The Profitability of Longer, Hedged Loans

In recent articles (last one HERE) we discussed the importance of commercial loan prepayment speeds. We explained the importance of keeping loans vs. making loans in driving bank profitability. The key factor affecting a loan’s expected life, after contractual term of the loan, is the specific loan prepayment provision. The most acceptable, marketable, and enforceable prepayment provision is a symmetrical breakeven provision (associated with hedged term loans). In this article, we will summarize a case study of a bank’s historical performance offering commercial term loans with a symmetrical breakeven provision (hedged loans), floating loans, and fixed loans with a declining balance prepayment.

Our Case Study of Hedged Loans

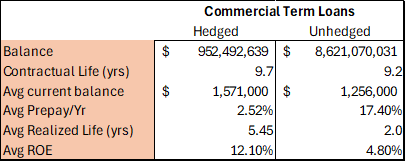

We analyzed the historical prepayment speeds for a commercial bank. We considered various loan types and measured how structures and prepayment provisions affected loan life. Our modeling also considered ROE calculations given the expected loan life and loan sizes. As expected, the type of prepayment provision (or lack thereof) drove loan prepayment speeds, and in turn profitability of various loan types. The table below summarizes our findings.

Approximately 10% of this bank’s commercial loan portfolio consisted of hedged loans and all those loans had a symmetrical breakeven prepayment provision. The remaining commercial portfolio was approximately 20% floating-rate loans with no prepayment provisions and 80% was fixed-rate loans with mostly declining balance prepayment provisions – ranging from no prepayment provision, 1% prepay in the first year, to 5,4,3,2,1 for 5 to 10-year fixed rate loans. But the enforceability of these prepayment provisions for fixed-rate loans was subject to wide variance in enforceability. The stated contractual life of the hedged and unhedged loans was close at over nine years. The average size of the loans was also within close range. The major difference between hedged and unhedged loans was the annual prepayment speed, expected realized life, and average ROE. Hedged loans demonstrated almost seven times slower prepayment speeds and, thus, demonstrated 2.7 times the realized life of unhedged loans. This longer life of hedged loans in turn resulted in much higher ROE (a 7.3 percentage points advantage for the loans alone, not considering any other cross-sell product benefit).

Key takeaways from this bank’s analysis are as follows:

- Hedged loans provide for an opportunity to include a symmetrical breakeven prepayment provision, which creates much longer expected loan life for term loans (2.73 times the expected life, even when the contractual life is similar).

- Floating loans had the highest prepayment speeds (27.3% pa), followed by fixed rate loans with various softer prepayment provisions (prepayment speeds of 15.4% pa), followed by hedged loans with 2.52% pa prepayment speeds.

- The prepayment speed differences on similar loan sizes, terms, and credit quality resulted in 7.3 percentage points difference in ROE. Hedged loans demonstrated superior bank ROE without factoring any cross-sell opportunities.

- The average prepayment speed of hedged commercial loans is approximately 7 times slower than this bank’s average commercial loan. This extended loan life should create a longer and deeper relationship for the bank, and offer additional cross-sell opportunities in the form of deposits and treasury management products. This is especially true for banks that target owner occupied CRE loans and certain category investor CRE with strong cash flow.

What stood out in our analysis, but not reflected in the numbers directly, was the inability of lenders to negotiate and enforce meaningful prepayment provisions in non-hedged loans. Bankers were unable to explain to customers why the bank needed the provision for economic reasons, enforcement of the provision was lax, and the declining balance provision was contractually excluded from many prepayment scenarios.

Additionally, our analysis explained how hedged loans can help lenders meet loan growth targets. If the average lender’s loan portfolio at the bank prepays at 17.4% pa, but hedged loans at only 2.52% pa, lenders with more hedged loans could more easily grow portfolios because fewer originations were needed to replace prepaid balances.

Conclusion and Applicability

The bank in our study was able to use the symmetrical breakeven prepayment on hedged loans to effectively decrease prepayment speeds, increase loan balances, and enhance the bank’s loan ROE by a substantial amount. Community banks that are targeting the benefits of longer relationship should consider extending the expected life of commercial loans through a hedging program. It appears that hedging programs can reduce commercial loan prepayment speeds to about 2.5% pa, which compares favorably to prepayment speeds on floating-rate and on fixed-rate loans. This relationship advantage can translate to sizeable ROE gains.