Managing The Earnings and Margin Trade Off

Many community banks are struggling with excess deposits and weak loan demand. The common question posed to us is, “should management focus on loan growth by accepting lower margins or wait for margins to recover?” This blog will address current banking industry dynamics, how banks are responding and what we see as some winning strategies.

State of the Industry

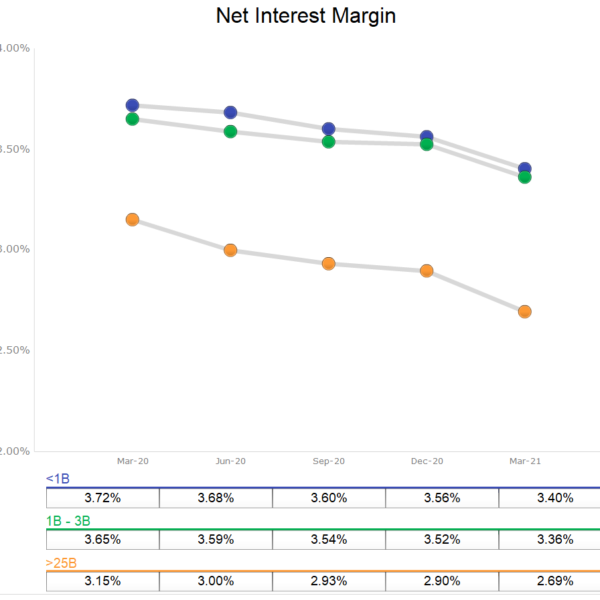

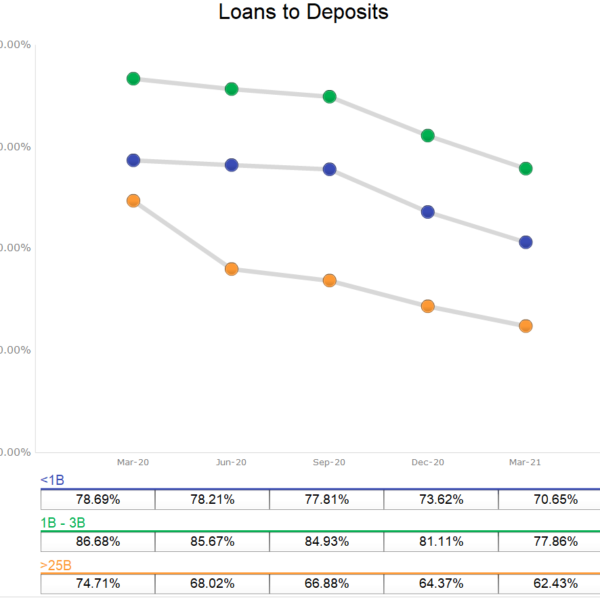

The two graphs below show NIM and loan-to-deposit ratios for all banks by asset bands (banks under $1Bn in assets, $1-3Bn, and over $25Bn). In the past 12 months, net interest margins (NIM) have declined by 29 to 46 basis points (bps), and the loan-to-deposit ratio has declined by 8 to 12 percent.

