Deposit Marketing In the Age of Machine Learning

In the olden days, if you wanted to market deposits, the head of Retail would come to Marketing and say something like – “We need to raise deposits.” Marketing would then put together some ideas for a print or digital campaign; Retail would sign off on it, and then they would roll it out. Maybe it worked, perhaps it didn’t, but the reality is it likely was successful at some level, and everyone was happy. Unfortunately, this approach is quickly fading and is highly inefficient. This article gives a live example and playbook of what is fast becoming the standard process in modern bank deposit marketing.

The Wrong Way to Handle Deposit Marketing

These days, banks have a data analytics person in marketing that does nothing but look at the data and develop ideas. Let’s say this person is curious about creating the most effective campaign to raise longer-term CDs since the asset-liability committee believes rates will continue to increase, and they want to add contractual duration.

In the days of yore, marketing would put together a cute ad; maybe it would have a puppy in it (as puppies always score well with capturing attention), or perhaps the ad would have a cute play on words like below.

Ironically, the main metric for success would be the dollars of deposits that were raised. This tactic is unfortunate, as the reality is that every dollar raised would likely hurt the bank. This bank, which prides itself on relationships, would be attracting rate-sensitive customers and would be destroying franchise value in the process. The bank would be gathering customers that it likely would not hold for the long-term, would cost the bank money, and would end up training both its customer base and employees that it is OK to market on rate. It would be doing all this while increasing its cost of funds AND shortening the duration of its liabilities. This is suboptimal deposit marketing.

Despite what this bank thinks, the result would be a disaster.

A Better Way To Handle Deposit Marketing In This Age of Data

These days, it takes some basic data, a couple of analytical tools, and some entry-level analytical knowledge to produce a highly effective deposit marketing campaign to add customers that want a relationship, not rate.

This starts with gathering data on your customers, keeping the data “clean,” and storing it in a single spot, such as a CRM system.

