Why Digital Assets Are Your Bank’s Future

Scoff at the NFT’s all you want, but they are your bank’s future. Not every bank, just those that will survive. All the crypto ads during the Super Bowl are another sign of this. Sure, in part, it’s a hype-driven Pets.com moment. However, like the changes that took place around Web 1.0, Web 3.0 is genuine and is set to have a similar impact on eCommerce and banking. In this article, we discuss digital assets, officially known as “controllable electronic records” by the law, and glimpse into that future to make a case for why banks could be at the center of this next evolutionary change.

The Basics of Digital Assets

No doubt you have been hit over the head with all the talk about Beeple, CryptoPunks, and Bored Apes. The NFT, or non-fungible token, is a digital asset that is more status symbol these days than a long-term collectible asset. In a year, no one will care about your Cool Pet or what your certified Twitter Icon looks like. Part of that NFT world will be relegated to a meme of the times along with leg warmers, Furbies, Pet Rocks, Beanie Babies, and the mannequin challenge. However, the other part of NFTs is life-changing.

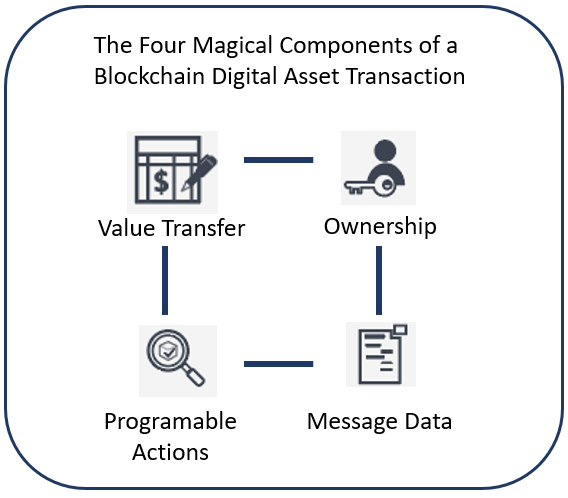

NFTs are significant to society in four economic altering ways – they confirm valid ownership, that ownership is immutably transferred simultaneously with value, that ownership/value is transferred simultaneously with an unlimited message, and that ownership/value/message can be programmed. If you travel down the evolutionary road of those four characteristics, they all lead to banks potentially having a material role in being at the nexus of future commerce.

The Digital Asset Explosion

Part of the challenge with commerce today is that an individual or business does not have a central storage place for the assets they own or the assets they have purchased in the past. While real estate, airplanes, boats, and automobiles have a transparent chain of title, that title and associated purchase information are stored in various forms in various counties and cities across the nation. Access is limited, and companies like CoreLogic and Autobureau have whole business models around making the information easily obtainable. Part of the allure of Amazon is that they keep a record of purchases and use the data to help both in reorder and for marketing of other suggested items. The data is a treasure trove of revenue.

There are hundreds of millions of other items where tracking and knowing ownership of a digital asset would be beneficial – computers, equipment, equipment parts, supplies, furniture, software, and even services. Businesses and households that need an inventory, valuation, repair, or risk tracking (fraud, theft, etc.) would all benefit from a standardized record of assets under ownership. The current way art and music are handled using NFTs point the way.

How Banks Are in The Middle

As we discussed in our primer on defi and blockchain (HERE), part of the allure of cryptocurrency is that it transfers the payment’s message (information about the transaction) and value simultaneously. Credit card networks like Visa, Mastercard, and American Express have created a whole layer of value by extracting this data. Product codes, quantity, unit charge, sales tax, time, location, and some 15 other fields are often collected and used for security, marketing, accounting, and general information. This transaction data often isn’t passed on to banks since the monetary settlement of the transaction happens separately from the message. Now, with a cryptocurrency such as a stablecoin, the message, the value, and the digital asset are all passed on to banks together, without the middleman of a payment network. These transactions can happen instantaneously in any amount and 24/7/365. There is not a payment channel available today that can handle that.

As the message and the settlement occur, banks will need to store and analyze the data, if nothing else, for security reasons to prevent fraud. It goes to reason that since the data needs to be stored in a data warehouse, then creating a series of customer-centric products around the data is easy to do. Banks will have the scale, security, and sophistication to be a trusted guardian of this information. Large banks will build their own infrastructure, while smaller banks will rely on consortiums, fintechs, and/or their traditional cores to manage.

