Combining Satellite Imagery and Machine Learning In Banking

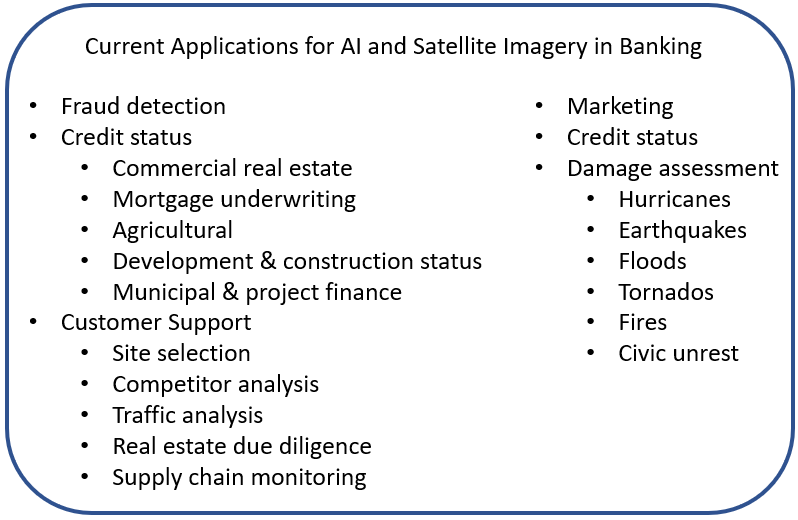

In the last five years, one of the new disciplines in banking that has emerged is the combination of machine learning and satellite imagery to gather bank intelligence on fraud, credit, and bank marketing. While this sounds daunting, in this article, we will show you some relatively simple applications of both artificial intelligence (A.I.) and satellite (sat) imagery to improve bank performance. In the last several years, bankers have learned that they have access to inexpensive imagery that is often free. This, combined with the fact that machine learning is now sophisticated, available, and accurate enough to handle the classification of location intelligence at scale, and you have all the makings of a game-changing technology that every bank should be using.

How and Why Use Satellite Imagery

There are close to 5,000 satellites, over half of them taking pictures of the Earth in some fashion for government or private purposes. Companies like American Landsat offer free images with “spatial resolutions” of almost 100 feet per pixel and cover a location every 14 days (called temporal resolution), or banks can leverage Google Earth. Private companies can get your resolution down to about 2 feet a pixel and can cover a location 2x per day. Popular bank solution providers are DigitalGlobe, Geocentro, Ersi, Planet Observer, Maxar, and others.

Banks can either use free images, purchase images on a one-off basis for a couple of hundred dollars or have a subscription to reduce image cost to $25 to $100 per image depending on the use and coverage.

Banks also need to decide their “task resolution” in that some private companies can deliver a database of exact addresses, while others will give you more sweeping shots that require additional programming or manual review.

Pricing and accessibility make satellite images a cost-efficient view of a location to gather data. Banks could send a banker, appraiser, or inspector to a property that might take about a week to gather 100% of the required data for a cost of $500+, or purchase an image, combine it with A.I. for an average of $220 and gather about 60% of the required data.

For example, using simple techniques, we can look at a building’s physical footprint, the time/location the photo was taken, and the shadows of the building in order to estimate building size. This is helpful for the verification of property improvements, fraud, and for validating appraisals.

Part of the advantage of using satellite images is that you can look at a time series of imagery in order to gauge changes to a property. Construction monitoring is an easy application, as is damage assessment after a disaster such as a hurricane. The images below are the before (left) and after pictures of Hurricane Michael that came through Florida at the end of 2018. The red boxes indicate collateral for bank loans, and this analysis shows the buildings as 100% and 70% destroyed, respectively, moving from left to right.

One added feature of using satellite imagery is access to a location. In many disaster events, non-essential personnel access is limited for weeks, while a sat image can be obtained on the next clear day.

Next to spatial, temporal, and task resolution, banks need to decide on “spectral resolution” in that if a bank uses a private company, some have the ability to pull images in different energy waves (example below showing various spectral filters highlighting different features) such as infrared, near-infrared, or radar. These images are excellent for accessing agricultural land quality, ag production, vegetation growth, erosion to properties, water damage (critical for flood assessment), drought impact, or even foot traffic patterns (as every person is a heat source of about the same size).

Image Processing and Automation

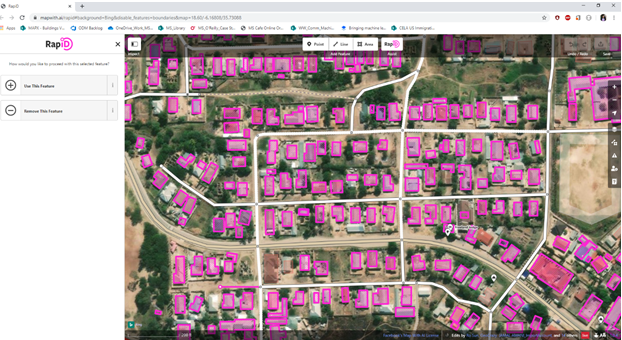

If you have more than 100 locations you want to keep tabs on, your bank is going to want to automate the process. Automation either takes coding and/or connecting with the right platform to pull the image, process, gather the data, and present a report. Amazon Webservices, Google Earth Engine, Microsoft, and other platforms have substantial “pre-processing” capabilities and can dramatically cut costs and time for banks. For example, Microsoft has available (either free directly or through applications like RapidID below) 155+ millions of buildings in the U.S. complete with “polygonization.” Here, not only are the parcels separated, but the buildings are outlined, including detached structures saving material processing resources.

