Defi, Blockchain, Babies and the Future of Banking – Part I

Today, the President’s Working Group released its long-awaited report on cryptocurrency (HERE) and the use of stablecoin in the payment system. The report gives a prominent role for banks causing many bankers to celebrate while others are left wondering what it all means for the future of banking. If you seek a working knowledge of defi (decentralized finance), blockchain, crypto, payments, and what it all means to your strategic plan, it first helps to understand the care and feeding of a child. In this article, if you stick with our tortured analogy, you will better understand these topics than the average attendee at Money 20/20 and most bankers in the industry. While intellectually interesting, this knowledge is critical to position your career and your organization. Banking will radically change in the next 36 months, much like a parent’s life when bringing home a new child.

Babies as a Store of Value

You bring a baby home from the hospital, and that baby has a specific value whether you like to admit it or not. To an average stranger that hasn’t focused on your baby, there is no value. It is not worthless; the stranger has never assigned value and doesn’t think about your baby. To the bachelor in the lobby of the hospital, that crying baby may represent negative value. To the parents, the baby has infinite value. The truth is that baby’s value is somewhere in the middle of being negative to unlimited, and it varies from moment to moment and from a person’s viewpoint. That baby has a series of attributes, states, and uses, all built on DNA, the human code. A baby is like a modern cryptocurrency (crypto) that is built on a programable blockchain.

Messaging: The Care and Feeding of a Baby

When you bring a baby home, and it’s under the supervision of its parents, you don’t write any instructions down to start. Parents semi-know how to handle a baby from siblings, friends, books classes, friends, and lore. Within the home, or “ecosystem,” both parents tend to communicate verbally and don’t write instructions down for each other as they pass their newfound bundle of joy back and forth. After a couple of weeks, however, instructions about the baby are passed when the supervision of that baby is passed. These instructions are often limited and passed on via text or Post-it Notes as in, “3 am feeding.”

That baby, within the house, is similar to a payment. A payment is comprised of two layers – a transfer of value and a message. Within a bank or ecosystem, the message is short, “dumb,” and usually consists of the amount, the sending account, the receiving account, and a timestamp. A customer gives instructions to move money from Account A to Account B, and it is done not by looking at a set of instructions and not by reading all the steps attached to each transaction but by a shared culture. No one really sees a message.

However, when payments move outside the bank, longer instructions are needed.

Dumb Babies and Dumb Messaging

When that baby is handed off to a grandparent, there is a transfer of value and instructions. Here, instructions are more in-depth and maybe short to the Mom’s mother or are several pages to the father-in-law. This is analogous to an ACH or wire transaction, as there is more room for messaging.

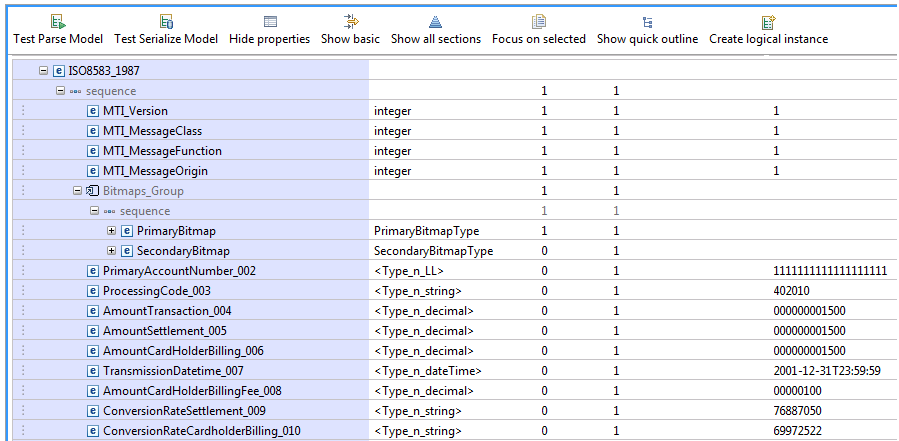

The payment channel with the best messaging are credit card payments using the ISO 8583 standard (above), which includes not only all the details of the transaction itself, but metadata about the transaction such as the product code of the item purchased, which terminal was used to process the transaction, the expiration of the card, and some 125 other lines of information.

For a debit card, this may be a single message, but like the mother calling to provide pre-instructions to the babysitter, that message may be in a “dual” format which is common within the credit card channel. The first message gives the basic information to authorize a transaction, while a second message may occur minutes or hours later to transfer the rest of the information and complete the transaction before the value is passed.

