How Safe Are You? 5 Lessons from The Safest Banks

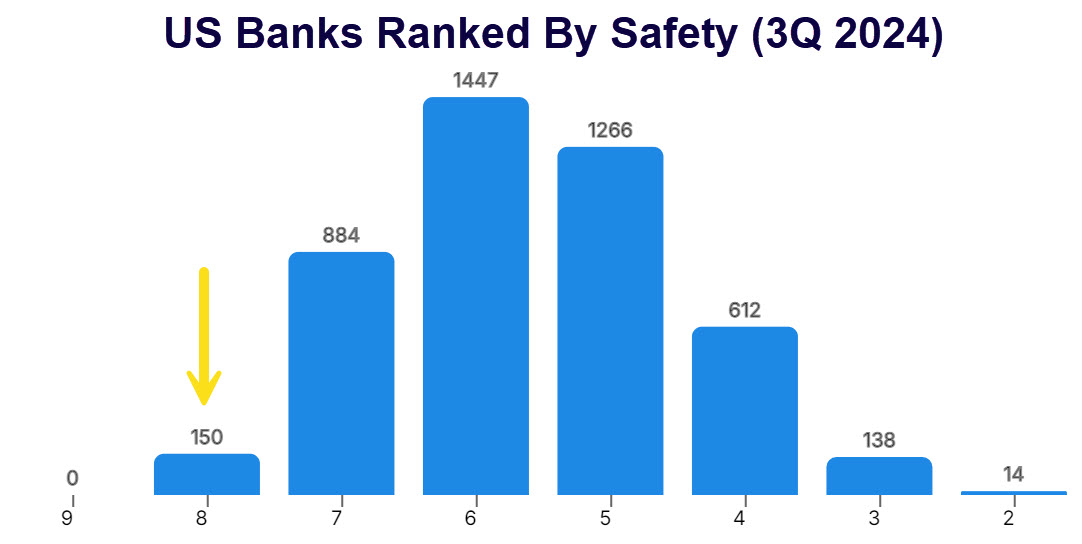

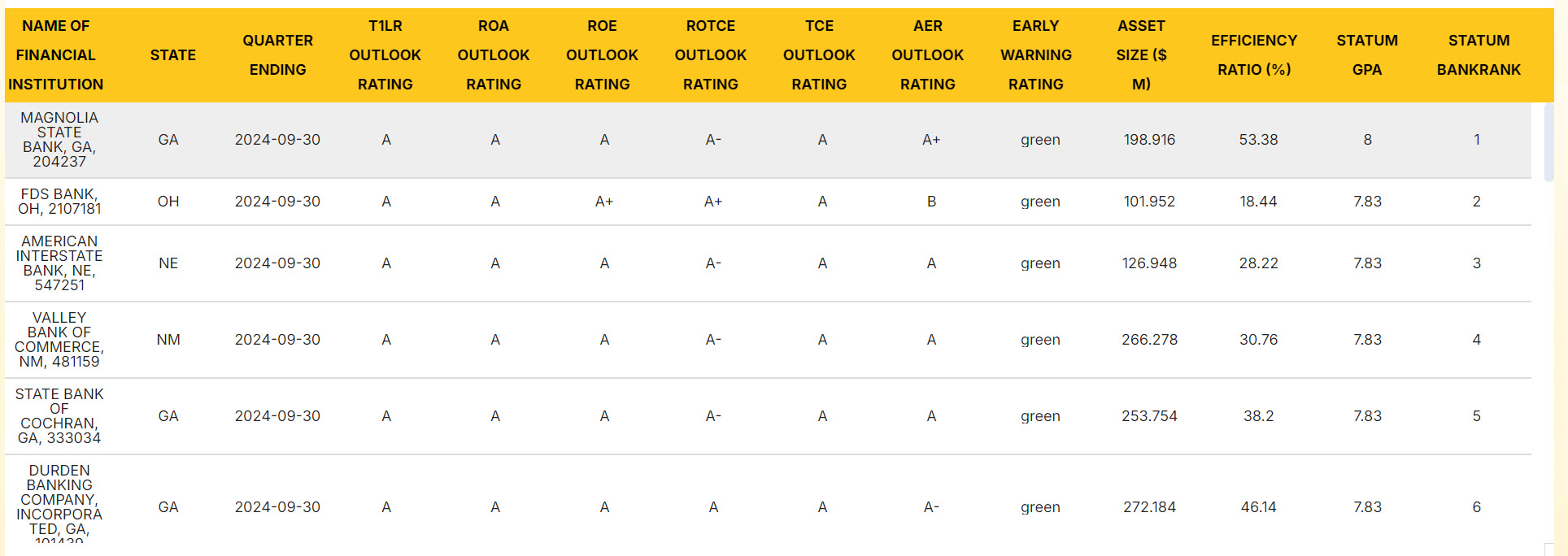

Based on the 2007 to 2010 bank failure experience, we modeled the financial health of every bank using the last 16 quarters of historical performance. We have also created projections for the next 18 months. There are 150 banks that currently have a Grade of “8” out of 10, with 10 being the safest. In this article, we look at those 150 safest banks to learn five connected lessons on how to create a bank that can withstand the next great economic downturn.

