ERC for Banks – Told You Are Not Eligible? Find Out

In discussing ERC (Employee Retention Credit) with banks over the last year, we discovered a common theme. Most banks have either been told they are not eligible or come to this conclusion on their own because they did not experience a decrease in revenues. Many banks performed better than expected during the pandemic due to offering paycheck protection program (PPP) loans. The reality is the revenue reduction test is only one way to determine if a bank is eligible for ERC. In the article, we explore the myths around eligibility and provide many banks with a path forward.

You Were Told You Don’t Qualify for ERC by Your CPA

When it comes to ERC for banks, many banks consult their CPAs only to learn that they are not eligible. While this could be true, it also could be that the CPA firm didn’t specialize in the ERC for banks, or offered a preliminary opinion. We work with well-known national CPA firms that specialize in working with banks specifically to claim their ERC tax rebate. Instead of just the revenue test, where most CPA firms focus, our approach targets the total or partial suspension of operations aspect of ERC eligibility.

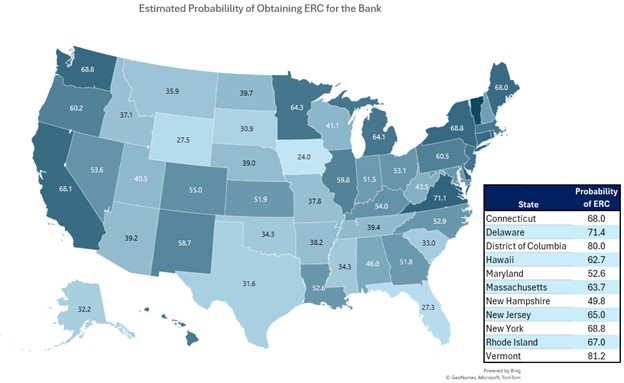

Our team has worked with approximately 55+ banks and secured over $82 million in credits. The average tax rebate is approximately $1.5 million. Due to varying government mandates, some of the more successful states include Alabama, California, Georgia, New Jersey, New York, and Texas. We have also helped banks in other states.

Below are our calculated probabilities, by state, of obtaining an ERC based on our team’s experience. Thus, if you are a bank in Georgia, you have a little better than a 50% chance of qualifying if we have no further information on you. Through a quick interview process, we can further hone these probabilities.

Bank ERC Eligibility

We work with top-tier accounting firms specializing in financial institutions’ ERC processing. They will evaluate your facts and circumstances on multiple dimensions and take a holistic approach to determine eligibility based on COVID having a more than nominal impact on your business. Before filing, each bank obtains an opinion from the CPA firm as to their eligibility. To date, none of these banks have been challenged.

ERC for Banks – How You Might Qualify

In addition to a revenue reduction test, there is an impact test. In the context of IRS guidelines, a ‘more than nominal’ impact is generally understood as a 10% or more reduction in the ability to provide goods or services. The 10% impact could be a combination of factors. Below are some popular insights we have gathered from analysis of other banks.

- Inability to hold in-person meetings—with customers, partners, regulators, industry representatives, and more.

- Lack of time to provide training and other services to create a remote work environment.

- Drop in sales of offerings that require live interaction: notary fees, opening new accounts in person, loans, wire transfers, etc.

- Social distancing and cleaning requirements hamper the quality of service, hours available, and number of customers allowed into the office or branch.

- Drop in branch foot traffic.

ERC for Banks – Your Potential Credit

The deadline to file for credits during 2020 has passed, but the good news is most banks have been eligible for Q1 of 2021, so you still have time to file this year. Focusing on Q1 of 2021 simplifies the amount of data needed.

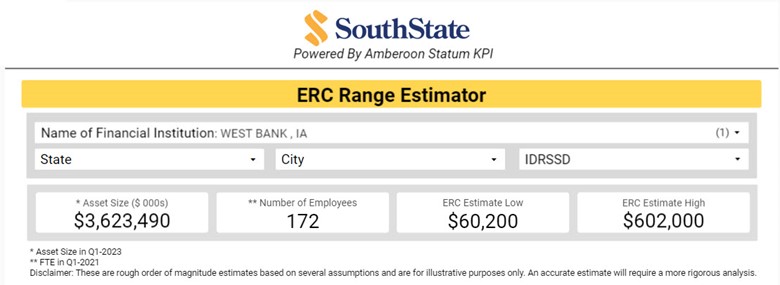

If you are a bank with less than 500 employees and are curious about your ERC eligibility, start HERE. The link will take you to a calculator and our estimate of what you could get back so you can see if it is worth the effort.

If you like what you see and want to move forward, our ERC Assist team will reach out to discuss our process in greater detail. We will set up a call to discuss your situation, timing, and risks. If you want to move forward, you will use our platform to upload similar documents, as many businesses did for PPP. This effort revolves around substantiating your 2021 payroll which is usually straight forward and painless for most banks.