Bank Product Design – The #1 Reason Why Your Bank Isn’t Growing Faster

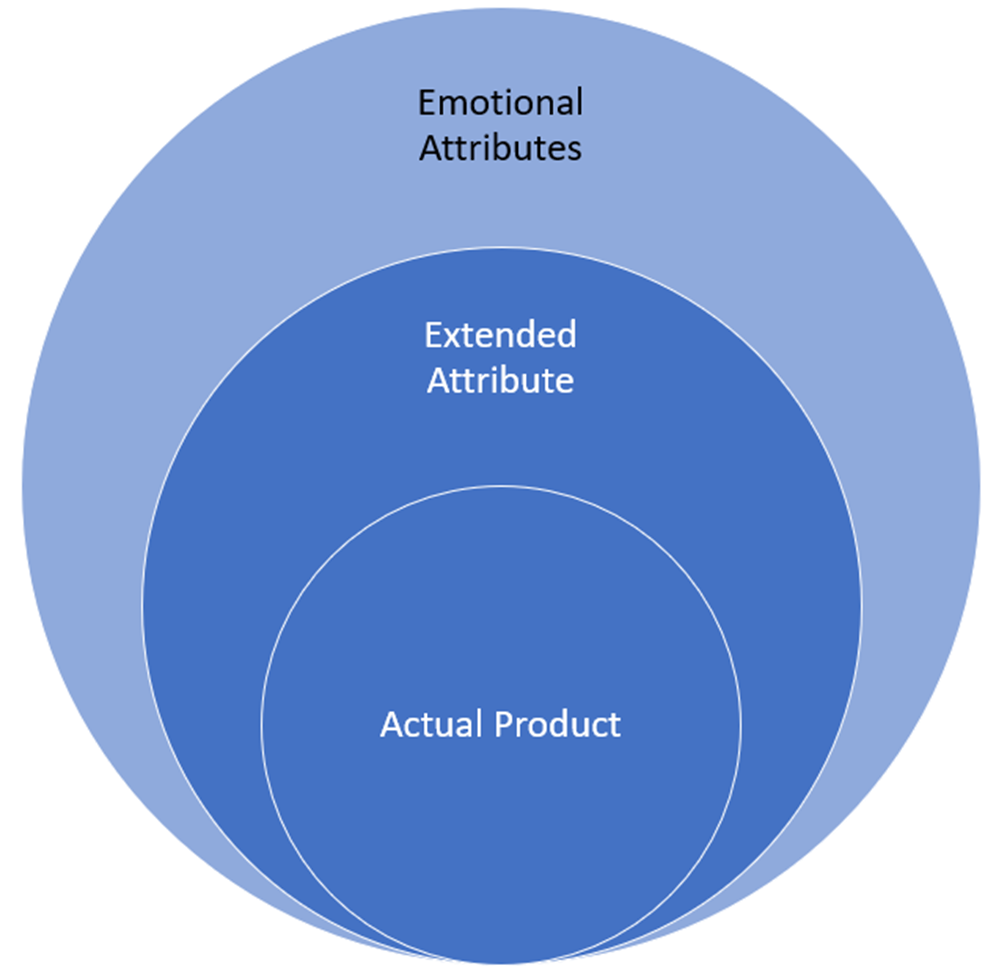

The reality is that most banks only design less than half a product. Sure, bankers are great at getting the basics right, but there is rarely much thought around 66% of the product’s design after that. In this article, we look at the elements of excellent bank product design and provide some hacks on how to improve your current product offerings.

The Basics of Bank Product Design – The Actual Product

When bankers talk about a product, be it a loan, transactional account, or treasury management service, they usually speak in terms of the actual product itself. The actual product includes the terms, fees, interest rate, operations, and details of how to access the product. Banks, to our credit, do a fantastic job at promising and delivering actual products that work. Unfortunately, that is only part of the battle.

