Bank Multiple Improvement: 33 Items Stakeholders Want to Know Now

Over the past several years, bank investors have been hungry to hear about growth and expansion. Revenue and growth have fueled bank multiples. Now, the tone is markedly different. We have poured through the recent 2Q earnings releases, spoken with a rash of institutional bank investors, traded thoughts with analysts, and compiled the following list of concerns that bank stakeholders (employees, shareholders, vendors, and regulators) now have. Whether it is an earnings call, quarterly shareholder letter, or employee update, these are concerns the market has, and as a bank leader, you should be prepared.

The Single Change in Messaging To Improve Your Bank Multiple

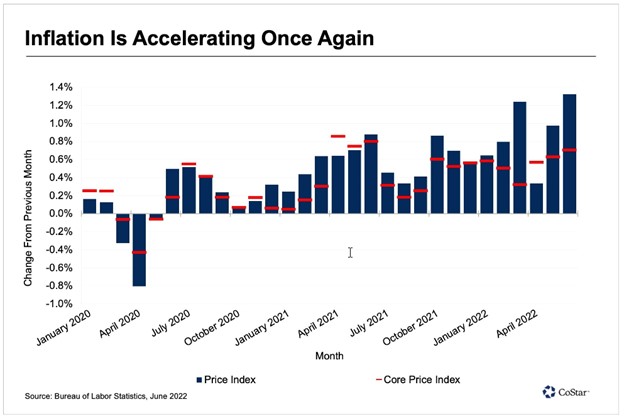

The end of July and August is a check-in for stakeholders to hear about the year’s first half and to get updated forecasts for the second half. The first half saw near-record volatility and a confluence of events that have never occurred before in the history of the world – a strong economy, rising rates, record inflation, and a reduction of liquidity. Stakeholders, understandably, now want to gain some insight.

In addition to being prepared for questions, staying “on message” will help drive investor confidence. Instead of the theme of growth, the new theme that investors are looking for is “conservatism.” It is time to play a little defense.

Uncertainty over higher rates, greater market volatility, and the threat of a looming recession, investors now suspect of growth. You talk about a growth story, and they hear “future credit losses. In the last two months, the messaging points for banks have shifted from one of prosperity to one of cautious growth and optimism layered with some contingency planning.

Providing a narrative around your “fortress balance sheet,” ever-more-efficient operations, and defensive vision is now critical.

General Performance

- Rate Hikes: Overall, most banks underestimated the number of rate hikes and the rate of net interest margin expansion in 2022. Most banks included 75bps in rate hikes. We have had 150bps in hikes already and have another 100bp, or more, to go. Now, stakeholders want to know what the bank has budgeted for the rest of the year?

- 2023 View: One extensive conversation that is taking place around bank performance is the fact that the Fed might be done with its rate hiking cycle earlier than planned, and the bulk of margin benefit would have accrued in 2022. While this faster hiking has been good for bank earnings this year, questions are starting to arise about the bank’s forecast and strategy for 2023? Be prepared for the question of if you believe earnings will be lower in 2023.

- The Customer Experience: A declining equity market, problems in crypto, decreasing real estate values, and higher rates have now made both consumers and businesses care more about banking and their financial future. When rates were at zero, and disposable income was growing, few cared about their bank. Now, more households and businesses are thinking about switching banks, and the customer experience is king. Stakeholders want to know how are you making life better for your customers?

