What Covid-19 Is Doing To Industrial CRE Loans

While several commercial real estate (CRE) sectors are showing signs of stress, the industrial sector is one of the few bank credit lines that are improving. Companies gained confidence at the end of the second quarter and started to lease more space. As such, weekly leasing activity jumped back to pre-Covid-19 levels after hitting a low in mid-April. In this article, we take a quick look at national CRE industrial sector economics and explain why banks may want to consider reallocating more capital to this area.

What is Fueling Demand For Industrial Space?

Despite disruptions in supply chain causing a step down in manufacturing, demand for industrial space over the second quarter has been largely fueled by e-commerce companies needing more space for distribution centers, more companies needing more space to spread workers out for both manufacturing and fulfillment, greater need for cold storage and near-double digit growth for data centers.

Risks Remain

Of course, credit risk is relative, and as we look to update our bank credit model (originally presented HERE), we find that our one-year probability default projection remains on track more than doubling for banks from 0.49% to 1.12% but still relatively strong compared to other CRE lines. A resurgence of COVID-19 cases coupled with the higher death rate and more restrictions, particularly in Florida, Texas, and California, keep our forecast in line.

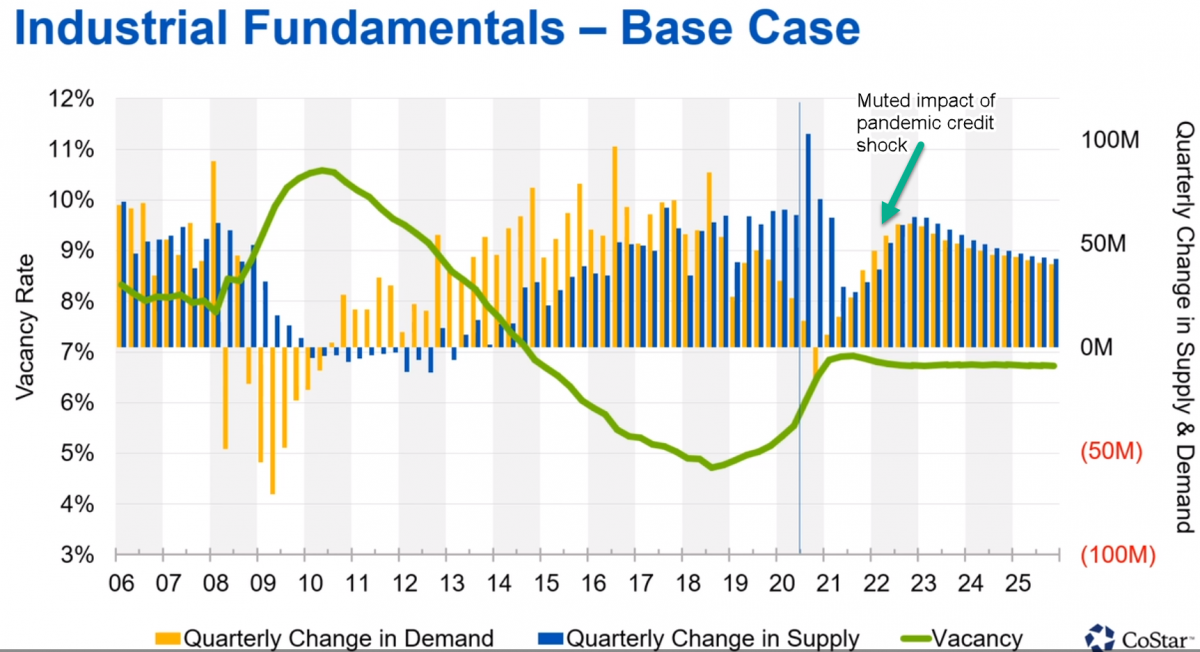

The general economics of the sector also concerns us slightly as construction was at a record pace in the second quarter, despite delays caused by labor quarantines and materials shortages. More than 64 million square feet of industrial space came online in the second quarter, another record high. As such, the national industrial vacancy rate rose slightly from 5.3% to a still benign 5.5%.