Better Bank Product Design – Extending the Product

In addition to the actual product, there is the extended product. The extended product is a set of attributes that comes with the actual product that entices consumers and businesses of banks. The extended features might include a certain service level, a guarantee, a customized training session, special access to management, cheaper pricing with usage, or special recognition. The attributes that augment the actual bank product usually serve to distinguish the product from the competition.

Airlines do a great job at this. The core product is the actual transportation of getting you from Point A to Point B. Still, then there are the preferential seats, boarding priority, lounges, relaxed luggage requirements, ground transportation to/from the airport, enhanced food, and free seat upgrades. The airline industry has done an excellent job at taking the actual product of transportation and extending the product into an experience with a set of defined attributes.

Few banks offer any additional attributes to set their product apart.

Best Practice in Bank Product Design – The Emotional Attributes

Inside the actual product is where the genuine product lies. This is the most essential part of bank product design, and only a handful of banks utilize this advantage. Emotional attributes are the psychological reasons why the product exists in the first place. It is how the product makes you feel. Whether they admit it or not, customers use a bank product for one of four reasons:

- Status and exclusivity

- Ease of use and utilitarianism

- Safety, security & accuracy

- Economic or rational reasons

The most successful product in the world, the products created by Apple, Amazon, Google, Microsoft, and Facebook, all solve a variety of emotional problems for the buyer. These companies impart status (Apple). They are the most straightforward product to use versus competitors (Amazon). These products make you feel more intelligent (Google) or make you more productive (Microsoft). Many of these products provide a sense of community (Facebook). In addition, all these products have a heavy helping of safety and ease of use that appeals to reason.

These emotional attributes can usually stem from a bank’s brand. If a bank’s brand is strong, it is then easy to impart this layer of psychological and emotional attributes to a product. Tesla is another shining example of how a brand imparts this halo of emotional connection to its product. Tesla is just a car at its core, but the company has layered a series of product design extensions such as charging, free loaner cars, concierge service, and constant software updates with this imbued layer of status, sustainability, and efficiency. The result is the most valuable car company in the world.

Contrast the before mentioned brands with products like Segway. The Segway is a workable product that was designed to replace walking. The problem was that overall, it wasn’t more efficient than walking and the mass market never wanted to replace walking. The product not only didn’t solve a problem, but it never had an emotional connection to its users.

Putting This into Action

To boost product penetration and sales, banks can go back to the drawing board and relook at their current products as well as new products and then work on the two layers of creating extended attributes and emotional connection. Every customer is deeply driven by the motives to be more productive, to protect themselves, to have status, or of convenience. Banks would be well served to take a step back and identify the core need of every product they have. Without having a clear understanding of the core need of the product, product decisions become difficult.

Even at the basic level, the product’s name, positioning, packaging, pricing structure, distribution channel, options, and marketing all are driven by the core need the product is trying to meet. Write the press release first (HERE) in order to decide what you want your customers to say and feel about the product and then work backward in product design.

The path is well-worn, so bankers needn’t feel like they must recreate the wheel. Sticking with our car example, banks can duplicate the playbooks of what Mercedes did for status, Toyota did for utilitarianism, Volvo did for safety, or the Nissan Leaf did for economics (rated and marketed as one of the cheapest cars to operate).