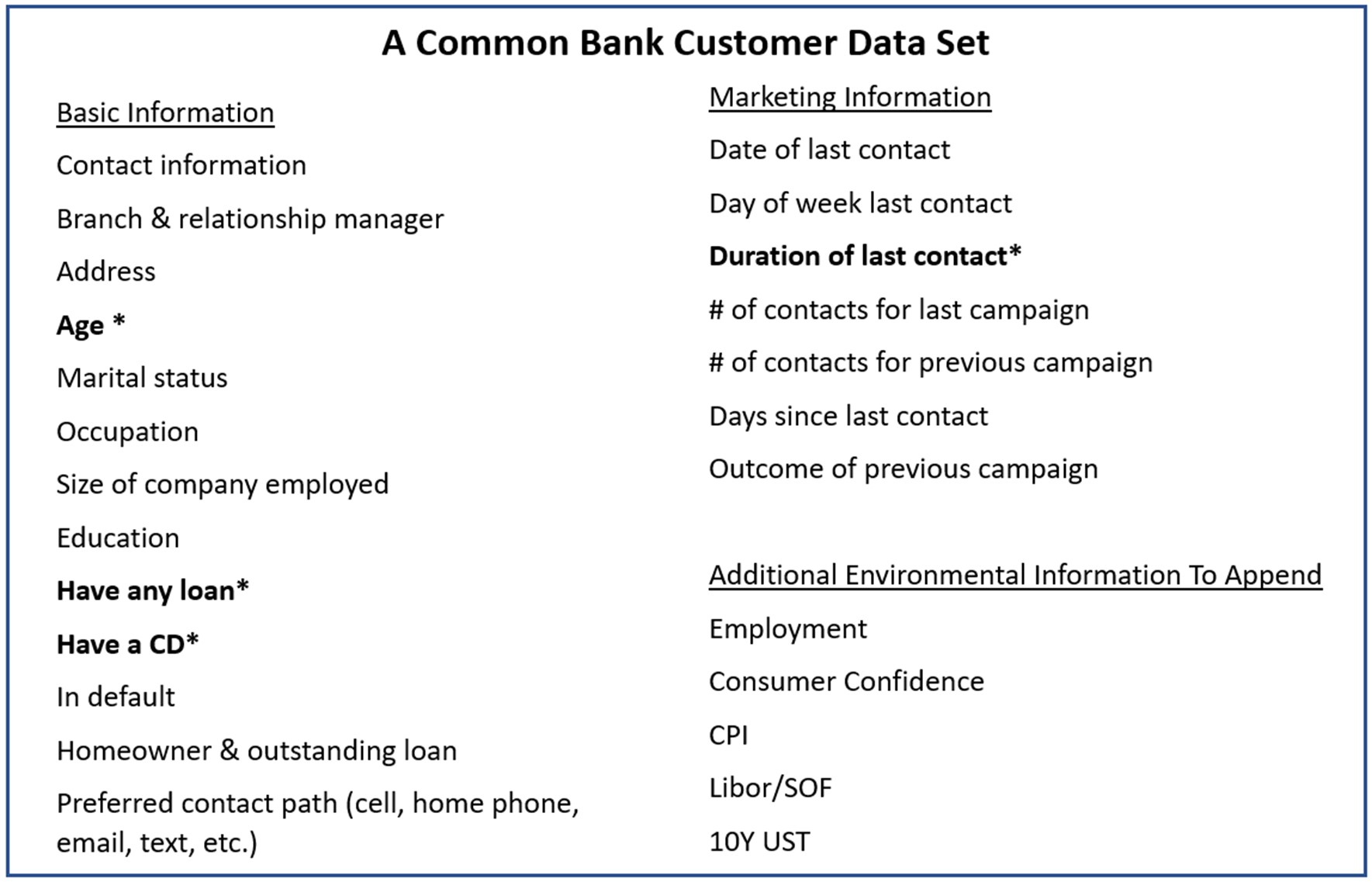

For the sake of this analysis, we will look at the below basic data set that most banks with a CRM system have. Bank marketers can use Excel (used in the example below) or go to a coder (either in-house or on contract) that knows R, Python, Tensorflow, or a similar language/platform to handle this analysis.

Alternatively, bank marketers can also go the easier route and use an off-the-shelf machine learning application. This approach is the more common route as little advanced machine learning knowledge is necessary, and the business line can often handle this analysis. Many banks use applications from IBM, Google, KNIME, Rapid Miner, or about five dozen others that are relatively inexpensive (Free to $400k with an average of around $10k per year). As we will show you today, these platforms will likely pay for themselves with the first usage.

All the above data is turned into numerical data (for example, the branch is represented by a branch number), and then a “q-value” test is done to determine the odds of a result occurring (such as purchasing a certificate of deposit (CD)) net of this result happening by chance and adjusted for a relatively small sample size. The higher the q-value, the more significantly important the attribute is, and the more bank marketers should take the attribute into account when planning a campaign.

Interestingly, the items in bold and asterisks above were the most statistically significant.

Using Statistically Significant Data in Deposit Marketing

Next, we divide all of our customer data and use two-thirds to develop a solution and a third to use as an “out of sample” test. In other words, the 2/3rds of the data should predict the other third of the data correctly.

