The Risk of Interest Rate Movement in Relationship Banking

In recent articles (here and here), we discussed why banks that take the interest rate movement risk demonstrate lower performance as measured by return on assets (ROA). Empirical evidence, historical bank failures, and common sense teach us that many risks do not translate to higher yields. The second article compared and contrasted community banks’ pay-for-risk and relationship business models. We made the case that, over time, the market does not adequately compensate banks for credit and interest rate risks. Top-performing community banks deploy relationship banking.

We define relationship banking as a model focused on a consultative banking approach. Bankers provide advice based on the customer’s particular situation and needs, as those needs change and evolve over the customer’s lifetime and as the market changes. The bank is compensated by selling products, services, and especially insightful and targeted advice. Some banks state that they are relationship driven but deliver risk-for-pay products. Other banks attempt to provide relationship banking but fail because they may not understand what is involved and how to differentiate from competitors effectively.

Many community banks state that they embrace and promote relationship banking. Still, the model is not easy to deliver effectively, and its implementation is not as intuitive as some bankers may believe. To implement the relationship business model, bankers must focus on the right talent, education, product mix, and executive support. Banks developing and delivering a relationship banking model can outperform the industry. However, community banks must attract, develop, and retain commercial bankers who can offer insightful financial advice. In this article, we will consider how bankers should view their bank’s and customers’ interest rate risk using the relationship banking framework.

Where To Find The Risk of Interest Rate Movement

Interest rate and credit risks are highly intertwined. Suppose a borrower demonstrates NOI (net interest margin) or EBITDA (earnings before interest, taxes, depreciation, and amortization) that is inelastic to interest rate movement, and that borrower has a short-term fixed-rate loan or a floating-rate loan. If interest rates are higher when that loan matures, the borrower can no longer service the loan, and interest rate risk creates credit risk. The review and understanding of interest rate risk must consider secondary or indirect effects.

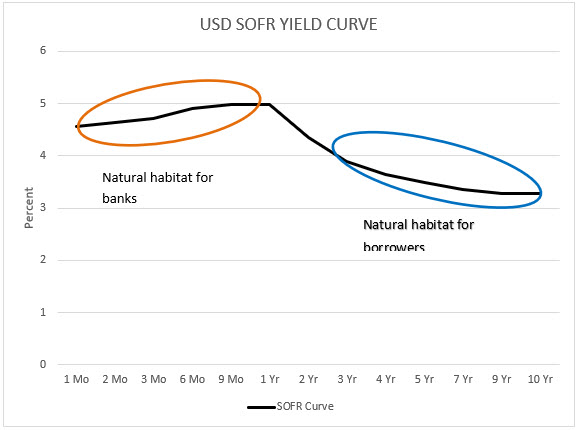

The basic building block of interest rate risk is the natural habitat for bank lending and customer borrowing. Banks’ cost of funding is best correlated to shorter-term rates, and banks generally want to generate loans with shorter interest rate duration – fixed rates of up to one to two years. This is where the banks take minimal interest rate risk. Some banks prefer the carry trade, where they borrow from depositors on the short end of the curve and lend on the long end. However, we saw how this ended for Silicon Valley Bank and how this is impacting other banks in the industry today.

While banks may want to keep their asset duration short, especially in this interest rate environment, borrowers are often better served with longer-duration loans to help stabilize cash flow, minimize refinance risk, and reduce interest rate and credit risks. The graph below shows the current shape of the yield curve and the natural habitat for borrowers and lenders.

Practical Application for Bankers

Using various examples, we will review how the relationship model considers the bank’s and the borrower’s interest risk.

Construction through-perm financing: Relationship-driven banks prefer to structure construction loans with a fixed rate term take-out established at inception. This structure adds tremendous value for the bank and the borrower and eliminates interest rate movement risk for the borrower. The fixed rate offers the borrower the safety of being able to plan for a pro forma debt service coverage ratio. The term loan adds balances and duration, thereby increasing revenue. It also eliminates substantial refinance and re-pricing risk. The term loan also increases the stickiness of the relationship and overall profitability for the bank.

Not allowing term loans to become current liabilities: Because relationship-driven bankers are in the business of keeping loans and not making loans, these bankers try to retain the existing earning asset for as long as possible and are proactive in offering refinance options well before the loan is within one year of maturity. It costs the average community bank $6k to $14k to book a new commercial loan but only about $2k to $4k to modify or amend an existing commercial loan. It is almost always preferable to be proactive in discussing refinancing options with existing customers to retain an existing relationship rather than: a) lose the customer or b) play defensive and respond to a competing offer.

Not predicting future interest rates: What advice should relationship-driven bankers provide about the future of interest rates and the business environment? Borrowers and bankers fall into the trap of trying to outwit the market on interest rates. This happens when choosing loan maturities, loan structures, and timing on rate fixing. However, no one has shown the ability to consistently outwit the market – equity, debt, or any other highly active market. As such, it is short-sighted for the bank to take too much interest rate movement risk and even more problematic to force the borrower to do the same. Further, advising a borrower or accepting their view that refinancing in a recession when interest rates might be lower is a losing strategy for all parties. In recessions, interest rates may be lower (or not), but access to capital may be tight, and credit spreads may be substantially wider.

Providing tailored borrower options: Relationship-driven bankers admit they do not have a crystal ball on interest rates. These bankers look at the market’s prediction using the forward curve but can still add value to their customers in other ways. These bankers can analyze a customer’s balance sheet, cash flow, and business model to structure products that insulate customers from adverse outcomes, regardless of what interest rates may do in the future. Lenders do not know what the future holds, but they can analyze the cost and benefit of retaining existing debt versus refinancing today. Bankers as trusted advisors can calculate what-if analysis to show borrowers their cost of financing if rates are higher or lower – because either outcome is equally possible by definition. Being able to show DSCR or advance rates for LTV with various dispersion in interest rates allows borrowers to make more informed decisions.

Conclusion

Relationship-driven bankers do not try to predict the future path of interest rates and dissuade their borrowers from doing the same. It is difficult for banks to handle too much interest rate movement and borrowers are usually the same. Instead of taking interest rate risk within a relationship, these bankers offer insightful financial advice specific to the current banking environment and tailored to their customers’ needs. In a future article, we will discuss how commercial bankers may develop this professional expertise and become better relationship managers. Developing expert knowledge about business verticals or finance structures has worked well for some bankers at our institution. We will share some techniques our bankers have used to gain this expertise.