What Floating Rate Loan Index Should Community Banks Adopt?

Recent regulatory messages have reinforced the importance for commercial banks to prepare for the end of LIBOR after 2021. However, banks cannot wait until the end of 2021 to find replacement index(es) because the transition from LIBOR requires changes to systems, vendors, training, and marketing that can take several quarters to finalize and implement. To meet the timeline for finalizing a replacement index by the end-2021 requires community banks to make choices now on which index(es) to adopt. It is important to note that regulators are providing an additional 18 months (to June 2023) to allow participants to focus on the remaining legacy exposures for transition; however, no new LIBOR contracts will be permitted after 2021.

Index Considerations

Like most banks, SouthState uses various adjustable-rate indexes, including LIBOR, Prime, US T-Bills, Fed Funds, and now, SOFR. At SouthState, fixed-rate loans compose the largest percentage of the loan balances, followed by LIBOR (at almost 28%) and then Prime (at 11%). Most community banks have some LIBOR-based loans, and larger banks have a higher percentage of their loan portfolio indexed to LIBOR. Should community banks consider SOFR as a substitute for LIBOR?

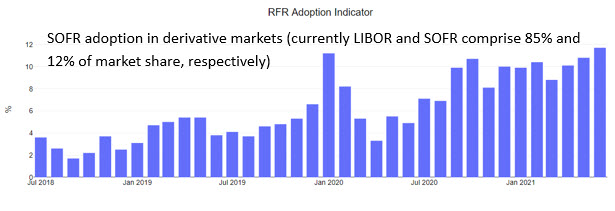

SOFR has not yet earned a dominant share of the banking market, but all indications are pointing that SOFR will replace the lion’s share of the existing LIBOR market. The graph below shows SOFR’s share of the derivative market. Currently, SOFR comprises 12% of that market.

There are two main reasons why SOFR adoption has not been faster than some would suspect. First, LIBOR is still available until the end of the year. Second, the market has shown a preference for term indexes, and SOFR is primarily priced as an overnight rate (the CME is now publishing term SOFR, but a futures market for term SOFR does not exist yet).

Regulators have now recognized that lack of adoption can be a self-fulfilling prophecy and are now prodding banks to move to adopt SOFR faster. This is why in the last few weeks, various regulators (FCA and CFTC) have issued statements about reinforcing the move to SOFR.

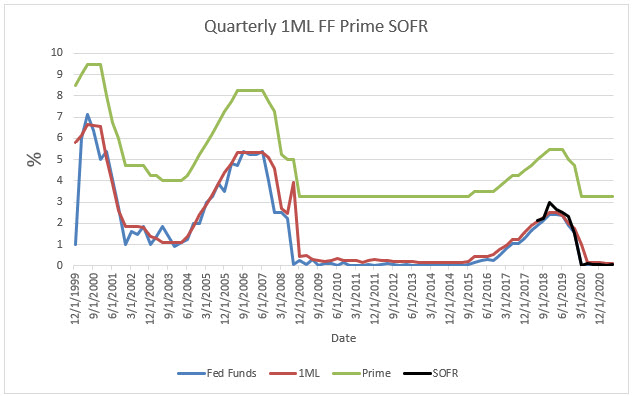

Detractors of SOFR and Comparisons

There are two major criticisms of SOFR voiced by market participants. First, SOFR has no credit component. Second, there is currently no futures market for term SOFR. The second criticism is moot because the market is currently developing a term structure for SOFR for futures and derivatives trading, and a term SOFR is expected to be available for futures and derivatives by the end of this year or early next year. The first criticism of SOFR requires a more detailed analysis. Prime and Fed Funds also do not contain a credit component; therefore, the shortfall of SOFR is not specific to that index alone. The market has not similarly pushed back on using Prime and Fed Funds. All four indexes (Prime, Fed Funds, LIBOR, and SOFR) are highly correlated, as shown in the graph below.

Most lenders can easily price a credit premium over Prime, Fed Funds, and SOFR to get an equivalent credit component inherent in LIBOR. The real concern for lenders is allowing a borrower to arbitrage the bank – borrow cheaply from the bank when the bank’s cost of funding is rising. This is precisely what happens on lines of credit when banks price these facilities to indexes without a credit component. In times of financial stress in the market, a bank’s cost of using rises, but Prime, Fed Funds, and SOFR would all be expected to fall, making a borrower’s cost of funding lower. This is particularly unfortunate since most banks do not charge a standby fee on lines of credit – lenders do not earn any return, potentially until the lender’s COF goes up, and that is when borrowers are more likely to draw.

There is a sound argument for lenders not to use SOFR (or Prime or Fed Funds) for lines of credit. However, for term loans, lenders can build a credit component to SOFR and avoid that arbitrage. That credit component has already been determined by ARRC to be 11.448bps for SOFR versus 1-month LIBOR and 26.161bps for SOFR versus 3-month LIBOR.