Unfortunately, this messaging hasn’t changed since 1987 and is limited as to both format and amount of information that can be crammed into that message. Because the messaging and transfer of value don’t take place at the same time, problems can occur. The whole success of the credit card industry arose because of this longer messaging standard, you could trust the person on the other end to carry out the instructions, and you would have confidence that the exchange of value would occur according to your intent and instructions.

Our current payment system is like a six-month-old that is about to grow up.

Smart Children and Programmable Money

As that baby grows into a child, it can start to pass on its own instructions. That is, that kid becomes a walking, talking store of value AND a message. You don’t need to write a long list of instructions when passing a five-year-old to school as they know what to do with a five-year-old, and the kid can talk for themselves.

More to this point, that child can not only pass on an unlimited amount of information before, during, or after a transaction, but it can LEARN over time and be able to provide more accurate instructions going forward.

This is a major change and represents a whole new way of handling that child and, by analogy, payments.

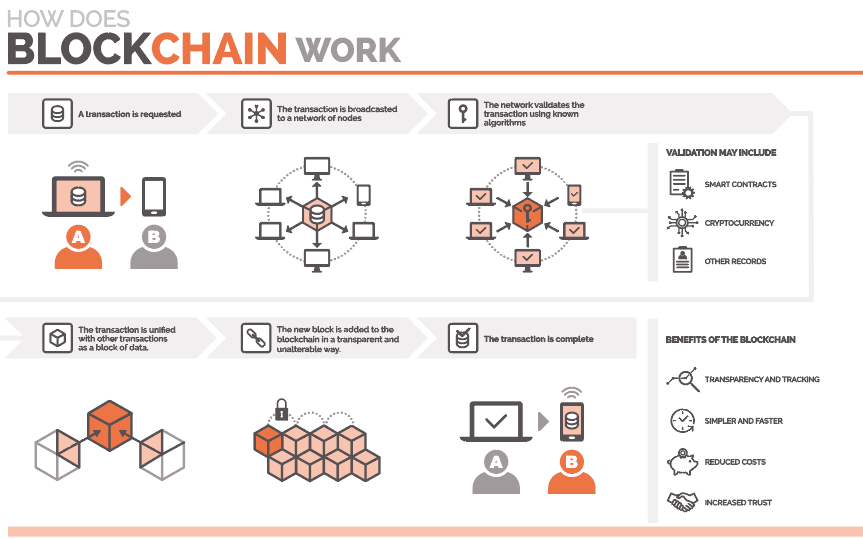

That young child represents the current state of crypto payments. Crypto is the store of value that is built on top of a blockchain, our distributed ledger, and that chain has its own core language (analogous to DNA) plus an additional language layer (analogous to English) to better help communicate. Not only can those language layers handle more complicated instructions, but those instructions can evolve over time according to their code and ability to handle machine learning.

Because the payment and message are the same, once you accept the transaction, you no longer must worry about trust, if the counterparty has the funds, how to get the data around the transaction, and the settlement of the transaction. All is taken care of in one bundle of joy. Risk is dramatically reduced, and payments become dramatically efficient. The asymmetry of handling trust, messaging, and settlement is gone. You don’t need an exchange or a certain transfer system like Fed Wire, you just need two willing parties.

The Fall of Risk

Not only does a significant layer of risk get removed from the system, but because the instructions and procedures are programmed into the blockchain, they cannot be changed and can be audited by anyone. This means not only can you no longer hide a transaction by using cash or by transferring value outside the banking system by using a numbered account or paying in diamonds. A blockchain transaction is fully traceable and easy to find. Equally important is that code that controls the settlement is without bias. The code to manage and settle that value doesn’t know or care if you are black, young, female, or live in Zamunda. If there ever is a bias in the code, it would be easily found and corrected.

While much of the crypto world remain anonymous, that is only because we allowed this to happen. While the transactions are not anonymous, the identity of counterparties is often shrouded. By tying the transaction to an identity such as what Coinbase and other exchanges do, the risk of fraud and bad actors is significantly reduced. Without material risk, a huge friction point in currency, payments, and the sanctity of collateral gets removed.