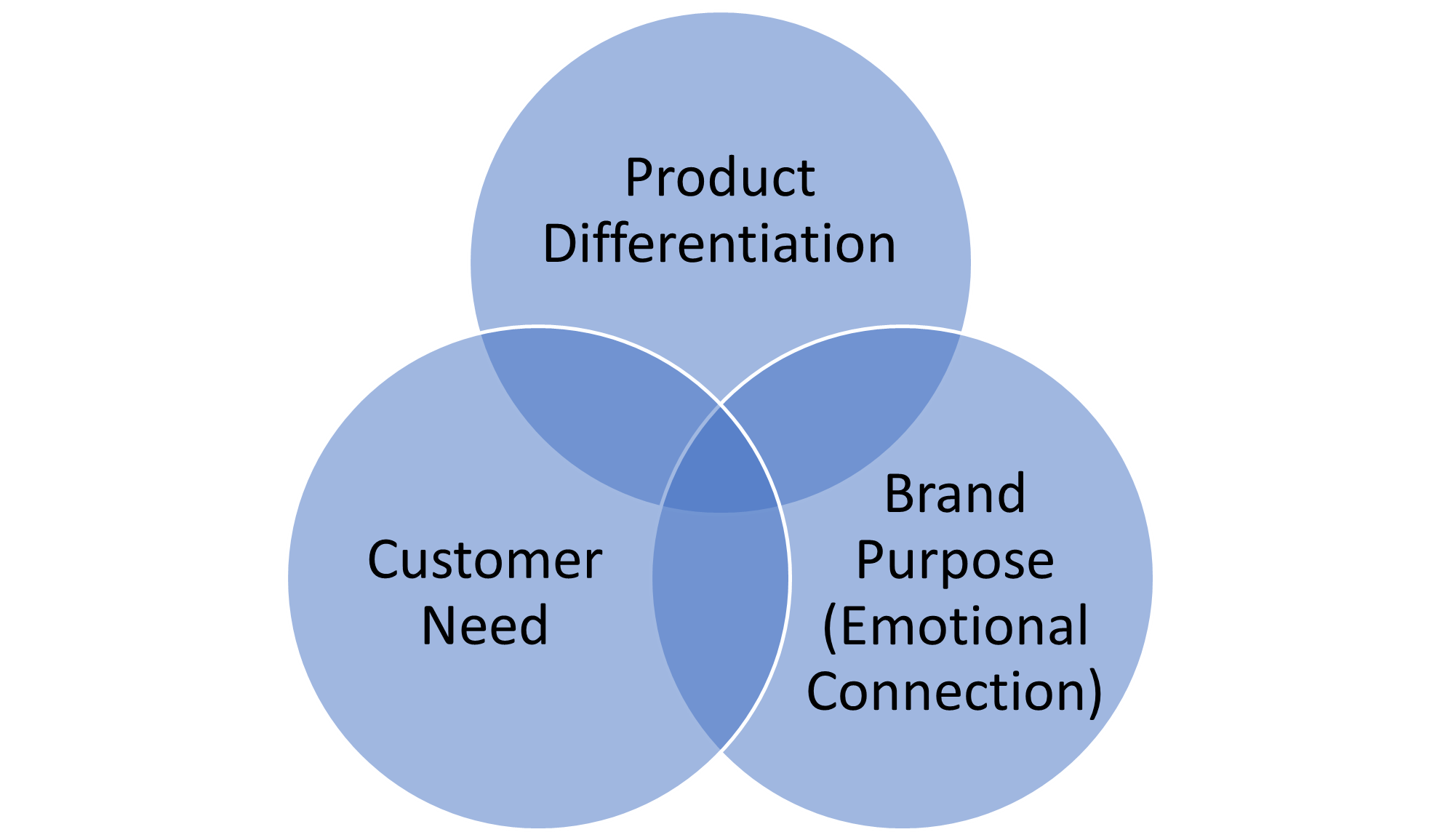

Another way to view this effort is to find the intersection between what sets each of your bank products apart, what emotional connection does it fulfill, and what customer need does it satisfy? Find the middle intersection of those three items, and your bank will be well on its way to boosting revenue and turbocharging product design.

