Credit Risk in the Time of COVID-19 and the Fed

The Fed did more than cut rates on Sunday; they pumped a massive amount of liquidity in the system, sending a signal to banks to level up. Far behind the health of employees and customers in the COVID-19 pandemic, comes the economic impact. Unlike the recession of 2008, where the economic impact came over many months, this pandemic impacted businesses in weeks providing much less time to prepare and adjust. The result is likely to be bad for the economy and bad for banks. If your bank is treating this as businesses as usual, then you are putting your survival at risk. This is an all-hands on deck moment, and, next to the health and well-being of your employees and customers, credit should be your next highest strategic priority.

What The Fed Moves Mean

In addition to cutting rates to zero on a Sunday, the Fed cut the discount borrowing rate an unprecedented 1.25% to 0.25%, while pumping $1.3T into the system (including today’s injection) for quantitative easing and removing the reserve requirements at the Federal Reserve. The Fed also talked major banks into cutting their share buyback programs and made it clear that all banks should use their capital and liquidity to support households and businesses impacted by the COVID-19 pandemic.

The Fed even went so far as to say that the largest banks can use their capital and liquidity buffers to lend and undertake “other supportive actions” if it is in a safe and sound manner.

The Macro-Economic Impact and Assumptions

To temper our alarmist tone, we are the first to admit that the economy started the year in relatively strong shape. January, for example, was the second-highest on record for retail sales, according to the National Retail Federation. Debt service coverage on loans, while off their 2017 and 2018 highs are still in rarefied territory. In short, we are starting from a place of strength.

Further to this point, the previous inverted shape of the yield curve and the current decline in equities is not necessarily a harbinger of credit disaster. The reality is that only about two out of every three major bear markets have signaled a recession. In the last 100 years, there have been approximately seven times that a major retreat in prices DID NOT result in a recession. However, banks need to tread carefully.

We are at the front end of this credit shock, and it is unknown how bad this will get. Judging by the statistics and the current trend, we will at least follow Italy for the next couple of weeks and see the suspension of many businesses.

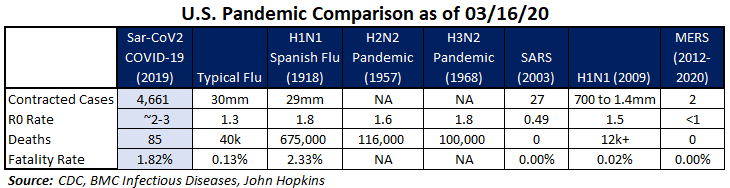

Using past pandemics as our model (below) and adjusting for more global transportation patterns and lower effectiveness of containment, we assume a fatality rate of 0.60% (currently running around 2%) and a 22% infection rate in the U.S. We assume that we learn that you can pass the virus on before a person is symptomatic and that once you have immunities, you are no longer contagious. This scenario results in approximately 429,000+ deaths in the U.S. and we assume this happens in two waves (fall also being a spike), and a vaccine is announced in 3Q to be ready for the 2021 flu season.

