6 Reasons You Should Drop Deposit Rates Now Before the Fed

It is a long held notion in banking that you only move deposit rates when the Federal Reserve moves rates. However, if you think about this practice, it doesn’t make much sense in terms of a bank’s profitability. Markets are dynamic. Interest rates, and funding costs, move independently from the Fed. In this article, we explore why now might be the right time to reduce rates before the next Fed meeting.

Reason One: Rates Are Down

Most banks moved rates last when the Fed dropped rates back in mid-December of 2024. Since that time, Treasury and swap rates have fallen approximately ten basis points (bps) and have stayed down consistently throughout 2025. As such, moving rates down ten basis points since the last time you moved rates allows your bank to maintain the relative level of deposit rates as you intended since the last Fed meeting.

Your bank funds itself off market rates so waiting for scheduled Fed meetings to move deposit rates places an artificial constraint on profitability. Conversely, being more responsive to downward rate movement, improves the profitability of the bank.

Reason Two: More Rate Cuts Are Coming

We don’t know this for sure, but the slowing economy has moved the market to price in six rate cuts and political pressure is such that it appears to be heading in that direction. If the market is correct and we get the next rate cut in June, there is nothing wrong for a bank to foreshadow this next move. As the market becomes convinced that the Fed will make this move, short-term rates will further drop.

Of course, if inflation continues to increase, the next move may be higher. If true, then a bank can easily increase deposit rates to accommodate market changes.

