Using Data For Bank Event Lead Generation

In an earlier article, we discussed how we use “cost per impression” as a metric for planning, budgeting, and executing bank events that are specific for customer retention and branding. In this post, we expand that analysis and apply it to those events that a bank hosts or participates in designed to generate leads (“lead gen”) for product sales. If done correctly, event lead generation can result in some of the lowest cost leads possible in the banking industry and have the highest product conversion rate of any channel compared to digital advertising, radio/TV, print, or traditional sales activities. Here, we highlight an effective tactic and provide banks with a framework for how to evaluate and choose events.

Mining Event Lead Generation Gold

While most banks hold community cocktail parties, lunch receptions, and host chamber of commerce events, one of the most underutilized events is for banks to attend statewide industry-specific functions. These are primarily annual trade association events for the profitable industries that your bank targets. For the enterprising community bank, they will essentially find themselves being one of the few banks there. Banks usually find resounding success as providers of capital and cash management services if the event and approach are right.

For example, if you were to attend your annual State Bar Association meeting with a target-rich attendee list full of managing partners and law firm office managers, you would likely be one of only three banks there. If you can demonstrate a law firm specialty, you will probably find that you have more deposit leads than you can handle. If you were to attend your state electric or water utility cooperative, you would likely be the only bank there and almost be guaranteed a shot at the subsequent refinancing or project bid.

Create a common evaluation framework and ensure you have communication between bank teams that attend. Within several years you can decipher the quality events that not only generate inexpensive leads but generate loans, deposits, and cash management fees. Soon you can have a portfolio of events that generate a return on investment measured in at least three figures.

Tracking Event Lead Generation Success

Most banks attend an event and fail to have a pre-meeting on the event laying out clear goals and objectives, plus fail to track metrics/outcomes or even conduct an after-action review on the effort. As a result, institutional knowledge is lost year to year, and improvement is slow. What happens is that banks attend the same events each year with a lackluster effort and negative returns. While seemingly sad, for banks that are on their lead gen event game, they can run circles around the others.

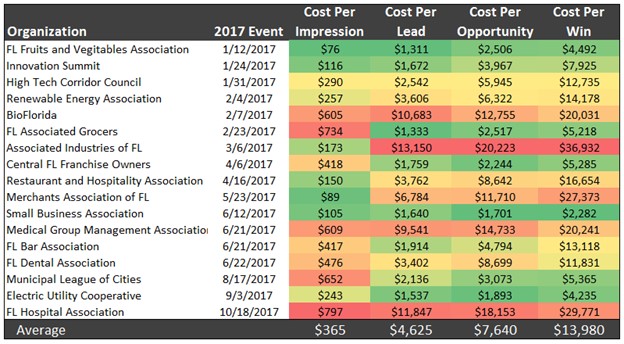

While the last couple of years has not been representative, we will go back to our 2017 data (below) and work backward since we have two years (about your average bank commercial sales cycle) of conversions after this event untainted by the pandemic.

The first step to calculating a return on event investment is to decide what metrics to track. Similar to events targeted at branding, tracking impressions is a good idea. Even better than branding events, you can track the number of qualified leads generated from the event. Some banks event rank the lead quality so they can produce not only cost per lead but the cost per “A1” or “hot” lead.

Taking that concept further, as leads work through the sales funnel. When they produce a qualified “opportunity” in that they express interest in a particular product like a loan or cash management service, banks can now calculate “cost per opportunity” and then take it to the logical conclusion of calculating “cost per win.”

One crucial point here is not to go too crazy with the analytics to start. Keep it simple such as the metrics suggested below, and then develop more granularity over time.

Capture The Information

Hopefully, your bank has a customer relationship management system to capture information about potential accounts that generate leads, so tracking becomes effortless. If not, a simple Excel worksheet will do, but know that it takes some manual effort on someone’s part. The thinking goes that while it seems like a waste of resources, you have already committed at least your business development officers’ time and cost of attendance. Thought in the marketing dollars in the form of sponsorship that you might have invested and spending an additional four hours of calculating metrics and tracking leads can be considered easy insurance to protect your investment. The reality is that at an average cost of $5k to $50k per event (including time and effort), your bank can’t afford NOT to track essential metrics.

Putting It Into Action

If done correctly, your bank ends up with a consistent data set for event lead generation and can leverage it to compare events. To the extent that you can track the business that ultimately results from each won opportunity and estimate the profitability, you have all the inputs to calculate a reasonably accurate ROI. Attend an event for two or three years, and your bank will have an excellent idea of what is worth the time and effort and what events are not.

Events can now be compared to each other and to other lead gen marketing channels, and you can now optimize your budget. You will likely find that you will keep investing in events until you get a set of events that generate returns on par with your other alternative channels. When this occurs, you can take solace in the fact that your marketing dollars are being optimized to the extent they can be.

After every event and again at the end of each year, the portfolio can be reviewed and restructured as necessary. Lower performing events can be dropped, and the most profitable events can be given further capital.

In future articles, we will be sharing some of our secrets on how to develop an attack plan for a conference if it pays to have a booth, how to demonstrate bank products effectively and how to follow up with leads. For this post, we wanted to lay the foundation, discuss the concept, and detail how to quantitatively drive success. Before your conference season starts and you still have an ample marketing budget, implement some of these ideas to boost your bank’s lead gen effectiveness.