Early Data on PPP Forgiveness Processing

Without approving the HEALS or HERO Acts, Congress gave little reason for banks to delay their Paycheck Protection Program (PPP) Forgiveness program. As such, many banks, like ourselves, launched on the 10th. With a couple of weeks of testing and processing, we thought it might be helpful to give an update that can hopefully inform your process. So far, 12,000 PPP Forgiveness applications have been submitted by 1,000 lenders (out of the 5,500 who participated). By copying some of these bank’s successes and avoiding the failures, your institution could be more efficient at processing the slew of applications that are about to hit.

Filing

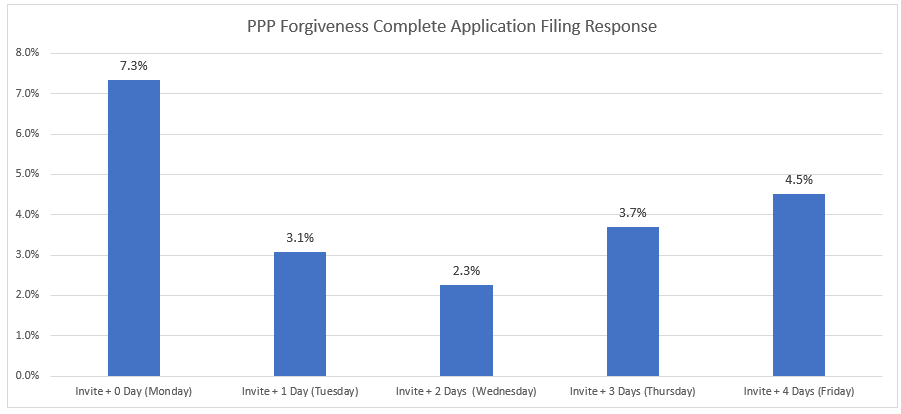

Not surprisingly, it turns out that more borrowers say they are ready to file than actually file. While we suspect the below data depends on when you invite PPP borrowers plus the later you go, the higher your response is likely to be, but below is a typical response rate for current filing access. If you send out 1,000 invites to file the first thing Monday morning, you may get approximately 73 complete applications on that day, another 31 the next, and so forth.

This data may help banks determine how any invites to send out per day to manage their production capacity plus have a representative sample size to gather data on the process.

Questions, Call Centers and Support – The Password Experiment

Of course, no matter how many webinars, videos, guides, and checklists that you do, you are going to get a slew of calls, emails, or chats when borrowers start to submit applications. For every 1,000 applications, you can expect to receive approximately six requests per hour during business hours and three requests per hour during non-business hours to include weekends.

By far, the most common call is regarding password issues. This topic makes up approximately 50% of the contact volume. We experimented and ran about 66% of our applications with pre-established passwords and pre-loaded information and 33% where the customer established a new account and loaded their information in for the first time. Not surprising, about 90% of the password/log-in issues were from the pre-established accounts. While many banks think this is the more customer-friendly way to go, they could be wrong. Ironically, if you make the customer establish their log-in credentials, it turns out better for everyone. While the customer does have to input the ten required fields needed from the original loan documentation (from the SBA 2483 Form), that appears to be less frustrating that not being able to log in and having to contact customer support. This path, therefore, requires less customer service support from the bank, and you potentially end up with higher overall satisfaction in the process.

Other than passwords, the top five questions (in order of frequency) have been around: 1) managing the Covered Period; 2) when the deadline is to file; 3) when should the borrower file; 4) the limitations of owner expenses; and, 5) what expenses are permissible.

Identifying Shortcomings

With a live process, shortcomings are surfacing. Some issues we expected and some have caught us off guard. Below are some of the more popular ones that we can offer some insight.

Deleting Applications: We failed to build a set of procedures around withdrawing a submitted forgiveness application. If you are using a third-party, it is highly likely they overlooked this as well, and their automation will not handle this. As such, having a dedicated person or team handling this plus a process can help save time. At a minimum, banks need to decide when and how to do this plus what notification to give.

Covered Period: While it is acceptable to apply for Forgiveness before the end of the 24-week covered period, the Covered Period or Alternative Covered Period must always reflect the full eight or 24-week time frame. The Covered Period DOES NOT end on the date the borrower spent all the PPP proceeds – it can only stop at the end of eight or 24 weeks. This has tripped up many banks. To solve this confusion, we created a “Maximum Forgiveness Date” where the borrower has achieved maximum forgiveness. We treat this separate from the end of the Covered Period, and it allows underwriters to more efficiently review data to support Forgiveness. Without knowing this Maximum Forgiveness Date, reviewers are left guessing and when the borrower intended forgiveness to be fully supported should it be before the end of the Covered Period (e.g. Week 12).

Post-Submission Modifications: A large issue has surfaced among banks in cases where the customer submits an application and then wants to make a change. Some banks are unable to kick the application back to the customer and therefore have to make any changes themselves. Conversely, other banks do allow the customer to make changes, but because the customer is allowed to change any field, the bank needs to re-validate all the fields causing extra work. The proper way to deal with this is to enable the customer to make changes to only the fields where the bank or customer spots an issue.