Either way, you can now capture information directly from the transaction source and capture more transaction information than the current Level 1, 2, and 3 structure works using the card network. For example, banks may allow the ability to embed an invoice, purchase order, billing statement, or request for payment within the payment message. For the first time, customers would be able to get documentary evidence of the payment along with the payment.

Programming Digital Assets and Payments

Then there is the ability to program both the payment and the digital ownership of the asset. Buy the Alfa Romeo Tonale SUV (below), and not only does it come with an NFT validating ownership, but the complete servicing record follows the asset so the owner has the information in one place while subsequent owners can validate the maintenance of the car. The blockchain record protects the car’s residual value while also increasing initial demand.

Instead of posting your video and turning over your ownership to YouTube, you can now create an NFT so fans can own part of the video and associated revenue stream. At present, on several blockchains, it is now standard to create an asset, tokenize it and program it, so the creator of the content gets 100% of the initial sales price and then a percentage, usually between 1% and 10% of subsequent sales of the asset.

Banks can now help program both payments and digital assets, so ownership transfers in increments as a loan is paid down, banks can set the timing of payments so the transfer of value and ownership can be set for prearranged times or when certain events occur (such as new appraisals), or banks can program payments similar to how a purchase card works today restricting users to transacting predetermined assets or payments such as the purchase of gas, supplies or travel.

The possibilities to program money and assets are unlimited. Banks can create a series of products that reach both wide and narrow to handle specific industries such as homeowners’ associations, media companies, trading exchanges, insurance, or thousands of others.

Digital Assets In The Metaverse and Physical World For Brand Loyalty

Then there is general commerce. While individuals likely won’t care about their ownership of a roll of paper towels, there is a myriad of assets where ownership will create a new form of collectible. The digitization of clothing has already taken place. Last month Gap released their Epic NFT that gamifies purchases. Buyers collect certain NFTs to unlock a rare Frank Ape designed physical hoodie.

Nike, Adidas, Burberry, Balenciaga, Dolce & Gabbana, Louis Vuitton, and others already have NFTs and will soon tie the digital assets to physical ones. Thus, when you purchase the latest special edition basketball shoes from Nike, you will not only be conferred ownership, but you will also get a digital representation of the article for your use in various games and metaverse space.

Consumers will purchase online or see a physical asset, such as a Louis Vuitton handbag, scan the QR code, purchase the asset in seconds while getting the payment confirmation and the NFT in their digital wallet. In the background, the bank will transfer a stablecoin cryptocurrency from the buyer to the merchant instantaneously at a fraction of the cost of the credit card networks. Within the process, banks will be capturing all the information around the purchase and ownership.

The merchant will be able to exchange one bank’s stablecoin for another or will be able to convert a bank’s stablecoin into a U.S. Dollar or central bank digitized dollar whenever desired for zero transaction fees.

Putting This into Action

Because all this data will flow through banks, banks are in an ideal position to capture the information within a digital wallet and be able to help households and businesses manage their portfolio of assets. Information around that Alfa Romero SUV, Nike basketball shoe, Louis Vuitton handbag, residential real estate, fractional plane ownership, and commercial building ownership will now all be resident within a customers’ s digital wallet. A bank’s mobile app will soon tie into this wallet and import critical information.

Once the information from the blockchain and digital wallet is within a bank’s app, the bank can create an array of services to drive engagement, fees, and product revenue. A customer may want to borrow against a digital asset, manage the asset (i.e., maintenance, loyalty points, appraisals, etc.), or share the data with others with the customer’s consent via an open banking API. Having all the data in one place will allow banks to also utilize a layer of artificial intelligence that will help optimize the value of those assets and provide a myriad of alerts and notifications.

In case you think this is way into the future, everything discussed is already in motion. There are now multiple bank consortiums (e.g., USDF) composed of about 100 banks in aggregate already heading down this path, building a digitized asset platform starting with payments.

Real-time payments, digitized asset management, and a stablecoin channel should be on every bank’s strategic roadmap, at least for active monitoring. Banks that wait to get involved will find themselves paying higher fees and/or being pushed outside of the transaction flow resulting in a near-term loss of functionality for essential products such as business-to-consumer, business-to-business, and treasury management.