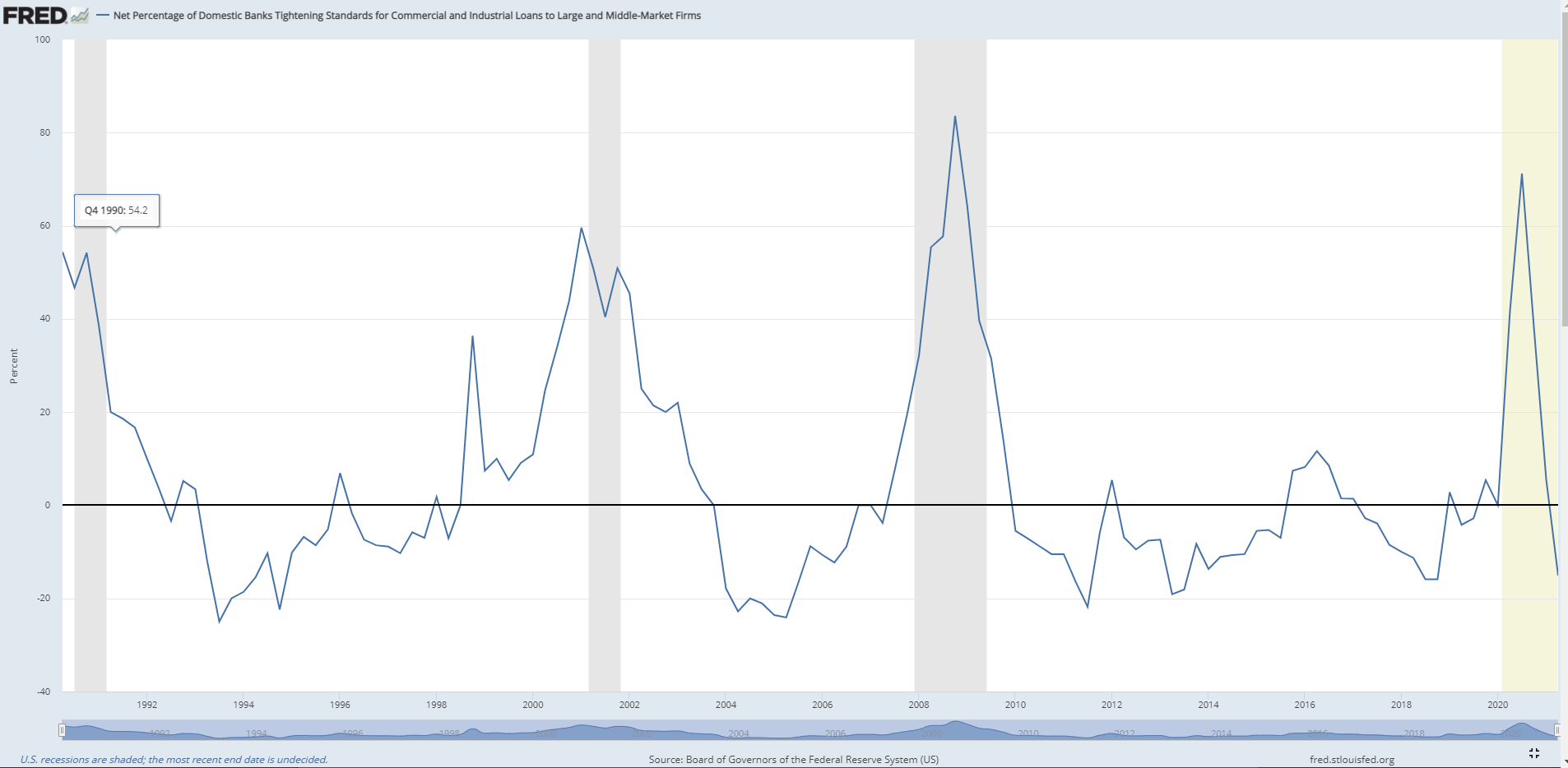

This trend shows no sign of ending anytime soon. The graph below shows the net percentage of domestic banks tightening standards for C&I loans as reported by Federal Reserve Economic Data.

The portion of banks saying they eased standards on credit in the first quarter of this year exceeded the percentage saying they tightened standards by most since 1996.

This survey aligns with what major banks have said in recent earnings reports. Bank of America, JPMorgan, and others have stated that they are moving to pre-pandemic credit standards. Further, these same banks are stating that they are ramping up marketing expenditures as a part of an effort to hit projections for loan growth this year.

How Banks are Responding

Many banks that do not follow the competition on loan pricing will continue to see growth in cash and cash-like assets as loan demand stays soft. While some banks stepped up their securities purchases sharply, quarterly increases in cash and equivalents outpaced increases in bond holdings at most publicly traded banks with more than $50 billion of assets, according to data from S&P Global Market Intelligence. For this bank group, the median ratio of securities to assets increased to only 20.7% from 20.4% in the linked quarter. Banks are increasingly willing to sacrifice credit margin to book loans rather than buy bonds.

On earning calls, a large percentage of executives indicate that they are hesitant to lock low fixed rates but are willing to sacrifice credit spread on loans today, realizing that potential turnaround in credit demand may take longer than expected and credit spread on future loans may be even lower.

Specifically, banks are highlighting the following strategies:

- Lowering target loan ROE. Thus, it is becoming more crucial for banks to measure returns on a RAROC relationship model because a slightly mispriced loan at a 1.50% spread is more detrimental to a bank than a slightly mispriced loan at a 2.50% credit spread.

- Lowering minimum credit spreads. Credit spreads down to 1.50% are not uncommon in some competitive markets. However, the value of the total relationship becomes even more important as cross-sell opportunities can increase relationship return on equity (ROE).

- Bankers are resigned to a longer than expected credit demand recovery. If hyper liquidity persists and loan demand stays soft, the better strategy is to act now to book credit than to wait for the competition to catch up and lower spreads further.

- Banks are targeting industries and segments. Because there is even less room for error with credit spreads at 1.50%, banks are identifying winning segments such as companies that will benefit from infrastructure or industrial and distribution CRE.

- Organic loan growth is key. Pressures on revenue from excess liquidity and low-interest rates could force many banks to consider M&A. As the saying goes, “shareholders can’t spend margin.” Banks that hope that loan demand would return and credit spreads increase may be prime takeover targets.

Some Winning Strategies

Banks are competing in an environment where asset prices are at historical highs and credit spreads are at historic lows. The industry’s operational costs are too high to support the traditional revenue model of high-cost branch networks. However, community banks still have some winning moves left.

- Individual community banks need to identify winning credit segments in their geographic footprint and concentrate on those segments. At SouthState, as an example, we are bearish on office CRE but bullish on industrial. We will focus our capital on segments that we believe have tailwinds and price those credits accordingly.

- In a world of 1.50%, credit spread banks must eliminate as much guesswork as possible because the margin of error is too low. Banks that use RAROC loan pricing models will have a major advantage over those that do not.

- Community banks must implement a relationship banking approach that entails the following:

- The lifetime value of a relationship is key to profitability. The expected life of the customer relationship must be at least five years and preferably longer. Customers that cannot be retained for 5 to 20 years do not represent sufficient lifetime value of earnings to make the relationship return positive for a community bank.

- Relationship banking must involve more than one bank product, and community banks must identify other profitable products, especially now that deposits have low economic returns.

- A high percentage of customer wallet creates more pricing leverage for the bank in the long term. Community banks can thrive if they identify customers to whom they are meaningful service providers and represent the primary banking relationship.

- Community banks can still compete effectively with properly differentiated products and talented bankers. With the right mix of vendors and internal employees, community banks are able to price their credit at a premium over national banks. But bankers must abandon the “business as usual” mentality and adopt forward-thinking approaches to banking.

Conclusion

While the pandemic may be coming to an end, the monetary and fiscal policies implemented to fight the pandemic will be with us for some time. Community banks will face some challenges on loan demand and credit spread, requiring innovative thinking and aggressive actions.