The Value of Data

The last piece of the puzzle is data. The ability to customize the transaction message allows the ability to transfer new troves of data. Not only can you encode all the transaction and counterparty information, but you can automatically capture information such as the weather, who else owned that store of value, how often that value changed hands, and all the conditions that needed to be satisfied around that data. Society, unhampered by technology, can now set the level of information that the blockchain should contain according to its need for security, privacy, and usability.

Not only does the additional data help to reduce risk, but it is a treasure trove for marketing or to help improve a customer’s experience.

The Disruption of Defi

The potential disruption of crypto and the blockchain cannot be overstated. The whole reason for the card rails gets eliminated since you now have trust, good funds, a method to transfer value, and unlimited messaging. Of course, banks are at risk as well. Since you don’t need settlement, you also don’t need a bank. Value can transfer instantaneously without a fiduciary. This can unlock whole strings of value.

You don’t need a stock exchange to help issue equity, you don’t need a record label to fund a new musician, and you don’t need a bank to hold your deposits, make a loan or handle your trust account. It is the Wild West of finance once again.

The Invoice Use Case

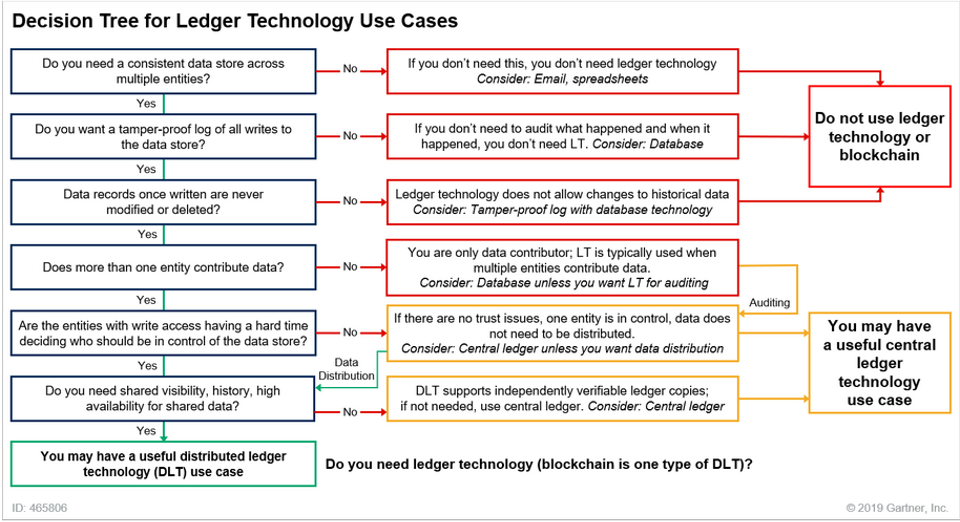

Not every bank product needs to be on a blockchain but some will greatly benefit from it. Below is a common algorithm that we like to refer to in order to figure out when a simple database will work or when a distributed ledger on a blockchain is best.

The decision tree above can highlight an unlimited amount of new products banks can create. To better understand defi, consider two use cases that highlight the value of using blockchain.

The simplest use case for smart contracts built on the blockchain to understand is for invoicing. Invoicing and payments are now separate. At present, there are fintechs that can issue an invoice on a blockchain that not only contains all the transaction information but it can be amended. Thus, customers no longer must figure out what invoice goes to what purchase and the details around payment since it is all one and the same.

By looking at the blockchain via a web browser or app, all the information will always be at your fingertips. More importantly, the invoice can be amended. Thus, if you factor in or sell that invoice, you no longer have to worry about ownership as the buyer of the receivable will be the undisputed owner, but the new owner doesn’t have to rely on the original seller and buyer to handle payment. Certain conditions, such as the delivery of goods, can be built into the blockchain, and the code can check who should get the transfer of value. If that receivable is sold five times, it is updated with five sets of payment instructions, so when the original purchaser makes a payment, it automatically goes to the owner of that invoice. Factoring becomes much less risky.

The Mortgage Use Case

The other major use case that is already prevalent is the settlement of a mortgage. Any time you try to settle a real estate transaction, there are hundreds of conditions that need to be met. The borrower, for example, can’t have a material adverse change in credit from the time of underwriting; you need to have a clean title, you need to be in compliance with hundreds of laws, agreement on disclosures, you need insurance, you need good funds during banking hours, you need to record title, and you need to confirm the release of funds. With a smart contract, all these conditions can be automated so that the code checks with the title company to make sure you have an unencumbered title, it checks with the insurance company to make sure the property is covered, and so forth.