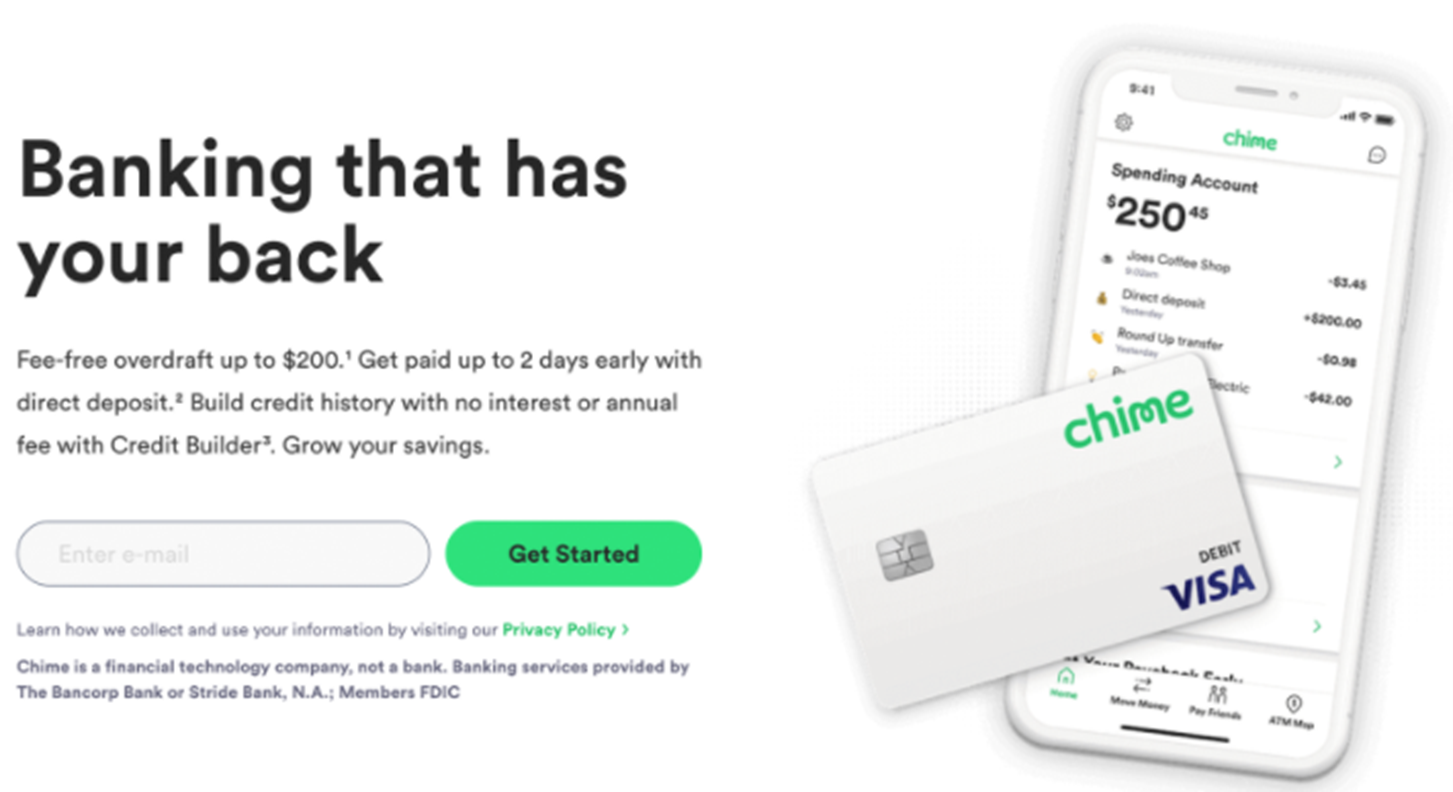

In the financial space, Chime started with the purpose of creating products that deliver “financial peace of mind.” Conversely, Marcus (Goldman Sachs) began with the brand purpose of achieving “financial well-being.” While similar, the emotional connection is clearly different. As a result, Chime focuses on similar language, more graphics, and a set of product attributes that offer simple, low-cost products that concentrate on saving you time and money in the near term.

