The Top 20 Deposit-Rich Industries for 2023

In the quest for deposits, one successful tactic at top-performing banks is to target the right types of customers. While desiring to bank everyone in your community is noble, it can be a poor use of resources. Some customers offer better returns because they use more banking services and have more deposit balances. Not to say you want to ignore parts of your community, but why not focus more of your resources on those industries that will make your bank more profitable? In this article, we look at 20 deposit-rich industries that have above-average profitability.

Not All Companies Are Equal – Some are Deposit-Rich

As they say, if you want to catch fish, you must go to where the fish are. The same is valid for deposits. If you need deposits, before paying a high rate on your CDs, why not go after the customers with more significant deposit balances? Not only will you be able to gather cheaper deposits, but the performance will be better as rates go up. To top it all off, the customer lifetime value is hundreds of times greater for a customer niche than it is for a CD-only customer.

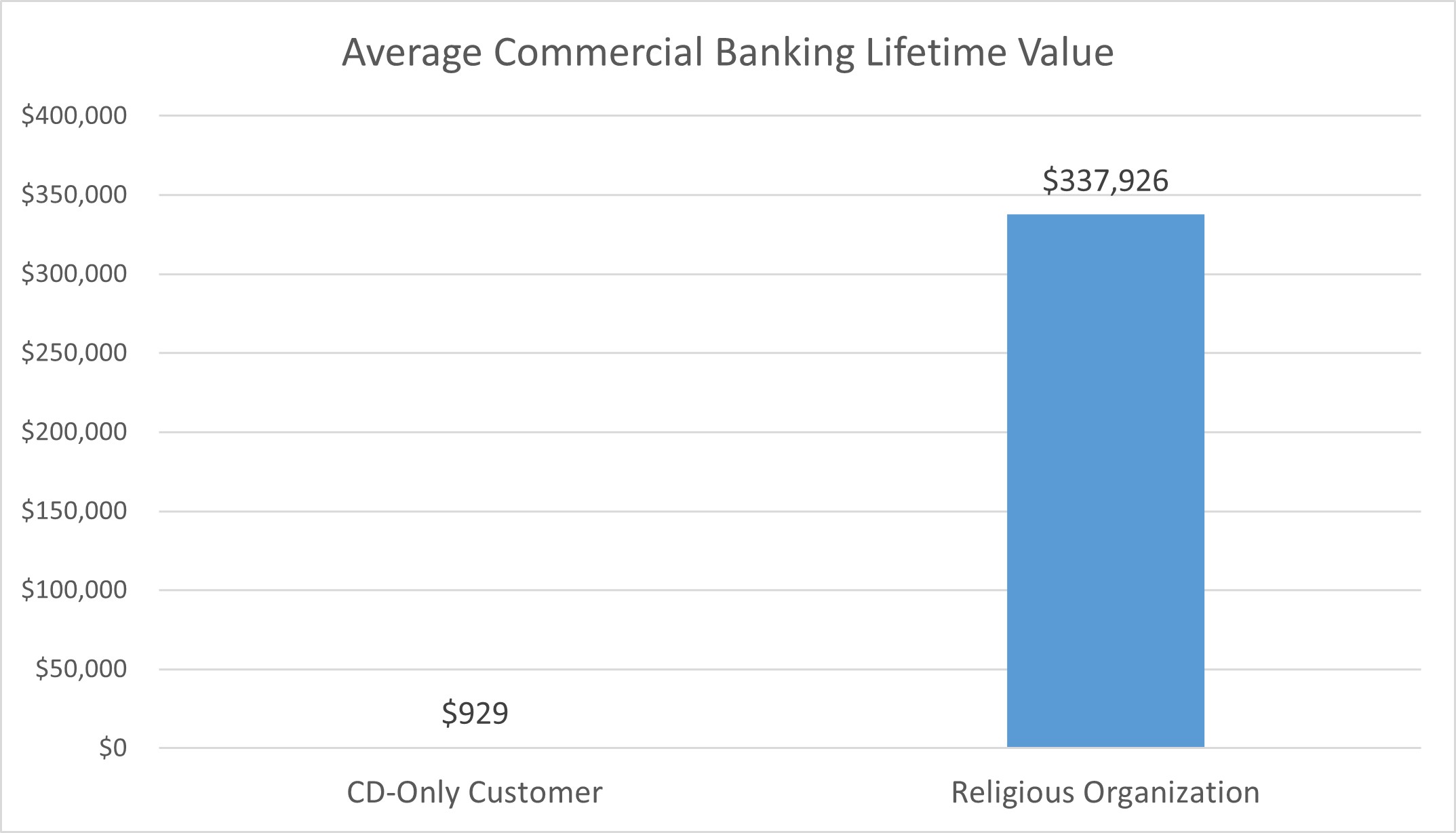

The graph below compares our data for a customer that uses only a certificate of deposit compared to a customer that falls within a commercial niche such as faith-based accounts. While banks lose money on many CD-only customers, and CD-only customers have a relatively short average life, a niche customer, such as a church, is almost always profitable because the bank has much higher retention rates and the average niche customer uses an average of four bank products.