Philosophical Interpretation: The biggest thing a bank can do is to square away all the philosophical differences that arise over the Covered Period, types of expenses, Safe Harbor interpretations, and documentation. There is an endless supply of special situations that each time causes a bank to stop and debate. While we did our best to codify some overarching concepts and answer the most common questions upfront, new situations arise hourly, causing us to relook at some old issues and debate new. Banks should build in this process, such as establishing a set time each day to regroup, work on process improvement, hash through the open issues and document.

Passwords: No matter how hard you try, passwords and application credentials are likely to be a problem. Employees that completed the original application and are no longer with the company, agents that completed the application on behalf of the owner, and owners that filled out multiple applications but because the system required separate emails, used dummy emails, and now cannot get a password reset and so forth will all potentially be part of the wave of customer service contacts your bank will likely experience at the start of the process.

Ineligible Borrowers: While many banks tried to screen out ineligible borrowers, many got through the process and were awarded PPP loans. Now during the forgiveness process, some banks are uncovering more of these borrowers, and the question arises – how much do you inquire and conduct due diligence? Once you find ineligible borrowers, it is clear that you can’t file for forgiveness, but then what is the process for remediation, and how do you manage that risk? Last week, many banks scrambled to figure this out. Banks that have yet to start the forgiveness process are encouraged to set up a separate workflow for how to deal with these borrowers while establishing clear protocols about how to handle them.

Successes

Certification: One issue that many banks had during origination but solved early on in the Forgiveness process is the risk that the person completing the PPP application was not authorized to file the application. Banks corrected this by including not only a certification that the person completing the Forgiveness application is authorized but having that person certifies that the original PPP loan was valid as well.

Funding Date: Banks need to build into the process a way to validate the Funding Date to ensure that it matches the bank’s system of record. Should the bank fail to validate this field and the customer inputs a funding date before the Funding Date on record, the application will fail and cause the bank to spend an additional 15 minutes researching, correcting, and resubmitting the application. Building a validation of this date into the process will save countless hours of frustration.

Communication: In our process, we have 12 different customer messages from “Click here to continue completing your application” to “Congratulations, your Forgiveness application has been approved by the SBA, and your PPP loan is now repaid in full.” Designing this ahead of time and then refining has proven to be a time-saver to quickly get updates and notifications out to the customer.

Customer Education: We held a series of webinars and produced a series of videos (HERE) that are giving us an excellent return on our time. By educating our customer base ahead of time, we are finding questions are reduced, and applications are going smoother. We went from getting questions from four out of five customers to getting questions from one out of five. That is a large reduction that will save staff time.

Chat: What started out as composing 25% of the customer service channel has grown to close to 50% borrower usage. The ability to provide automated responses and manage multiple customers means you need fewer bankers to answer questions, which means you can have extended customer service hours. The ability to provide content, links, and visual explanations help the customer often understand better than if they were on the phone. The ability to analyze past conversations helps inform the chatbot for the future while assuring a certain level of quality control.

Cross-sell Follow-up: Customers are appreciative of a good PPP and PPP Forgiveness process. As such, it has been shown that they are more likely to move accounts at other banks to PPP lenders that treat them well. One such happy customer gave their bank 19 other operating accounts from their other businesses as a result. Having a campaign and training around asking for additional business can fuel growth and leverage the Forgiveness effort.

Reporting: Understandable and actionable data is going to be needed, and many banks have yet to solidify a good reporting set. Having both summary and detail data and visualizations can help banks improve the process an allocate resources to help solve bottlenecks. Below are the top 20 reports that banks are using to manage their production.

- Total # of applications in process

- Total # of applications approved by the bank

- Total # of applications approved by the SBA

- Total # of applications approved and boarded/modified

- Stage report by number and dollars

- Total Forgiveness dollars approved by the bank

- Total Forgiveness dollars approved by SBA

- Total Forgiveness dollars declined by the bank

- Total Forgiveness dollars declined by SBA

- % of total customers that have applied for Forgiveness

- % of total customers that the bank has approved

- % of total forgiveness amount that the bank have approved

- % of total forgiveness amount that the SBA has approved

- % of applications achieving partial forgiveness

- Top reasons for declines

- The average time the customer is in channel to approval

- The average time for bank to approve an application

- The average time for SBA to approve an application

- The average time to document SBA approval

- Other performance metrics as needed: complaints, call center metrics, etc.

Putting This Into Action

The Forgiveness process is more complicated than the origination process, yet some banks are treating Forgiveness as the same. The Forgiveness process is complex and more time consuming than origination. While it took approximately 20 minutes to review and approve a PPP loan, it is taking an average of 70 minutes to review a Forgiveness application. Moreover, there are more steps in the workflow, and more customer interaction is often required. By copying some of the above successes and working on some of the challenges, your bank can reduce processing time and enhance customer satisfaction.