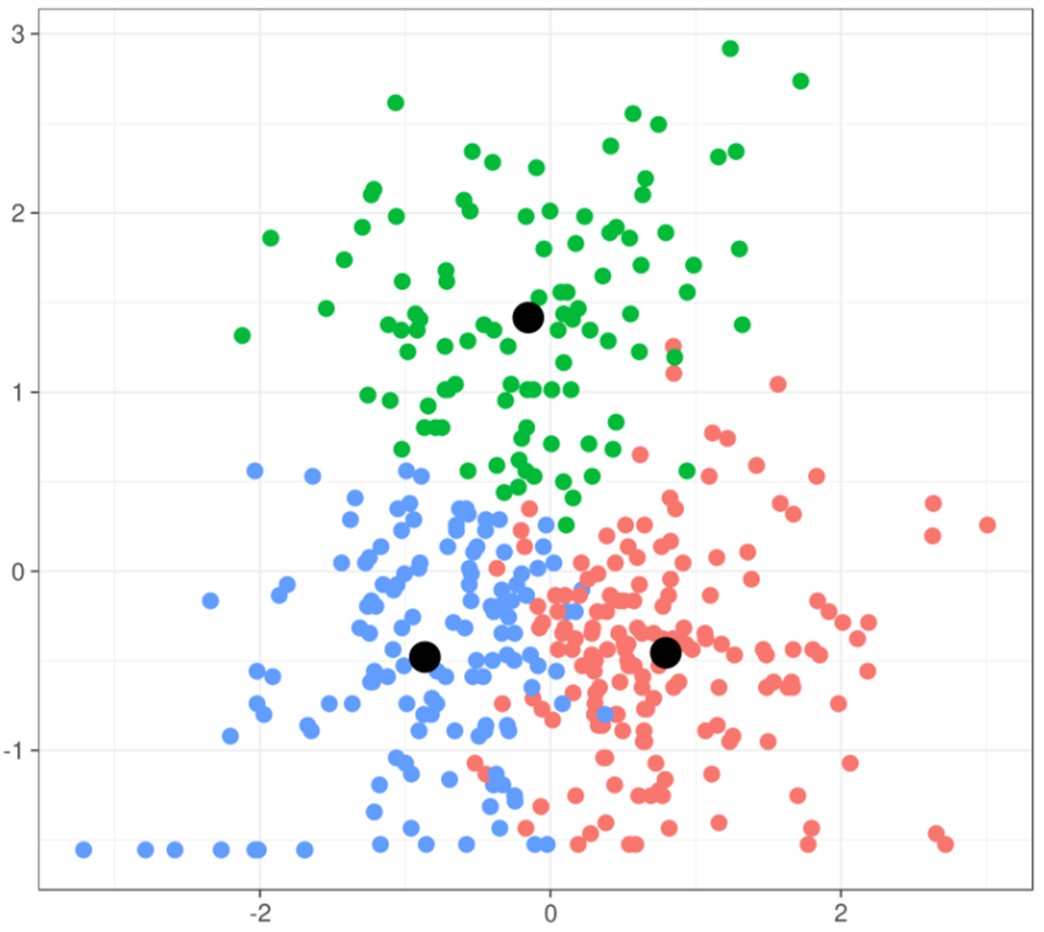

Using a machine learning technique called “k-mean clustering,” we let the machine learning application (Excel, IBM Watson, etc.) find the data’s best grouping. Here, the algorithm groups collections of customers together that have a certain set of similarities. Part of the beauty here is that this is an “unsupervised” algorithm, which means the computation can pull all it needs to know from the data. The bank marketer needs no prior knowledge of the data or the relationship of the data to one another.

The k-mean clustering algorithm can come up with 50 groups or just two groups, depending on the data. In this case, the data best fit together in three distinct groups. By using this approach, we can identify the probability of a customer, as a group, converting to a certificate of deposit.

