What is Going to Happen to The IOER Rate?

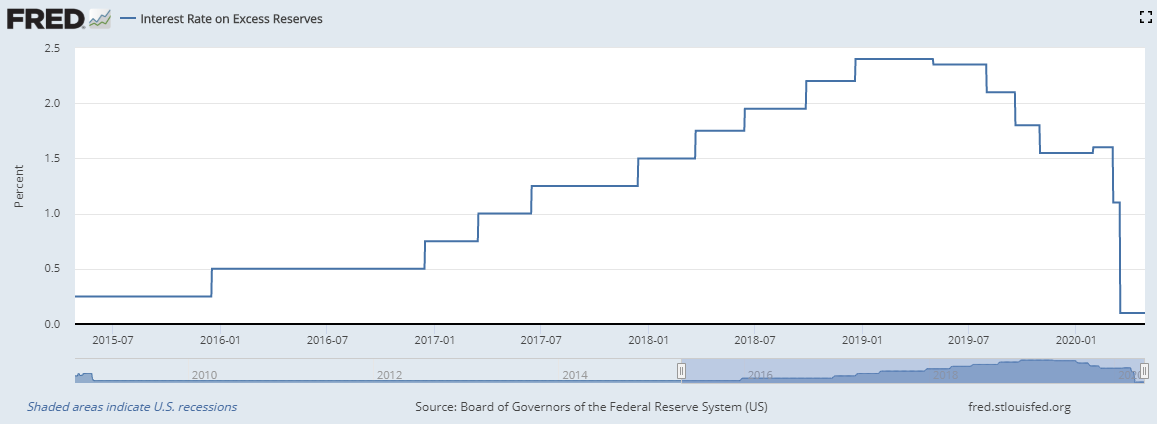

The rate that the Federal Reserve pays on bank deposits, called the Interest on Excess Reserve Rate (IOER), is currently at ten basis points and will be the subject of an interesting discussion at the upcoming Fed Open Market Committee Meeting this week. At the end of last week, the Fed Funds effective rate was four basis points which could be a problem. Usually, whenever the Fed Funds rate gets to the bottom portion of the target range, which is now 0.0% to 0.25%, the Fed has adjusted the IOER rate up in order to promote the index to move closer to the center of the range. The question is, what will it do now?

Normal Expectations

The answer is of particular interest to banks given the large amount of liquidity left on deposit at the Federal Reserve by banks since their remains to be a functioning Fed Funds market. In normal times, that is in times of ample liquidity; we would expect the Fed to raise the IOER rate by ten basis points in order to keep the range valid.

However, we doubt the Fed, and the President, is willing to take the risk of the optics of raising ANY rate given the state of the US economy. This would normally not be that big a deal one way or another, but this time there is more risk. Our prediction is that without the Fed moving this time, Fed Funds futures will move into negative territory prior to year-end which will in term put pressure on Libor and other short-term indices.

Preventing Negative Rates

One major issue is within an increase in the IOER rate, Fed Funds have a higher probability of moving negative, which creates many technical challenges for the market. For starters, many bank core systems cannot handle a negative index rate. Allowing the Fed Funds market to go negative would have an impact on other short-term rates such as FHLB advance rates, repurchase agreement transactions, money market funds, deposit rates, and Treasury Bills – all of which requiring separate systems to manage which could potentially struggle with tracking a negative rate. These technical factors will further hurt liquidity and cause temporary dislocations.

While Europe was able to adjust their shareholdings to limit the impact of negative rates from causing money market funds to “break the buck,” American funds, because of their sheer size and volatility, may not have that luxury. As such, a very real scenario would be the cessation of major money market funds in the US which would force liquidity back on to bank’s balance sheets at a time when banks will least be able to handle the additional funds. The added liquidity and cost will then, in turn, force banks to offer negative deposit rates to at least some sections of their customer base.

We predict the Fed will leave the IOER unchanged now put will increase this rate at the June meeting or even between meetings should the situation warrant. Banks should continue to monitor the situation and prepare for a negative index.