Enlisting ARMIES To Drive Bank Innovation

Areas of improvement in banking abound, which is part of the problem. Banks often struggle with how and where to focus their resources to produce innovative products and services. Do you tackle digitizing the consumer loan process, or do you push into cryptocurrencies? Do you introduce a new treasury management product or upgrade your online account opening process? In this article, we break down our “ARMIES” framework that will help your bank prioritize products, initiatives, or product attributes.

Step One: Solidifying Intent

Understanding what your customer wants to get done is the first step towards innovation. We call this starting place developing the “Intent” of the customer. The Intent is the functional or emotional goal they want to achieve. For example, when it comes to payments, a customer either has to send money for a practical or “functional” reason, such as paying their electrical bills. Or, the customer wants to send money to fill an emotional reason such as purchasing a good or donating to their church. Sure, an emotional intent might be functional on its surface, but they are also using a bank product as a means to an end to accomplish a certain feeling or perception.

For any given product or service, there might be one intent or thousands of intents. Bank innovation starts with an understanding of not what the bank wants but what the customer wants, even if the “customers” are employees for an internal bank product or process. One critical point here is to understand that Intents are devoid of demographic stereotypes. Demographics don’t matter in this framework. It doesn’t matter if you are a Gen Z or Boomer; what matters is that you want to pay a bill or save for retirement.

Step Two: Employing ARMIES

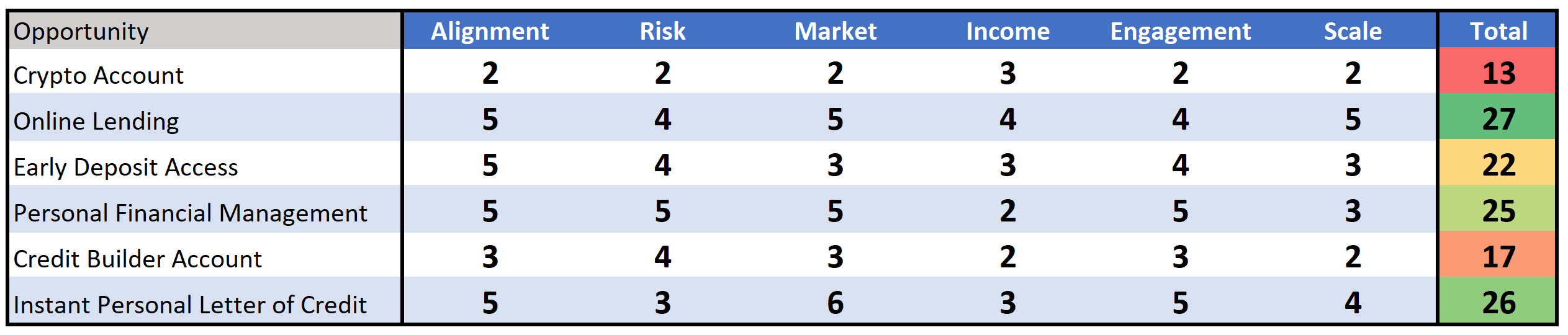

From the intent, bankers will try to reframe the question (HERE) and then arrive at a set of solutions to solve the customer’s challenges. The next step is to prioritize those solutions to an ordered list to buy or build. To do that, we employ a methodology with the acronym of “ARMIES,” which stands for Alignment; Risk; Market; Income; Engagement and Scale.

ARMIES allow banks to compare projects along the six dimensions that have the most significant impact on bank performance. For each category, bankers attempt to quantify the solution’s impact on a scale of 1 to 5, with “5” having the most positive attribution. Part of the beauty of this system is that a bank can start with an estimation of the numerical value of each number and then quantify each number in each category as they mature. Further, the quantification of each number may change over time as the bank grows in both size and complexity.

Alignment: The first question to ask, and score, is strategic alignment. How close does this project further the goals set forth in your mission or strategic objectives? Strategic alignment quantification is done on a scale of “1” to “5,” with “5” being in full alignment with your long-term strategic objectives or goals.

Risk: The Risk categories include all the effort and resources to pull off the project, including the various risks of building or buying the solution to the intent set that you are trying to solve. This is also done on a scale of “1” to “5,” with “1” being a high-risk project and “5” being a low-risk project that doesn’t require a material expenditure of money, time, effort, or risk.