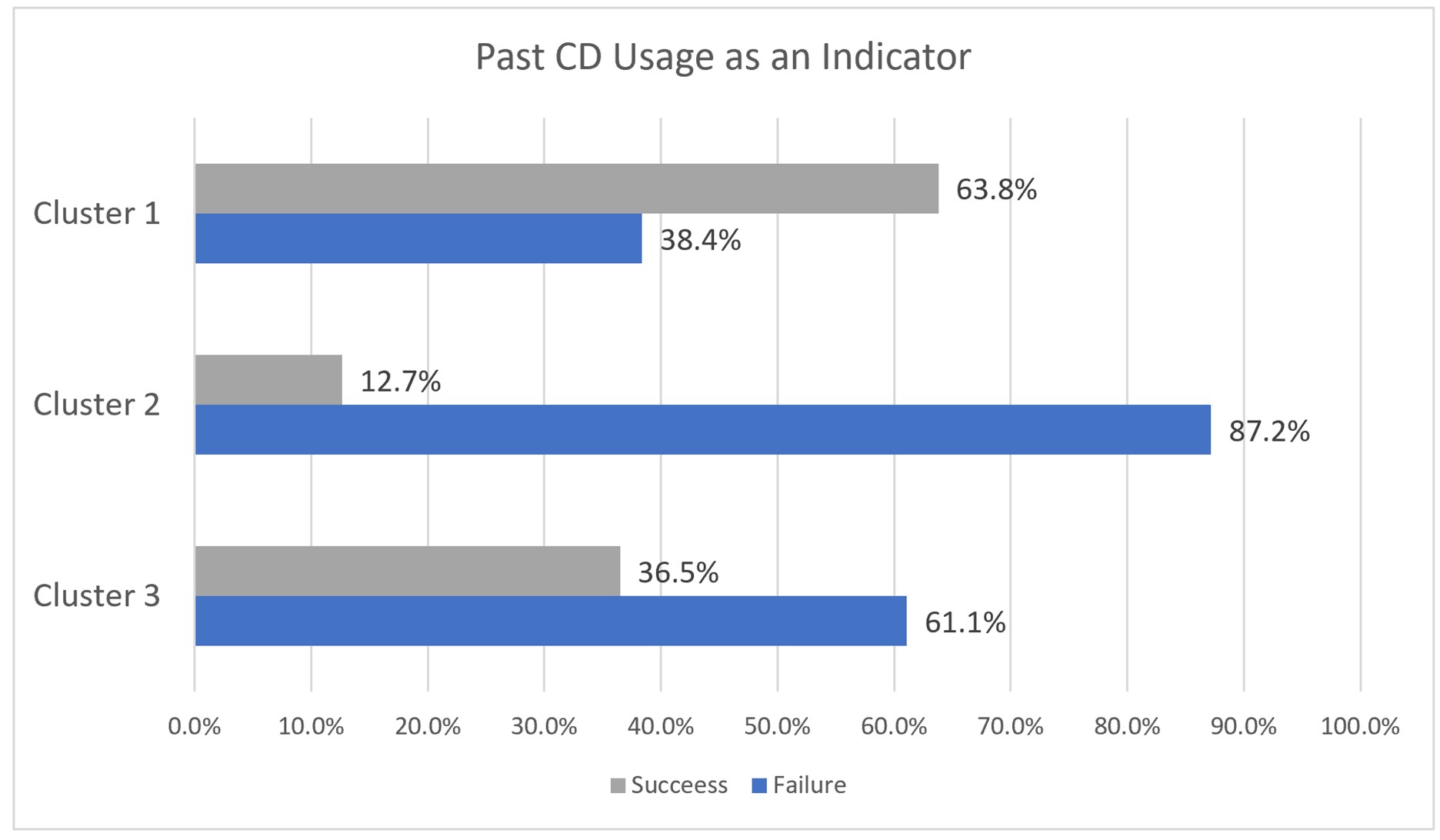

Since we are going after deposits, we first look for customers whom past deposit promotions have converted. Here, we see a group of customers that the machine has grouped because of like attributes, and we see a group where they have converted due to a past promotion 64% of the time. Alternatively, we see Cluster 2 with only a 13% chance of saying yes. Cluster 3 is a mixed group that is not strong or weak on future CD purchases based on past CD purchases.

Now that we have this data, we have the basis for creating a deposit marketing campaign. Next, we need to explore those other attributes that had high q-values to see what we can tease out of the data.

Do Loans Matter To Deposits?

