How To Use Gen AI for Strategic Planning in Banking – Part I

As you approach strategic planning season, one topic that will surely come up is your strategy for generative AI (Gen AI). Luckily, you can turn to Gen AI to help you in your planning, as the strategic process is just one of the many bank processes that bankers can improve with this technology. This article presents our six-step framework for getting started, discusses using AI for strategic planning, and looks at some of its strengths and risks.

The Background of Using a Gen AI “Consultant”

Using AI for bank strategic planning means taking on a new strategic planning consultant, which many banks routinely do. Any consultant can cause more damage than they are worth if not leveraged correctly. However, when used correctly, they can function as a highly productive team member who can help you arrive at your conclusions faster and more accurately.

The Advantages of Including a Gen AI Consultant

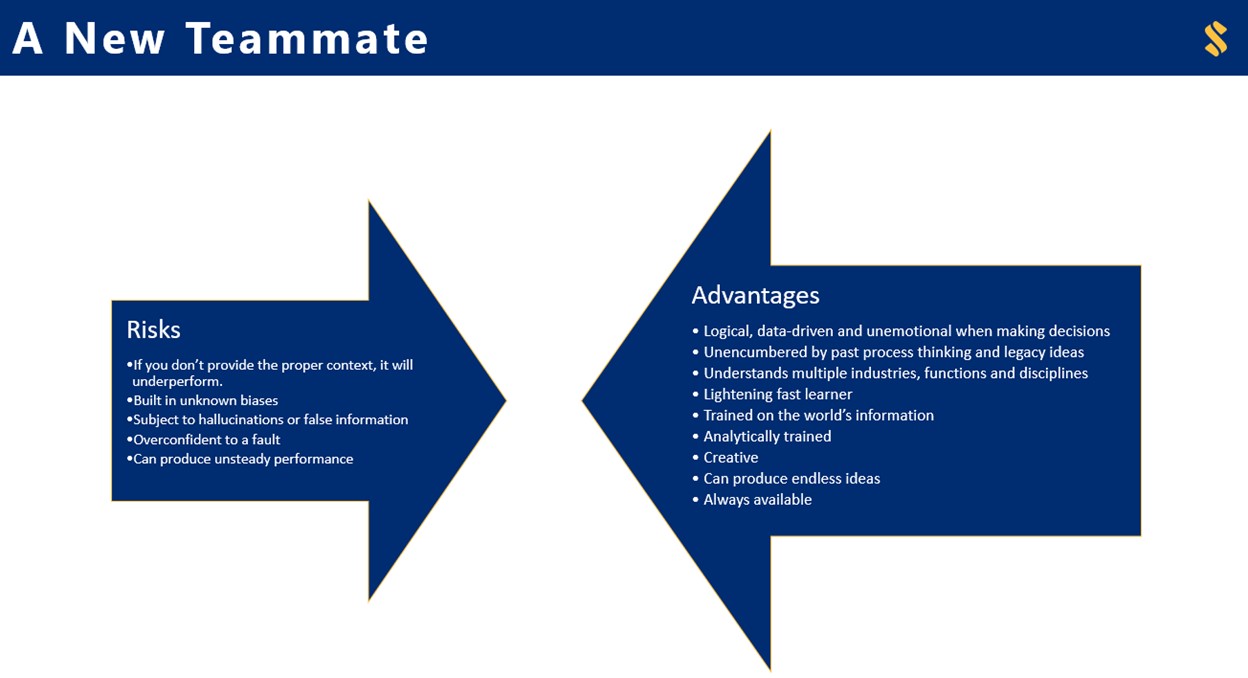

Using Gen AI for bank strategic planning means bringing someone to the table who has been trained on the vast majority of the world’s online knowledge. More importantly, it can quickly use that knowledge to make logical, data-based decisions in an unemotional fashion unencumbered by the past. This is to say; it helps banks break the cycles of past thinking to include legacy ideas and processes.

Bankers can uncover fresh approaches, and AI can connect ideas so tactics follow strategy, which can follow execution across multiple initiatives.

The consultant can be effusive, producing a never-ending stream of ideas spanning multiple domains and functions. The gen AI consultant can talk intelligently about leadership, bank performance, financial structuring, marketing, lending, legal, compliance, and deposits.

The AI consultant can access your call report history and ingest bank documents, including past strategic plans, vision statements, department goals, and anything else the management team deems necessary.

