7 Ways Instant Payments Impact Deposit Performance

With almost 30% of banks utilizing some portion of instant payments, the industry is starting to gather more data on how instant payments impact balances, customer acquisition, and account usage. Instant payments have the potential to change the payment landscape for banks. In this article, we look at seven ways instant payments impact deposit performance and add insight into what it means for banks.

Background of The Instant Payments Study

We combine our experience with data from the Federal Reserve and a recent study by Lu, Song, and Zeng at the University of Washington and the University of Pennsylvania that analyzed 50 billion transactions across multiple banks and credit unions. For instant payments, the study looked at the effect of sending an instant or faster payment through the FedNow network and the impact of using Zelle, Venmo, PayPal, and Cash App for instant transfers.

Since the study’s focus was on material money movement, it examined only transactions above $50 to eliminate the noise associated with smaller transactions.

Below, we detail seven ways instant payments are starting to impact deposit performance.

One: Provide It, and They Will Come

When banks say, “Customers are not asking for instant payments,” they are saying that they never ask their customers if instant payments are important. A Federal Reserve survey from last year found that 86% of businesses and 74% of consumers want faster or instant payments. Reducing costs, increasing payment flexibility, and the 24/7/365 nature of instant payments are the top three reasons cited for the need for instant payments.

But those are surveys. What about in the wild? The data from customers with access to instant payments shows that 63% of accounts used one of these instant payment channels if available. That is impressive considering most banks have not started active marketing instant payments to consumers and have started with businesses.

The insight here is that if you price and market the product correctly, instant payments will not only start to cannibalize other payment channels such as cash, checks, and wires, but it will also have a set of other attributes impacting bank performance.

Two: Customers Have More Than One Account and Will Use Instant Payments To Transfer Funds

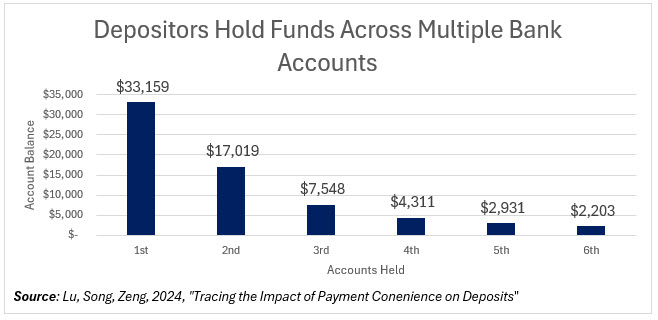

A 2019 survey by the Mercator Advisory Group showed that the American depositor has an average of 5.3 bank accounts. As can be seen below, these balances are material. Many of these additional accounts serve a purpose (more on this later), and customers actively transfer money between accounts to meet those purposes.

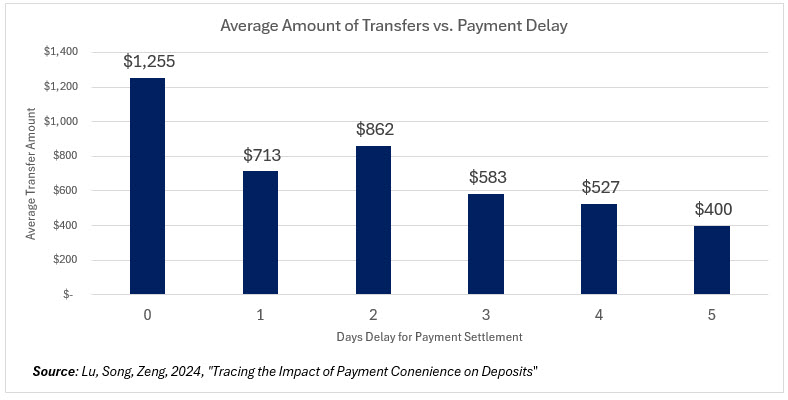

Unsurprisingly, the less payment friction introduced, the more money will flow in and out of the account. Without instant payments in the calculation, the average settlement time for a payment is two days (mainly due to the high volume of ACH transactions). By including the instant channel in the calculation, that settlement time drops to 1.5 days.

The study found that if you make a payment channel that is faster and less expensive than other payment channels, such as checks and wires, the quicker and cheaper channel will be used and will be used more frequently. While this is a benefit for banks to drive engagement, it also is a risk for banks that provide instant payments. As the study demonstrates, faster settlement payments increase gross deposit transfers between bank accounts while reducing deposit balances.

Of course, offsetting this risk is the fact that accounts with instant payment capabilities are likely to have more balances to begin with. All things being equal, customers will want their primary account, that is, the account with the largest deposit balances in it, to also have instant payment capabilities. As such, instant payments will prove increasingly crucial to obtaining our customers’ primary and secondary accounts.

Three: Faster Settlement Results in Larger Transfers

With the ability to send money out of their account more efficiently, customers will move greater balances between accounts and move money more often. This means that accounts with instant payment capabilities become more relevant and important to customers.

Four: Wealth and Deposit Balances Drive Payment Adoption and Sensitivity

Wealthier customers are more likely to use instant payments and more likely to move around larger payments. The same goes for deposit balances. This finding, while intuitive, remains a critical insight given the events of Silicon Valley and First Republic Bank. Uninsured depositors, those with balances over the $250,000 FDIC threshold limit, are more likely to utilize instant payments and more likely to drain balances. In order to manage liquidity, banks, mainly publicly traded ones, should not only closely monitor these accounts but also take measures to limit account balance volatility. Establishing daily transfer limits, having a key performance indicator where you would cut instant payment usage off, AND having the ability to delay outflows for up to a week in the depository agreements are all risk mitigation strategies that may prove crucial in a bank run.