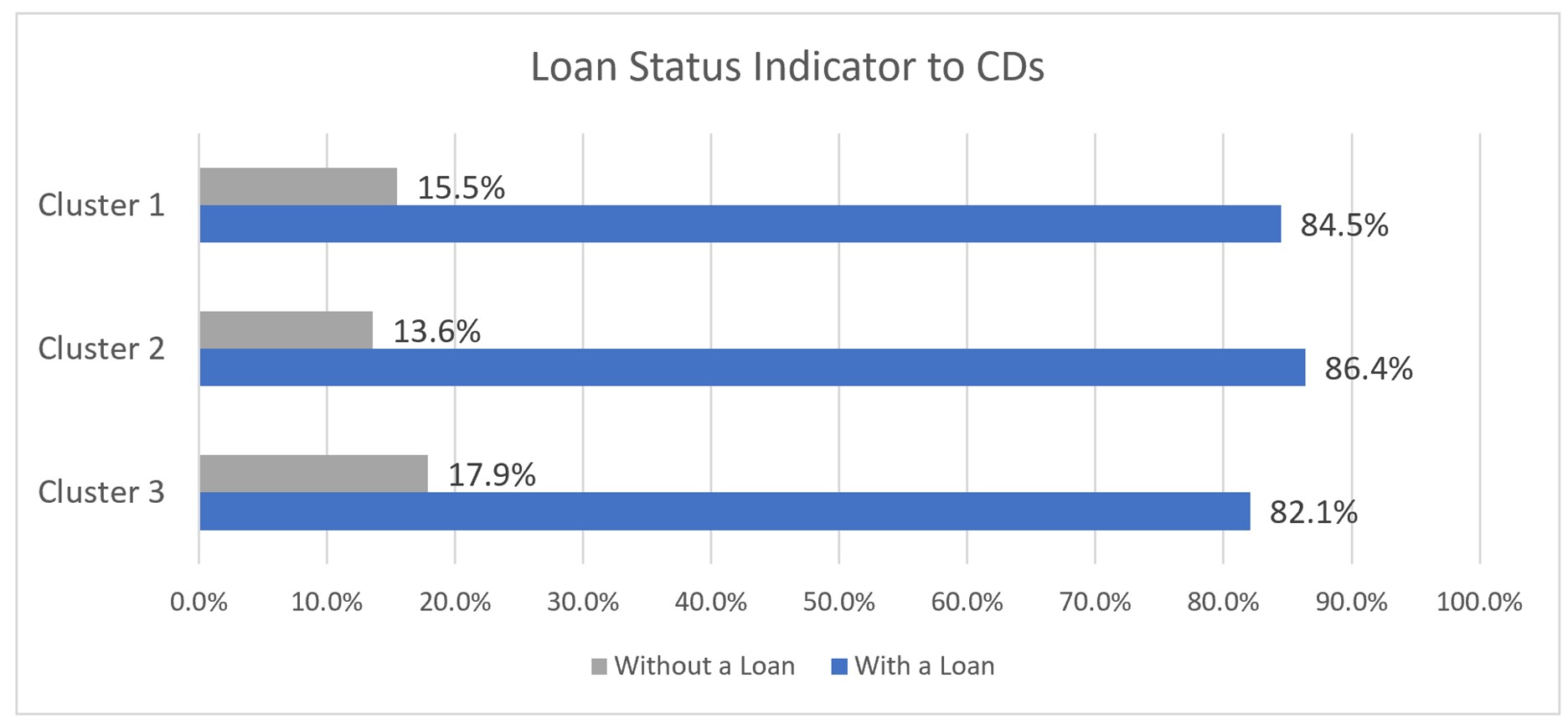

We can then look for other attributes of each of the above groups and come up with a couple of other findings.

From the data, we see that having or not having a loan is a similarity between the groups, but it is not a huge driver or influencer on the CD decision. From the below data, bankers can see that Cluster 2 has a slightly greater probability of saying yes to a CD promotion, and Cluster 3 has the lowest.

