A Marketing Tool For Lenders – Our ROI Calculator

Commercial lending is more competitive than ever. To effectively differentiate their services, commercial lenders will need to be thought leaders, understand their market and industries, and provide more insightful advisory services. Commercial lenders can differentiate themselves by running return on investment (ROI) scenarios for their borrowers to help them make better financing decisions – especially when comparing buy vs. rent decisions. In this article, we discuss calculating an ROI on the property and provide our ROI calculator to help lenders be trusted advisors.

What is ROI

Return on investment (ROI) measures gain (or loss) on an investment relative to the amount of money invested. ROI is usually expressed as a percentage and the formula is as follows: Net Project Benefits divided by Project Cost times 100. For example, if you can invest $100 and earn a $20 profit, then your ROI is 20%. ROI is typically used for comparing various investments or comparing alternative projects for companies.

Other measures of return are also common, such as return on assets or equity, net present value of cash flow, or time to break even. However, ROI is simple to understand, easy to use, and is a good way to compare investment alternatives.

Why Is It Important for Lenders

Most community bank commercial clients do not have professional CFOs or treasurers. Therefore, while the community customer may be proficient in running his/her business, often they lack financial tools and need help understanding the math. This is where commercial lenders can differentiate themselves from competition. Commercial lenders have the financial background and industry knowledge to help customers understand the financing and the math. A commercial lender can gain a competitive advantage by taking the time to understand the customer’s business, creating an ROI calculator and running scenarios for the customer. We built a rental property template ROI calculator to get you started and it is available to download without charge.

The biggest challenge to lenders in gaining business is that the client decides not to invest in a property, project or business, thus not needing banking services. The lender’s task should be to demonstrate why taking on debt may be the prudent decision for the customer. A well created and objective ROI calculation may be just the tool to gain a new client and to book your next big loan.

Steps to Using Our ROI Calculator

There are five basic steps for lenders to follow in using ROI analysis to help the client make investment decisions. These are as follows:

- Identify borrower investment needs. These can include the business needs of the client, personal needs for investment, payoff requirements for funds, preferences on type of project, amount of funding available to invest, sources of external liquidity, and possible partners and affiliates.

- Identify borrower investment alternatives. A borrower may be considering purchasing a multi-family property, but alternative investments must also be considered – for example, buying a business, investing in the stock market, buying a certificate of deposit, or purchasing art.

- Identify performance needs. What return would satisfy the customer? How much time is the customer willing to devote to the business? How much risk is the client willing to take?

- Run ROI model for various investment alternatives. Various models are required for different types of investments. However, the ROI formula is simple and can accommodate just about any investment alternative.

- Compare the various alternatives based on ROI output. Show the client the ROI for each identified alternative and discuss the pros and cons of each. Use a balance set of measures that consider the ROI, risks involved, amount of investor’s time required for each alternative and length of investment commitment.

Why Purchase vs. Lease

Leasing may make sense for some business owners but there are serious disadvantages to leasing, as follows:

- The property needs to be returned to the lessor at the end of the lease term.

- The lessee does not recognize any appreciation on the property.

- The lessee has less say over how the property is used or developed.

- The lessee cannot rely on steady rent costs.

- The lessee has less control over their business on the property.

Consider that the average manufacturing business sells for 0.5 to three times earnings before interest taxes, depreciation and amortization (EBITDA), a service business for 1 to 4 times EBITDA, and restaurant for 0.5 to two times EBITDA. However, the average real estate sells for an average of 12.5 times net operating income (NOI) (or close to 12.5 times EBITDA), and industrial/warehouse currently sells for almost 17 times NOI. Whether you’re a doctor, restaurateur, farmer, or manufacturer, you will probably have a higher ROI on your bought owner-occupied real estate property than on your business.

Good commercial lenders can run lease vs. buy scenarios for their prospects and explain how ownership financed with bank debt may be the cheapest form of financing and highest ROI for the investor.

Our ROI Calculator

Here is a link to download a specific ROI calculator in Excel used to assess the ROI of an income producing property: Rental-Property-Template ROI SSB 2024. This template is a tool lenders can use with clients to calculate ROI for potential rental properties. The template allows lenders to demonstrate how different input factors can contribute value to the client and thus help the client make an informed investment decision.

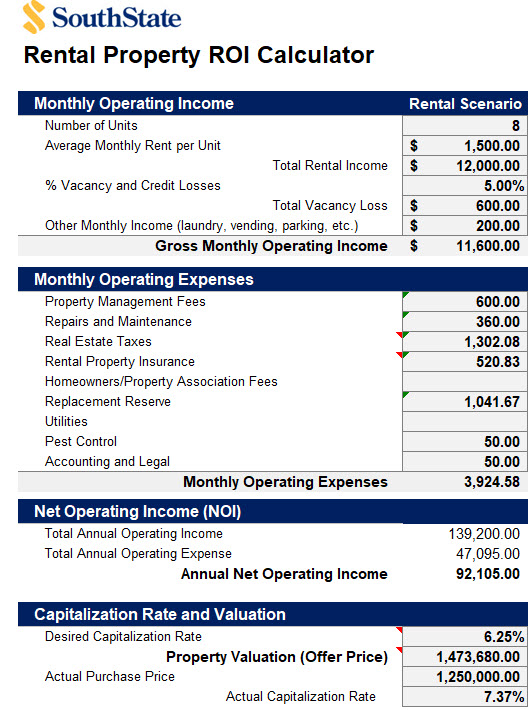

The calculator starts with monthly income, subtracts operating expenses to arrive at NOI. It then uses cap rates to value the property and incorporates various financing options the lender can suggest for the customer. Finally, the calculator shows cash flow, and then ROI measured as cash-on-cash and ROI measured as total economic return (including principal reduction).

This calculator affords the lender an opportunity to inform the client about the merits of rental property investment and provides the lender an opportunity to offer the credit product available for that specific property. While this template is designed for rental property, it is easy to create a template that will fit any borrower project or business.

Conclusion

One important way for lenders to differentiate their services is to add value through thought leadership, advisory services and deep market knowledge. Most community bank clients need financial advice that bankers can provide. If bankers do not provide such direction and knowhow, then real estate brokers, lawyers and accountants will certainly do so. ROI analysis on alternative investments is one way community bank lenders can add value to their clients and gain new business.