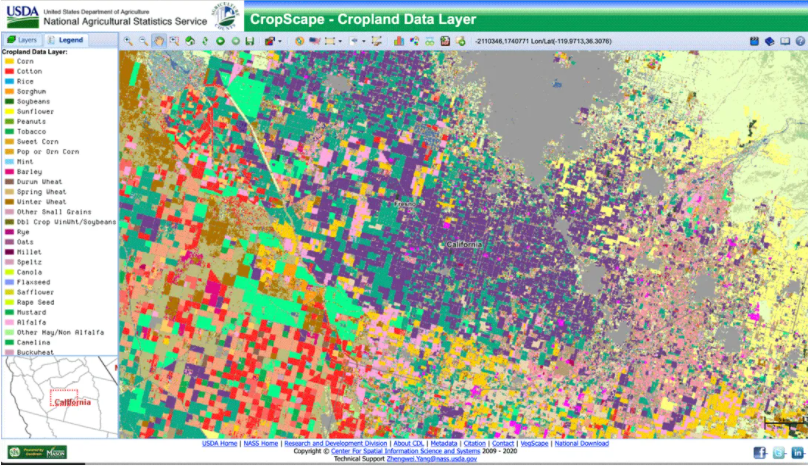

The U.S. Department of Agriculture (USDA) maps 100 different crops in 48 states to estimate crop production yield. Banks can obtain this information, to include a time series, to help with agriculture lending and risk assessment.

Each of these platforms has API integrations that you can connect to extract the required images. You can feed these platforms a list of addresses off a spreadsheet, tell the resolution/output you desire and give it the date ranges you need. In minutes you will get your desired work product, which could also be integrated into platforms like Salesforce, nCino, Finestra, or others.

On some of these platforms, calculations like estimating foot traffic, a building’s size, or the number of employees can also be included in “post-processing.” If not, the bank can create an algorithm to add further data.

For example, for the Paycheck Protection Program (PPP), to detect fraud, banks can match up the number of locations a borrower has and then pull the building. Below, this borrower had a high fraud score as it had 10+ PPP loans to this single location, all in different borrower names covering 40+ employees. By estimating the size of the building and counting the average number of pre-Covid-19 cars in the parking lot on a series of dates, we estimated that the building in question had no more than 15 employees at any one time. Here we automated the pulling of the images off Google, the estimation of building size, the estimation of parked cars and then a fraud score.

Credit, Marketing and the Customer Experience

Banks are now experimenting with next-level applications for satellite imagery and combining the imagery with other data such as cell phone activity, demographic information, or thousands of other data sources. For example, banks can map out each home or business in a particular area and generate a solar savings proposal complete with financing. Using a relatively simple algorithm, banks can estimate building size, power requirements, roof area, and orientation towards the sun to then create an indicative proposal complete with tax and subsidies on cost savings for electricity. The borrower now has a turnkey solution to increase cash flow, while the bank generates fees on the solar install, lowers its credit risk on any existing loan at the same time generating more business.

There are dozens of applications like the one above where a bank can generate ideas to help customers generate new business and reduce credit risk. Site selection and traffic analysis have various uses now more than ever as traffic patterns have radically changed due to the pandemic.

Training and Incremental Model Improvement

Of course, with all these applications, one key is improving the process over time. Every time you have fraud in a commercial building or business, every time you have a default, or any time a desired or undesired event happens, the details should be committed to a database and explored using imagery and machine learning.

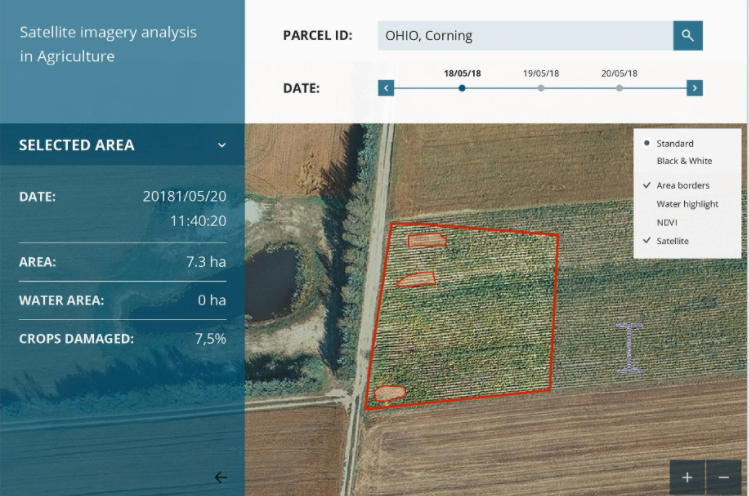

By teaching the application, it can get more and more accurate. The application below, for example, correlates crop damage and production so bankers can know their credit status at the same time as the borrower, thereby limiting the asymmetric knowledge problem in lending.

Putting This Into Action

Satellite imagery processing is still in its nascent stages for banking, but it has proven to improve efficiency, credit losses, and reduce risk. By starting to experiment with its applications now, you will better equipped to apply this technology and adjacent technologies in the future. This is a new area of banking that is emerging, and bankers would be well to have a working understanding of satellite imagery as well to have some basic knowledge of the popular machine learning languages used around imaging to include Python (and some of the open-source libraries like Keras), R, Tensorflow, and others.

Combining machine learning with satellite imaging has applications for the use of drones (separate article coming), connecting with street view images such as from Google and using crowdsourced photos such as those off social media, Yelp, or Google. With each use, the application gets smarter and more accurate until it surpasses the accuracy of humans and can handle the analysis at scale. The end result is a more accurate outcome, faster and at a lower cost than what banks are doing today.