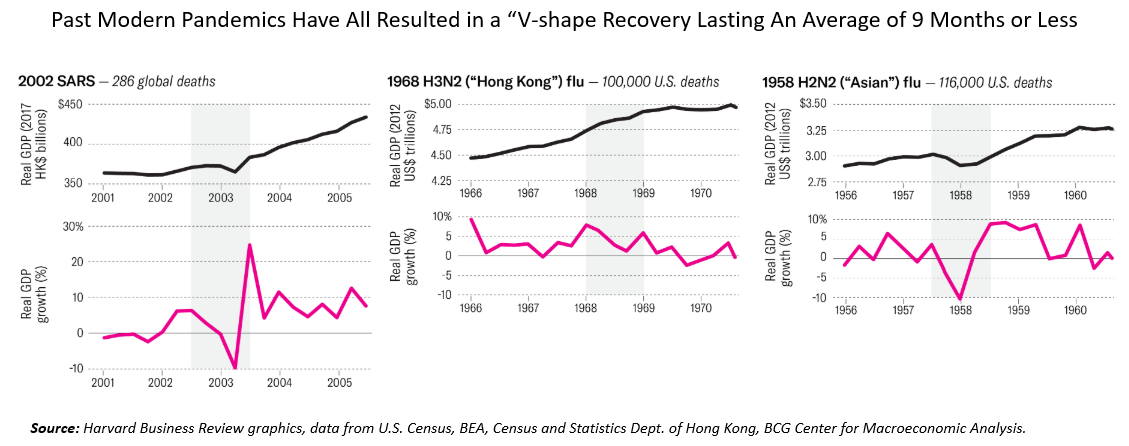

This scenario takes approximately 1.5% off U.S. GDP, which pushes us into a recession for two or three quarters.

The Microeconomic Impact – Our Framework

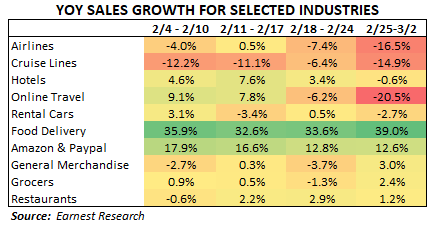

Of course, where the rubber meets the road is on an individual borrower level. The last data set we have was from the last week in February when the economic impact was just starting to be felt, but as can be seen below, the results for some industries, like travel, are devastating. Banks shouldn’t wait for the data and should immediately move to assist their existing customers and attempt to provide relief while at the same time securing the bank’s current position.

To help with triaging communication and capital, we have developed a framework and algorithm that groups customers into various categories and then prioritizes them based on risk and need.

STEP 1: Understand what is happening to demand: Is demand for the borrower’s product or service being impacted, and if so, how. Is demand for the borrower’s products, increasing, decreasing, shifting forward, shifting back, or remaining unchanged. Those companies where demand is shifting down and is not likely to be made up in the future will get the highest priority of resources. Hotels and restaurants are the best examples as once COVID-19 stabilizes, people are not going to travel twice as much to make up for past trips.

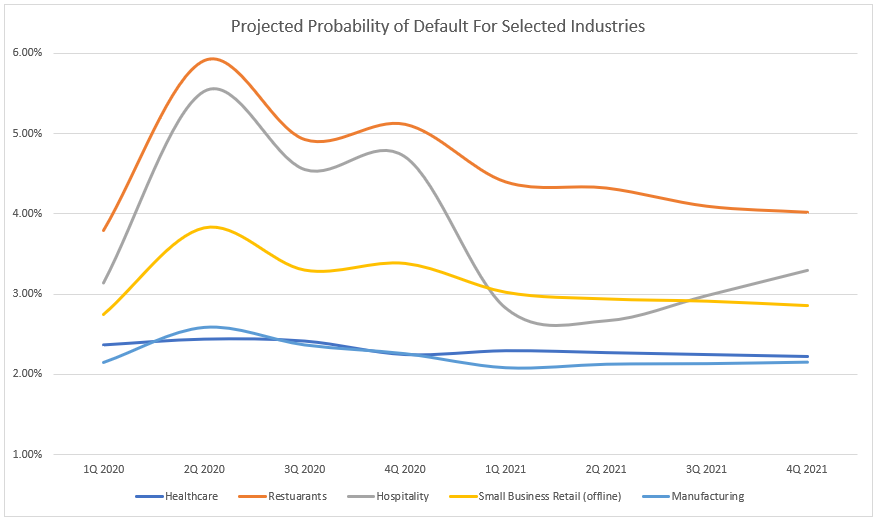

This category of businesses represents the bank’s largest credit risk. Businesses like restaurants and hotels that have few long-term sources of revenue now find themselves facing 30% to 80% revenue reductions and are now chewing up cash flow with relatively high fixed costs. Hospitality credit has had an amazing run, but there is a reason banks have collected 20%+ premiums on pricing over the last ten years. This sector is volatile, and that volatility is now being monetized in the form of steep losses. Since these losses are likely to be the deepest, banks should make this category of risk their highest priority.

