“Time-on-Task” Should Be Your Dominate Banking Metric

While “customer delight” is a worthy goal, few banks should focus on the concept. We covered various methodologies HERE. Instead of trying to “Wow” your customer, in this article, we present the “time-on-task metric” (and its companion, the Customer Effort Score (CES) framework) and detail not only why it matters but why it can change the course of your bank.

The Problem with Focusing on Customer Service

While every bank says they are about service, few define what that means, and even fewer still have metrics to manage it. If you have not done those two things, then you don’t have a shot at providing superior service as you scale. Because service means different things to different bankers, the effort is often ignored or turned into a managerial mess.

What usually happens is those customers that desire a particular product, such as a 20-year fixed rate loan, or a certain level of service, go elsewhere. The bank ends up with a group of customers that either doesn’t require superior service or that put up with the level of service because the bank provides some other value, such as credit or geographical convenience.

A bank like this often does an occasional survey confirming its bias. Management pats themselves on the back for their above-average scores, never understanding the customers that never came to their bank, left, or the referrals they never received. The bank limits its growth potential and is ultimately acquired by a bank that provides better products and services.

The Problem with Measuring Customer Service

Of course, some banks do define customer service and do measure it. If done right, it can not only be a proxy for the customer experience but can provide insight into where to improve.

On the other hand, some banks, like a major national bank, focus on their “Net Promoter Score” and often end up with worse customer service than without it.

A recent mystery shopping outing resulted in the banker letting us know he was going to “delight us” with his service, only to take 20 minutes to accomplish a simple task and then require two other bankers to get involved. At the end of the encounter, he let us know how they are measured on this rating system and if we can’t give them a high score, to let him know why and he will correct it.

Time-on-task is more quantifiable, less easy to be gamed, and more indicative of a factual outcome.

The Problem with Wowing Customers

Wowing customers consistently is difficult. First, it takes continued creativity. While giving away free chocolate after a branch transaction is easy, it’s harder over mobile and harder to keep coming up with new ideas.

Consider that a Harvard Business School survey showed that 89% of customer service managers stated their primary strategy is to exceed customer expectations. Ironically, 84% of customers said expectations were not exceeded during their last interaction.

Banks expend a bunch of effort, and the data shows it doesn’t matter much. Delight only matters if your bank can do the basics well. While customers appreciate the effort of delight, they leave, refer, or buy other products based on how happy they are with a brand and service.

In a Harvard Business School study of 75,000 people, participants were asked three questions:

- How important is customer service to loyalty?

- Which customer service activities increase loyalty, and which don’t?

- Can companies increase loyalty without raising their customer service operating costs?

Two findings came to light that every bank should consider. Delighting customers doesn’t build loyalty; making it easy to transact business does. Second, if you make things faster for the employee and customer, customer satisfaction improves, service cost drop, and customer retention increases.

Most banks that measure customer service utilize a customer satisfaction (CSAT) score. Unfortunately, repeated studies fail to draw the connection between how instructive the CSAT is. Consider that 20% of “satisfied” customers say they intend to leave any bank, while 29% self-report being dissatisfied but intend to stay.

Think of service delivery as a teetertotter with the customer on one side. On the other is a large bucket of water. A customer comes to your bank because of proximity, loyalty, brand, and, hopefully, products. The quality of ongoing service has very little to do with acquiring new customers.

However, once that bucket is filled up, since the products and services are not all that different between banks and rarely change, it’s challenging to get new water in. While the quality of service does not significantly impact the water going in, it has a considerable impact on the water going out. That bucket gets emptied every time frustration occurs with the bank until, finally, the customer’s weight tips the balance in that direction, and the customer hits the ground and leaves.

Customers come for the brand but leave because of service.

Time-on-Task – Your Best Metric to Focus On

Instead of bugging your customer with customer satisfaction questions, use this principle as your NorthStar:

Reduce the time it takes the customer AND employee to solve problems.