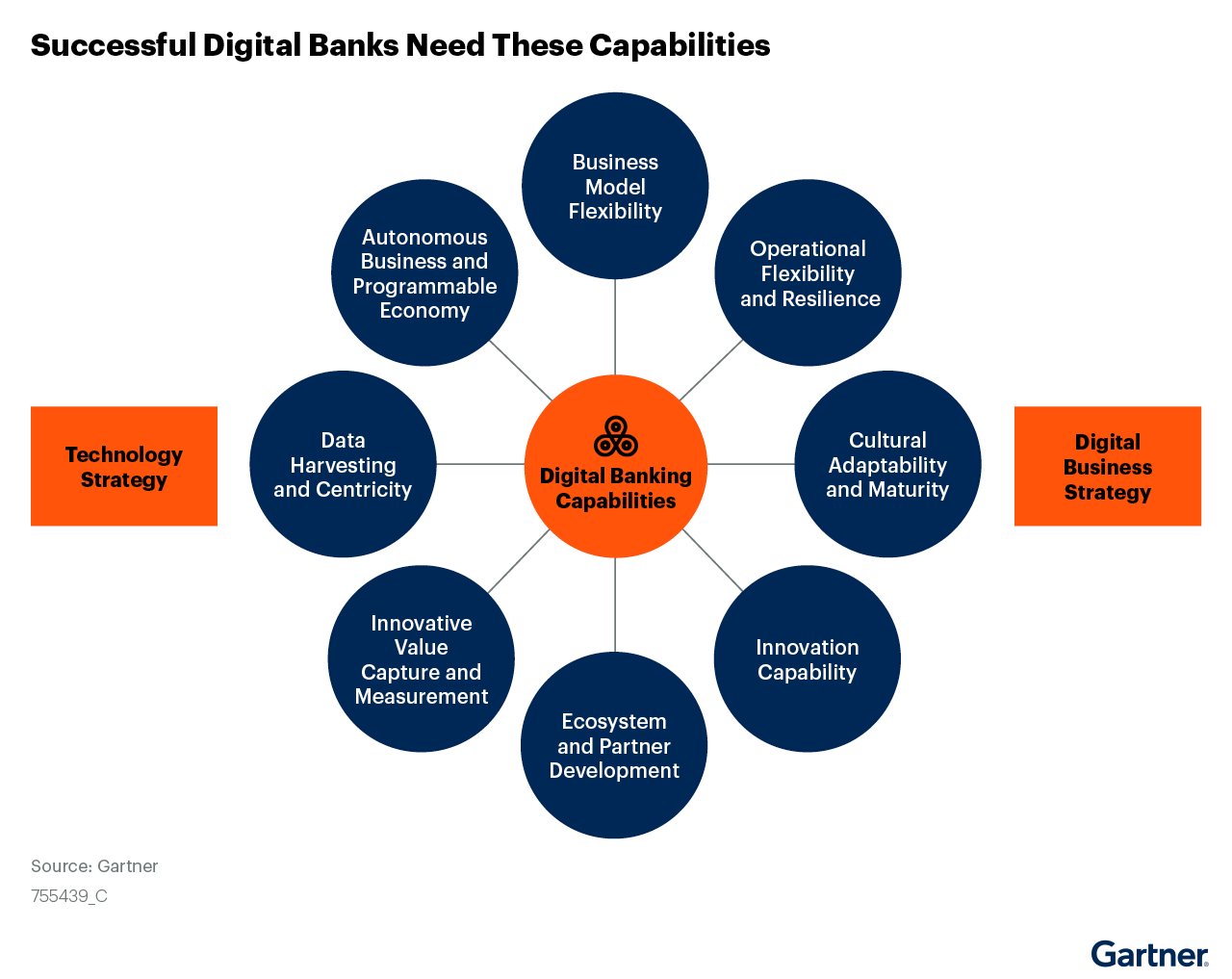

- Technology: Stakeholders are primed to hear a technology narrative. Articulate what major innovative initiatives (deposit opening, payments, and loan processing remain the big main projects) the bank is working on and how it will impact cost, the ability to scale, customer experience, or the employee experience. Questions about how much you spend on technology relative to your total budget and historical trend remain common.

- How are you handling partnerships, and are you part of any fintech consortiums to assist are now common questions.

- How are you doing on the common digital transformational initiatives listed below?

Top Line Revenue & Lending

- Quality Growth: Banks should start to emphasize core quality growth over absolute growth. Be prepared to dial back growth estimates for the year’s second half.

- If growth is predicted to be relatively strong for the rest of the year, stakeholders want to hear how the bank is “buying” that growth other than expanding credit. New programs like ARC, more hires, market expansion, more marketing, or something similar are all acceptable ways to talk about expansion through the lens of conservatism.

- Be prepared to discuss how your pipeline looks for the second half of the year. Most pipelines are thinning out, so be ready to discuss.

- Be prepared to discuss commercial and industrial (C&I) loan trends and C&I utilization trends.

- Loan Pricing: Loan pricing has increased in the capital markets, yet bank loan pricing has continued to compress. Stakeholders are interested in hearing about your trends, how you plan to compete in the face of potentially higher credit risk, and your targets.

- Fee Income: Many banks are keeping more loans on balance sheet, which can hurt fee income. Some banks have fee income lines of business (i.e., mortgage) that are rate sensitive. Still, others are making changes in programs like NSF and overdraft fees. As fee income becomes more important as credit risk rises, stakeholders will be asking the tough questions about what your bank is doing to maintain fee income growth or how it will preserve the current level of fees in the future.