The national banks have been largely SOFR-ready since the beginning of this year and are currently offering customers SOFR-based products. Regional banks are now also making SOFR available to their customers. Frost Bank, PNC, Silicon Valley Bank, Capital One, USBank, and many others have marketing and educational materials available on their websites. These banks are all at various stages of training their customer-facing employees on how to explain SOFR and better market the index.

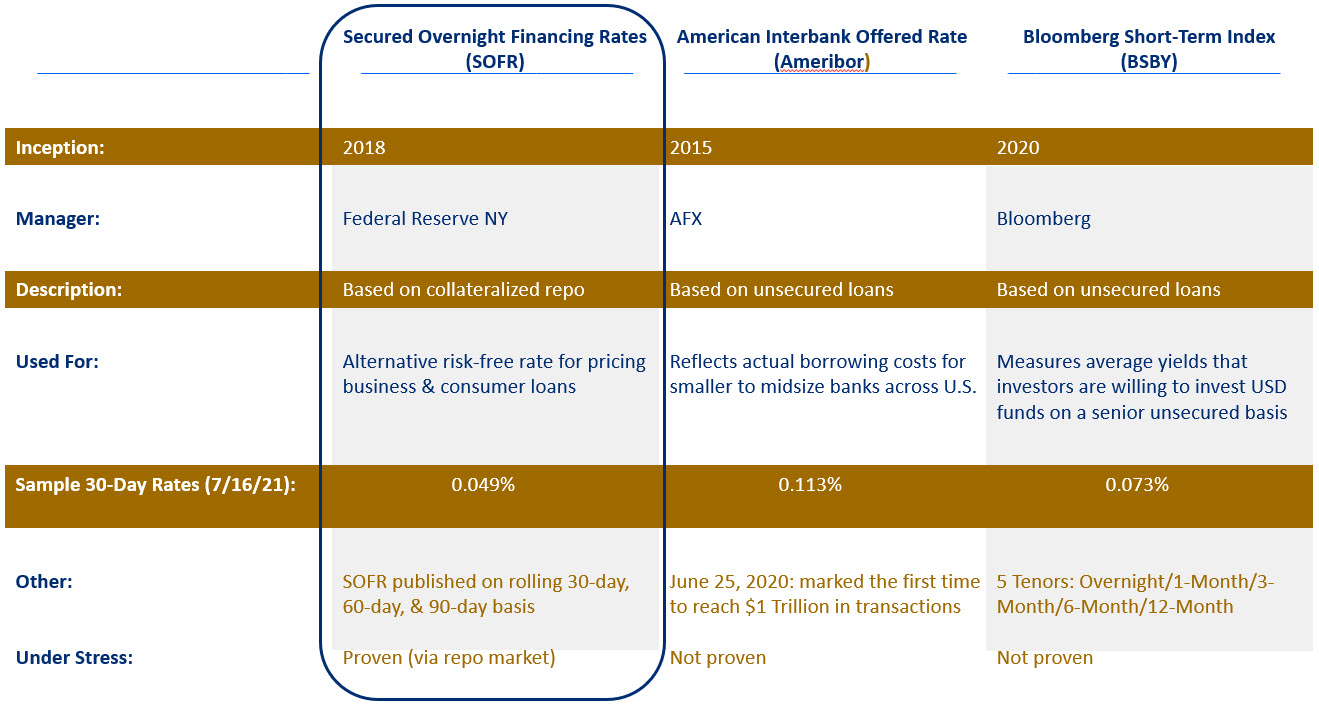

Alternatives to SOFR do exist. There has been discussion about the benefits of Ameribor and BSBY (Bloomberg Short-term Index). However, SOFR is by far the bigger market, with a daily volume of just under $1Tn. While it is hard to discern the current size of the Ameribor and BSBY market, it is a small fraction of the SOFR market. SOFR hedges are as liquid as LIBOR, and billions of USD SOFR derivatives trade daily, but Ameribor made the news when JPMorgan and Bank of America entered into the first Ameribor derivative trade in May of this year. Those same two banks also entered into the first BSBY-based swap in the same month. A summary of the three indexes is shown below.

Conclusion

There is a specious argument made by some that only one index can thrive in the market. In reality, the US has been a multi-index market for decades, with LIBOR, Prime, Fed Funds, and T-Bills all sharing the work of floating and adjustable-rate indexes. However, LIBOR was the overwhelming majority of the market for contracts outstanding in USD. Ameribor and BSBY may carve out a place in the market. Still, the industry has already created a broad and transparent market for SOFR, and it will be SOFR that gains the best execution and most comprehensive availability. At SouthState, we have booked a handful of SOFR-based loans and urge other community banks to start testing SOFR for document preparation and their core financial systems. SOFR may not be the right index for every instrument, but it will likely gain the majority of the adjustable index market share.