Here is the Future of Bank ROE and What to Do About It

The average return on equity (ROE) for the banking industry declined to 11.10% in Q1/24 (a 23 percent decline in the last year). For banks under $10B in assets, ROE declined to 10.53% in Q1/24 (an 11% decline in the last year). The typical published analysis considers the industry in aggregate which conflates the challenges and opportunities at community banks (those under $10B in assets). In this article, we will discuss why community banks’ ROE is under pressure, what the future of a bank’s cost of funds and net interest margin looks like in the future and what these challenges portend for banks. We will also discuss what actions banks can take to improve performance.

Cost of Funds (COF) is An ROE Problem

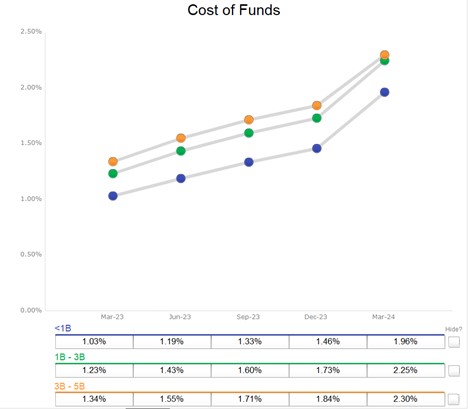

Community banks’ net interest margins declined at a quicker pace in the first quarter than in the prior four quarters as the deposit shift from non-interest-bearing demand deposit accounts (DDAs) to interest bearing money market demand account (MMDA), and time deposit accounts (CDs) continued. The graph below shows cost of funds for banks in three asset categories (under $1B, $1-3B, and $3-5B in assets). Similar increases are seen for banks between $5-10B in assets.

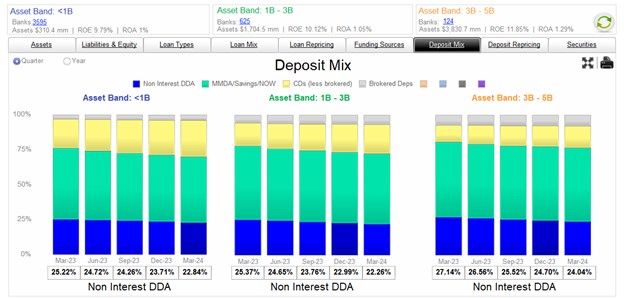

There are two troubling aspects of the increased COF in the graph above. First, the Fed’s last rate increase was in Q2/23. The continued increase in COF comes from the latent effect of rate increases. If the Fed does not change short-term interest rates, COF will continue to increase (more on this below). Second, much of the increase in COF for community banks is the result of shrinking non-interest bearing DDA being replaced with higher cost CDs (see graph below). For the smaller community banks, DDA balances decreased 9.4 percent, and CD balances increased 25.3 percent.

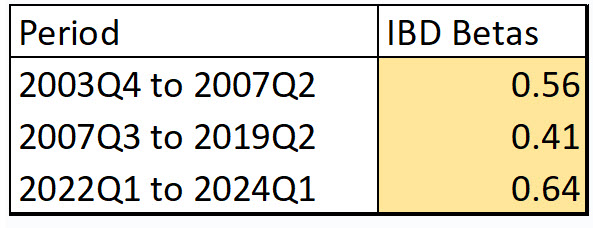

The important question is how will COF evolve over the next few quarters? To answer that question, we need to analyze current deposit betas and funding gap (the difference between money market rates and the industry’s COF interest bearing deposits). The table below shows interest bearing deposit betas over the last three hiking cycles. This hiking cycle’s deposit beta is already higher than the last two – and this is expected given the amount of liquidity drain, ease of online money transfer, and the severity of rate increases. However, will deposit costs continue to rise if Fed Funds do not move?