Duration of Engagement

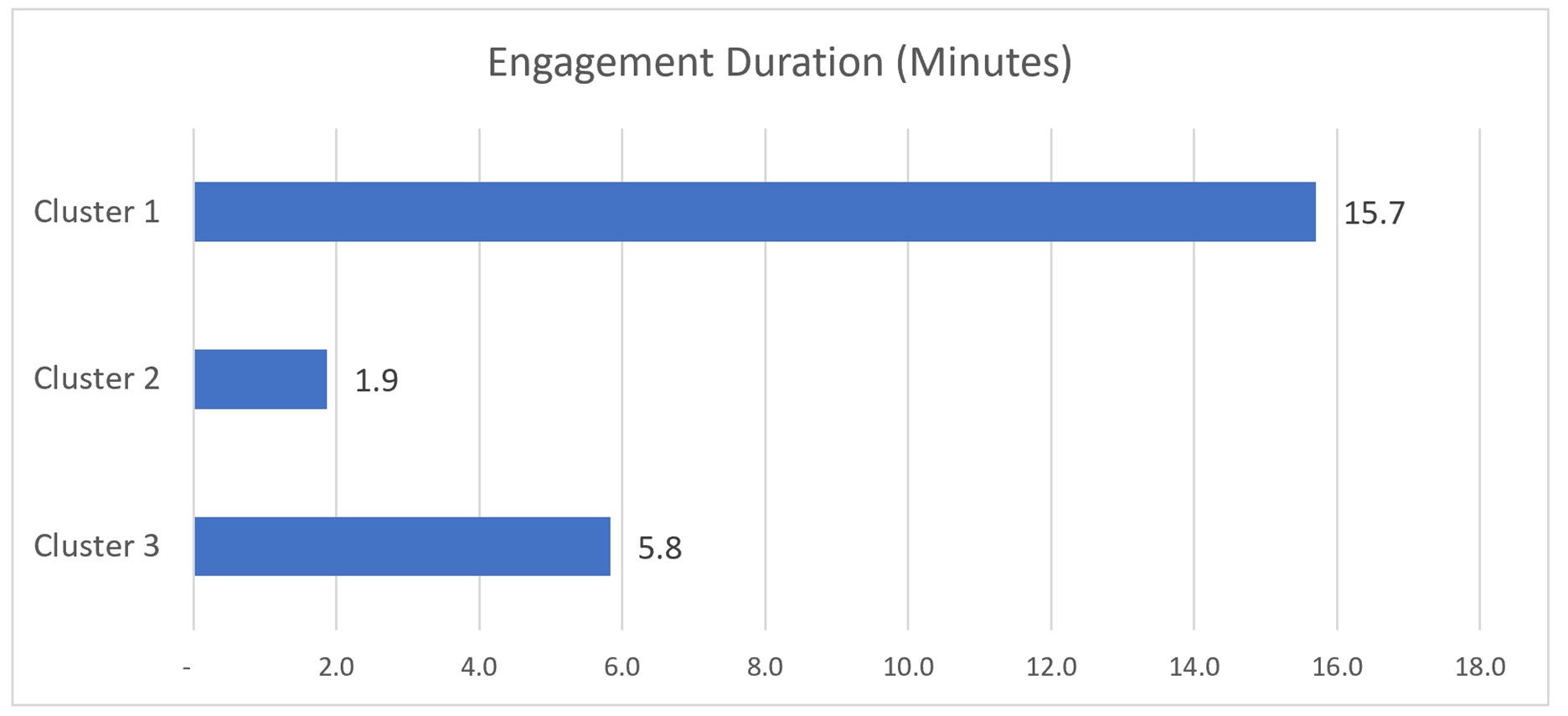

Another interesting attribute to emerge from the data is that customers will stay talking to a banker longer (this also is true for website time on page), researching a bank’s deposit product if they are more likely to purchase a deposit. This makes logical sense but is often overlooked when marketing for bank deposits. When you cut the data in this manner, you see that the customer group with a high deposit conversion rate stayed engaged during an education/sales call for an average of 15.7 minutes versus just under 2 minutes for Cluster 2.