Market: Market estimates the size of the marketing the new product, service, or process could impact. Is the addressable market all banking customers, or just a select few with a unique problem? The larger the market for the innovation, the higher the score. Further, this metric encompasses how easy it is to get to the market or the expected customer acquisition cost. Usually, we give one point higher here if it is a new product that is likely to get some press to help the product expand its marketplace. As such, this metric might go to a “6” if it was a new product and large addressable market.

Income: Income is straightforward and is the net profit expected to be made on this product or service over five years. Thie income calculation doesn’t have to be exact, but a bank should have a standard methodology developed to forecast revenue. This should include a time horizon (i.e., five years), the cost of internal personnel (i.e., hourly average salary cost x 1.25 to handle benefits and management), a standard number of customers in each category (retail, commercial, medical, etc.), the cost of capital and similar.

Engagement: Engagement attempts to quantify the amount of value that imparts to the customer. The concept is that the more the customer engages with the product, service, or process, the more value they must be deriving from the product. If customers are using the product five times per day, then that is likely a “5.” Conversely, if customers will only use the product once per year, then that might be a “1.”

Scale: Scale is the amount of operating leverage that is achieved by bringing the project live. It is the quantification of the value added to OTHER products, services, or processes within the bank that increases the return on an existing investment. A product that takes advantage of an existing investment to either generate more money for that investment or lower the incremental cost of that investment positively impacts the rest of the bank. The more products, services, or processes the proposed project can positively impact, the greater the score. A product like card controls might help sell credit and debit cards while enhancing the treasury management platform and enhancing data around the customer.

Variations on the Methodology

Banks can expand the five-category grading scale to ten to achieve even greater granularity between projects. Similarly, some banks may want unequal weightings for some categories. For example, a bank may want to expand Risk and Income to ten-point scales to give more weight to them while keeping the other categories at five-point scales.

In another variation, Risk can be broken up into two metrics, one to capture the initial project risk of introducing a new innovation to the marketplace and another weighting to encapsulate the risk of the product itself. For example, if purchased from a third party, online lending could be low risk, but if the platform is used to push into sub-prime auto loans, it might be a high-risk item.

Step Three: Evaluating Outcomes

Once all the ARMIES scores are tallied, and you go back through the scores to make sure they are correct, the next step is to take the top-rated projects and figure out what is a test you can do to validate some of the assumptions underlying the scores. This might look like a mock-up with user testing that gets put in front of customers, a scaled-down, or minimum viable version of the product, or it might be going to another bank to learn from their experience with a similar product.

The goal here is to reduce risk and gain confidence in the rankings.

