The Recency Trap and Building Deposit Balances

One of the lessons that was driven home at the recent American Banker Small Business Banking Conference in Nashville was the difference in marketing between large national banks and community banks, particularly deposit marketing. Most national and regional banks allocate marketing resources to recently acquired customers to get them to build deposit balances and purchase other products, while most community banks do not. Many banks fall into the “recency trap.” This article explores the recency trap and discusses how to prevent it.

The Recency Trap in Banking Background

Consider how much of your bank’s operating, sales, and marketing effort is spent acquiring new customers versus growing your existing customers. If you are like most banks, 85% of your effort is not directed at increasing product usage. That is a problem because when you look at conversion rates for bank products, the highest is among those customers that are in your top 25% of profitability. There is a tendency to overlook these customers since they are already where you want them. However, profitable customers to your bank are likely profitable customers to other institutions as well. These customers often spread their banking relationships and likely have more deposit balances to bring over or more banking needs to be met.

The conversion rate is the success rate at which a sales or marketing message is delivered and the percentage of the total targets that convert or complete the desired action. The Recency Trap is the misguided thinking that once the customer is acquired and onboarded, you can celebrate and move on to the next customer. This is especially true if the customer is already in the top quartile of profitability.

The data would indicate not marketing to a new customer is a mistake. The best time to sell a customer is right after they become a customer. As we wrote about HERE when we showcased our favorite non-rate marketing campaigns, this is one of our favorite deposit-building tactics.

The Time Since Purchased Data

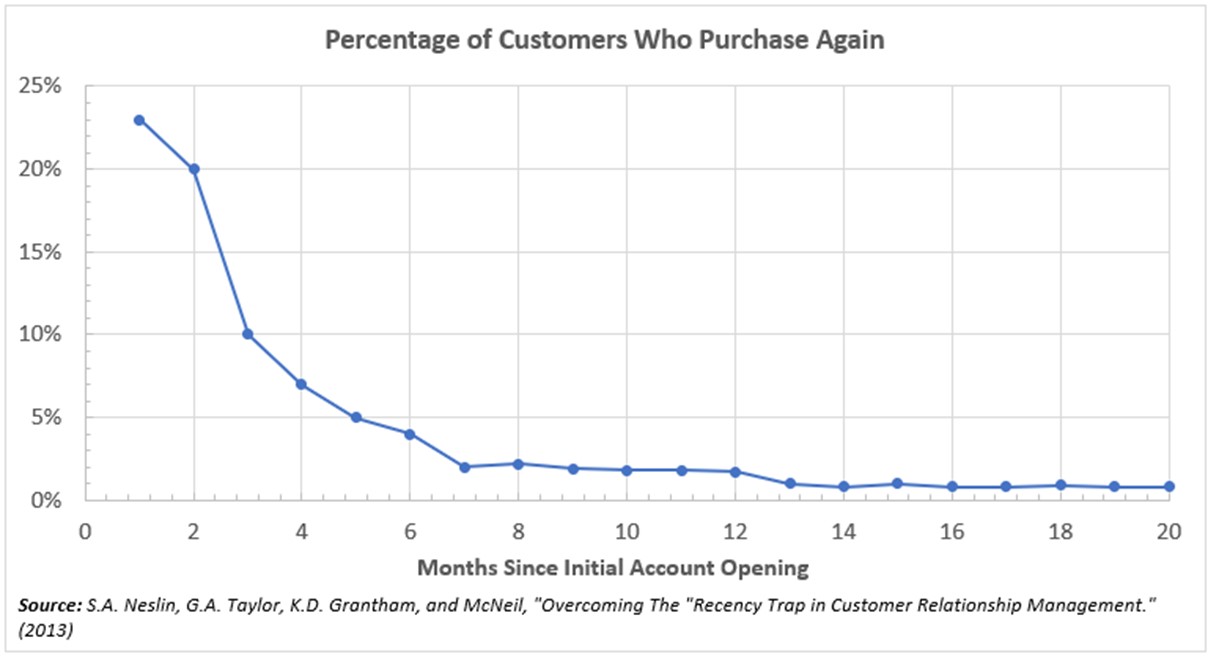

Regional and national banks track the “Days since last purchased” as a marketing key performance indicator (KPI). There is a reason for this. As most data sets indicate (below), customers are more likely to purchase another product or add to their existing balance right after they open an account or purchase another bank product, such as a mortgage or wealth management investment.

As you can see, one of the highest conversion rates is to take an existing deposit account and give customers a reason to add to their balances. Saving for retirement, vacation, college, business expansion, tax liability, or reserve accounts are all successful promotions banks have run to execute on this principle.

The converse to this principle is also true – the longer you wait, the harder it is to sell a new customer a product or to get them to build deposit balances. This effect can be dramatic. There is a substantial difference in the probability of purchasing after the third, sixth, and seventh months from the initial onboarding. Tracking this data at the customer level should not only drive marketing campaigns but also be part of the 360 degree view of the customer in the bank’s customer relationship management (CRM) system. In this manner, every bank contact should have knowledge of the time since the last purchase so that if the customer is within seven months of the last purchase, bankers should be more sensitive to listening to the customer’s needs in order to be more successful at conversion.

Getting Customers into The Habit of Banking

Banks planning marketing campaigns should look at their (or our) data on past responses to determine which customers are most likely to react favorably to a deposit promotion and then spend their resources accordingly. Given where rates are today, a bank can increase customer (and franchise) value by hundreds or thousands of dollars per customer by marketing other non-maturity deposit accounts such as health savings, 401(k), business savings, or other long-duration liability products after a customer opens a new transaction account.

Customers that take out loans, should automatically be marketed for a transaction account in order to make it easy for them to make monthly loan payments.

Bank engagement is a habit. Too many bank products don’t lend themselves to consistent engagement, which is where bank product design and marketing should come into play. While many customers will remain engaged after a purchase, many more will not as they move on to other life challenges. In short, customers often get out of the habit of banking. If banks forget about these customers, then it is likely that these customers will forget about the bank. Your job as a banker is to find ways to keep customers interested. This is done through education, gamification, product design, and marketing.

Recency Trap Experiment

Of course, please don’t take our word for it. Successful banks are consummate testers and are always experimenting. A recency marketing test is an easy and inexpensive experiment that could uncover tremendous value.

Any bank can quickly test the value of recency marketing. A bank easily has the data to create its version of the above recency curve. Banks can start by extracting the account opening date and then plotting the elapsed time. Then, banks can establish a control group and a test group of customers drawn from the front and middle of the curve who ordinarily would be ignored. The bank can then record conversions as they market to this test group. Banks will need to do this for some time to remove the seasonal effects, but no month has higher recency conversions than January, so the start of 2024 is the perfect place to start.

Banks conducting this experiment should increase franchise value and become more adept at testing, listening, and using the data to drive value on par with national and regional banks.

In a future article, we will discuss refining the above methodology to improve conversions.