Do You Have Too Many or Too Few Loans On Your Pipeline Report?

The average bank closes about 35% of their loans on their commercial loan pipeline report. Hearing this number begs the question – is that the optimal level for that metric? Put loans on that have a greater percentage of closing, and you potentially deprived transactions from getting the support they need. Put more loans on, and you potentially risk wasting resources by talking and tracking loans that have a low percentage of closure. In this article, we explore the purpose of the pipeline report and look at ways how to optimize pipeline management.

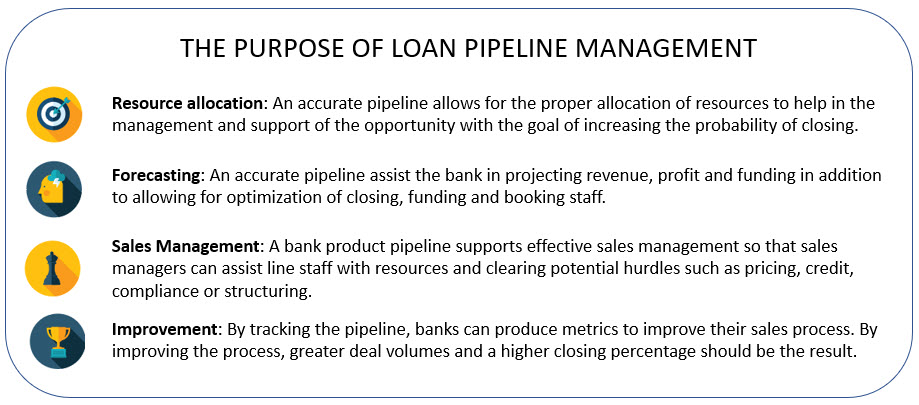

The Purpose of the Loan Pipeline Report

While the purpose of tracking loans seems obvious, often, the nuances get lost, making for an inefficient process. On its surface, the pipeline report quantifies the sales funnel to drive sales and project closings for revenue and liquidity management purposes. However, the pipeline report is much more than that. A loan pipeline is a representation of a bank’s sales process. A clean pipeline usually means a clean sales process, and a clean sales process often results in a more profitable bank.

2015 research by Vantage Point Performance and Sales Management study found that revenue was 18% higher for companies that had a formal sales process compared to those that said they did not have an effective sales process. Having good pipeline management practice and discipline is critical to an effective sales process.

The Cost and Benefit of Putting a Loan on Your Pipeline Report

Putting a loan on a pipeline report hopefully has a benefit. If not, then you need to question your whole pipeline management sales process. Putting a loan on should bring added visibility and resources such as a credit “pre-flight” or early review, the request for more due diligence information, assistance/advice from other lenders, and potentially a call to the borrower from management. On average, by our calculations, a loan has between a 2% and 10% better chance of closing if it is on the pipeline report early than if it is not. Getting an early review from your credit team to help you better structure and price the loan, for example, has proven invaluable in jumping the conversion rate of loans on the pipeline.

With the average present value of a commercial customer’s lifetime value for a community bank being over $233,000, even if you can increase the conversion rate by 2% by putting the loan on the pipeline report early, then that is a return of approximately $4,663. However, chances are you will be closer to 5%, equating to an average $11,657 return.

Of course, putting a loan on the pipeline report comes at a cost. On average, a loan is in the pipeline for at least eight weeks, which means the whole team must discuss, and the meeting goes longer. In addition, being in the pipeline also means more data to track, plus it usually means additional automated email follow-up requesting information or alert the borrower as to status.

Adding up the cost comes up with a funds transfer price of approximately $136 per loan. With such a low cost, that is a return of 34x. The conclusion here is that banks should put many more loans on. How many more largely depends on the bank and its process. As banks put more loans on, resources get spread, and the conversion rate reduces. If you keep playing this out, the equilibrium comes out to around 22%.

As an aside, a common practice for banks is also to have a “prospect” category of the report that doesn’t impact the closing percentage but still gets an array of basic resources to help close the loan. This “hybrid” loan pipeline management model works fine, so it is just a matter of bank preference if you count prospects in your closing numbers or not.

More Loans but More Focus

The act of putting a loan on a pipeline report also has some intangible benefits. Relationship managers and lenders that place loans on a pipeline tend to spend more time tracking and looking after the opportunity. Managers, on the other hand, now get to see more loans and can better understand the universe of opportunity so they can use their experience to home in on the profitable customers, the loans where they can make a difference to increase the probability of conversion or to bring their expertise to advice NOT to expend resources because of the low chance of closing.

A pipeline management meeting should be about the loans you DON’T want to spend resources on as well as the ones you do. To that point, the pipeline meeting is also the opportunity to focus the right amount of resources on suitable loans. The heart of an extraordinary pipeline meeting is the act of asking the right questions and then highlighting both challenges and solutions for the good of the group. Special situations should be taken offline and given their full attention, while common problems such as structuring, pricing, the sales process, or additional support should be highlighted both as a path to good communication but also for training.

Not every loan requires discussion. Loans that are moving along their pace likely require no focus. Conversely, loans that are stuck should be triaged as sales management finds out if there is anything that can be done to move the borrower along. Sometimes, relationships are stuck for reasons outside the bank, and good sales management also dictates spending few resources.

Below are some traits born out by research and practice by banks that take sales management and pipeline management seriously.

Putting This into Practice

Sales management is a skill like any other that takes training, practice, monitoring, and continual improvement to get good at it. Enhancing your bank’s pipeline management can make a massive difference in volume, transaction velocity, and closing percentage. Every bank’s situation is different, so there is no one way to manage a pipeline. However, some of the best practices above revolve around respecting the sales process and committing to good pipeline management. Integrate these best practices into your sales management, and you will quickly see the fruits of the effort as you not only achieve your budget but develop your staff to achieve more than they do now.