That’s it. It is a simple formula – Take every process in the bank, clock it and then figure out how to reduce “the total time-on-task.” If you are choosing between two vendors, select the one that results in the fastest total time spent by customers and employees. Speed becomes a proxy for satisfaction. While it doesn’t always translate exactly, it does more than 90% of the time.

Improving this internally means creating a new process, leveraging technology, leveraging data, and imparting an easy-to-figure-out total experience design. Do this, and you have a recipe for long-term success.

The faster you make the process; the higher your satisfaction will go.

One tremendous advantage is that the directive of improving the time-on-task is easily quantifiable, measurable, and trackable. Tell an employee to “delight the customer,” “make it easy,” or “exceed expectations,” and they flounder. Even if you can lead by example, that example will soon be lost across geography and time.

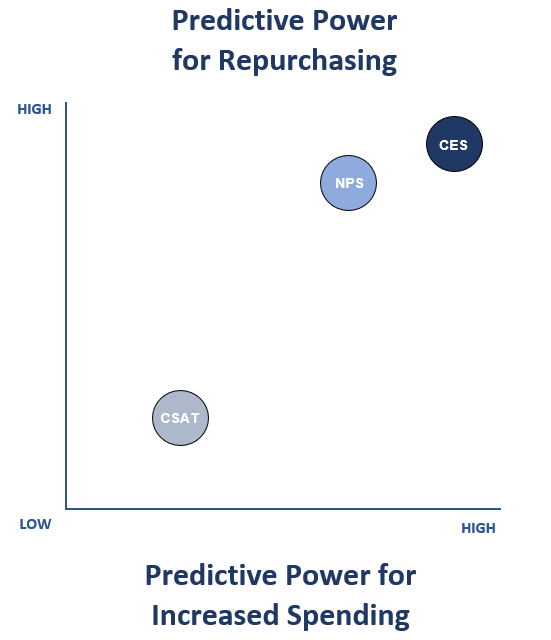

Harvard Business School (HBS) did a study to confirm this where measured problem resolution across channels (having a problem on mobile and having to contact the call center, for example). After each interaction, customers were asked to score their effort on a scale of one to five. They correlated the score to the reuse of the product. What they found is that the Customer Effort Score was a better predictive measure than both the Net Promoter Score and Customer Satisfaction Score.

Using Time on Task

While there are many important metrics in banking, none we feel are more important than creating a better customer and employee experience. While that is often hard to measure, measuring the total effort by aggregating the time it takes the customer and employee to complete a task is one of the best ones a bank can focus on.

Net Promoter Score has a limited place because of its limited value. Since we are awash in data, there is little need to measure intention when we can measure behavior. Utilizing the time-on-task or a Customer Effort Score is a measure of behavior.

Similarly, customer satisfaction is an attitude culled from past experiences. It is not all that predictive of revenue or loyalty.

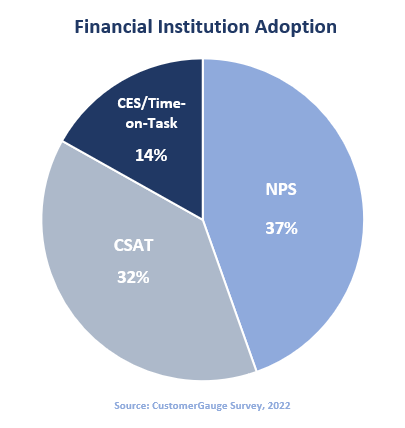

Of those financial institutions that use some service tracking metric, less than 15% of financial institutions utilize any metric around CES or time-on-task, according to a recent study (below). This could be your bank’s easy metric to manage and reduce the time customers, and employees spend on tasks. The time it takes to complete a process is immediately actionable. You can break down each part of the process and see where the bottlenecks of time are.

Time-on-task can be applied to any employee or customer effort – opening an account, handling a complaint, sending a payment, or walking from an ATM to your car. Reducing time-on-task or improving the CES can result in greater satisfaction for both the employee and the customer, leading to better retention and profitability.

In a future article, we provide further insight into reducing time-on-task as we attempt to improve various processes and product design in banking.