The 50-Year Mortgage as a Thought Experiment

The Administration announced that it is evaluating the possibility of offering home mortgages that are portable, assumable and have a 50-year amortization. The goal of these ideas is to make US home ownership more affordable. We believe that there are many other more germane factors constraining home affordability, but these ideas deserve consideration and attention. Most importantly, these ideas help bankers understand what constitutes value when it comes to long-term mortgages.

The 50-year Mortgage

The idea of offering 50-year amortizing mortgage for home buyers has superficial appeal in increasing affordability. Longer amortization periods lower monthly P&I loan payments. Consider that a $400k, 6.00%, 30-year mortgage results in monthly P&I payment of approximately $2,417. Increasing the amortization period to 50 years drops the monthly P&I payment to $2,109, for a monthly payment saving of $308. However, this is only a superficial analysis. Let us know consider all the downsides of the 50-year home mortgage.

- Greater Credit Premium: We need to assume that a 50-year mortgage would have a higher rate than a 30-year one. The spread between 15 and 30-year mortgages is about 52bps. While there is currently no market for a 50-year mortgage, the market currently prices 50-year equivalent credit quality instruments at 40 to 60bps premium to 30-year instruments. Assuming a 50bps premium for a 50-year mortgage results in the monthly payment increasing from $2,109 to $2,257, or monthly savings of $159 compared to the 30-year mortgage payment of $2,417. While any savings serves to increase affordability, $159 per month savings on $400k mortgage is not material.

- Greater Interest: The financing on the 50-year mortgage is vastly more expensive than a 30-year mortgage. If held to maturity, the $400k, 30-year mortgage at 6.00% results in $470k of total interest payments, but the 50-year mortgage at the same rate results in $867k in total interest payments. Assume that the 50-year mortgage is priced correctly to the curve at 6.50% rate, and total interest payments are $956k. When analyzed on interest costs, the longer mortgage is more expensive. And even though most mortgages do not go to full term, most of the interest expense of the 50-year mortgage occurs in the initial 15 years of the loan.

- Lower Equity: The 50-year mortgage creates little equity in a house. In ten years, the 30-year mortgage pays down $60k in principal, but the 50-year mortgage only pays down $15k in principal. And this creates the largest problem for affordability. The 50-year mortgage is riskier because of less principal reduction in the beginning of the loan, which will require greater upfront equity by the borrower to compensate the lender for greater risk. Whatever small monthly savings the 50-year mortgage can achieve is offset by lenders who will require higher down payments, and higher down payments will decrease affordability for most buyers.

The best way to view the 50-year mortgage is as an interest only loan with similar monthly payments but higher required down payment. The reality is that we cannot engineer a financial instrument to fix the housing affordability issue.

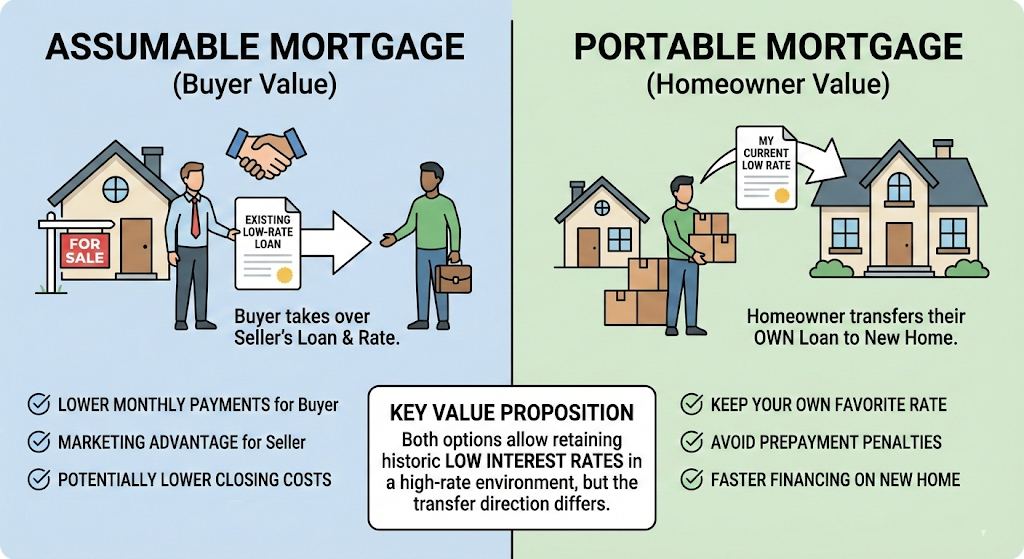

Mortgage Portability

The ability to move your mortgage from property to property (assuming the mortgage rate is preferential to current rates) is not a new idea, and neither is mortgage assumability. Commercial loans have similar features – for instance, the ARC program allows banks to make up to 20-year loans that can be assumed and collateral substituted.

What makes portable mortgages appealing is that it eliminates rate gap (difference between borrowers’ interest rates and current market rates). The pushback to portability is the cost to investors/lenders with duration extension of the mortgage. However, while portability will extend the average life of the loan, investors/lenders should be indifferent if the mortgage is hedged for interest rate risk. Consider the lender accruing hedged interest on the mortgage at an adjustable rate of SOFR plus 1.50%. Without portability the average expected life expectancy of the loan is ten to 12 years, while with portability, the average life of the loan becomes 15 to 20 years. The portable loan earns a constant spread to the banks COF. Further, the longer loan allows for a reduction in LTV – at ten years the $400k mortgage has reduced principal by $60k, but the portable mortgage at 20 years has reduced principal by $176k. The longer instrument (assuming there is no decrease in credit quality and no cash-out financing) is a safer loan.

To make the portability feature market functional, investors would need to include a credit approval clause. This feature ensures the capacity to repay debt, and debt-to-equity ratio stays at acceptable levels. Assume in our example, if the $400k mortgage is ported in ten years to another home, the outstanding balance of $340k and this amount is unlikely to be the new mortgage needs of the borrower. It is more likely that the borrower will need a higher mortgage for the next home. The additional mortgage can be a second loan at the then prevailing rates with a shared security interest in the home or the two mortgages can be blended into one mortgage rate and payment. This is what we currently accomplish with our ARC program.

Some will point out that the portability feature will help homeowners with low interest rates, and there is little benefit to everyone else. But this is not exactly true. Interest rates are cyclical and the portability feature over the long run will be invoked by those buyers who bought homes when rates bottomed, while those buyers who bought homes when rates peaked would walk away from their portability feature and originate new mortgages at lower rates. Further, portability will save borrowers on origination costs. As loans extend, there will be fewer loan resets, fewer mortgages refinanced, and less costs over the long term for home buyers. A loan that can be ported house to house is a valuable option for home buyers that is likely, over interest rate cycles, increase affordability.

Conclusion

While the 50-year mortgage appears to not offer a viable solution for home affordability, portable mortgages add value to homeowners, and over the long term, will lower financing costs and increase home affordability. By identifying the right home buyers, mortgage lenders can structure portable and assumable mortgages where the loan is not collateral-dependent. Portable mortgages will extend the expected life of the loan, reduce friction costs for borrowers, and reduce overall homeownership costs.