Reason Three: Negative Sentiment Is Growing Reducing Interest Rate Sensitivity

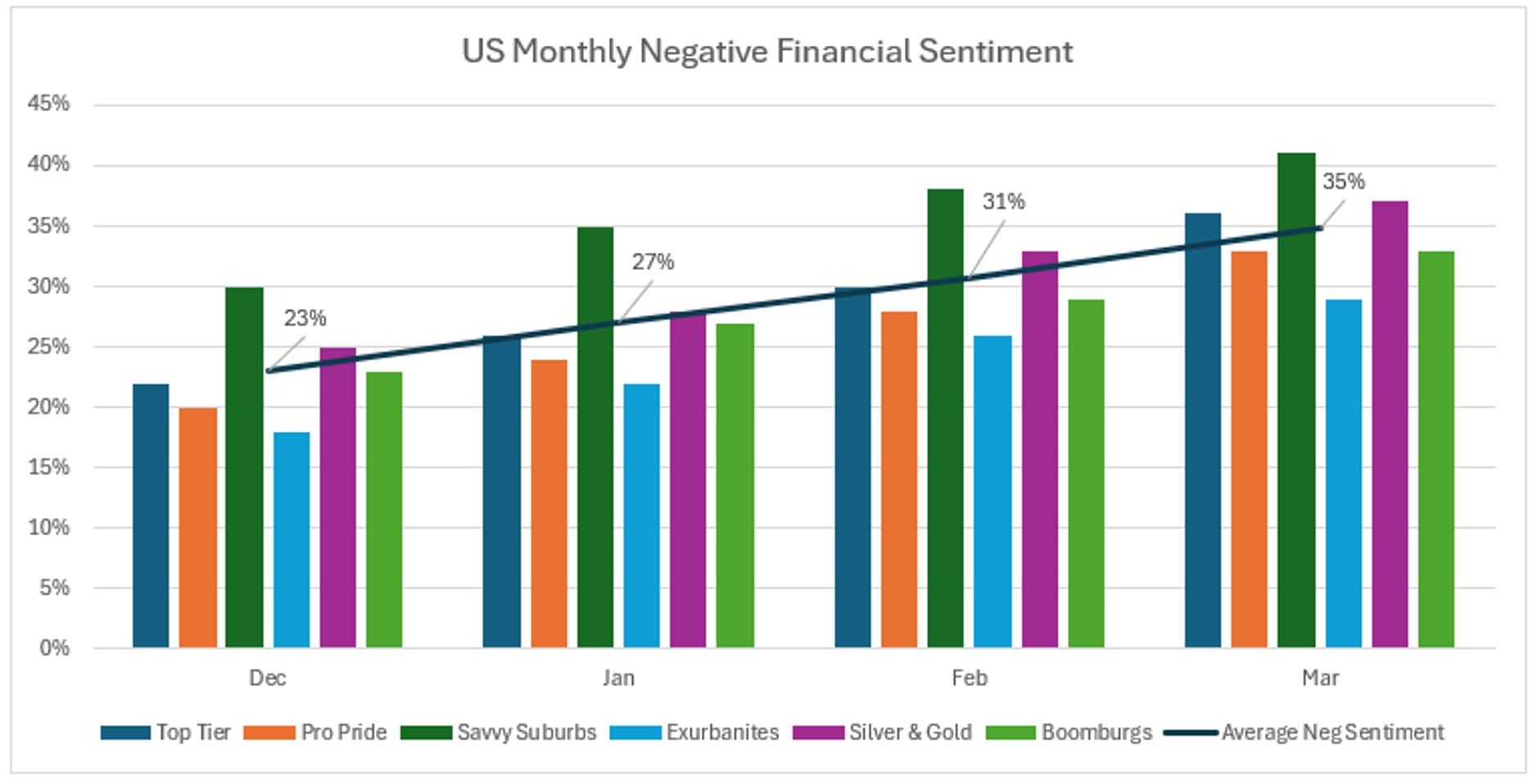

Through the help of Amberoon, a banking technology company, we track negative sentiment on news headlines and social media for key psychographic customer segments (below). We map the bulk of these segments to the ESRI Tapestry framework, in order to allow us to compare customer segmentation performance with other banks.

It is no surprise that negative segment has continued to increase since December of last year and April is likely to be another increase as well. As fear increases, deposit rate sensitivity dampens. Retail and commercial customers are less likely to switch banks and move their money if they know that their new bank will likely reduce rates in the future, and they seek the safety and security of their current bank.

While rate sensitivity varies by bank depending on its location (we have this analysis for any geographic location), in general, the higher the negative sentiment the less runoff a bank will see when it lowers rates.

