Use This Conversion Tactic for Building Deposit Balances

Take a second to think about how much of your operating, sales and marketing effort is spent acquiring new customers versus growing your existing customers. If you are like most banks, 80% of your effort is not directed at increasing product usage. This could be a problem because when you look at conversion rates for bank products, the highest are in those loyal customers that already use a product – they just don’t use the product to its fullest extent. If you are looking at building deposit balances, consider the below tactic.

Understand Conversion Rates When Building Deposit Balances

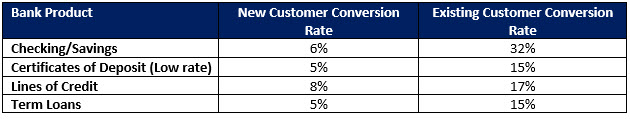

The conversion rate is the success rate in which a sales or marketing message is delivered and the percentage of the total targets that convert or complete the desired action. Here are some common conversion rates that compare qualified potential new customers (via web, email, direct sales, etc.) and existing customers for popular bank products:

As you can see, one of the highest rates of conversion is to take an existing deposit account and give retail or business customers a reason to add to their balances. Retirement, vacation, college, business expansion or acquisition are all items that households or businesses commonly think about but don’t act on unless they are reminded and have a clear path.

Asking Existing Customers To Convert in a Timely Manner

Banks that plan marketing campaigns should look at their (or our) data on past responses to figure out which customers are most likely to react favorably and then spend their resources accordingly. Next to marketing to existing customers, the other bit of low hanging fruit is recent activity. A customer is more likely to convert if they are recently familiar with the bank and product and they are satisfied with the service they are getting. This formula is the reason why millions of community bank customers sign up for a debit card or bill pay and then don’t use it.

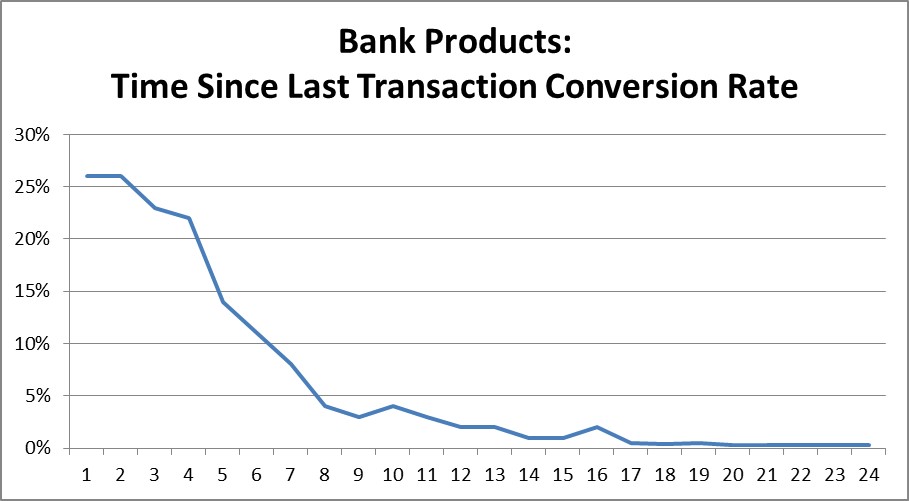

A customer is more likely to open an additional account or use a product if their time from last interaction is kept to a minimum. While this varies as to bank product, we have summed up a composite picture of all bank products based on our experience. As you can see, conducting a marketing campaign during the onboarding process can make an enormous difference in conversion rates.

The practical action based on this data is that banks should design marketing campaigns around when an account is opened, a loan closed, or a new product subscribed to. Our HSA account experience is a classic example as it is one of our top 15 of more most profitable deposit marketing campaigns (HERE).

Sending a series of follow up emails, in-app notices or retargeted ads that promotes product usage helps set behavior patterns and confidence in the product so permanent adoption is more likely. The result is more engagement and more deposit balances.

Allocating Resources

When deploying management time and marketing dollars, banks must weigh whether to spend the money to acquire new customers, or do they spend the money on increasing their share of wallet with existing customers? If done soon after a transaction (or an account open/loan closing), we can tell you that marketing to existing customers is multiple times more efficient. The ironic part is, as can be seen on the conversion curve, somewhere around month eight, the chances of conversion approach that of a new customer. Thus, if banks don’t do anything or wait too long, they don’t have to worry about it.

The tactic is simple, allocate more of your marketing capital to new existing customers and time the message to soon after they are onboarded or right after the first use of the product.

The above data is different for various products for various banks and for various geographies. Loans, for instance have much lower conversion rates when compared to deposits, so if we pulled loans out you would see a more muted curve. Deposits, particularly savings, are one of the most sensitive accounts to marketing energy. Sometimes a simple and single email can yield material results in the form of higher average balances.

One crucial point is to take a product and try a test. These days, mobile marketing is very quantitative and very inexpensive. A return on investment can instantly be seen, and various marketing strategies and tactics can be compared. Establishing a control group of customers, marking their last transaction, and then testing to see how many and when they convert can give you amazing insight into the data. From the data, glorious stories will emerge that will point you down a clear marketing path – a path that will hopefully result in greater profitability and success in building deposit balances.