Interest Rate Sensitivity

- ALM Prediction Accuracy: Has your balance sheet been acting as predicted? How asset sensitive are you? Stakeholders want to know that you understand how the rise in rates and the shape of the yield curve impact earnings and your asset-liability management (ALM). Are you more sensitive to the short, or long-end? What curve twists are baked into your earnings projections? Are you thinking of a steeper, flatter, or inverted curve?

- Loan Rate Mix: How are you managing interest rate risk? Are you booking fewer fixed-rate loans? How many loans are on floors? Do you have any caps in play that will hurt earnings as rates go up? Stakeholders want to hear that you are well positioned for more Fed rate hikes and more inflation.

- AOCI: Be prepared to discuss the impact of higher rates on your investment portfolio and the impact on accumulated other comprehensive income (AOCI). The sentiment is that banks have too much interest rate risk in their investment portfolios, taking away flexibility on the lending side.

- What are your bank’s moves around moving items into the available for sale (AFS) portfolio to give you more flexibility or to the held to maturity (HTM) to limit the impact of a negative mark-to-market?

- Linear Impact: The market assumes your bank will continue with the same linear interest rate sensitivity for each rate hike. For many banks, this isn’t exactly true, and they will become much more interest rate sensitive in the future because of the structure of their balance sheet. Be able to explain how future rate hikes will compare to past rate hikes in terms of balance sheet impact.

- Prepayments: The rapid rise in rates, combined with volatility and an inverted yield curve, has caused many banks to undergo unanticipated convexity and duration changes in their balance sheet. As rates rise, many banks have seen an increase in prepayments as borrowers liquidate their property and get out of the market or take longer-term fixed-rate loans to protect them against rising rates. Stakeholders will want to know what is happening with your loan prepayment speeds and what is predicted for the future.

Asset Quality

- Capital Allocation: Stakeholders would like to hear that you are tightening credit standards and cutting back on certain sectors such as loan purchases and construction. There is also a general concern that pricing is too tight in some sectors, such as multifamily and industrial. Stakeholders will want to understand if this is the case for the markets you face. One key set of questions will be about your commercial real estate concentrations and what you are doing to diversify. Chances are you will get more questions about riskier lines of business such as development loans, consumer credit, warehouse lines, and specialty lines of business that are susceptible to a downturn.

- Credit & Reserves: The days of releasing reserves are over. While the probability of default has continued to decrease for most lending areas, loss given defaults have risen almost across the board. Higher rates mean lower valuations and greater expected losses. Stakeholders want to hear that you are safeguarding the balance sheet for the future. Explain why you are conservative with your allowance for loan and lease loss allocations (ALLL), credit box, delinquency projections, charge-off estimates, and general credit view. Are you making any changes to your loan-to-value targets, or do you have enough of a buffer already? Be prepared to talk in-depth about credit trends in your footprint. Stakeholders know that it is the lending in the last two years before a recession that terminates banks. Is your bank prepared for the contingency of a widespread economic downturn in 2023?

- Construction: Given inflation and supply chain issues, many projects are over budget and require more equity. Has the bank seen issues with borrowers slow to inject more equity, or does the bank have more loan-to-cost exceptions? In the face of a recession, construction is your riskiest sector. Show stakeholders that you are on top of this risk.

- CECL Banks: If you follow the Current Expected Credit Loss (CECL) methodology, what changes are you making in your model? Are you placing a higher probability on a bear case scenario? Are you using more “Q” or qualitative factors in your modeling?

Deposits

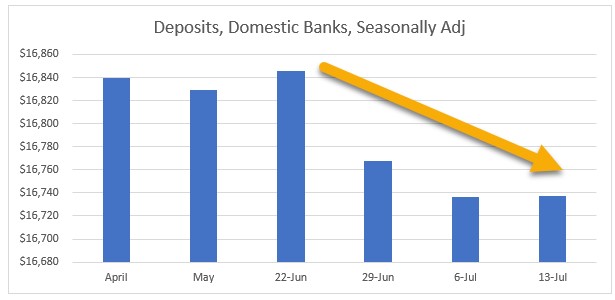

- Deposit Volumes, Mix & The Impact of the Fed’s Balance Sheet Reduction: The Fed started “Quantitative Tightening” in June and has decreased the Nation’s balance sheet by $735B. The Fed plans to keep reducing its securities holdings by $47.5B next month and then go to $95B per month for Sept. and beyond. Has the bank felt any runoff in deposits after adjusting for tax payments? Is money migrating to certificates of deposits (2.50% APY for 18 months at Capital One), to money market mutual fund accounts (1.25%+), other banks (that are paying 1.20%+), or somewhere else?

- Are any new deposit lines of business or niche markets being targeted to help build inexpensive balances?