Lesson 1: Generate Operating Leverage to Produce Capital

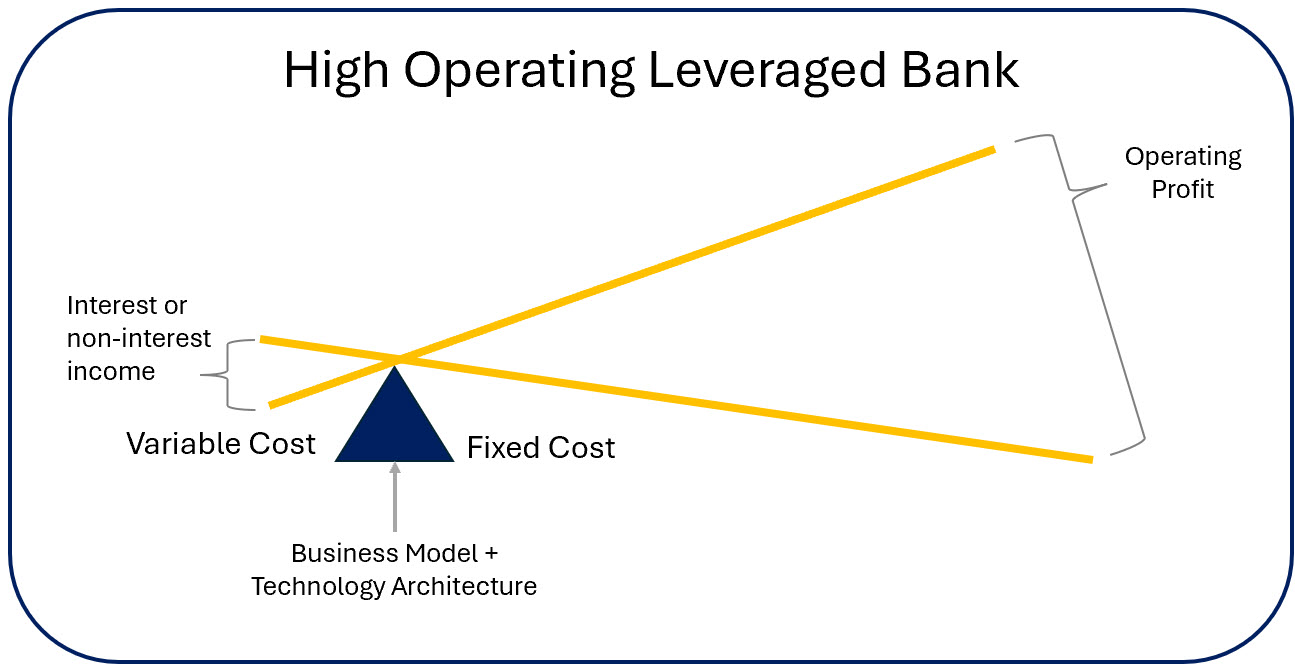

If there is a single lesson in banking that decides success in all areas of performance, it is this – sell more profitable products to more profitable customers to the point where your bank generates a consistent risk-adjusted return above its cost of capital. This should be every board and bank CEO’s main job. Do this, and everything else in banking falls into place.

