by targeting CZs, but our efforts may be more efficient because of the density. A billboard or radio spot on the Hwy. Four may be more expensive, or they may be cheaper on a per-impression basis. By the same token, the message is different within the CZ than it is for some of the more rural parts of Polk County, thus making our advertising message potentially more effective.

Putting This into Action

We are not here to tell you that you should switch to commuter zones for making credit and marketing decisions; we only wanted to highlight the fact that there might be other geographical definitions that are more advantageous and better suited to your bank. It might be that two MSAs within your service area perform identically, so it may be to the bank’s advantage to put those MSAs together in a single credit and marketing region to simplify decisions.

It comes down to what best fits the goals your bank wants to achieve and what your current service area looks like. The general rule of thumb for bank performance is that, since the influence of geography has such a large impact on credit and credit has such a large influence on bank performance, banks should at least be sensitive to how credit performance is distributed within their service area.

Your bank will likely make better decisions when deciding where to focus branch staff and where to invest capital by better understanding geography.