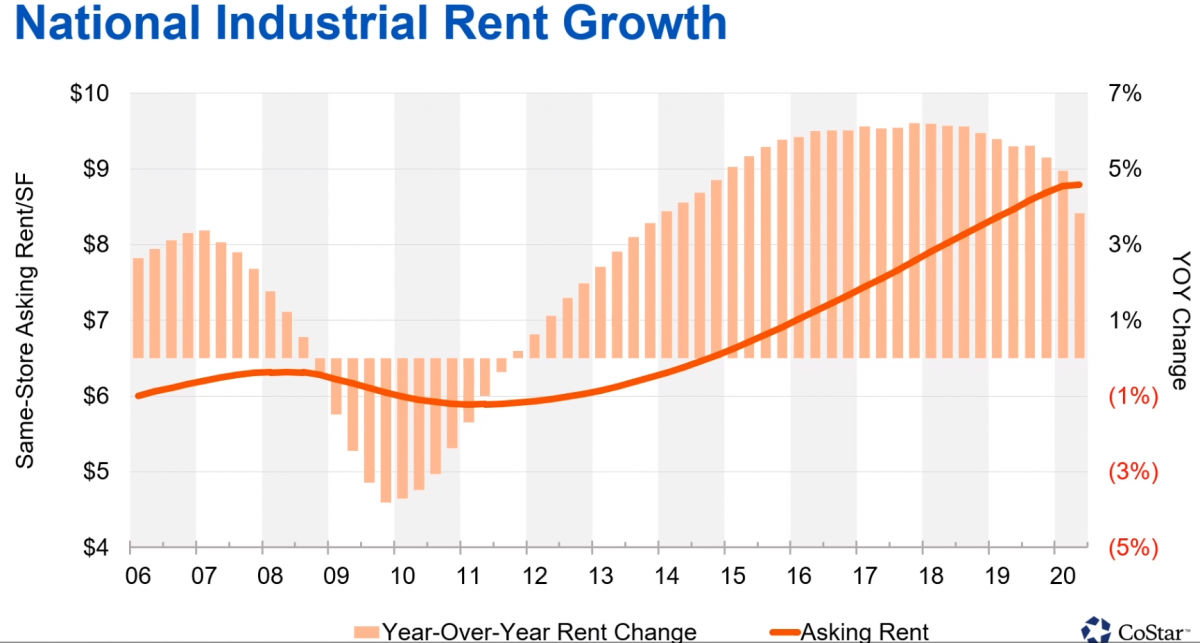

Similarly, while the big retailers like Amazon, Target, Walmart, Big Lots, and others increased space, smaller players did downshift demand. The net result is after a five-year run of positive rent growth; lease rates fell from 5% to a 3.8% growth rate as of the end of June.

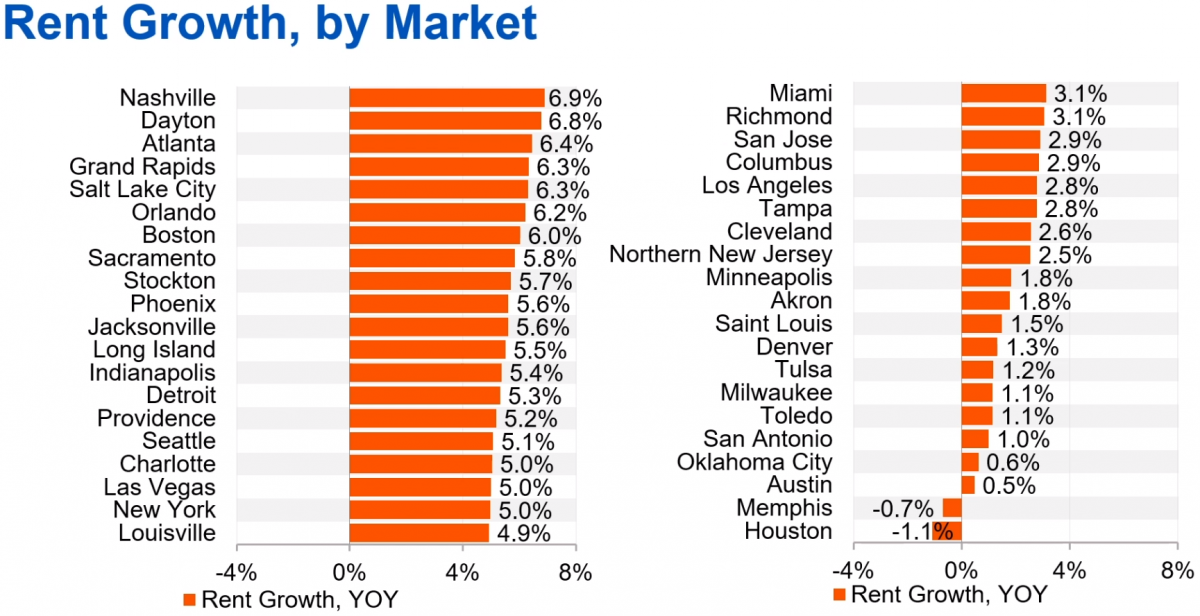

As a result of these trends, look for a rare period of negative space absorption in 3Q but look for demand to snap back relatively quickly by 1Q of next year. While new additional space is significant in places like Dallas/Fort Worth, Atlanta, and Chicago, most bank markets will see less than 1% of new inventory hitting for the remainder of this year. Markets like Nashville, Dayton, Grand Rapids, Salt Lake City, and Orlando should still have enough demand to easily absorb the new industrial space.

Of all the industrial markets in the U.S., the one that concerns us from a bank debt perspective is Houston that is being hit hard both with the pandemic and the energy shock causing much lower demand and increasing supply. Below is the CoStar data on year-over-year rent growth by major US market.

Bank Pricing

Pricing for well-structured loans above 1.5x debt service coverage and below 75% loan-to-value, increased from a nominal credit spread of +2.35% at the start of the year to + 2.65% at the start of third-quarter are in-line with the increase in expected losses.

While banks should look to increase risk-monitoring to all CRE sectors, the industrial sector remains on the lower end of the risk scale. Increasing reserves, increasing exposure to quality owner-occupied borrowers while reducing exposure to speculative properties, and being selective to the owner’s industry are all steps banks are taking. In addition, once the right project is found, banks are locking higher-quality borrowers in with longer-term fixed-rate financings combined with prepayment provisions to mitigate the potential for inflationary risk and to extend the duration of the loan.

Banks that follow these steps together with reducing exposure in the riskier hospitality, retail, and hard-hit industries should find that this rebalancing can help profitability.