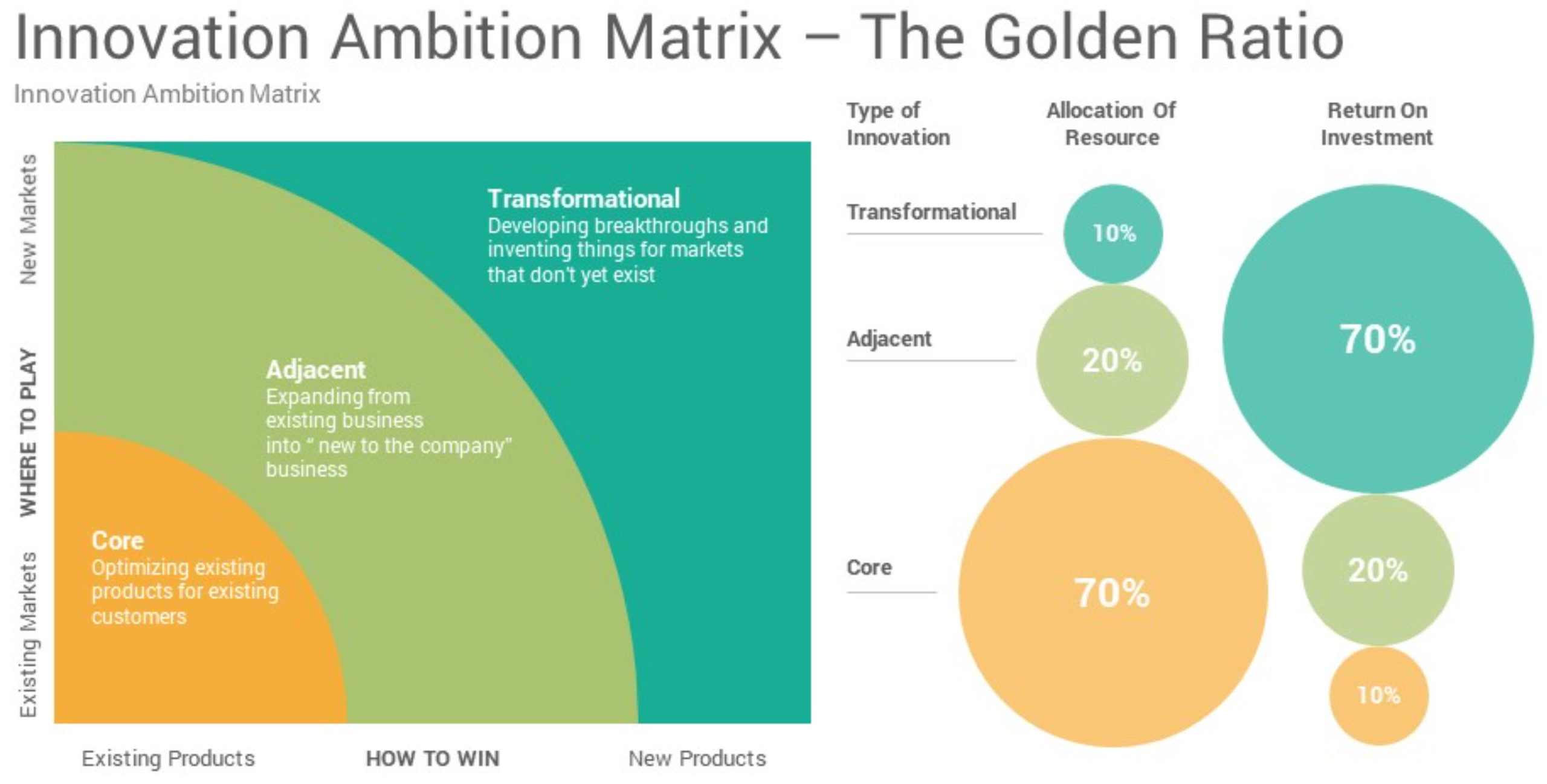

Each outcome can be also ranked on the Innovation Ambition Matrix below that was developed by Bansi Nagi and Geof Tuff. Here, your core products are in the lower left and are essentially improvements to existing products. From there, you also want a certain amount of your innovation portfolio in the “Adjacent” space which are extensions of your current products or expansion into similar markets that you currently focus on now. These are medium-risk areas where you want to expand and consider investing 20% of your investment resources. Finally, the “Transformational” space is where you map your “moonshots” or high-risk projects where you want to capture new customers or new markets. These are the projects that will set your bank apart from the competition as you push into new frontiers.

Using the ARMIES approach isn’t a one-time exercise as it is best used in an iterative process. Banks should retain their ranking from year to year, add new projects, and re-rank opportunities as markets may change and capabilities may be enhanced, thereby reducing the risk for some projects.

Putting This Into Action

The methodology isn’t perfect and can be modified to each bank’s needs. However, ranking opportunities in some fashion is a best practice of innovative companies the world over. While many banks have ranking systems, often they are not quantifiable or don’t include items like Alignment, Scale, Engagement, or Risk.

For your next innovation effort, enlist the ARMIES ranking system to see if it can’t add some more disciplined to your innovation process. The ARMIES framework helps pull everyone’s thoughts and fears out into the daylight so they can be properly evaluated. With such a framework, banks often fall into being “chased by ghosts.” The Chased by Ghost syndrome is when fellow bankers have objections and concerns such as “regulatory risk” or “market acceptance” that are not defined and not specific. As a result, many good projects die because ghosts are hard to defend against if you can’t see them and don’t know what the actual fear is. The ARMIES framework helps bring the ghosts to light and forces bankers to figure out how to quantify the risks and how to overcome them.