Debt is another dampening factor for deposit outflows. Customers with higher debt levels are less likely to transfer money from their accounts and into accounts that fund items like savings and investments.

Five: Bank Account Specialization

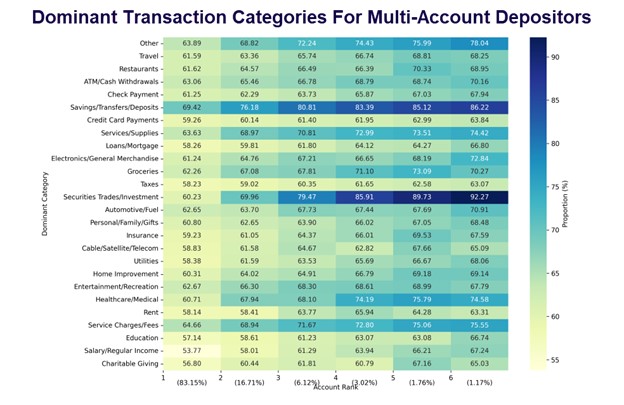

One area that the banking industry does not talk enough about is account specialization. With between five and six accounts on average, customers tend to use accounts for specific purposes such as savings, to service a mortgage, or to pay bills associated with a project or location such as a second home. Statistically, 57% of all accounts are utilized for a distinct purpose. Below is an illustration from the study that shows payment distribution patterns among depositors who maintain at least two bank accounts. Each account below is identified by its primary purpose category, defined by accounts where that purpose composes more than 50% of the payments. The heatmap’s x, or horizontal axis, ranks as the most frequently used account. The numbers in the middle of the box indicate the percentage of payments in that account attributed to that primary purpose. The intensity color within the cell represents the degree of dominance of that category.

The takeaway here is that this data opens up several marketing campaigns to attract/retain customers, increase balances, and enhance payment volume. While a customer’s primary account tends to be more general in nature (far left side), as customers open other accounts, they use them for things like savings, investments, services, healthcare, groceries, auto expenses, Travel/entertainment, home improvement, electronic/appliances, and gifts, in that order.

While we will analyze this finding more in-depth in the future, for the sake of this article, understanding each account’s purpose can help a bank design instant payment products and specialty accounts to make these customers more profitable. Banks that can identify specialty accounts for items like healthcare, home improvement, charitable giving, or education may want to provide tax reporting to help customers better track their tax position. Similarly, many customers keep accounts to purchase furniture, electronics, or other hard goods, so reporting leveraging instant payments’ rich data format that includes receipts and invoices can help customers keep track of insurance coverage and claims.

Six: Introducing Instant Payments

The study paid particular attention to the behavior of those accounts that had not used instant payments but were then introduced to instant payments upon receipt of instant funds. Once they are introduced to the product, a material percentage of the customers, 24%, will start to use it for themselves.

The insight here is that as many banks are receiving only banks, these customers who are receiving instant payments are a sensitive cohort to start marketing instant payment send capabilities to spur adoption.

Seven: Higher Rates Impact the Speed at Which Funds Are Transferred

As interest rates rise and the difference between what your bank pays on interest-bearing accounts and competitor pricing increases, it is no surprise that the rate of outflows will increase. The greater the difference, the more the outflows. The more efficient the payment channel is, the faster this will occur. Depositors with high balances, particularly uninsured depositors, will likely experience the largest change in balances. Further, depositors who become more comfortable with digital and mobile banking are more likely to transfer balances when the interest rate differential increases.

While banks may lament that payment velocity is increasing, there is no putting the toothpaste back in the tube. Competition will force most banks to adopt this technology to compete for treasury management and consumer primary account status.

Putting This Into Action

The data clearly shows that even though your customers may not be asking for instant payments, they are likely using instant payments through other institutions or financial technology firms, such as PayPal. Reducing payment costs and delays to allow for better financial control is proving to drive adoption and capture engagement.

Making payments easier for customers usually means customers will increase the frequency and amount of payments from the account. The study found that this “consumption” of goods and services increases deposits held at the bank by an average of $5,114.

The adoption of instant payments significantly influences customer behavior and deposit management. While the average settlement period for all payment channels was just above 1.5 days back in 2014, in 2024, it is now closer to one day due to the increase in usage around same day ACH and instant payments. As instant payments continue to expand, the average settlement time will move to six hours by the end of the decade. In the next five years, same-day settlement should become the norm, not the exception.

Wealthier customers and those with higher deposit balances are more likely to use and benefit from instant payments, yet they also pose a greater liquidity risk. To mitigate this, banks should monitor accounts closely, enhance their liquidity management, and implement measures such as daily transfer limits and the ability to delay outflows to offset some of this risk.

Furthermore, understanding account specialization and leveraging payment data can enhance marketing strategies, product development, and customer profitability. Introducing instant payment capabilities to receive-only customers can also increase adoption and improve deposit performance.

While instant payments come with risk, they also bring opportunities, such as more customers and larger balances. This is a strategic decision that every bank will have to make.