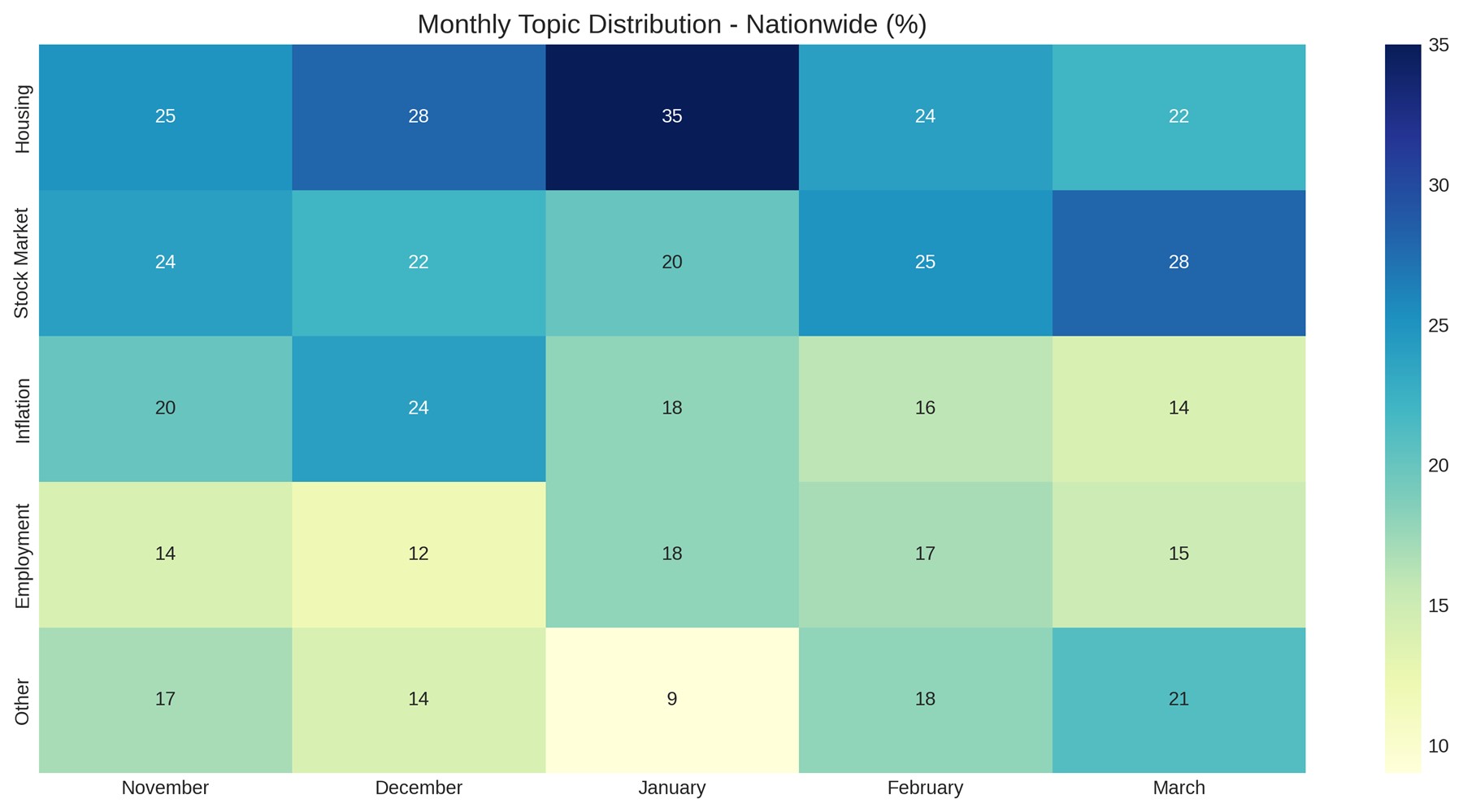

We can get more granular and see the main drivers of this lower deposit sensitivity are largely influenced by negative sentiment around housing affordability (35% of posts in January), and stock market concerns (currently the largest driver of negative sentiment with 28% of posts). One of the largest drivers of lower deposit sensitivity is negative sentiment around employment which we project will increase in April and continue to increase as the economy slows and DOGE cuts have an increasing impact.

Reason Four: Reduced Off Cycle Sensitivity

When the Fed makes a rate move, it is amplified in the press and more customers talk about interest rates and what their banks are doing. The increased media attention and subsequent discussions around interest and deposit rates tends to increase customer deposit rate sensitivity. Discussion around rates peaks during Fed meetings.

As such, when banks move rates off Fed cycle, customers often exhibit less rate sensitivity resulting in less deposit run off should a bank lower its rates.

Reason Five: You Are Behind Budget

It is likely your bank budgeted three rate cuts for 2025 with the first occurring in March. This was the predominate thinking back in the late fourth quarter of 2024 when budgets were finalized. Since you have not experienced the cost of funds relief that your bank expected, moving rates now would help get your bank on track. The longer a bank waits to make a move, the harder it will be to make up the lost margin.

Reason Six: You Need To Improve Your Beta

If you are a publicly traded bank, your value is, in part, determined by your deposit beta. The lower your beta, or sensitivity to rates, the more franchise value your bank is likely to have. Since Fed rate movement tends to have an outsized influence on short-term rates, when you move deposit rates in conjunction with when the Fed moves its target rates, your beta tends to increase. Moving deposit rates before the Fed, lowers your beta thereby having a positive influence on public value.

How to Move Rates – Sample Testing

Admittedly, every bank’s customer base is different, so each bank needs to understand its customer’s deposit rate sensitivity. We advocate that every bank should have a test market that is representative of their customer base so that they can test new products and new pricing. Lowering rates in a test market allows the bank to gather more data around the rate sensitivity of its customers.

Moving rates and then charting balance movements for each customer segment will provide the data a bank needs to have confidence to move rates systemwide.

One thing to test is how rate changes impact your exception pricing. It is highly likely that your bank has a subset of customers with deposit rates over four percent. These customers tend to be your most rate sensitive, so care is urged here. However, with negative sentiment up, now is the time to reanalyze and retest in order to see if they complain or see if they start to move balances.

For many of these high-cost customers, a bank may want to move rates more than ten basis points in order to bring them back down to manageable levels. Given the high degree of negative sentiment, banks may be able to move rates lower between 10bps and 35 bps without negatively impacting deposit value.

Putting This Into Action

Being constrained to moving rates only when the Federal Reserve moves rates robs a bank of its agency and deposit strategy. Gaining more flexibility and responsiveness to market movement can improve a bank’s performance and enhance its franchise value. Not only does every basis point count to help profitability but time is an enemy. Moving rates sooner rather than later will improve performance as well as provide your bank data that can open up a whole new framework in your deposit strategy.