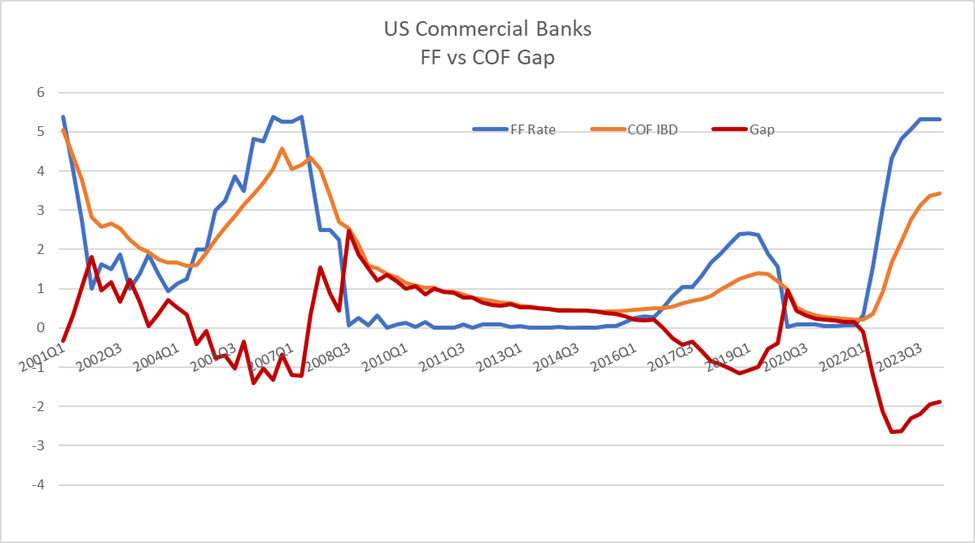

To answer the previous question, we consider the funding gap (difference between Fed Funds, as proxy for money market rates, and the industry’s COF for interest bearing deposis (IBD)). This funding gap represents a depositor’s forgone interest between keeping money at a bank and moving funds to a money market mutual fund (similar risk and liquidity). The current gap is the largest it has been in the last 23 years but has been shrinking as the banking industry pays up for deposits. The average funding gap over the last 23 years is about zero (one basis point to be exact), and currently that funding gap is 1.88%. We would expect, given the current competitive environment, increasing deposit betas, and presence of internet deposit takers, that if the Fed stays put on interest rates, the industry’s COF may increase an additional 100-175 basis points (note that COF for banks under $1B in assets increased 50 basis points in Q1/24 alone, quarter-over-quarter, with no change in Fed Funds rate). This cost of funds increase will continue to pressure bank ROE.

Loan Repricing

While deposit betas for community banks continued to climb, loan beta is not keeping up. Loan repricing will also hurt bank’s future ROE.

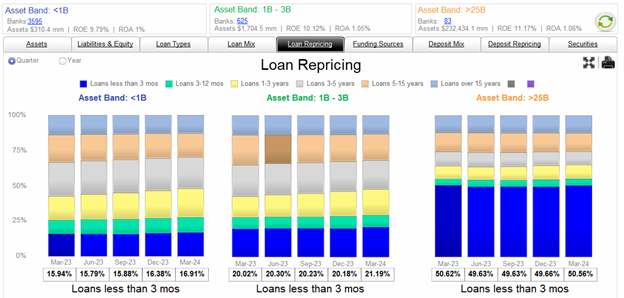

For community banks, loan betas are badly lagging the increase in deposit costs. Community banks have a disproportionate mix of fixed-rate loans that have yet to come up for repricing. This is further exacerbated by borrowers extending their below-market-coupon loans to the greatest extent possible. The graph below compares contractual loan repricing buckets for three group of banks (under $1B, $1-$3B, and over $25B (there are only 83 charters in total in the last group)). National and super-regional banks hold many more floating rate loans (for several reasons, to be discussed and analyzed in future articles). The average national bank has proportionally three times as many adjustable-rate loans as a community bank. Therefore, loan repricing (or loan beta) is much faster at larger lenders. Higher proportion of adjustable-rate loans helps banks increase loan betas and stabilize net interest margin (NIM).

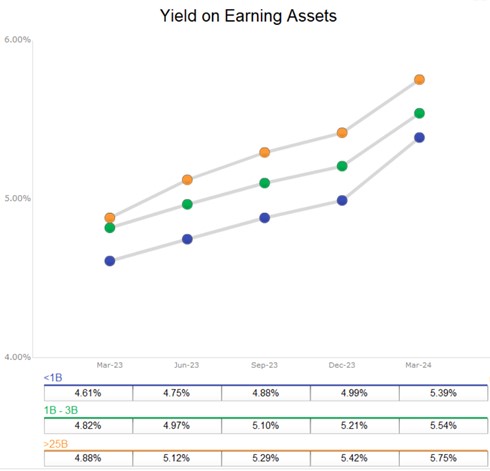

The graph below shows how larger institutions (with more floating rate loans) have been able to generate higher yields in the current hiking cycle.

The longer duration of loans on community bank’s balance sheet will contiunue to hurt ROE even if interest rates don’t move. Should inflation not get under control, ROE will be significantly impacted.

Taking Action

If the Fed does not lower interest rates, community banks need to be prepared for continued COF pressure, decreasing NIM, and lower ROE. However, there are many tactical and strategic steps that community banks can take to protect profitability and decrease risk.

- Products & Service: Community banks must emphasize products and personnel that can attract lower cost IBD and non-interest bearing DDAs. Treasury management, payments, health savings accounts, wealth products, sweep accounts, and service, all help attract customers with higher ROE and a lower cost of funds.

- Profitability Tracking: If ROE is important, then measuring ROE is more important. Banks absolutely need a risk-adjusted return on capital relationship profitability model. We provide our model, Loan Command, at our cost with no contract and no obligation to remove any excuse bankers have for not measuring ROE.

- Variable Rate Loans: Community banks must increase exposure to variable-rate loans (loan hedging programs are particularly valuable and potent for community banks, and they also have the added benefit of generating non-interest income). Community banks must also invest in and develop treasury management, wealth management and corporate deposits products.