Using blockchain allows much cheaper and faster transaction closings, a closing that can happen any time of the day to include weekends. What is more, the transaction can be quickly audited, so if you are going to sell that mortgage in the secondary market, the due diligence and transfer can be instant. Banks and firms that have already done this have recognized more than 100 basis points of cost reduction. Through the use of the blockchain, underwriting and securitizing any asset become materially more efficient.

The Growth of New Bank Products

While the future of defi may seem bleak for banks, it is not. Smart contracts combined with crypto will shortly become ubiquitous. Banks like JP Morgan Chase and community banks such as New York Community Bank already have working applications as to the above. In addition, several banks have trade finance products built on a blockchain. There are approximately 200 banks currently moving to crypto and blockchain, and innovation will continue to explode.

Banks are now free to build their own value construct into their payment, credit, trust, wealth, mortgage, and fiduciary channels. Banks still have the advantage of trust and still have the ability to leverage an asset eight to ten times. After the release of the President’s Working Group on Financial Markets Report on Stablecoin, its clear that banks, because of regulation are the preferred party to usher in this new era of finance. Banks can remain relevant if they so choose, but innovation needs to start now.

There are a whole host of products yet to be invented that banks can play a central role in.

Payroll companies, for example, will start to pay their workers on a daily basis with the automated approval of their employers. “Card controls” will be replaced by “Smart Credit” so that credit will be extended based upon an unlimited amount of dimensions to include the type of payment, amount, time, location, person, or if the temperature is over 80 degrees. Trade, healthcare, manufacturing, municipalities, utilities, and a whole host of industries will see transaction costs drop along with risk.

Payments will be able to be set up that will be bank agnostic and across the span of time. A household might want to pay for college in a smart contract for reduced tuition, and payment will be pushed to the college every quarter for four years if certain conditions are met, such as enrollment. Should the household change banks, the smart contract will automatically be updated.

In a twist of irony, banks will start charging for the DELAY of payment while certain escrow functions are performed (like in our mortgage example) since real-time settlement will become the norm.

“Embedded finance” will continue to grow, and banks will no longer have just human customers but will have the “Internet of things” or objects conducting transactions. When your car needs service or your refrigerator needs milk, it will just order it and charge your account. The counterparty initiating a transaction will be a piece of software often contained on the cloud’s “edge” and not in a centralized location. “Edge computing” will be common, creating new architectures for banks.

The Rise of the Bank Coin and Central Bank Digital Currency

To facilitate 24/7/365 transactions, banks will develop their own “coin” or cryptocurrency. The coin will be a “stable coin” or a crypto-backed one-for-one with the U.S. dollar. Each bank will hold the dollars in reserve so that its crypto coin can be exchanged for U.S. dollars at any time by its customers. This “closed system” is usually the first step in transferring value between a bank and its customers.

The next step is to handle payments within a “closed network.” Here, there are currently four or five “consortiums,” or groups of banks, that have agreed to exchange stable coins with one another across the consortium’s network of banks, bringing more liquidity to the system. Next, open networks will soon be formed as entities like The Clearing House or Early Warning Services, the managing consortium of Zelle, and stable coins will be able to be exchanged between most banks.

If all this sounds vaguely familiar, it is as it is how our present-day monetary system evolved. During the early and mid-1880’s we had the same set of problems and developed the same way, with each bank issuing its own banknote that represented a store of value. Bank consortiums soon evolved to take other banknotes, and by around 1865, there was a national currency that could then be traded. With federal, state, and individual banknotes flying around, it was confusing, and liquidity was often thin.

The liquidity problem was finally solved by the creation of the Federal Reserve in 1907, and now any holder of U.S. currency could exchange their paper note for value to include gold or a deposit with any bank of its choosing. We highlight this history lesson as it is the reason we believe the evolution of crypto will follow a similar path. Ultimately, we will see a U.S. Central Bank Digital Currency, “CBDC” (discussed HERE).

Next Up

In Part II, we will discuss some of the more popular bank blockchains, how banks will manage multiple blockchains, some other products that can be created on the blockchain, and how banks should prepare for both using their stable coin and a CBDC.

Just like a child takes care, feeding, a lot of love, and education to grow into a productive adult, so does blockchain, crypto, and defi for banks. Banks need to get started on these innovations and figure out a plan on how to best leverage them. How much to invest, what products to start with, who to partner with, and what talent is needed are just some of the questions that should be answered in the next year.