- Do you foresee tapping wholesale funding options this year?

- Deposit Rates: What are you doing with rates? When do you think you will raise them again, and what is happening with flows? Stakeholders want to hear a general plan on how you are going to limit the expected rise in deposit cost.

- What proportion of deposits are “surge deposits” and expected to run off as the Fed reduces the size of its balance sheet?

- What are you doing to manage deposit interest rate risk? Are you taking Federal Home Loan Bank (FHLB) advances or locking in more CDs?

- What is your deposit pricing positioning going forward? What are you seeing from your competition?

- What are you doing with your branches to keep deposit rate sensitivity down?

- Betas: What are your updated deposit betas, and how will they change with each rate hike?

Expenses

- Expense Control: How are higher inflation and the cost of inputs impacting operating income?

- Is labor cost manageable?

- Branch Network & Office Space: What are you doing with the bottom 20% of your branches (based on performance)?

- What is your updated plan for office space, back to work/work from home, and real estate in terms of space and cost? How has your back-to-the-office strategy been working, given the challenges in hiring?

- Efficiency: What is your update on the efficiency ratio by year-end?

Real Estate Lending

- Real Estate Loan Growth: Originally (4Q of 2021), commercial real estate new projects were expected to grow 12% for 2022. Now, with higher-than-expected rates, the market is expected to come down by 18% to about $733B. How is the bank adjusting its volume targets for the year?

- Focus on the Real Estate Portfolio: The increase and consistency of inflation have resulted in lower real estate valuations and reduced net operating income for many properties. Others like hospitality, multifamily, gas stations/c-stores, and e-commerce it has helped. How has the bank’s portfolio been faring? Did the bank insist on longer leases, so properties are not able to adjust rents fast enough?

- Recourse: Banks are playing this both ways, and your organization should be clear. Some stakeholders are asking about recourse trends as a means of seeing if your bank is loosening credit standards in cases where you are accepting more non-recourse deals. Other banks frame accepting more non-recourse deals because they are trying to show moving up in credit quality and would rather have more substantial sponsors and better cash flow than recourse. Make sure your bank has its message and supporting evidence straight.

Other Items To Help Bank Multiples

Of course, there is a myriad of other secondary issues of interest that you should be prepared for and provide updates on. While not as weighty as credit and deposits, the below concerns are still significant.

26. Talent Retention and Recruiting: The largest challenge for banks is finding and retaining quality talent. What is your banking doing here, and how has it improved in 2022? Is it slowing hiring because of higher wage costs or speeding it up to have the talent to get gains in other areas?

27. SOFR: How are you doing with the LIBOR to SOFR transition? Is it ready to have LIBOR end of all existing loans mid-next year?

28. Regulation: What are your regulators concerned about? Are the rising concerns with BSA/AML, fraud, late fees from the Consumer Financial Protection Bureau (CFPB), or Executive Order on Merger Review impacting your operations at all?

29. Capital: What are your plans for a capital raise or restructuring? Are you buying back equity?

30. Fraud & Cyber: P2P fraud, account takeover, and synthetic IDs have hurt banks in 2Q. How has your bank been affected, and what are you doing about it? Remote worker cyber risk, mobile banking malware and attacks, cloud service security threats, ransomware, and data security remain top of mind since these occurrences at banks have continued to increase over the past year. What is your investment in cyber, and what projects do you have underway?

31. Crypto: With the fall of cryptocurrency and digital asset values, if your bank is evolved or has stated that it wants to get involved, what is the latest update?

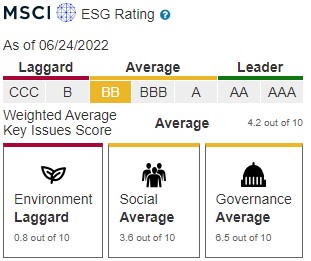

32. ESG: What is the bank doing to improve its support around environmental, social, and governance? The average community bank has a rating at the bottom end of the average (below). What is it doing to improve in the future?

33. M&A: Has the environment and lower bank multiples made you change your M&A tactics at all? Are you looking at smaller deals, rural deals, non-bank deals, or mergers of equals?

Putting This into Action

As we have said in the past, the last five years have been great for bad banks and bad for great banks. If you are a great bank, it has been hard to stand out relative to your peers. This is all about to change.

These 33 items should help you prepare internal and external presentations and be better informed to answer stakeholder questions. These items can also serve as a springboard into a robust internal discussion about planning for the next year that should surely help you improve performance and create franchise value that will be valued at a greater multiple.