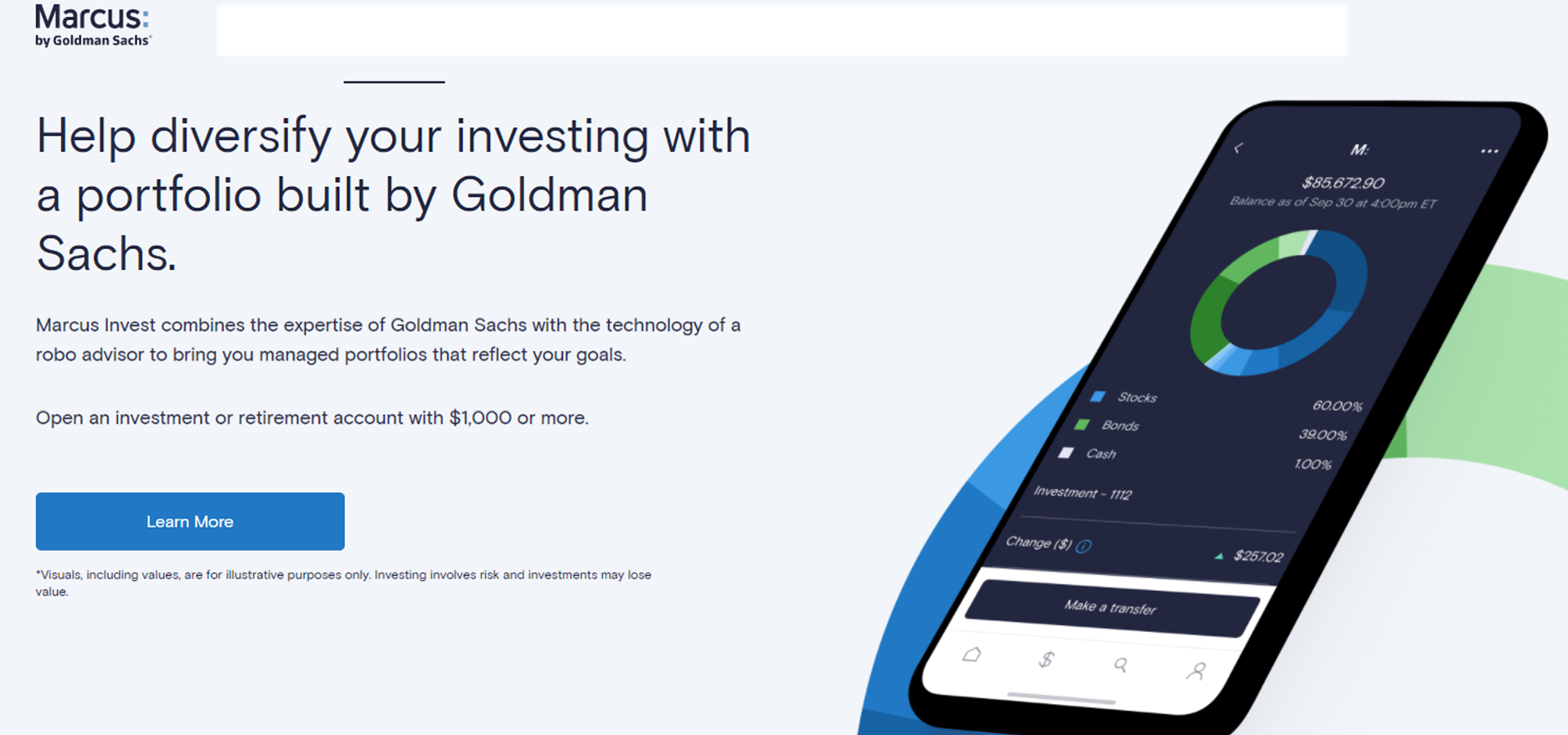

In contrast, Marcus’s emotional ties led to a more sophisticated marketing and product approach, so they took a longer-term view and have product attributes that focus on long-term savings goals like retirement, home buying, and building net worth over your career.

Both these financial brands are executing textbook successful product design and are primarily the reason why both have put up the fastest growth in a product that the industry has ever seen. In eight years, Chime went from a start-up idea to ten million customers, a $14.5B market capitalization, and more than $600mm in revenue. In five short years, Marcus has gone from zero to over four million customers, $4.7B in loan balances, $46B in deposits, $1.5B in fees, and a five-star customer rating.

Take any bank product, tie it into your purpose, wrap it with extended attributes and then imbue it with emotional context that ties back to your purpose and that product will likely be highly differentiated in the market. While this methodology doesn’t guarantee success, it is a proven pathway of best practices followed by some of the smartest companies in the market.