Increasing Deposit Balances and Profit

Consider this case study – customer acquisition costs for a company that provides security guards and patrol services are about $8,000. That figure is approximately the same cost as targeting a trade organization. The average security company has about $80,000 in deposit balances, while the average trade association has about $501,000 in balances.

Since the time of acquisition, the cost of acquisition and the overall effort are about the same, so why not target state and national trade associations?

They are also more plentiful. While there are approximately 4,400 independent security firms in the U.S., there are more than 8,000 trade associations. Almost every trade association needs a checking and savings account, a money market account, debit/credit cards (and processing), remote deposit capture, RTP/ACH/wire services, bill pay, health savings, and 401k services. Why spend your resources on paying higher rates when you can put that capital into sales and marketing to specific deposit-rich customer segments and see a much better return?

Top 20 Deposit-Rich Industries

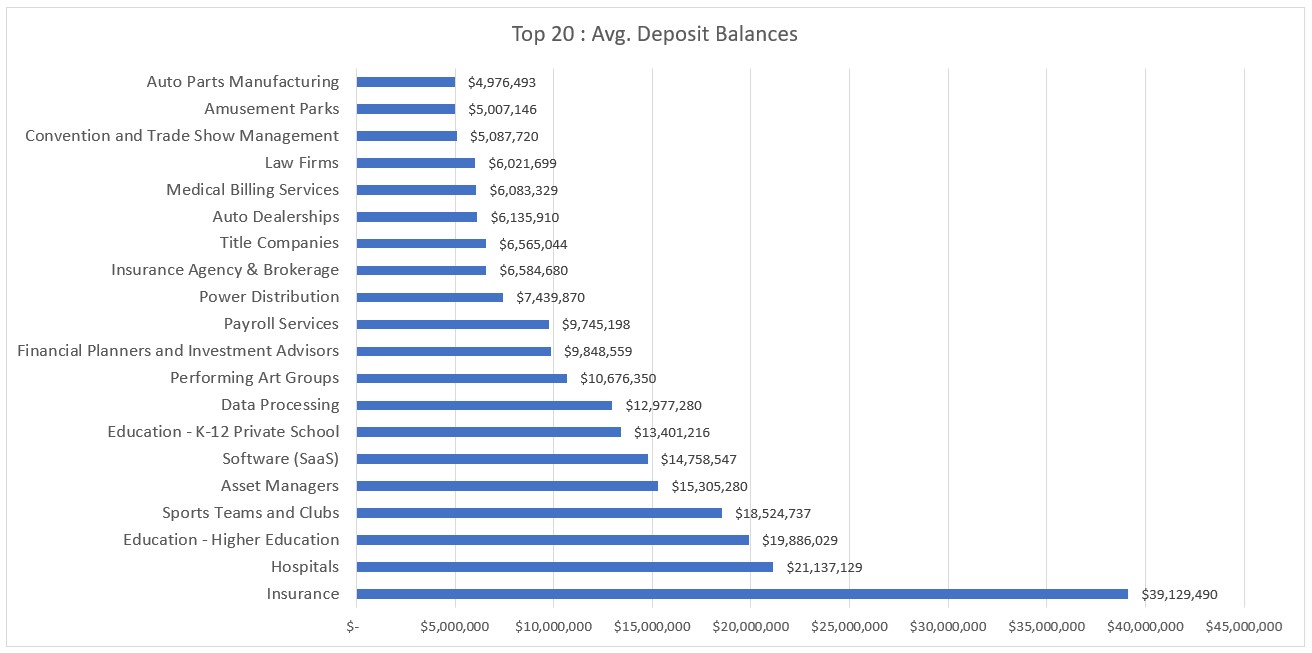

Using the data we have, we looked at some major industries that have above-average balances that community banks have had success with in the past. While many banks know about and have specialties in industries like the legal field and labor unions (there are whole banks devoted to these niches), there are many other overlooked customer segments in that few banks have specialties.

Further, we point out that there are many other specialties such as family offices, money service bureaus, holding companies, and political entities that we either don’t have the data for or are not categorized as “industries” but would be included among the customer types that are deposit-rich.

Below are our estimates of the top 20 deposit-rich industries based on growth projections for next year:

Putting This Into Action

Before you start raising your rates on CDs to attract deposits, consider developing a focus on a particular industry. To have a niche, you need specific marketing materials, at least one dedicated person, some industry knowledge/experience, and a plan to specialize in a customer segment. Any time you believe you can get 15 or more customers over three years in a particular industry, it is likely worth having some dedication. Banks can start small with one or two niches depending on their state and then grow their focus. Banks can combine niche marketing with our three rules around getting your deposit promotions right HERE.

Not only will your bank find it easier to bring on more deposit balances, but profitability will increase, and your cost of acquisition will drop as your bank gets known within the industry. While you don’t need to turn your whole bank into a specialty bank, 2023 is an excellent time to shift some resources into this effort and grow your deposits through the strategy of targeting deposit-rich industries for operating accounts instead of using the brute force of paying higher interest rates across geographies.