2 Ideas From HMBradley That Your Bank Should Try

HMBradley is a fintech that has partnered with Hatch Bank, a subsidiary of Firstrust Bank ($3.7B, PA), to offer two innovations that we have talked about in the past, but few banks have executed. This fintech has tiered their rates based on the percentage saved and offers only a single operating account instead of checking, savings, money marketing, and similar accounts. In this article, we will cover both ideas for your bank’s consideration.

A New Way to Tier Deposit Accounts

While most every bank tiers their deposit accounts and rates by aggregate size, we have long argued that the process is meaningless for about 90% of the banks that don’t market off their tiers and inefficient for the 10% of the banks that do. The ultimate way to tier deposit accounts is to customize each offering to individual balance sensitivities so that you maximize a combination of profitability or interest earned for your customer, depending on your bank’s goals. This currently reduces the mass inefficiencies in our industry of either paying too much interest hurting profitability or not enough, which either underserves the customer or, more likely, causes them to have to open accounts at other banks.

To pull off customized deposit tiering takes more data work and a personalization engine, which only about 500 banks have, banks need to look for other frameworks to start to close the gap. One such way is HMBradley’s construct to pay interest based on the percentage of funds saved per deposit.

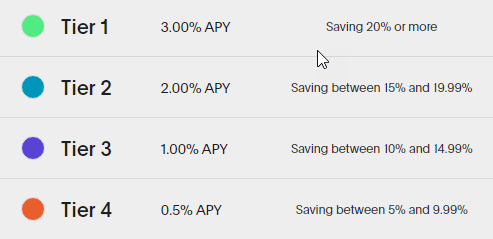

Let’s take a look at their structure and rates below.

All direct deposit customers start at Tier 3 rates and then move from there. Each quarter, the bank looks back at the percentage of the deposit retained and applies the applicable rate up to Tier 1. While their rates are exceedingly (and unsustainably) high given this market, there are a couple of items to point out.

Balance building incentive: Poll most customers and more than 90% will not have and know what a bank’s tiers are and have little behavioral incentive to increase balances. Here, customers are reminded of the reason to save every month, further supporting a savings habit. If a customer is low the first month, then they are shown what they need to save to increase tiers, thus resulting in a gamification reinforcement of a habit that benefits both the customer and bank.

0% APY: If a customer does not build their balances and falls below 5%, then they earn 0%. This move is brilliant and helps offsets the high rates paid as every customer feels like they have an interest checking account and doesn’t mind getting 0% because they are in full control. This is different than having a 0% checking account and an interest-bearing checking and making the customer choose. Using this framework, banks can move the tiers accordingly and add or subtract account attributes to achieve target profitability. The customer has not only control but also little need to have multiple checking and savings accounts.

Percent of Savings Not Balances: Aside from the behavioral impact the tiering has, there is also a sense of universal fairness that is fantastic for the customer experience. Many customers are put off by banks having a $50,000 tier as they might feel they can never achieve that level of balance. However, with HMBradley’s framework, it doesn’t matter if your balances are $900 or $9,000 you can achieve the same level of interest (however, we point out that accounts go to zero above $100k).

Finally, Subaccounts

Few customers need or want multiple accounts – its extra work to reconcile, they need to take the extra step in moving money back and forth, and it can get confusing. Ironically, banks don’t want a customer to have multiple accounts if they can avoid it as each account has a fully allocated cost of between $1.40 and $5.00 per month to maintain depending on the core system, size/cost structure of the bank and account attributes. Fewer accounts with larger balances mean an improvement in operational efficiency. For banks to get below the coveted 40% efficiency ratio, moving to an omnibus transactional account will be in every bank’s future in order to compete.

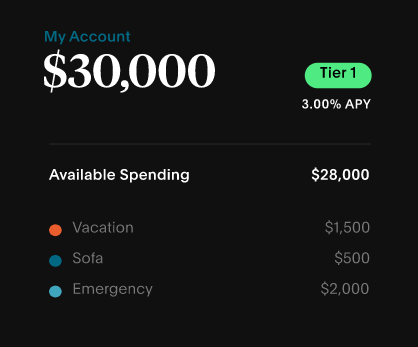

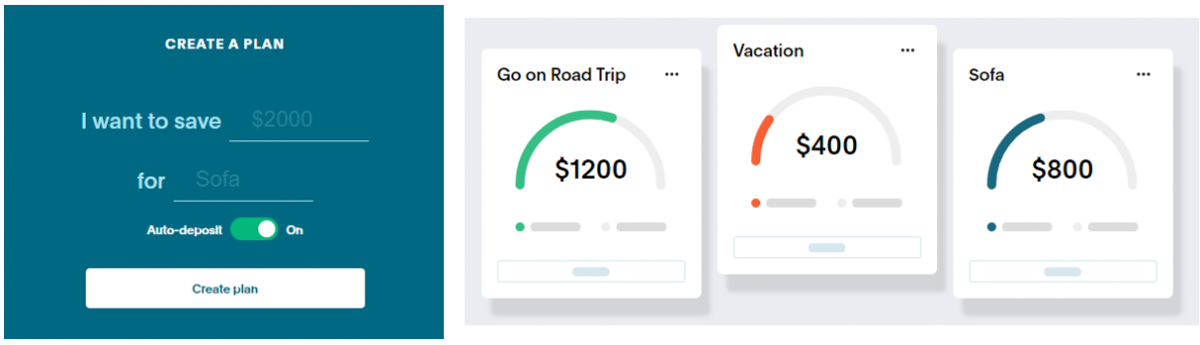

Here, HMBradley allows customers to not only gain interest based on savings percentages but allows the customer to establish separate subaccounts, each with different goals and reporting (below). This results in several positive attributes for the bank and customer.

Efficiency: The customer now gets the benefit of having the ability to track an unlimited number of subaccounts while the bank only has to maintain a single account. This is a far better structure than having balance requirements and/or additional monthly charges for customers that want to save for college, taxes, vacations, and more.

Gamification: In addition to being able to set up various accounts, customers can both set goals for each account and set up automatic contributions to each plan, all while working towards the next savings tier.

Data: The best attribute of this set up is that banks can gain insight into the intent of the customer. At present, the majority of banks have no way to know what a particular account is used for in order to data-mine marketing strategies. With this structure, banks can easily see not only the desires and goals of each account but their performance towards those goals making it easy to create ongoing promotions, incentives, and marketing campaigns leveraging this data. This benefits both the customer and the bank.

Putting This into Action

Many banks have the application layer within either their core or online/mobile banking application to pull these account attributes off, but don’t use it. Other banks have no ability to create an application layer, which should also send a signal. Either way, banks need to take a hard look at their ability to generate account attributes similar to the above and lay plans to acquire the technology and/or develop the creativity as this will be much more common in the future.

Any initiative that can enhance the customer experience while reducing the cost structure of the bank should be considered as a priority. Creating tiering based on a savings percentage and focusing the bank on one omnibus account with the ability to manage subaccounts are both ideas that will become standard in the next five years.