Businesses where demand for product increases (e.g., hand sanitizer manufacturers), shifts forward (e.g., grocery stores) or shifts back (e.g., electronics) should undergo another level of due diligence. These credits may need additional liquidity, but since they pose less long-term credit risk, they can be triaged behind those customers where demand shifts down and is lost forever.

STEP 2: Estimate the level of negative and positive demand sensitivity: We estimate how fast demand is likely to decrease and how fast it will return. The more public-facing a business is, the more likely they will exhibit higher negative demand sensitivity. Businesses, like sports venues that have already closed and have very limited revenue coming in and demand that will be slow to come back, should receive the next highest attention.

STEP 3: Determine the borrower’s supply structure: Most credit injuries are a result of falling demand. For COVID-19, however, many businesses will suffer a cash flow shock as a result of supply-side interruptions. These could be disruption of finish goods, parts, or materials from China, or it could be from workers not being able to show up due to infections, quarantines, or lack of childcare. For these companies, the shock should be relatively short-lived and resolve in a “v-shape” recovery. That said, these businesses may need additional liquidity.

STEP 4: Understand the borrower’s current cost structure: We rate each borrower as to their flexibility of their cost structure. Hopefully, this is already in your underwriting analysis, but even if it is, bankers should check to make sure the ratio of fixed to variable costs is still valid. Those industries, such as hospitality and amusement parks that have high fixed costs, will receive the next highest priority for risk management and restructuring. Customers that can reduce their variable costs along with revenue can buy themselves more time.

STEP 5: Look for specialty situations and devote resources to lines of credit: Lines of credit (LOC) merit special consideration and highlight the strength and weakness of having LOCs in the marketplace. Of all the bank products, focusing on working capital line usage should be the priority as they are likely going to be drawn on in this environment, which is exactly the time that banks do not want to increase their exposure. Bankers need to make sure that every line draw comes with a conversation, so at least the true risk can be assessed.

STEP 6: Decide if the business can help with pandemic support: Those businesses that can do the greatest collective good for the community should be given priority. Hospitals should get resources before amusement or entertainment venues.

After walking through each of the six steps, banks can assign a numerical risk score or achieve a rough understanding of which credits should receive a higher priority. Those credits with multiple negative co-factors, such as decreased demand, high negative sensitivity, low positive sensitivity, high fixed cost, and withdrawn lines of credit should receive the highest priority for evaluation.

Post Triage

Starting with the perceived highest risk loans first, every banker should be on the phone talking to every borrower in order to collect and/or verify the information to complete the above algorithm. Note that while it will be tempting do collect the information and then go to work on solving problems, fight the urge. Like any good triage effort, you want to minimize your treatment at first pass in order to collect information and prioritize credit risk. This allows your bank to do the greatest good for the largest amount of risk. No need to spend time on a $300k line to a restaurant when you could be helping a radiology medical group to expand their $2mm LOC to purchase imaging equipment to help with COVID-19 diagnosis.

We are starting to model probability of default projections, and while this may be radically different for your situation, you can at least see the magnitude of expected change at this point in time for some industries that we are tracking (below).

Only after existing loans are triaged, conversations then need to be had with borrowers that expect to go into payment default first, and then those that will go into covenant default.

Bankers need to proactively look for ways to secure extra collateral, guarantees, equity, or cash flow and then discuss how to restructure the loan in order to decrease the probability of default. This might be a payment forbearance, moving to an interest-only structure for a period of time or reworking the amortization schedule, the important part is to bring quality borrowers some relief.

In addition, bankers need to get a handle on business interruption insurance and see if that could be a source of funds and used in covenant calculations while at the same time making sure the bank is receiving proper reporting. The sooner bankers do this, the better as things are likely to get worse in the next six months.

It will be tempting for bankers to wait and see how the situation develops. However, this is not the time to be passive. Banks need to get in front of the recession and put in the extra work now in order to prevent greater issues later. Communication and data are your friends, and the first mover has the advantage.