Impact of Customer Age

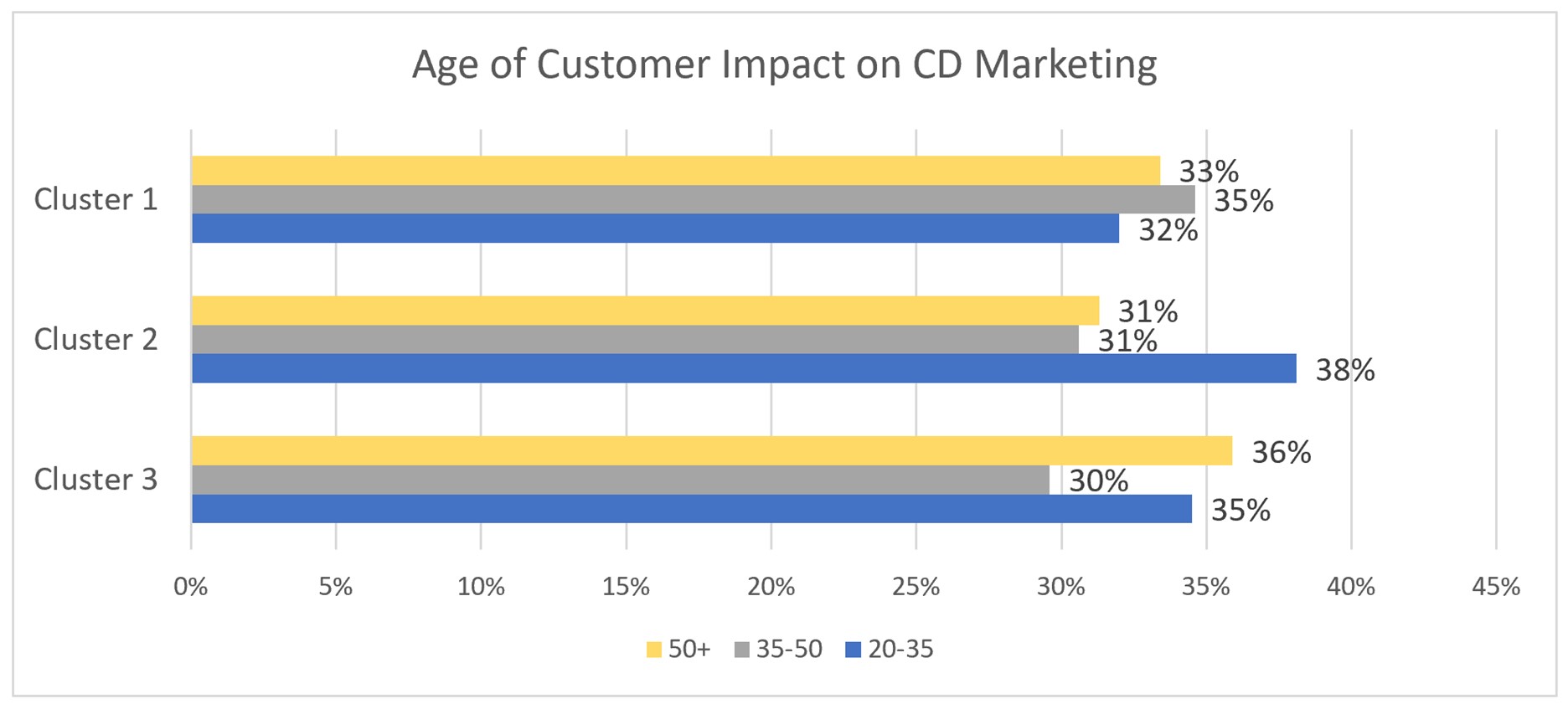

We hate lumping customers into demographic segments because of the chart below. The data below indicates Cluster 1 is composed of our middle age customers, while Cluster 2 skews younger and Cluster 3 older. Note that while age is a factor, it is not a huge predictor when it comes to CDs. To assume you should market CDs to your Baby Boomers might be a mistake and misses the real value in marketing around intent.

