Building The Relationship Banking Model

In a recent article (here), we discussed why banks that take risks to earn higher revenue demonstrate lower performance as measured by ROA. Empirical evidence, historical bank failures, and common sense teach us that many risks do not translate to higher yields. While in that blog, we specifically considered the risk-return tradeoff for credit risk; in a future article, we’ll consider interest rate risk. This article will compare pay-for-risk vs. relationship banking business models for community banks.

In a pay-for-risk model, banks emphasize generating revenue by charging for risks that they take. Banks succeed by assessing and underwriting this risk, capitalizing on opportunities where risk is overpriced. Unfortunately, the adage applies risk-for-pay: you can only be as successful as your dumbest bank competitor. Over time, the market does not adequately compensate banks for credit and interest risk. A more appealing model for many community banks may be to embrace relationship banking. While most community banks believe that they emphasize relationship building, that may not be the case. Now is an excellent time to revisit the differences between these two standard banking models.

What is Relationship Banking

Relationship banking focuses on a consultative approach with customers, selling services and advice based on the customer’s particular situation and needs. Bankers adapt those services based on changes in the customer’s financial or business lives. The relationship banking approach is premised on high-touch service and product cross-sell. Despite many community banks embracing this model, a relationship-driven bank is challenging to execute well. Some banks state that they are relationship driven but deliver risk-for-pay products. Other banks attempt to provide relationship banking but fail because they may not understand what is involved and how to differentiate from competitors effectively.

Which Model is Best

Many banks can succeed using the relationship banking model. However, success does not occur by happenchance. Therefore, bankers must decide how the relationship banking model can work for their bank on their market, mission, management’s competence, and local competition.

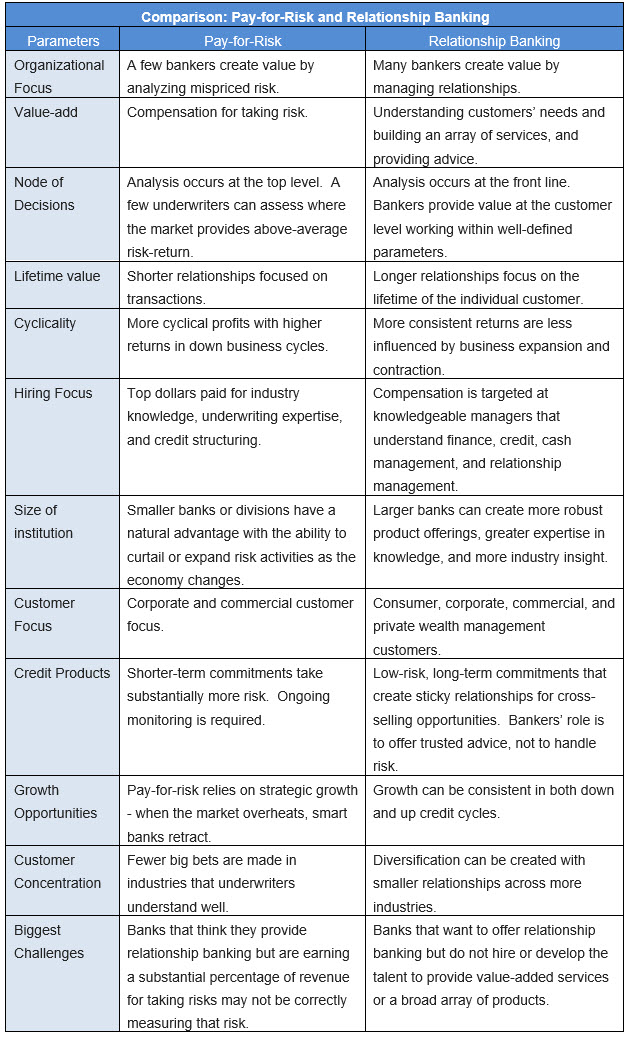

We contrast the two models on various parameters in the table below.

While there are examples of both banking models working for community banks, most community banks achieve greater success with relationship banking because it is not dependent on a few bets made during challenging economic times. Profitability in the pay-for-risk model is much easier in a declining economy because competition for credit retracts. Banks can find opportunities to earn above-average returns for risk. However, in non-recessionary periods, it takes much more effort to find niche markets or customers where risk is priced correctly. Mistakes during these periods lead to bank failures in the next recession.

Conclusion

While community banks almost universally promote relationship banking, the model is not easy to deliver effectively. With the right talent, education, product mix, and executive support, banks can outperform the industry by deploying the relationship banking model. However, community banks must attract, develop, and retain commercial bankers who can offer insightful financial advice supporting the relationship banking model. In future blogs, we will consider how bankers should manage their borrower’s interest rate risk and how commercial bankers may develop this professional expertise and become better relationship managers. Developing relationship knowledge has worked well for some bankers at our institution, and we will share some ideas our bankers have used to gain this expertise.