Every bank in our 150 safest bank list is a capital generating machine because of earnings. These banks generate enough earnings, in a variety of markets, to not only provide an attractive return to their shareholders but create enough capital in which to fund PROFITABLE growth. The important takeaway here is that not all growth is profitable, and some growth is destructive. Managing quality growth usually starts with making sure the bank is employing strong, but safe, operating leverage.

Lesson 2: Be Efficient

To support Lesson 1, most of these banks that produce above their cost of capital do so because of efficiency. One of the best ways to control your destiny is have a consistent efficiency ratio below 40% while producing growth above GDP. Developing a new product, going into a new market, acquiring a new bank and any other strategic endeavor may or may not work. However, cutting the right costs to make your bank more efficient while still be able to grow your bank at the rate of GDP growth, almost always results in greater earnings. Those top 150 banks have an average efficiency ratio of 48%.

Lesson 3: Pair Talent with A Business Model

In terms of lowering an efficiency ratio, for most of these 150 banks, it is hardly ever about cutting staff or compensation. In fact, it is usually the opposite. A hallmark of a top performing, and safe, bank usually means the CEO has created an organization that gets the most out of its talent which allows them to both pay up to acquire the best talent and pay above market to retain that talent.

To gain efficiency, many of the banks on this list have a specialty and are able to segment their customer base. Many of these banks are trust banks that are able to generate a high amount of non-interest income through fees through any market. Other banks on the list, are captive finance or monoline banks that specialize in a particular type of credit such as financing John Deere equipment or providing credit cards.

While you do not have to be a specialty bank, having more specialties in profitable products and profitable customer segments usually results in greater operating leverage and efficiencies.

Lesson 4: Pair Talent with Technology

Of course, not all banks on our safest banks list are specialty banks, many achieve their safety through outstanding management. They manage business lines and credit exceedingly well often with leveraging technology to help reduce costs. Digital loan origination, account opening, a modern core system, data analytics (to include a CRM system) and automated back-office services are the most common modern platforms that can be found at each of these banks.

Lesson 5: Price and Manage Credit Correctly

Counterintuitively, it is not about having the lowest credit risk in constructing a safe bank. Many of the banks on the list have higher credit risk than the average bank. However, what it is about is pricing the credit risk accurately for an above average return, managing that credit risk well if there is a problem and then developing a profitable relationship with that customer. To pull this off, these banks either know their niche exceedingly well and/or utilize a model that allows them to apply risk-adjusted pricing accurately. Each of these banks also show excellent credit discipline dealing with their problems quickly and efficiently while also staying focused on their primary credit objectives.

Putting These Lessons From The Safest Banks into Action

When it comes to creating a safe and secure bank, there are many ways to do it. The above five lessons should serve as every bank’s NorthStar as the lessons are timeless principles that can serve every bank well no matter its size, experience or business model.

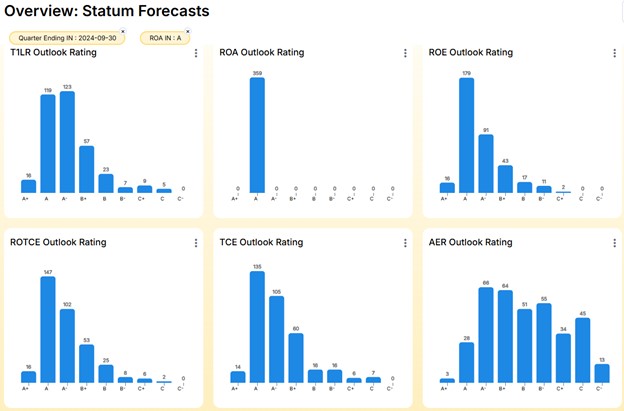

If you are interested to see where your bank ranks, would like to inspect our peer group of the top 150 banks, or would like to create a peer group of your own to see how you compare, you can access the “Health Prediction” HERE on our Correspondent Bank Resource page. If you do not already have a log in, you can register at the bottom of the page to gain free access.

When you log in, each bank has an overall letter grade, plus a grade for the individual categories of capital formation/stability, efficiency and profitability.

You can search your bank or create any peer group you want based on asset size or performance. You can also click into any category and see the composition (above). For example, if you want to see the types of banks that make up the ‘A” category for return on assets (ROA), you can click and see the distribution and details for each bank in the category.