The Risks of Including a Gen AI Consultant

Of course, this consultant has risks. Like a human consultant, you don’t know if they have built-in biases or how well they perform. Accuracy at times will be suspect and should be questioned. The biggest flaw in Gen AI is that any question or prompt is subject to you, including the proper context. It may perform exceedingly well on some topics, while performance may falter on other days or other topics. This inconsistency is often underappreciated in our current Gen AI hype cycle.

Like a consultant, they will follow your lead and want to tell you what you want to hear, which is often implied by your question or referenced source documents.

Grading Risks by Gen AI Function

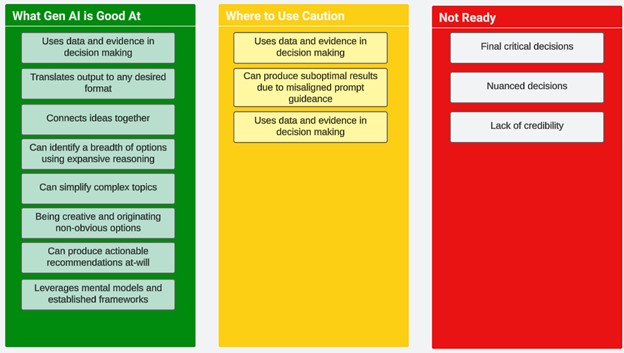

Bankers wanting to use gen AI should clearly understand what it is good at and is not. For all the concern around gen AI being biased, it is also refreshingly unbiased to legacy ideas. The most significant advantage of using gen AI for bank strategic planning is its ability to produce ideas and recommendations that are evidenced-based and not influenced by what has been done in the past. You may not want to take AI’s recommendations, but at least it should make you think about what someone outside looking in might think.

Gen AI excels at distilling options down to recommendations, which is helpful to management teams that are having a hard time deciding. While the risk is overconfidence in its recommendations, the technology can quickly synthesize data into a clear recommendation. Humans, in contrast, can spend countless hours talking about a topic without having the clarity or courage to make a tough call. AI can also be beneficial for breaking tunnel vision or the tendency for humans to over-index on a single solution.

Of course, AI’s use of data and evidence can also be biased by the knowledge of the internet. Ask it about tactics for raising deposits, and it will often quote using a high interest rate as a tactic since so many banks do this. Thus, while being data-driven is a strength, it is also a weakness that should be met with skepticism and caution.

Bankers need to be aware of how they provide context and ask questions. Nuanced questions about human capital or culture tend to be nuanced and difficult for Gen AI to opine accurately on.

The right questions are also important. Ask a question about improving the net interest margin, and it will assume that a nominal net interest margin is important to performance without regard to a risk or cost adjustment. Ask about producing an above-average risk-adjusted return on equity, and bankers will achieve much more accurate results.

Gen AI is good at highlighting customer behavior and industry trends. For brainstorming and idea testing, AI is a net plus and an asset to the team. However, due to its inconsistency and opaque decision-making, the tool is not good at making recommendations for critical decisions.

The most considerable drawbacks of using gen AI for bank strategic planning are the newness and the lack of trust. For all its benefits, it is essentially a beta technology and new to banking. Where a human consultant can walk in with a set of validated experiences, AI can make recommendations and provide input that may or may not be accurate. Because of the newness in the technology and the newness of bankers dealing with technology, caution should always be exercised. That said, the more you use gen AI for bank strategic planning, the faster bankers can build trust and the better your output will be.

Changing the Strategic Planning Equation

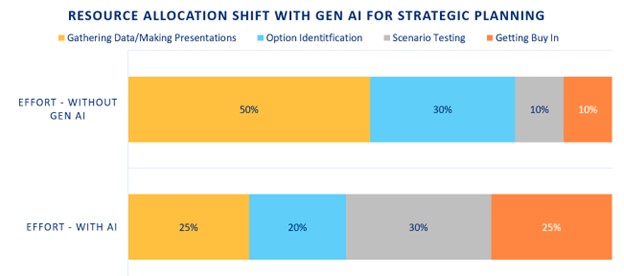

Part of the value of using gen AI for bank strategic planning is the shift of bank resources. The traditional way of strategic planning has executives and line managers spending an estimated 50% of their time gathering data and preparing presentations. Gen AI is excellent at gathering and synthesizing data in seconds. Managers will still need to keep in the loop to tell the tool what data to look at, what time frame, and how to present it, but what used to take 10+ hours now takes closer to two hours per manager. Using AI means less time for gathering the information and more time for analyzing it.

