5 Actionable Insights From 2Q 2022 Bank Earnings

With 100+ public banks reporting, we have more than a representative sample to see 2Q 2022 bank earnings trends and derive some operational insights on bank performance. We touched on the 33 Items That Stakeholders Want to Know, which highlights some of the industry’s concerns and serves as a good checklist of items to touch on for employee, shareholder, and analyst briefings. In this article, we put some data behind the trends and provide optimal targets to help you run your bank more successfully.

Methodology

We used the S&P Global database, earnings releases, and investor calls to gather the first hundred banks releasing 2Q numbers as of 8/2/2022. This sample skews to larger banks and includes most of the industry by asset size but may not represent banks below $1B in assets.

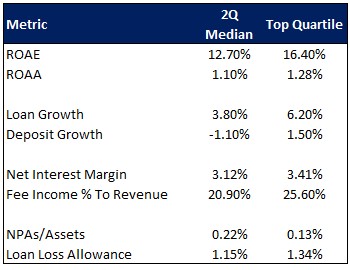

The chart below has the median and the top quartile performance metrics for the second quarter.

The 2Q 2022 Bank Earnings Overview

Since everyone is watching deposits, let’s start there.

As expected, 2Q was the first time we saw net deposit outflows in this cycle as the Fed reduced its balance sheet. Deposits decreased in our sample banks by 1.1%. Most deposits were lost at large banks and trust banks. Banks started to raise deposit rates for the first time in years.

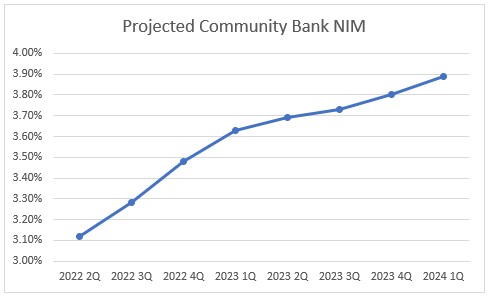

Deposit costs increased six basis points while overall margin went up 25 basis points to 3.12%. As a reminder, the upper bounds of Target Fed Funds started the quarter at 50 basis points and ended at 1.75% (currently at 2.50%).

Fees at banks dropped, primarily driven by mortgage operations, and net interest margin increased by approximately 25 basis points to 3.12%.

Loan growth was up about 4%, driven mainly by C&I at larger banks and CRE at smaller banks.

Credit quality improved as non-performing assets-to-total assets declined a basis point to 0.22%. Allowance for loan and lease losses (ALLL) remained steady at around 1.15%.

Insights Based on 2Q Bank Earnings

Insight #1 – Deposit & Margin Management: Deposit runoff has started and will make it to community banks by October. For 2Q, larger community banks lost about 0.3% of their deposits, and small banks were either flat or continued to gain.

Institutional and corporate money will go to higher returning alternatives such as money market funds. Prime funds are offering a 1.86% rate which will trend up. The general rule of thumb is that these funds will pass on about 70% of a rate increase, so the difference between money fund offerings and bank rates will increase. Come the start of 4Q, banks will be in a growing battle to retain their larger corporate deposits.

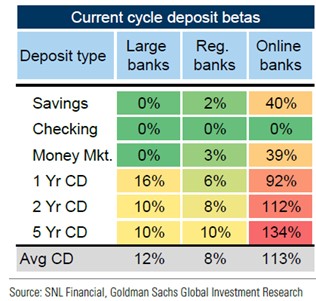

For retail accounts, for the first time since the pre-pandemic era, spending growth has outstripped income growth. This will decrease savings levels and, in turn, retail deposit balances. More to this point, community banks will see increased competition from online-only banks. Last month we saw a skyrocketing of rates by some of the more aggressive banks (like Capital One), and we now see that in their deposit betas (below).

For 2Q, deposit betas were sub-10% for most community banks and around 15% for regional banks. These betas were better than initially forecasted. However, expect sensitivity to increase from here. Deposit betas will increase for most banks to the 40% level by the start of next year and continue to grow. The positive here is that 2Q saw about a 75% loan beta that should increase to the 85% range by 4Q. These trends will further support improving margins.

Banks will also need to contend with deteriorating deposit mix changes. Banks experienced this trend at the end of 2Q, but it will be more evident in the third and fourth quarters of this year. Retail accounts will take balances from checking and redirect them into interest-bearing deposit accounts.

While banks are almost out of time, now is the last chance to increase service branding, eliminate your short (less than a year) certificate of deposit offerings, and create new payment/deposit products that support deposit duration.

Insight #2 – Liquidity Management: The chess pieces are now set up so that banks can recognize performance based on their liquidity management. The trick will be to tighten loan pricing to grab higher-quality credit borrowers and maintain positive loan growth while ensuring deposit runoff and costs are maintained.

This is to say that liquidity management will drive alpha or outperformance. For 2Q, banks are in the 65% to 70% range. The goal is to attempt to manage to the 85% target mark for optimal performance.

Insight #3 – Credit Quality: Credit quality has been better than expected this cycle. Most banks have seen no movement or reductions in credit risk. This, however, will not last. Given our current models, banks are safe through the end of this year. Then, banks will start to see some cracks.

Higher interest rates will result in smaller debt service coverage ratios, which means higher default probabilities. Higher cap rates mean higher loss given defaults. The net impact is a reversion to the mean for credit losses over time. In 2Q, those banks that increased their reserves did so driven by loan growth and not a change in credit outlook. By 1Q, this will start to change.

The two areas of commercial real estate credit that are most at risk are new, 2021, and 2022 properties where rent/lease levels cannot be sustained going forward, and older, pre-2015 properties that have not had recent renovations. This will be particularly true for the office and retail sectors.

Insight #4 – Prospective Underwriting Standards: Knowing the above, many banks said or implied that they look to tighten credit standards and control growth. Look for this trend to increase. Look for tightening to occur in land development loans, new construction, commercial & industrial (C&I), and commercial real estate (CRE), in that order. Few banks made comments in their releases around the consumer sector, with some doing the opposite, talking about the low level of housing vacancies and the strength of the consumer.

Insight #5 – Reinvestment and Efficiency: Operating efficiency remained about flat in 2Q. One issue has been that gains in net interest margins were offset by a drop in fees at many banks. However, in 4Q and for 2023, banks should see net gains and improved profitability. This will help lower the efficiency ratio for high-performing banks to the low 60%s. Proactive banks will take part in these gains and reinvest for the long-term, taking care of projects that reduce processing costs and improve the total experience.