Get Our Calculator – The Borrowers’ Dilemma of Waiting For Rates

The Fed just finished their July meeting and there are many banker that will be further waiting for rates to drop. By the same token, many borrowers are grappling with the decision of when to lock their permanent financing. Some borrowers are choosing short-term financing in anticipation of the Federal Reserve embarking on an interest rate cutting cycle – which may or may not happen, and the degree of interest rate cuts cannot be predicted with certainty. However, borrowers are not systematically comparing the benefits and costs of obtaining short-term financing vs. locking in current long-term market rates.

Borrowers typically are relying on gut feel instead of analytically comparing the anticipated benefits and costs. For example, how many rate cuts would be required to make the borrower indifferent between obtaining a short-term loan at a higher rate today, in anticipation of lower rates in the future? How can lenders provide guidance to borrowers on their feasible options, the costs and benefits of waiting to secure longer-term financing and comparing payment costs? We created a free model that allows bankers and borrowers to compare interest payments on various loan amounts, amortization periods, credit spreads and commitment terms based on today’s yield curve. You can download the model HERE (or use the link below). However, there are other considerations beyond the payment costs that borrowers and lenders must consider.

Considerations While Waiting For Rates

While you are waiting for rates to drop, it is important to understand that we do not know where floating rates will be in the future – the market has a view, the Fed has view, and borrowers may have another view. But no one can predict the future, and we are proponents of a simple tenet that long-term assets should be financed with long-term liabilities to stabilize the debt service coverage ratio (DSCR).

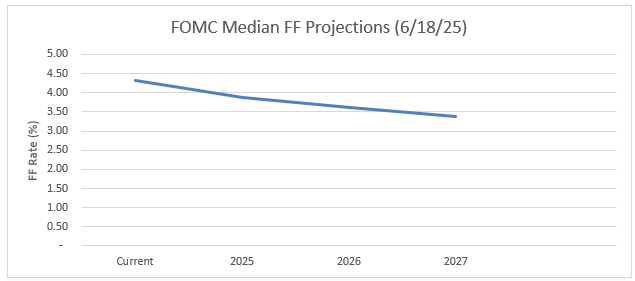

The latest FOMC dot plot appears below. Each Fed member of the FOMC submits one projection of the most likely outcomes for GDP, inflation, and unemployment rate for each year from 2025 to 2027. Each FOMC participant bases projections on information available at the time of the meeting. Further, these projections represent each participant’s assessment under appropriate monetary policy and the absence of further shocks to the economy. Our free model considers the FOMC’s latest dot plot when comparing the borrower’s costs and benefits of waiting to secure longer-term financing and comparing payment costs for interim financing. No surprise, that the model shows the same financing costs to the borrower since we are using market-driven rates – you cannot game the market.

However, there are other variables for the borrower to consider as they wait for rates:

- Changes in Market Expectations: Markets move rapidly as witnessed by the Fed stating that inflation was transitory, to hiking Fed Funds rates by 5%, to higher for longer mantra. No one can predict future economic realities. Most borrowers cannot react fast enough to market changes to take advantage of those lower costs.

- Credit Risk is one sided: Financing long-term assets with short-term liabilities adds credit risk that is disproportionately borne by the lender (25% equity vs. 75% debt). If rates are higher when a short-term loan matures or cash flow is lower, the borrower’s DSC ratio may not meet the bank’s underwriting criteria, or the ratio may be below 1.0X. Further, on most amortization schedules, the principal repayment in the first few years is exceedingly small, thus exposing the lender to more risk. Both the borrower and lender are subjected to credit risk if rates are higher than expected in the future.

- Market Risk: The market is mostly wrong about the future of interest rate, but the market is especially poor in predicting extreme events. The Federal Reserve is waiting for the economy to react to trade and immigration policy changes. The impact of these policy changes is unknown, but the magnitude of such changes can be severe. A recession may result in lower interest rates but also lower cash flow, wider credit spreads, lack of willingness by banks to lend, or additional asset classes being out of favor by banks.

- NOOCRE A Special Case: Borrowers with NOOCRE projects are in an especially precarious position. NOOCRE financing is highly levered with minimal ability to lower operation costs or add different revenue streams. CRE loans are frequently highly leveraged: a loan underwritten to 1.20X DSCR, 76% LTV, 9.2% debt yield, and CRE cap rate of 7.00% results in a loan leverage ratio of 10.83 (total debt divided by NOI). To get the leverage ratio below 6X (a key underwriting criteria) a CRE loan would need to show 42% LTV and just over 2.0X DSCR. Investors in NOOCRE are especially vulnerable to waiting for their desired interest rate environment.

- Sales Risk: Lenders are giving a free option to borrowers who finance with temporary credit facilities with anticipated savings in the future. Let us assume that a borrower financed long-term assets with a 2-year floating or fixed rate, a recession did not occur, and market rates are lower as predicted by the forward curve. The result is that the borrower paid higher interest rates during the short-term financing period and will obtain a lower rate (as predicted by the forward curve) on longer-term financing. The borrower’s blended rate is no better than had the borrower taken the longer-term facility at the initial entry point – this is the math of the forward curve and its current inversion. However, the bank will now need to compete for that borrower’s business again with possible irrationally priced competitors. Neither the borrower nor lender achieved an optimal outcome.

Conclusion

Short-term financing may be the right choice for some borrowers but financing long-term assets with shorter-term floating or fixed rate facilities has several drawbacks. Our calculator creates a starting point for borrowers to perform what-if analysis and compare the cost of locking in a long-term loan rate vs. the cost of floating a loan or accepting a short-term fixed rate and being subject to short-term interest rate movements. As you run the calculator for your borrower, let us know if you want to see a formal PDF presentation showing the cost of a fixed vs. floating rate debt for your specific borrower and assumptions.

Get the Calculator HERE .