Further, Gen AI is excellent at evaluating and laying out the options within a strategy. This evaluation process took about 30% of the strategic effort as each manager and executive sifted through numerous options. Using Gen AI, this time can be cut in half.

As a result of these time savings, some of these hours can be devoted to running scenarios around different strategies. Understanding the outcome of various scenarios, anticipating questions, preparing for pushback, and figuring out how best to present the initiative can now take up the bulk of the time. This is critical as it is in this phase that initiatives are won or lost.

In like fashion, now more time can be spent socializing the idea with customized arguments that highlight the various parts of the initiative. Gen AI is the best tool the world has ever seen for making “transformations.” That is, it excels at taking the output and presenting it in various forms, whether it is for a compliance person who emphasizes the associated regulations and risks, the CFO, or the head of operations.

In seconds, bankers can produce tailored presentations, emphasizing the areas of expertise and presenting in a format that best highlights the person’s learning style. Gen AI can present the information in narrative, graphic, bullet point, or list form. If you know the CEO is an Enneagram 6, you can emphasize their love language of security, conservatism, and how the initiative is being done at other banks.

Getting Started with AI for Strategic Planning

Let’s assume you have access to your version of ChatGPT 4o (the most popular and best for quantitative calculations), Microsoft 365 Copilot (also ChatGPT), Anthropic’s Claude 3.5 Sonnet (likely the best model for strategic reasoning), DeepSeek R1 (best value for the price) and Perplexity Pro (the best for pure research). Any of these models are a good start, whereas Gemini 2.0 Flash and Llama 3.3 tend to lag in performance (but only slightly) to any of the above.

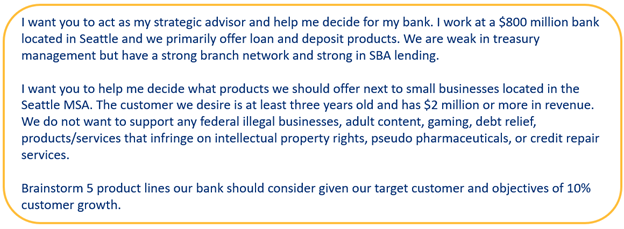

It is important to note that none of these models train on or need to train on your data. If you view that as a risk and must use a non-enterprise, public model, then we suggest you genericize and anatomize your data. This will get you 80% to 90% there without worrying about the model using your data in the future. An example is below.

Let’s also assume you have the skill set to create quality prompts, provide the context in preprocessing (we will discuss), be able to upload files, and have a budget of a couple hundred dollars for this effort.

Step 1: Identify the Decisions You Need to Make

You don’t need to use AI for every decision, but here is a framework for understanding what strategic bank decisions you should consider leveraging gen AI for:

- Needle Moving Decisions – What markets to be in, what products to offer, or what customer segments to go after are all worthy of gen AI. Gen AI provides the most value when leveraging disparate data sets such as profitability, economic climate, and psychographics. You can use gen AI for little decisions, but your return will be lower.

- Complexity—Because AI can handle data and input from a variety of sources, it provides the most significant time savings compared to human analysis. Gen AI is strong at picking up trends and making recommendations based on data. It is also better than a human at understanding and evaluating downstream implications of decisions, such as what a push into a new market will do for interchange or check volume.

- Close Calls—There is no need to take the risk of AI for obvious decisions. Your management and board know if they need to raise capital now, so why go through the effort of creating the right context for Gen AI?

- You Have Expertise—If you are trying to evaluate whether you should go into wealth or mortgage and have no expertise, then you are setting yourself up for failure as you cannot evaluate the output accurately. However, if you are trying to optimize your loan mix based on your cost structure, competition, and objectives, Gen AI will likely be able to help, and you will likely be able to evaluate its input.

Some samples are below.

AI For Strategic Planning – Coming Up Next

Next week, we will cover the remaining five steps, show how to use gen AI to generate a Monte Carlo simulation of your strategic initiatives, and how to use AI to “Red Team” your strategic plan. Utilizing gen AI for strategic planning can save your bank months of time and result in not only better ideas but better execution of those ideas. The more you utilize gen AI for planning, the more accurate and efficient you will get with the tool and the more effective your outcome.