Forming a Hypothesis and a Strategy

From the clusters, informed by the data, emerge three primary strategies in order of expected effectiveness.

Engagement: From the data, we now know the following – the probability of saying yes to a deposit promotion correlates with the time invested in learning about the bank and its products. In addition, we know a client’s loan status and age have a medium impact.

These customers are likely to engage with bankers to find out more information about the risks and benefits of deposits, and these customers that take the time to learn are more likely to purchase a deposit. These customers are a prime segment for digital remarketing and a follow-up email drip campaign.

Based on some of our past work, we know effective campaigns based around the tax advantages of savings in your health savings account, the tax advantages of savings in your 401k, the importance of having an emergency fund, and how you can counter the low savings rate trend, are all highly effective messages, in that order.

Because of their willingness and need for engagement, this customer group is also likely more service sensitive. Here, expending more service and marketing resources would probably be wise, as your potential conversion rates are predicted to be higher. This customer grouping will be more likely to give you testimonials, referrals and answer surveys because of their engagement score.

Age – Young: Here, the data shows that customers and potential customers between the ages of 20-35 are likely to engage not in a branch or in person but online. Call duration is low, web usage is high, and this cluster has a high propensity for having another loan at the bank, such as student debt or an auto loan.

In fact, delving into the data, there are specific needs that are more correlated to this age range where they want to save, but they want to save safely BEFORE they take on more debt, such as an auto loan or a mortgage. Recent data indicate that due to the pandemic, for those that have maintained employment, this correlation is higher than ever.

Using this data, banks should prepare to launch savings messages that focus on safety, the magic of compounding, and being disciplined in savings before making a big purchase. Goal-oriented savings accounts and CDs are highly relevant to this cluster.

Step back for a second and recognize the power of this data. Before, it is highly likely that your bank advertised to all customers some savings attribute (a high rate, the speed of opening, etc.) And you likely had separate marketing for first-time home buyers.

From the data, you see that if you can combine these two campaigns with specific messages, not about the product, but about the advantage of saving now for a home later. This generates a continuum of the message where you can not only increase your marketing lift on deposits but also on mortgage sales. Banks can, and should, offer tied promotions to keep customers within this campaign by offering free breakage fees on their deposits if they find a car or home they want before the CD’s maturity or discounts on their mortgage within this program.

Age – Older: In this cluster, age skews higher, deposit conversion and engagement are medium, and the presence of a loan is low. This group is either in retirement or contemplating retirement and has reduced their debt level. Based on other data, we know this group values safety/capital preservation and is sensitive to the themes of passing a legacy to their children, saving more for retirement, saving for assisted living, and creating a funeral support account.

Above, you can see that for Cluster 1, the middle-aged customers are the highest compared to the other clusters. Young customers are dominant in the other two clusters.

Putting These Deposit Marketing Lessons Into Practice

By using a data-driven approach to deposit marketing, banks can be more effective. Leveraging machine learning can bring new insights into the data making each campaign more effective. Before this analysis, the average bank could expect about a 3% conversion rate on any given CD campaign. The above suggestions based on the three clusters can provide you closer to a 16% conversion rate. That is more than a 5x marketing lift with a couple of work hours. Banks that are 5x more effective than their competition can better allocate resources to achieve even higher returns.

Before, a bank might spend $1,000 on a marketing campaign targeting the twenty-something crowd, trying to entice them with a high rate. Now, banks can be more effective by targeting a twenty-something crowd that doesn’t want to spend too much time on the phone or in the branch AND has other debt that they are looking to take on or refinance. Banks can increase their effectiveness while spending more money on fewer targets and achieving a better ROI on the campaign.

This data abounds at banks, and the knowledge and tools are freely available. By leveraging k-mean cluster analysis and other simple techniques, bank marketers can be much more effective at their jobs.